Life insurance is designed to pay out a death benefit to a person's beneficiaries when they pass away. The older someone is when they purchase a policy, the more expensive the premiums will be, as the cost is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The closer someone is to their life expectancy, the higher the risk for the insurance company of having to pay out.

| Characteristics | Values |

|---|---|

| Do life insurance benefits decrease as you get older? | Yes, benefits decrease as you get older. |

| How does age affect life insurance rates? | The older you are, the more expensive the premiums will be. |

| How much do premiums increase per year of age? | On average, about 8% to 10% for every year of age. |

| Do term life insurance premiums increase with age? | This depends on the type of term life insurance. With annually renewable term life insurance, premiums increase as the policyholder ages. With level term life insurance, premiums remain the same throughout the term. |

| How does age affect qualification for life insurance coverage? | Age can affect whether a person qualifies for life insurance coverage, with qualifying medical exams getting more stringent as one gets older. |

| What is the best age to get life insurance? | The earlier, the better, as rates increase with age. |

What You'll Learn

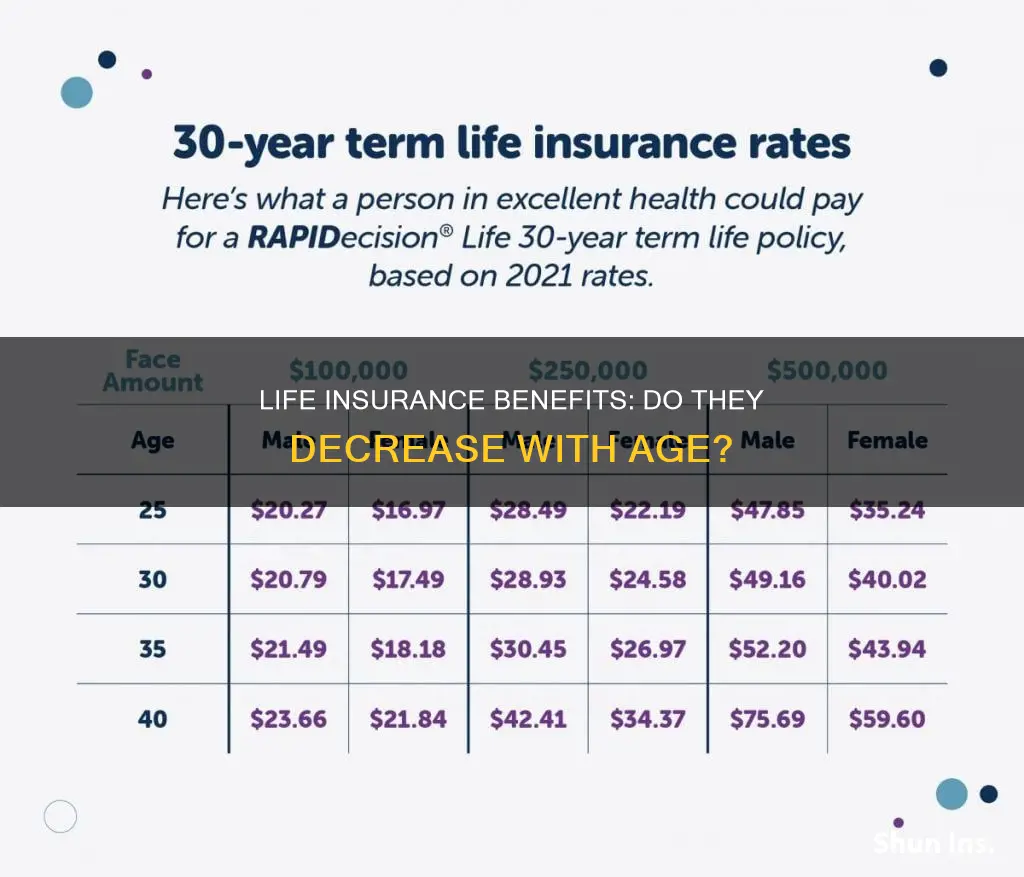

Life insurance premiums increase with age

The cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The older you are, the more likely that day is to come. The annual premium, or "rate", for a term life insurance policy is determined at the time of purchase and set for the duration of the policy. The premium amount increases on average by about 8% to 10% for every year of age. This can be as low as 5% annually if you're in your 40s, and as high as 12% annually if you're over 50.

Term life insurance policies typically offer lower premium rates compared to permanent life insurance. With term life insurance, you pay premiums for a set term, and the premium remains the same every year. With some permanent life insurance policies, the premium rises annually. Permanent life insurance policies are often significantly more expensive than term life policies.

Age also affects whether a person will qualify for life insurance coverage at all, with qualifying medical exams getting more stringent as you get older. Most carriers only offer 20-year term policies to those aged 18 to 70. After that, you cannot get a term that lengthy. Older applicants may also be assessed for their mental condition and can be declined for failing a cognitive evaluation.

