Life insurance is a financial product that pays out a sum of money to your beneficiaries after you die. The cost of life insurance varies depending on factors such as age, gender, health, occupation, and lifestyle choices. The type of policy chosen, such as term or permanent life insurance, also affects the price. Term life insurance is generally cheaper as it covers a fixed period with no cash value component, whereas permanent life insurance includes a cash value feature and covers the policyholder's entire life. Life insurance companies use mortality tables and interest earnings to calculate premiums, and operating expenses are also factored into the cost. Charges and fees vary by product and insurance company, and common fees include the cost of insurance protection, premium loads, administration fees, and mortality and expense risk charges.

| Characteristics | Values |

|---|---|

| How often is life insurance charged? | Monthly |

| What factors influence the cost of life insurance? | Age, gender, health, occupation, hobbies, criminal history, financial history, coverage amount, smoking status, family medical history, driving record |

| What factors do not influence the cost of life insurance? | Ethnicity, race, sexual orientation, credit score, marital status, number of policies, number of beneficiaries |

| What are the common types of life insurance? | Term life insurance, permanent life insurance, whole life insurance, universal life insurance |

| What are the main considerations for determining the premium rate? | Mortality, interest earnings, expense factor (operating costs) |

What You'll Learn

- Life insurance costs vary based on age, gender, health, and lifestyle choices

- Charges are deducted from premiums to compensate for sales expenses and taxes

- Administration fees are charged for accounting and record-keeping

- Premium loads are deducted from payments before they are applied to the policy

- Life insurance companies use mortality tables to estimate how much money they will need to pay for death claims

Life insurance costs vary based on age, gender, health, and lifestyle choices

Life insurance is typically charged on a monthly basis. The cost of life insurance varies based on several factors, including age, gender, health, and lifestyle choices. While some of these factors are controllable, such as lifestyle choices, others like age and gender are not.

Age is a significant factor in determining life insurance rates, with younger individuals generally paying less than older people due to their lower likelihood of developing health problems. The cost of life insurance tends to increase with age, as the risk of health issues and mortality rates rise.

Gender also plays a role in life insurance pricing, with males often paying more than females. This is because men usually have shorter lifespans and are more likely to engage in dangerous jobs or lifestyles, making them riskier to insure. However, it is important to note that gender-based pricing may not be allowed in certain regions or types of insurance.

Health is another critical factor considered by insurance companies. Insurers evaluate an individual's height, weight, and medical history, including any chronic or serious illnesses. People with pre-existing health conditions or unhealthy habits like smoking tend to pay higher premiums.

Lifestyle choices can also impact life insurance rates. Engaging in high-risk activities, such as skydiving or amateur car racing, can result in higher premiums. Other factors, such as criminal history, occupation, and financial history, can also influence the cost of life insurance.

It is worth noting that life insurance rates are generally affordable, and individuals can take steps to lower their rates by maintaining a healthy lifestyle, managing their weight, and avoiding high-risk behaviours.

High Blood Pressure: Life Insurance Rates Impacted?

You may want to see also

Charges are deducted from premiums to compensate for sales expenses and taxes

When it comes to life insurance, there are various charges and fees that are important to understand before purchasing a policy. One such fee is the premium load or sales charge. This charge compensates insurance companies for sales expenses and state and local taxes. In other words, these charges cover the costs of selling the insurance policy and are deducted directly from the premium payments made by the policyholder.

Premium load or sales charges are standard across the insurance industry and are used to maintain the policy. These fees cover accounting, record-keeping, and administrative costs associated with managing the policy. They are typically deducted from the policy value on a monthly basis. It is important for policyholders to be aware of these charges as they can impact the overall cost of the insurance policy.

The amount charged for sales expenses and taxes can vary depending on the insurance company and the specific policy. It is influenced by factors such as the company's operations and efficiency. Therefore, it is advisable for individuals to carefully review the terms and conditions of their life insurance policy to understand the specific charges and fees that will be deducted from their premium payments.

