Life insurance is a financial safety net that provides peace of mind for you and your family. While the death benefit is typically tax-free, there are exceptions where taxes and other financial considerations may apply. For example, if your beneficiary receives the life insurance payment as a series of installments, any interest accrued during the period is taxable. Additionally, if the policyholder leaves the death benefit to their estate instead of naming a person as the beneficiary, estate taxes may be triggered. Understanding these nuances and carefully planning ahead can help minimize potential tax liabilities and ensure your loved ones receive the intended financial support.

| Characteristics | Values |

|---|---|

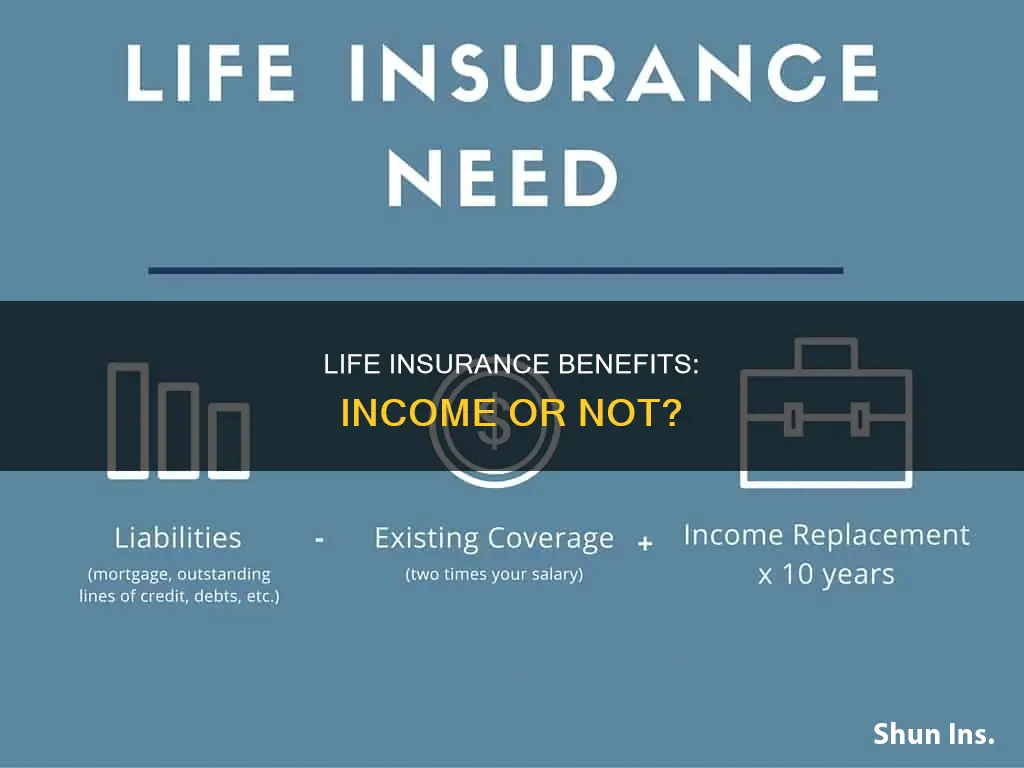

| Are life insurance benefits taxable as income? | No, life insurance benefits are not taxable as income. |

| Are there any exceptions to the above? | Yes, if the beneficiary receives the benefit in installments, they will have to pay income tax on the interest. |

| Are there any other taxes that may apply to life insurance benefits? | Yes, estate tax, inheritance tax, and generation-skipping tax may apply in certain circumstances. |

| What is the estate tax? | The estate tax is levied on the right to transfer property upon death if the estate is worth more than the maximum threshold allowed. |

| What is the inheritance tax? | The inheritance tax is levied on the recipient of any inherited cash payouts, properties, and other assets. This tax is currently enforced in Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania. |

| What is the generation-skipping tax? | The generation-skipping tax is imposed on any assets that skip a generation and are only enforced when they exceed the same threshold as the estate tax. |

What You'll Learn

Interest on life insurance benefits

Life insurance benefits are generally not considered taxable income. However, any interest accrued on the benefits is taxable and must be reported. This interest is calculated from the date of the insured's death until the date of payment to the beneficiary, regardless of whether the claim has been fully filed with the life insurer.

