To file a life insurance claim, the beneficiary must submit a death certificate and claim form to the life insurance company. A death certificate is a key document that provides proof of death. Typically, the beneficiary will need to request a copy from the funeral home or medical professional who prepared the death certificate and confirmed the time and place of death. The death certificate is a standard form of documentation required when filing a state life insurance claim. The beneficiary will also need to submit the policy document, which contains information about the life insurance policy, including the policy number, amount of the death benefit, and the names of the beneficiaries. Finally, the beneficiary will need to fill out a claim form, providing information about the policyholder, the policy number, the cause of death, and the relationship to the policyholder. While there is no time limit on how long a beneficiary has to file a life insurance claim, it is important to submit the claim as soon as possible to ensure a timely payout.

| Characteristics | Values |

|---|---|

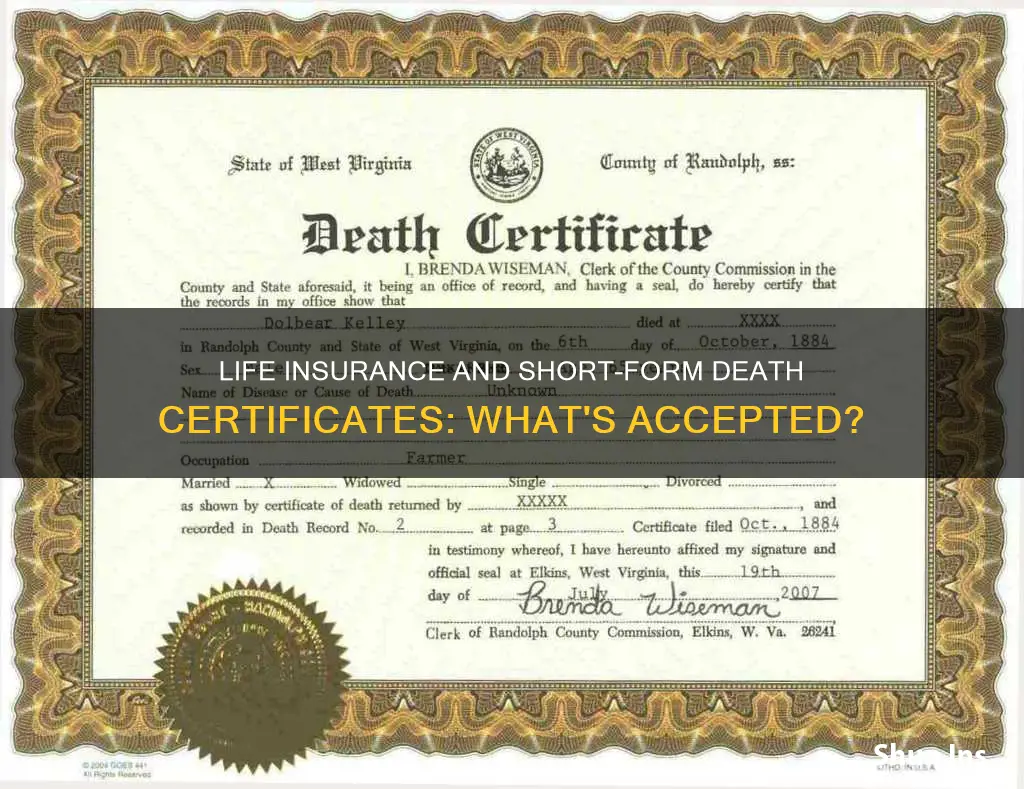

| Is a short-form death certificate required? | No, a certified death certificate is required |

| What is the purpose of the death certificate? | Provides proof of death |

| Who can provide a copy of the death certificate? | Funeral home, medical professional, local vital records office |

What You'll Learn

What is a short-form death certificate?

A short-form death certificate, also known as a short certificate, is a legal document that shows the decedent's name and date of death. It also shows the name of the executor or executrix who has been named to handle the affairs of the estate.

In the US state of Pennsylvania, a short certificate is a court document demonstrating that you have the right to administer the estate of someone who has died. It is proof that you have been appointed by the Probate Court to administer a deceased individual's affairs. Short certificates are "short" because they are a one-page notice of a longer court order that officially designates who can open the estate and has the authority to gather and dispose of the deceased person's assets.

In Pennsylvania, short certificates are issued by the Register of Wills, which is the county office charged with accepting wills and issuing the court order giving permission to administer the estate. The Register of Wills and their staff for the county where your loved one lived when they died are the only people with the authority to issue this certificate. They do so as part of the probate process.

Global Life: Health Insurance Provider?

You may want to see also

Do life insurance companies require a certified copy of the death certificate?