In addition to sales expenses and taxes, there are other charges that may be deducted from premium payments. These include the cost of insurance protection, which is based on factors such as age, gender, health, and death benefit amount. There may also be monthly per-thousand charges based on age, gender, and underwriting classification. Understanding these charges is crucial for individuals considering purchasing life insurance to ensure they are fully aware of the costs involved.

Life Insurance: Accidental Death Coverage Explained

You may want to see also

Administration fees are charged for accounting and record-keeping

Administration fees are charged by life insurance companies to cover the costs of maintaining the policy, including accounting and record-keeping. These fees are usually deducted from the policy value on a monthly basis. It is important to understand the various fees and charges associated with a life insurance policy before purchasing one.

The cost of life insurance is influenced by several factors, including age, gender, health, occupation, lifestyle choices, and family medical history. Generally, younger and healthier individuals pay lower premiums. Life insurance rates also vary depending on the type of policy, such as term life insurance or permanent life insurance, and the coverage amount.

Term life insurance is typically more affordable as it covers a fixed period and does not build cash value. On the other hand, permanent life insurance lasts a lifetime and includes a cash value component, resulting in higher premiums.

It is worth noting that life insurance companies use mortality tables and interest earnings to calculate premium rates. They also consider the expense factor, which includes the costs of operating the company, such as salaries, agents' compensation, and legal fees. These factors can vary across different insurance providers.

Additionally, life insurance quotes are usually higher for smokers compared to non-smokers due to the associated health risks. Life insurance rates also increase with age as life expectancy decreases. Therefore, it is advisable to purchase life insurance at a younger age to lock in lower rates.

Life Insurance: A Child Changes Everything

You may want to see also

Premium loads are deducted from payments before they are applied to the policy

Life insurance is an important financial product that provides peace of mind and security for individuals and their loved ones. When purchasing life insurance, it is crucial to understand the various fees and charges associated with the policy. One such charge is the premium load.

A premium load is an additional fee or charge imposed on the regular premium paid by the policyholder. It is expressed as a percentage of the premium and is deducted before the remaining amount is allocated to the policy's cash value. Premium loads are designed to cover administrative costs, underwriting expenses, and sales commissions incurred by the insurance company. By imposing these charges, insurance providers can maintain their operational efficiency and provide additional benefits or services to the policyholder.

The calculation of premium loads involves evaluating various risk factors associated with the insured individual, such as age, health condition, and lifestyle choices. These factors are assessed through actuarial techniques and statistical data analysis. Premium loads can be calculated either as a percentage of the base premium or as a fixed amount, depending on the insurance company's policies and the specific coverage provided.

It is important for individuals to carefully review and understand the premium load associated with their chosen policy. These charges can vary among different insurance policies and impact the overall growth of the cash value over time. Premium loads are standard in the insurance industry, and insurance companies are required to disclose them transparently to policyholders.

Understanding premium loads is essential for individuals seeking insurance coverage. By considering these charges, individuals can make informed decisions when purchasing life insurance and ensure they are getting the best value for their money. Premium loads play a crucial role in the overall cost structure of life insurance policies.

Chewing Tobacco: Life Insurance Premiums and Health Risks

You may want to see also

Life insurance companies use mortality tables to estimate how much money they will need to pay for death claims

Life insurance policies are priced based on two underlying concepts: mortality and interest. The third factor is the expense factor, which covers the company's operating costs. The premium rate is determined by the cost of the policy, which includes the cost of selling insurance, investing the premiums, and paying claims.

Mortality tables are used by life insurance companies to estimate how much money they will need to pay for death claims each year. These tables are statistical charts that show the rate of deaths occurring in a defined population during a selected time interval or survival rates from birth to death. They are used to inform the construction of insurance policies and other forms of liability management.

Mortality tables typically show the probability of a person's death before their next birthday, based on their current age. The tables are constructed separately for men and women, as men tend to have shorter lifespans and more dangerous jobs or lifestyles, making them riskier to insure.

In addition to age and gender, other factors such as smoking status, occupation, socio-economic class, and family health history are also considered in mortality tables. These tables provide statistics indicating the likelihood that a person of a given age will live a set number of years. This allows insurance companies to assess risks in individual policies and their overall insured population.