If the beneficiary is a minor, the life insurer may be unable to pay the claim until the beneficiary turns 18 or has a legal guardian. In such cases, interest will still accrue from the date of the insured's death, and the interest rate will be determined by the rate in effect at that time, not the rate at the time of payment. This rate may fluctuate and change over time.

If the beneficiary receives the life insurance benefit as a series of installments, the insurer will typically pay interest on the outstanding death benefit. This interest will be taxable income for the beneficiary.

To avoid paying taxes on the interest accrued, the policy owner can transfer ownership of the policy to another person or entity. Alternatively, they can set up an irrevocable life insurance trust (ILIT) and transfer ownership of the policy to the trust. However, if the policy owner passes away within three years of transferring ownership, the proceeds will be included in their estate for tax purposes.

Homeowner's Insurance: Does It Cover Loss of Life?

You may want to see also

Estate and inheritance taxes

Firstly, if the policyholder names their estate as the beneficiary instead of an individual, the inherited money from the life insurance policy will be subject to estate taxes. This is because the value of the estate increases, and heirs may be faced with high estate taxes. In 2024, estates over $13.61 million are subject to estate tax at the federal level, and some states have their own estate or inheritance tax laws with different thresholds.

Secondly, if the owner of the life insurance policy is different from the insured person, the payout to the beneficiary could be considered a taxable gift. This scenario occurs when three different individuals are listed as the insured, policy owner, and beneficiary. The IRS considers the death benefit in this case to be a gift from the policy owner to the beneficiary, and gift taxes may apply. However, the gift tax exemption for 2024 is $18,000 annually and $13.61 million for a lifetime, so careful planning can help avoid taxation.

To avoid estate and inheritance taxes on life insurance benefits, individuals can consider transferring ownership of the policy to another person or entity. This strategy requires choosing a competent adult or entity as the new owner, who will then be responsible for paying the premiums. It is important to note that the original owner gives up all rights to make changes to the policy, and the transfer is irrevocable. Another option is to create an irrevocable life insurance trust (ILIT) to hold the policy, removing it from the individual's estate. However, the three-year rule applies to both ownership transfers and ILITs, meaning that if the original owner dies within three years of the transfer, the proceeds will still be included in their estate and taxed accordingly.

Gerber Life Insurance: Does It Have an Expiry Date?

You may want to see also

Whole life insurance and tax

Whole life insurance is a type of permanent life insurance that offers coverage and accumulates a cash value over time. This type of policy is more expensive than term life insurance but provides lifelong coverage, making it ideal for those with lifelong financial dependents, such as children with disabilities. Whole life insurance can also help high-net-worth individuals save for retirement and diversify their investment portfolios.

Tax-Advantaged Growth

Whole life insurance policies earn interest in a tax-advantaged account, and the growth of the cash value is tax-deferred. This means that any interest earned on the policy is not taxed as long as the funds remain in the account. This can provide tax-free growth over the long term.

Tax Implications on Withdrawal

If you withdraw money from your whole life insurance policy, there may be tax implications. Withdrawing an amount less than the total premiums paid is generally tax-free. However, if you withdraw more than the total premiums paid, the excess amount is typically subject to income tax. This includes cases where you surrender the policy or borrow against the cash value and are unable to repay the loan.

Interest on Death Benefit

If the policyholder elects to delay the benefit payout, and the life insurance company holds the funds for a period of time, the beneficiary may have to pay taxes on the interest generated during that period. This situation can arise when the beneficiary receives the death benefit in installments, which is common when the beneficiary is a young child or financially dependent on the deceased.

Estate Taxes

While life insurance proceeds are generally not taxable as income, they can be included in your estate for tax purposes if the total value exceeds federal and state exemptions. This means that your beneficiaries may have to pay estate taxes on the life insurance payout if your estate's value surpasses the exemption thresholds.

Transfer of Ownership

To avoid estate taxes on life insurance proceeds, you can transfer ownership of the policy to another person or entity. This strategy can help remove the policy from your taxable estate, but it's important to carefully consider the tax and legal implications before making such a transfer.

