Life insurance covers death due to natural causes, illness, and accidents. However, the insurance company can deny paying out your death benefit in certain circumstances, such as if you lie on your application, engage in risky behaviours, or fail to pay your premiums. Life insurance policies also cover suicide, but only if a certain amount of time has passed since you bought the policy. If you have a pre-existing condition, you may still be able to get life insurance, but it may be more expensive and you may have to accept lower coverage.

| Characteristics | Values |

|---|---|

| What does life insurance cover? | Financial support for beneficiaries when the insured person dies |

| Covers funeral costs, debts, mortgage payments, income replacement, and future security | |

| Types of life insurance policies | Term life, whole life, universal life, and guaranteed issue policies |

| Riders | Accidental death, disability waivers, accelerated benefits, long-term care, guaranteed insurability, and term conversion options |

| Does life insurance cover sickness? | Yes, life insurance covers death due to natural causes, illness, and accidents |

| Life insurance covers suicide, but only if a certain amount of time has passed since you bought the policy | |

| If you have a pre-existing condition, you may still qualify for life insurance, but it may be more expensive and offer less coverage | |

| Critical illness insurance is a supplementary insurance product that provides a lump sum benefit to cover living expenses if you are unable to work due to illness |

What You'll Learn

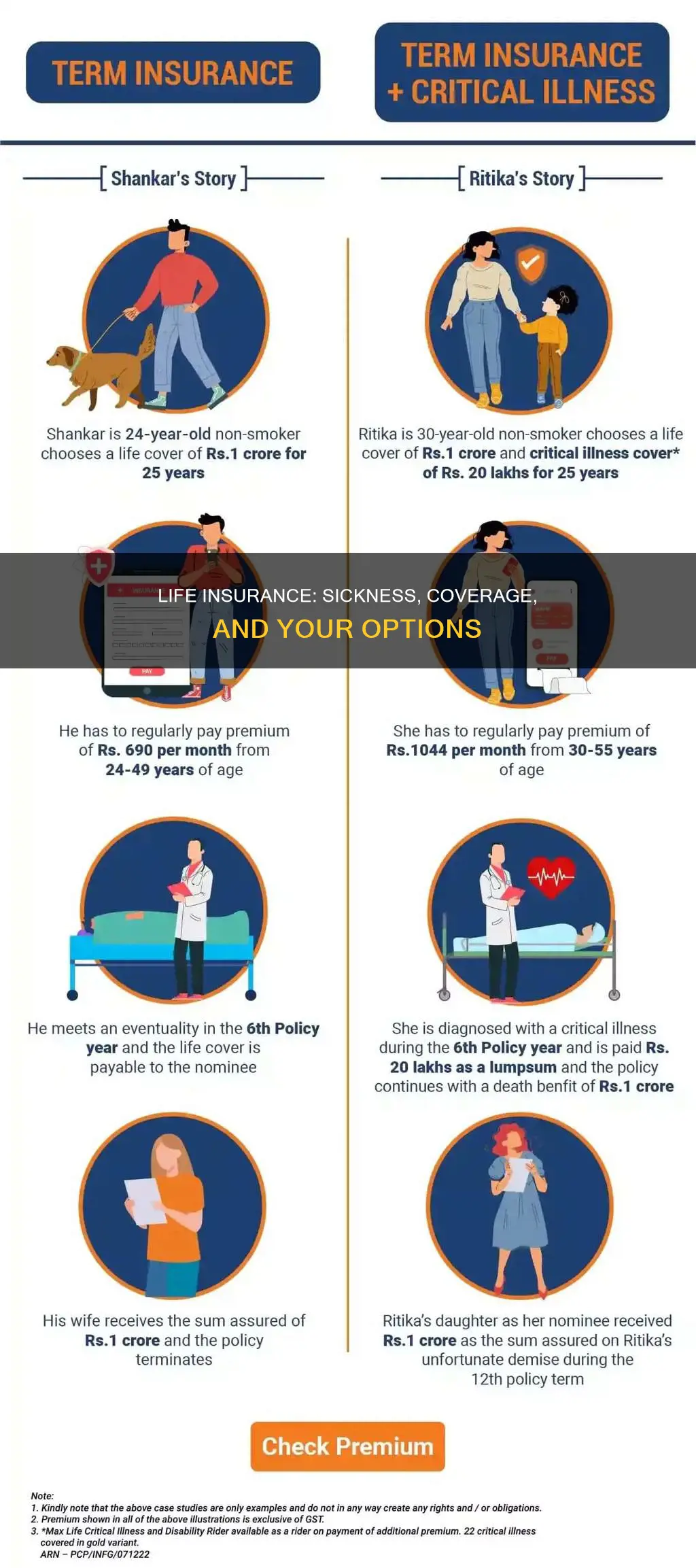

Life insurance and critical illness insurance

Life insurance covers most causes of death, including old age, illness, and other natural causes, as well as death by accidents. It offers financial support to beneficiaries when the insured person dies, helping to cover funeral costs, debts, mortgage payments, income replacement, and future security. There are several types of life insurance policies, including term life, whole life, universal life, and guaranteed issue policies, each with varying features and premiums.

Life insurance policies do not cover every cause of death, and there are some exclusions. These can include suicide (usually within the first two years of the policy), dangerous or illegal activities, substance abuse, and misrepresentation on the application. If the insured person has a pre-existing medical condition, this may also affect their coverage options and increase their rates. In some cases, a pre-existing condition may result in higher costs or limited coverage.

Critical illness insurance is a supplementary insurance product that is separate from life insurance. It provides a lump-sum cash benefit to the policyholder if they are diagnosed with a critical illness, which can help cover living expenses and bills while they are unable to work. Critical illness insurance covers a range of conditions, including heart attack, stroke, cancer, organ transplant, and coronary bypass. Some policies may also include additional conditions such as blindness, deafness, or paralysis. The cost of critical illness insurance varies depending on the provider, the policyholder's age and health, and other factors.