FEMA: Flood Insurance and Life-of-Loan Monitoring Explained

You may want to see also

Term life insurance policies have fixed premiums

The premium for a term life insurance policy is based on the insured person's age and health at the policy's start. The premium remains the same for the length of the term. For example, a 5-year renewable term policy will have a level premium for 5 years, after which it will change to reflect the new age of the insured. Some longer-term policies guarantee that the premium will not increase during the term, while others allow the insurance company to raise the rate.

Term life insurance policies typically offer lower premium rates compared to permanent life insurance. The annual premium for a term life insurance policy is determined when you buy the policy and remains fixed for the duration of the policy. This means that the premium amount will not increase as you get older during the policy term. However, if you renew the policy after it expires, the premium will be recalculated based on your age at the time of renewal.

The premium amount for term life insurance is established based on the policy's value and the insured person's age, gender, and health. The insurance company also considers its business expenses, investment earnings, and mortality rates for each age group. In some cases, a medical exam and information about your driving record, medications, smoking status, occupation, hobbies, and family history may be required.

Chase Life Insurance: What You Need to Know

You may want to see also

Whole life insurance policies are permanent

Whole life insurance policies usually have level premiums, meaning the amount paid every month stays the same. However, there are also modified whole life insurance policies, which have lower premiums for a set number of years, followed by higher-than-standard premiums in the later years. With whole life insurance, the death benefit amount is guaranteed and will not change. This is in contrast to term life insurance, where premiums increase as the insured person gets older.

The main benefit of whole life insurance is that it offers lifelong coverage, as long as premiums are paid. It also provides a cash value component that can be used for loans or withdrawals, and the death benefit amount is guaranteed. However, whole life insurance is generally more expensive than term life insurance, and the cash value may grow more slowly than with other policies. Additionally, whole life insurance policies do not offer flexibility to adjust premiums or the death benefit.

Understanding Post-Mortem Dividends: Form 706 and Life Insurance

You may want to see also

Life insurance coverage decreases at 70

The coverage amount will continue to decrease at the beginning of each Plan Year (1st of January) after your 70th, 75th, 80th, 85th, and 90th birthdays, while the rate you pay will keep increasing. If your Optional Life Insurance is set to reduce below $10,000, you will be automatically enrolled in Fixed Optional Life Insurance.

At this stage of life, final expense insurance, also known as burial or funeral insurance, is a great option. It has much lower premiums than other types of life insurance, and you only need to answer a few simple health questions on the application instead of taking a health test. These policies are used to cover funeral costs, but the funds can also be used for other expenses.

The premium rates are fixed, making them easy to factor into your budget, even if you live on a fixed income. Policies build cash value, and you can usually take out a loan against them to pay for expenses while you're still alive, such as medical bills. The application is easy to fill out, and your approval can come in as little as a few days.

High Blood Pressure: Life Insurance Rates Impacted?

You may want to see also

Life insurance rates are determined by health and lifestyle

Life insurance rates are determined by a number of factors, including age, health, and lifestyle. While age is a primary factor influencing your life insurance premium rate, your health and lifestyle can also have a significant impact.

When applying for life insurance, you will typically be asked about your health history, including any pre-existing conditions, as well as your family's health history. This information helps insurers evaluate your risk of developing serious health issues in the future. Additionally, you will be asked about potentially risky lifestyle behaviors, such as smoking, which can also affect your premium.

Your overall health, including weight and the presence of pre-existing conditions, plays a crucial role in determining your life insurance rate. Generally, people in good health will pay lower rates than those with multiple health conditions. Major pre-existing conditions, such as heart disease, stroke, diabetes, or cancer, usually have a greater impact on premiums. More minor conditions, such as asthma, being overweight, high cholesterol, or high blood pressure, typically have a lower impact.

Lifestyle choices can also significantly affect your life insurance rates. For example, non-smokers are often offered lower premiums than those who use tobacco. Engaging in high-risk activities, such as skydiving, rock climbing, vehicle racing, or rodeo, can also trigger higher rates or even affect your eligibility for coverage.

It is important to be transparent when applying for life insurance. Lying or omitting relevant information on your application can result in your policy being denied or your beneficiaries not receiving the death benefits.

Lemonade Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, if you have Optional Term Life Insurance, your coverage will decrease from the age of 70 onwards. Your premium rates, however, will continue to increase every five years.

Yes, life insurance rates increase as you get older as there is a higher risk of health complications or a shorter life expectancy. This means there is a greater risk of the insurance company having to pay out a death benefit.

The average monthly rate for life insurance is $22 for a 30-year-old, $32 for a 40-year-old, and $80 for a 50-year-old. The cost depends on various factors, including age, health, and type of policy.