Civil Service Life Insurance: Cash Value and Benefits Explained

You may want to see also

Group term life insurance and tax

Group term life insurance is a common benefit provided by employers. It is a type of life insurance that covers a group of people, often offered as part of an employee benefits package. While an employer may pay the premiums for this coverage, group term life insurance can be taxable or tax-free depending on the amount of coverage provided.

Group term life insurance is tax-free for the employee up to a certain amount. Specifically, if employer-provided coverage is greater than $50,000, the excess amount is considered a non-cash fringe benefit, and the premiums for that extra coverage become taxable income for the employee. The IRS has a table in its "Publication 15-B: Employer's Tax Guide to Fringe Benefits," that employers can use to determine the cost of excess coverage based on the worker's age. For example, if you're 45 years old, your premiums would be calculated at 15 cents per month (or $1.80 a year) for every $1,000 in coverage. The first $50,000 of coverage isn't taxed, so if you had $200,000 in total coverage, you'd be taxed on the cost of $150,000 in coverage, or $270 for the full year ($1.80 x $150,000).

There can also be tax implications if employer-provided group term life insurance is offered for an employee's spouse or dependents. If the amount of coverage is $2,000 or less, then it's not taxable to the employee. However, if the coverage exceeds $2,000, the entire amount of the premium is considered taxable.

The amount shown on your paycheck or pay stub for group term life insurance represents the taxable benefit. At the end of the year, your employer will report the total cost of any group insurance you received that was in excess of $50,000 and is therefore taxable. This amount will appear in box 12c of your W-2 form and will also be included in your income for boxes 1, 3, and 5.

It's important to note that group term life insurance policies are different from individual policies, where life insurance premiums are not tax-deductible and are treated the same as any other expense.

Combined Insurance: Life Insurance Options and More

You may want to see also

Avoiding life insurance taxes

Life insurance benefits are generally not considered taxable income by the IRS. However, there are certain situations where taxes may be incurred, such as when interest is generated on the benefit. Here are some strategies for avoiding life insurance taxes:

Ownership Transfer

If you want your life insurance proceeds to avoid federal taxation, you can transfer ownership of the policy to another person or entity. Here are some key guidelines to follow:

- Choose a competent adult or entity as the new owner, who can be the policy beneficiary.

- Obtain the proper assignment or transfer of ownership forms from your insurance company.

- The new owner will be responsible for paying the premiums on the policy. You can gift them money to help cover these costs.

- Understand that this transfer is irrevocable, so be cautious when choosing the new owner.

- Obtain written confirmation from your insurance company as proof of the ownership change.

Irrevocable Life Insurance Trust (ILIT)

Another way to avoid taxes on life insurance proceeds is to set up an ILIT. This involves transferring ownership of the policy to the trust, and you cannot be the trustee. Here are some considerations:

- You can maintain some legal control over the policy by choosing trust ownership instead of transferring ownership to an individual.

- Ensure that all premiums are paid promptly by the trust.

- If the beneficiaries are minor children, an ILIT allows you to name a trusted family member as trustee to handle the money on their behalf.

Tax-Free Loans and Withdrawals

If you have a cash value life insurance policy, you may be able to take tax-free loans or withdrawals from the cash value to supplement your retirement income. This can help keep your tax bracket down by reducing taxable income. However, be cautious, as loans and withdrawals may decrease the death benefits and cash value of the policy.

Timing and Estate Planning

The timing of your death in relation to the transfer of ownership can impact tax liability. The three-year rule states that gifts of life insurance policies made within three years of death are subject to federal estate tax. Therefore, it is crucial to plan ahead and make any ownership transfers well in advance. Additionally, carefully consider your beneficiary designations. Naming your estate as the beneficiary can increase its value and potentially subject your heirs to higher estate taxes. Instead, consider naming specific individuals as beneficiaries to take advantage of tax exemptions.

Life Insurance: Geico's Accelerated Rider Option Explained

You may want to see also

Frequently asked questions

Life insurance proceeds are typically not taxable as income but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions.

Beneficiaries may have to pay federal estate taxes if the total value of your estate is over $12.06 million. If you live in a state that charges an estate tax and the value of your estate exceeds your state's threshold (ranging from $1 million to $7 million, depending on the state) they may be subject to state tax as well.

Many life insurance policies come with the option of accelerating a portion of your death benefit if you become terminally or chronically ill. This is typically not taxable.