Freedom Life Insurance: Prep Coverage and Benefits Explained

You may want to see also

Pre-existing conditions and life insurance

Pre-existing conditions can make it more difficult and expensive to get life insurance, but even if you have a chronic or terminal health problem, you can likely find a policy you qualify for if you shop around. The specific policy types you qualify for will depend on your particular medical problems, how well your condition is managed, and the insurer.

A pre-existing condition is a medical issue you were diagnosed with or treated for before applying for life insurance. Each insurer has its own underwriting process, which is how they assess applicants' risk profiles. Some insurers are more flexible about certain health conditions than others. In general, you’ll raise a red flag if you have one or more of the following pre-existing conditions:

- High blood pressure

- Diabetes

- Cancer

- Asthma

- Previous injuries (depending on their severity and any lasting effects)

- Smoking or chewing tobacco

If you develop a serious condition after you already have life insurance, it won't affect your rates. Your life insurance premium will remain the same for the length of your policy.

When you apply for life insurance, the insurance company may ask questions about your age, fitness level, lifestyle, and medical history. They may also ask questions about your family medical history. In many cases, you'll be required to undergo a medical exam to qualify. You might be able to opt out of the medical exam, but doing so may increase your premium significantly.

Generally, your life insurance premium will be lower the younger you are, the better you maintain any conditions, and the less you participate in risky activities. When you purchase a policy, you might consider adding a guaranteed insurability rider in case you want to increase your death benefit at a later date without undergoing medical testing.

- Stick to your treatment plan: Demonstrating adherence to your treatment plan shows the insurer you’re managing your condition and helps you stay healthy. Show insurers proof that you visit your health provider regularly, take any prescribed medication, and follow any other medical advice or instructions your health provider has given you.

- Get regular exercise: Regular exercise keeps you healthy overall. It offers numerous general health benefits and can reduce the risks or symptoms of your pre-existing condition. Evidence of regular exercise can further convince an insurer that you’re managing your condition and maximizing your health.

- Lose weight (if you are overweight): Depending on your condition, losing weight can increase your chances of approval for a life insurance policy. This is because getting to a healthy weight can lead to a range of positive health effects, such as reduced blood pressure, better blood sugar, and a lower chance of developing other conditions.

- Shop around: Insurance coverage costs and terms for the same coverage can vary between insurers. Shopping around can help you find insurers willing to offer coverage to you despite a pre-existing condition. It can also help you compare quotes and choose the insurer offering the best rates and terms.

