Life insurance rates are determined by a variety of factors, including age, health, gender, lifestyle, and the type of policy chosen. Age plays a pivotal role in calculating life insurance premiums, with older applicants facing higher premiums due to an increased likelihood of a payout. As individuals journey through life, the probability of passing away rises, elevating the risk for insurers. This means that policy costs generally increase with age, as the chance of a death benefit claim becomes more likely. While other factors, such as health status and lifestyle choices, also influence pricing, age remains a primary driver of life insurance rates.

| Characteristics | Values |

|---|---|

| How are life insurance rates determined | Life insurance rates are determined by factors such as age, health, gender, lifestyle factors, type of life insurance policy, and amount of coverage |

| How does age affect life insurance rates | Life insurance rates typically increase with age as health issues become more frequent and the likelihood of needing to use the insurance rises |

| How much do life insurance rates increase with age | On average, the premium amount increases by about 8% to 10% for every year of age, but it can be as low as 5% annually if you're in your 40s and as high as 12% annually if you're over 50 |

| Are there factors other than age that affect life insurance rates | Other factors that affect life insurance rates include health status, gender, lifestyle choices, occupation, family medical history, driving record, and credit history |

| How can I get the best life insurance rates | To get the best life insurance rates, it is recommended to buy a policy as early as possible, maintain good health, choose the right coverage amount and term length, and quit smoking if you are a smoker |

What You'll Learn

Life insurance rates increase with age

Life insurance rates are primarily based on life expectancy, and as age is a key factor in determining how long someone is expected to live, it plays a pivotal role in calculating insurance premiums. The older you are, the more likely you are to pass away, and so the greater the risk to insurers of having to pay out a claim. This is why life insurance rates tend to increase with age.

How Age Affects Insurance Premiums

Actuarial tables are used by insurance companies to estimate life expectancy and mortality rates, and these, along with other factors, are used to determine how much someone will pay for life insurance coverage. The older you are when you purchase a policy, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The older you are, the more likely that is to happen.

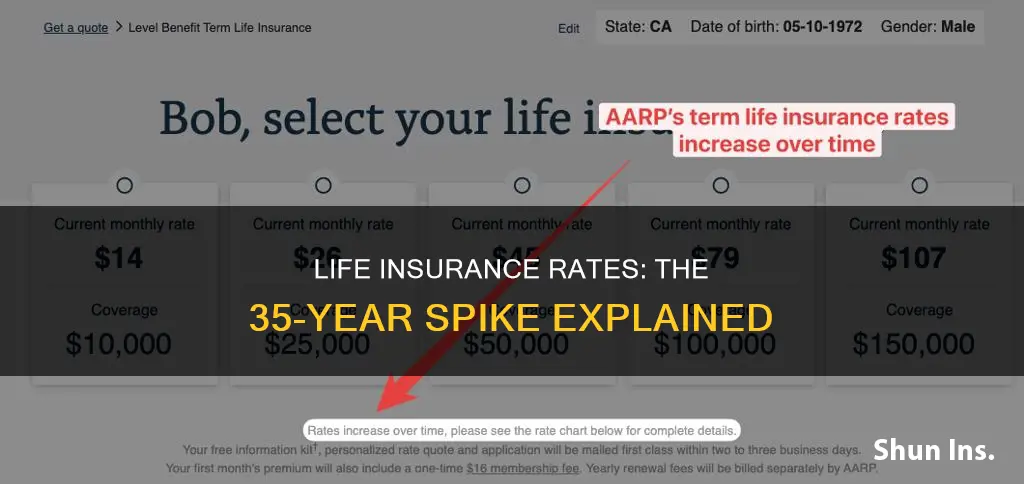

The average monthly rate for life insurance is $22 for a 30-year-old, $32 for a 40-year-old, and $80 for a 50-year-old. The increase in monthly premiums as you age is much smaller when you are young compared to when you are older. For example, the average life insurance quote only increases by 6% between the ages of 25 and 30, but it jumps by 86% between the ages of 60 and 65.

