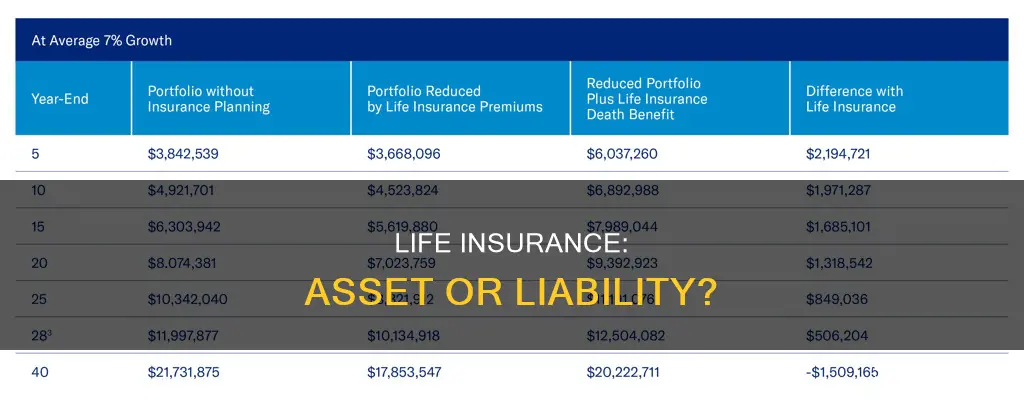

Life insurance can be a necessity for most people, but only some types are classified as an asset. An asset is something a person owns or controls, which has some type of value and can be converted into cash. In most cases, term life insurance will not be counted as an asset. Term life insurance is a form of protection that lasts for a set period and pays a death benefit to your beneficiary if you die while the policy is active. Whole life insurance, on the other hand, is considered an asset because it accumulates cash value over time, which can be withdrawn while the policyholder is still alive.

| Characteristics | Values |

|---|---|

| Whether life insurance is considered an asset | Depends on the type of policy |

| Types of life insurance policies that are considered assets | Whole life insurance, universal life insurance, variable life insurance, indexed universal life insurance |

| Types of life insurance policies that are not considered assets | Term life insurance |

| Reasons why some life insurance policies are considered assets | Accrue cash value while the policyholder is alive; the cash value can be withdrawn while the policyholder is alive |

| Reasons why some life insurance policies are not considered assets | Do not accrue cash value; only pay out to dependents in the event of the policyholder's death |

| Factors that determine whether life insurance is considered an asset | The ability to benefit financially from the policy while alive |

| Institutions that consider life insurance as an asset | Banks, mortgage lenders, divorce courts |

What You'll Learn

Whole life insurance is an asset

Whether or not life insurance counts as an asset depends on the type of life insurance policy in question. Whole life insurance is considered an asset, whereas term life insurance is not.

An asset is something that a person owns or controls that has some type of value they can access or benefit from. In the financial sense, assets are concrete things of monetary value that are owned at a given time. Liquid assets include money in a bank account, stocks, or holdings in investment accounts.

Whole life insurance is a form of permanent life insurance that accumulates cash value over time. A portion of the premiums paid goes into a tax-deferred savings account, which is referred to as the cash value of the policy. This cash value can be withdrawn while the policyholder is still alive, and it earns interest over time. Therefore, whole life insurance is considered an asset, particularly during divorce proceedings or mortgage underwriting. The cash value of the policy is included in the value of the policyholder's estate.

In contrast, term life insurance is not considered an asset because it does not have a cash value component. Term life insurance is temporary coverage that lasts for a set period, usually 10 to 30 years, and it only pays out a death benefit to the policyholder's beneficiaries if they pass away during that time. Term life insurance does not provide any financial benefit to the policyholder while they are alive, so it is not classified as an asset.

Citibank's Life Insurance Offer: What You Need to Know

You may want to see also

Term life insurance is not an asset

Term life insurance is not considered an asset because it does not have a cash value component. Term life insurance is designed to provide temporary coverage for a set period, typically 10 to 30 years, and does not accumulate cash value over time. The main purpose of term life insurance is to offer protection and ensure financial stability for your family or beneficiaries in the event of your death.

Unlike whole life insurance or other permanent life insurance policies, term life insurance does not allow you to withdraw funds or benefit financially while you are alive. It is purely a form of protection and does not serve as an investment vehicle. The value of term life insurance lies in the peace of mind it provides, knowing that your loved ones will be taken care of financially if something happens to you.

While term life insurance may have mathematical or intangible value, it is not considered an asset in the traditional financial sense. An asset is typically defined as something you own that has concrete monetary value and is expected to provide a future financial benefit. Term life insurance does not meet this definition as it does not have a cash value that can be accessed or utilised while the policyholder is alive.

In rare cases, proceeds from a term life policy might be considered an asset if the policy is sold for a profit or if the total assets inherited exceed a certain threshold, resulting in estate or gift tax implications. However, these are exceptions to the general understanding that term life insurance is not classified as an asset.

It's important to note that different experts may have varying opinions on whether term life insurance is considered an asset, and it can depend on the specific circumstances and riders within the policy. If you have questions about your specific policy, it's always best to consult with a licensed financial advisor or insurance agent.

Ezlynx Life Insurance Support: What You Need to Know

You may want to see also

Life insurance as an asset in divorce proceedings

Whether or not life insurance is considered an asset depends on the type of policy. Term life insurance, which only pays out to dependents in the event of the policyholder's death, is not considered an asset. This is because it has no cash value and cannot provide financial benefit to the policyholder while they are alive.