For example, a male non-smoker wanting to buy a $100,000 life insurance policy at age 40 is estimated to live to age 81, according to mortality tables. This means the insurer can expect to receive 41 years of premium payments before paying the death benefit. The insurer sets the premium based on this mortality prediction and the future payout.

By using mortality tables, life insurance companies can determine the average life expectancy for each age group and set premiums accordingly. The younger and healthier you are, the cheaper your premiums will be. Insurers typically classify applicants as super preferred, preferred, or standard, with premiums calculated based on the risk class.

Health Insurance: A Key to Longevity?

You may want to see also

Frequently asked questions

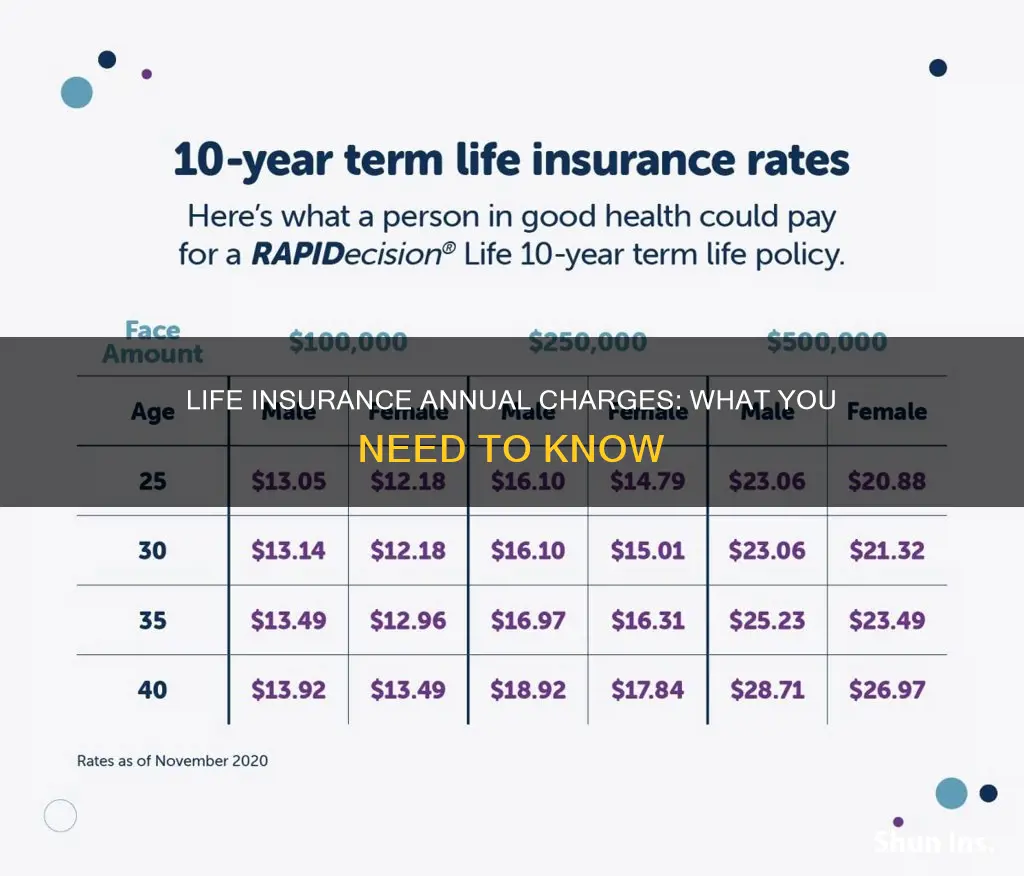

The cost of life insurance depends on several factors, including age, gender, health, occupation, and lifestyle choices. The average cost is around $12 to $14 per month for a 20-year, $250,000 to $500,000 term life insurance policy for a healthy 30 to 40-year-old.

Life insurance charges are typically paid monthly. However, some policies may offer annual payment options, but this is less common.

Yes, there are various fees and charges associated with life insurance policies. These include the cost of insurance protection, premium loads/sales charges, administration fees, monthly per-thousand charges, mortality and expense risk charges, and fund management fees.