Yes, life insurance companies require a certified copy of the death certificate to process a death claim. This is a key document that provides proof of death and helps prevent fraud.

The death certificate is one of the first documents you should obtain when someone passes away, as it is needed to notify insurance companies and begin the claims process. You can request a copy from the funeral home or medical professional who prepared the death certificate, or from your local vital records office.

In addition to the death certificate, you will also need to submit the policy document and a claim form to the insurance company. The policy document contains information such as the policy number, death benefit amount, and beneficiaries. The claim form, or "request for benefits" form, is where you will provide information about the policyholder and their cause of death, as well as your relationship to the policyholder and how you would like to receive the death benefit.

It is important to note that life insurance policies do not pay out automatically after the policyholder's death. Someone, usually the beneficiary, must notify the insurance company and file a claim. There is no time limit for filing a claim, but it is best to do so as soon as possible to expedite the process and receive the benefit quickly.

Group Life Insurance: Covering Your Immediate Family?

You may want to see also

Where can I get a copy of the death certificate?

To file a life insurance claim, the beneficiary will need to submit a death certificate. Here's how to get a copy of the death certificate:

Death in the US:

Contact the vital records office of the state where the death occurred to learn:

- How to order a certified copy of a death certificate online, by mail, or in person

- How to get a copy fast

- The cost for each certified copy

You will need to know the date and place of death. The state may also ask for other details about the deceased, how you are related to them, and why you want the certificate.

Death of a US citizen abroad:

When a US citizen dies in another country, the US embassy or consulate should get a death certificate or notification from the foreign government. They will then issue a Consular Report of Death Abroad (CRDA). Use the CRDA in the US as proof of death for closing accounts and handling legal tasks. You can get up to 20 free certified copies at the time of death. Order more copies of the CRDA from the Department of State.

Who can order copies of a death certificate?

In many states, there are two types of death certificate copies: informational and certified. Informational copies are for personal records and are usually available to anyone who requests them. Certified copies bear an official stamp and are necessary for tasks such as claiming life insurance proceeds. In some states, certified copies are only available to members of the deceased's immediate family, the executor of their estate, and people with a direct financial interest in the estate.

How to get copies of a death certificate:

The simplest way to obtain a death certificate is to order it through the funeral home or mortuary at the time of death. If you're in charge of winding up the deceased's affairs, it's recommended to ask for at least 10 copies. You will need one each time you claim property or benefits that belonged to the deceased. If it's been some time since the death and you need to order death certificates yourself, contact the county or state vital records office. For recent deaths, start with the county office, as they are more likely to have the certificate on file. After a few months, the state office will probably have it as well.

Cigna's Individual Life Insurance: What You Need to Know

You may want to see also

What other documents do I need to provide to make a life insurance claim?

To make a life insurance claim, you will need to provide the following documents:

- A certified death certificate. This is a key document that provides proof of death. You can request a copy from the funeral home or medical professional who prepared the death certificate. You can also request a copy from your local vital records office by phone, in person, or online.

- The policy document, which contains information about the life insurance policy, including the policy number, amount of the death benefit, and the names of the beneficiaries. If you are having trouble finding the policy document, you can contact the insurance company or the deceased's financial representatives.

- The claim form, also known as a "request for benefits", where you fill out information about the policyholder, including their policy number and the cause of death. You will also provide your relationship to the policyholder and how you would like to receive the death benefit.

- Proof of your identity, such as a driver's license, Social Security card, or birth certificate.

In some cases, you may also need to provide additional documents, such as a medical certificate (as proof of the cause of death), a police report (in case of unnatural death), or hospital records (if the deceased died due to an illness). It is important to contact the insurance company to find out exactly what documents are required for the claim.

Life Insurance Interest: Commercial Policies and Earning Interest

You may want to see also

How long do I have to make a life insurance claim?

There is no deadline or time limit for filing a life insurance claim. You can collect a death benefit at any time, as long as the policy was active and in force when the policyholder died. However, the sooner you file a claim, the sooner you will receive the payout.

While there is no time limit, it is still a good idea to file a claim as soon as possible. This is because the insurer could need a month or longer to investigate the claim before paying out.

To file a claim, you will need to submit a death certificate and claim form to the life insurance company. You can do this online, in person, or over the phone. You will also need to provide the insured's name, date of birth, date and cause of death, state of residence, Social Security number, and policy number.

Whole Life Insurance: Joint Policies' Value Increase Explained

You may want to see also

Frequently asked questions

To submit a life insurance claim, you will need to provide a death certificate, the policy document, and a claim form.

You can request a copy of the death certificate from the funeral home or medical professional who confirmed the time and place of death. You can also request a copy from your local vital records office by phone, in person, or online.

If you can't find the policy document, you can contact the insurance company or the deceased's financial representatives.