On the other hand, whole life insurance and other types of permanent life insurance with a cash value component are considered assets. This is because the policyholder can withdraw funds from the policy while they are alive.

During divorce proceedings, any cash value policies, including joint or survivorship policies that cover both spouses, are counted as assets when dividing property. This means that the cash value of the policy is listed among the marital assets to be divided, with each spouse typically receiving half.

If there are children involved, life insurance becomes even more important. The spouse with primary custody may want to maintain a policy on their ex-spouse with a benefit amount high enough to replace child support or alimony until the last child is grown. This ensures that the children will still be financially provided for in the event that the non-custodial parent passes away.

Additionally, the spouse with primary custody may want to take out a life insurance policy on themselves to protect their children or other dependents in case they pass away. To determine the minimum benefit amount, they can calculate how many years they have until their youngest child turns 18 (or 21 for extra safety) and multiply this number by their annual income.

It is important to note that, in most states, an ex-spouse is no longer considered to have an insurable interest, and therefore cannot remain on the policy. However, a divorce decree may require the ex-spouse to stay on the policy, especially if there are children involved.

DCU's Term Life Insurance Offer: What You Need to Know

You may want to see also

Life insurance as an asset when applying for a mortgage

Life insurance can be a valuable asset when applying for a mortgage, and there are a few ways to leverage it. Firstly, lenders may accept your life insurance policy as collateral for the mortgage. In this case, the death benefit from the policy would be used to pay off the remaining mortgage debt if you were to pass away before fully paying off the loan. This option can improve your chances of qualifying for a mortgage and may even lead to a lower interest rate.

Another way life insurance can be used as an asset is if the policy has a cash value. This is typically associated with permanent life insurance policies, such as whole life or universal life insurance. The cash value of these policies can be accessed and used towards the down payment or future mortgage payments. However, withdrawing the cash value may reduce the death benefit and available cash surrender value, and there may be surrender charges.

It's important to note that term life insurance, which is designed for temporary coverage, usually does not accumulate cash value and, therefore, may not be considered an asset in the same way. Additionally, mortgage life insurance, where the lender is the beneficiary, may not provide the same flexibility as a standard term life insurance policy, as the death benefit goes directly to the lender instead of your loved ones.

When applying for a mortgage, it is crucial to include all your assets, as this can impact the type of mortgage you qualify for and the interest rate you receive. Lenders will consider your net worth, income, and assets to assess your ability to make mortgage payments, the down payment, and closing costs.

Life Insurance and Probate: What's the Connection?

You may want to see also

Life insurance as an asset when applying for student financial aid

When applying for student financial aid, it is important to understand how life insurance policies can affect your eligibility. The treatment of life insurance as an asset depends on the specific type of policy and the application process. Here is what you need to consider:

Treatment of Life Insurance as an Asset:

The cash value of whole life insurance policies is generally not considered an asset for the Free Application for Federal Student Aid (FAFSA). FAFSA specifically excludes the cash value of whole life insurance policies from the list of assets that need to be reported. This means that the money built up in your whole life insurance policy will not have a direct impact on your FAFSA application.

Impact on Financial Aid Eligibility:

While the cash value of whole life insurance policies is not included in the FAFSA calculation, it is important to note that the treatment of life insurance as an asset may vary for other financial aid applications or institutions. Some colleges and universities may use additional information, such as the CSS Profile, to allocate institutional funds. In these cases, non-qualified annuities associated with life insurance policies may be counted as assets. Therefore, it is essential to review the specific requirements and guidelines of the financial aid application process you are following.

Strategies for Maximizing Financial Aid Eligibility:

To maximize your eligibility for need-based student financial aid, consider the following strategies:

- Reduce Income During Base Years: Minimize income in the years leading up to the application. This can include taking an unpaid leave of absence, incurring capital losses, or postponing bonuses until after the base year.

- Convert Included Assets to Non-Included Assets: Convert assets that are counted by FAFSA (such as savings and investment accounts) into non-included assets (such as retirement accounts). This will shelter them from the need analysis process and increase your eligibility.

- Increase Family Members in College: If multiple family members are enrolled in college at the same time, the family contribution is split among them, potentially increasing eligibility.

- Take Advantage of Dependency Status: Changing the student's status from dependent to independent can impact eligibility. Getting married before submitting the FAFSA or delaying college until age 24 can lead to independent status.

- Spend Student's Assets First: Prioritize spending the student's assets before touching the parent's assets. Student assets are typically assessed at a higher rate and can significantly impact financial aid eligibility.

- Utilize Retirement Funds: Maximize contributions to retirement funds, such as 401(k) plans, pension funds, and IRAs, as these are generally not considered assets by the need analysis formulas.

Impact of Insurance Proceeds:

It is important to note that while life insurance policies themselves may not be counted as assets, the insurance proceeds can be considered income on the FAFSA in the year they are received. This could impact your financial aid eligibility. Consult with a financial advisor to understand how insurance proceeds may affect your specific situation.

Florida's Insurance Agent Licensing: Life and Health Exclusivity

You may want to see also

Frequently asked questions

Term life insurance is not considered an asset as it lacks cash value and only pays out to your dependents in the event of your death.

Whole life insurance and other forms of permanent life insurance with a cash value component are considered assets as the policyholder can withdraw funds from the policy while they are alive.

In rare cases, proceeds from a term life policy might become an asset if the policy is sold for a profit or if your total assets amount to a very high value.

The easiest way to identify whether your life insurance policy is an asset is to consider whether you can profit from it while you are alive.