Life Insurance and DMX: A Legacy's Future

You may want to see also

Suicide and life insurance

Suicide is a sensitive topic, and it's important to know how life insurance policies treat it. Most life insurance policies include a suicide clause that prevents the insurer from paying out to beneficiaries if the insured person's death was due to self-inflicted injury within a certain period, typically two years, from the start of the policy. This clause is designed to prevent someone from purchasing a policy immediately before taking their own life so that their loved ones can receive financial benefits.

The exact conditions of what your life insurance policy covers will depend on your individual contract, but suicide is generally excluded from coverage within the first two years of the policy. After this exclusion period, suicide may be covered, and the policy may pay out for suicidal death if there is no suicide clause or if the clause is no longer in effect, provided no other terms in the policy have been violated.

It's important to note that group life insurance through an employer or organization, as well as military life insurance, generally does not include a suicide clause, so these policies can pay out for suicidal death. However, supplemental life insurance purchased through an employer usually has a standard suicide clause.

If you or someone you know is struggling with mental health issues or having suicidal thoughts, it's crucial to seek help. Resources like the Suicide & Crisis Lifeline (988) are available to provide support and assistance.

Fidelity Life Insurance: Physical Exam Requirements and Details

You may want to see also

Risky activities and life insurance

Life insurance policies cover most causes of death, but there are some exclusions. One of these is dangerous or risky activities, which can include:

- Skydiving

- Deep-sea diving

- Race car driving

- Flying a plane

- Horseback riding

- Bungee jumping

- Parasailing

- Off-roading

- BASE jumping

- Hang gliding

- Rock climbing

- White water rafting

- Skiing

- Motorcycle racing

If you take part in these activities, you may be denied coverage or pay a higher premium, as the insurer considers the action high-risk. However, some insurers may agree to cover these activities for an extra charge.

If you don't disclose a dangerous hobby or work on your insurance application to secure approval, this is considered fraud. If the insurer finds out, they may deny the application, adjust the policy and premium payment, demand back payment of adjusted premiums, limit the benefit payment, or even cancel the insurance policy.

It's important to note that not all insurance providers consider the same activities hazardous, and occasional participation in a hazardous activity will not necessarily classify you as a high-risk applicant.

Geico: Life Insurance Options and Benefits Explored

You may want to see also

Life insurance and criminal activity

Life insurance companies evaluate the risks of insuring individuals with criminal records, and the likelihood of approval depends on the nature of the conviction and the time elapsed since the conviction. A criminal record indicates a high-risk lifestyle, with a greater chance of early death and payout of the death benefit. The type of criminal conviction is also significant—while misdemeanours can be problematic, felonies are considered more serious. Major felonies, such as murder, acts of terrorism, rape, drug trafficking, and participation in organised crime, will usually result in automatic decline from insurance companies.

Life insurance companies are hesitant to insure individuals who are currently incarcerated or on probation or parole due to the high risk of re-offending and returning to jail. However, those who had life insurance before being incarcerated can usually keep their policies as long as the premiums are paid.

For individuals with a criminal record, it is important to be honest on the life insurance application. Background checks are standard, and nondisclosure can result in severe consequences. Working with an experienced insurance broker and fully disclosing the criminal record can increase the chances of obtaining life insurance. The nature and severity of the conviction, as well as the time elapsed since the conviction, will impact the type of policy that can be obtained.

The more time that passes since a conviction, the better the chances of obtaining life insurance with favourable rates. Underwriters look for positive lifestyle changes sustained over time. Additionally, completing rehabilitation programs, such as drug rehab, or engaging in volunteer work can improve the chances of approval. Seeking guidance from an independent insurance agent who has experience with high-risk cases can increase the chances of obtaining life insurance with a criminal record.

Freedom Life Insurance: Does It Exist?

You may want to see also

Frequently asked questions

Life insurance covers death due to natural causes, illness, and accidents. However, the insurance company can deny paying out your death benefit in certain circumstances, such as if you lie on your application, engage in risky behaviours, or fail to pay your premiums.

Life insurance offers financial support to beneficiaries when the insured person dies, covering funeral costs, debts, mortgage payments, income replacement, and future security.

There are several types of life insurance, including term life, whole life, universal life, and guaranteed issue policies. Term life insurance is typically the cheapest form of coverage, even if you have a pre-existing medical condition.