Other Factors Affecting Insurance Premiums

While age is a primary factor in determining life insurance rates, other factors also come into play. These include:

- Health: People who are in good health will generally pay lower rates than those with multiple health conditions. Major pre-existing conditions like heart disease, stroke, diabetes, or cancer usually have a greater impact on premiums. More minor conditions like asthma, being overweight, high cholesterol, or high blood pressure usually have a lower impact.

- Gender: Since women have a longer average life expectancy than men, their insurance rates are generally lower.

- Smoking status: Smokers are considered to be at higher risk of developing health issues, and so they tend to pay more for life insurance.

- Occupation and lifestyle: Applicants who engage in low-risk activities often pay less for insurance than those who participate in high-risk roles or hobbies.

- Type of coverage: Term life insurance plans generally have significantly lower rates than whole life insurance policies. No-exam life insurance plans are more convenient but can significantly raise premiums.

When to Purchase Life Insurance

Since the cost of life insurance rises with age, the most cost-effective strategy is to buy it as early as possible. This will lock in your lowest premium and save you the most money in the long run.

Chrysler Retiree Life Insurance: What's the Deal Now?

You may want to see also

Life insurance rates for women vs men

Life insurance rates are influenced by a variety of factors, including age, gender, health, lifestyle, and the type of policy chosen. While age is a significant factor, gender also plays a role in determining premiums.

Men generally have shorter life expectancies than women, leading to higher life insurance rates. On average, women pay about 24% less for life insurance than men. This difference in rates is more pronounced at older ages. For instance, at age 65, a woman might pay around $2,017.50 per month for a $750,000 coverage amount, while a man's premium could be as high as $3,602.50 for the same coverage.

Actuarial tables, which consider historical data on mortality rates and life expectancy, show that men tend to die earlier than women. This increased mortality risk among men is the primary reason why their life insurance rates are higher.

However, it's important to note that gender is not the only factor insurers consider. Medical history, lifestyle choices, and other factors can have a more significant impact on the cost of coverage. Additionally, gender-neutral options are not always available on life insurance applications, which can create challenges for transgender and non-binary individuals.

Life insurance rates for women and men can vary depending on age, health, and other factors. Women typically pay lower premiums due to their longer life expectancy, but the difference in rates may increase with age.

Liberty Mutual's Life Insurance: Drug Testing and Policy Details

You may want to see also

Whole life insurance rates

Whole life insurance is a permanent life policy that provides coverage for your entire life, meaning it never expires. As long as you pay your premiums, the policy will pay out a death benefit to your beneficiaries after you pass away. Whole life insurance rates tend to be much higher than term life insurance rates.

The cost of whole life insurance varies depending on several factors, including the insured person's age, gender, health status, occupation, hobbies, and the type of policy and coverage amount they choose. Generally, younger people will pay lower premiums than older people due to their longer expected lifespan and better overall health. Women also tend to have lower rates than men since they statistically live longer.

- A $500,000 whole life insurance policy costs an average of $451 per month for a 30-year-old non-smoker in good health.

- A 35-year-old female can expect to pay an average of $25 per month for a $500,000 term policy, while a 35-year-old male can expect to pay $30 for the same coverage.

- A 45-year-old female might pay about $201 per month for a $100,000 whole life policy, while a 45-year-old male might pay about $215 for the same policy.

- A 30-year-old will likely pay a lower premium than a 40-year-old, with the difference increasing with age.

It's important to note that rates can vary across different insurance providers, so it's recommended to shop around and compare policies before making a decision. Additionally, being transparent when applying for life insurance is crucial, as lying on an application can result in an application being denied or death benefits not being paid out.

Chest Pain: Can It Impact Your Life Insurance Eligibility?

You may want to see also

No-exam life insurance rates

No-exam life insurance policies allow you to get coverage without a medical exam. However, they are generally more expensive than traditional insurance policies. This is because insurance companies need to offset the risk of writing a policy with less or no health-related information about the applicant.

No-exam life insurance policies are ideal for those who need coverage fast, have been denied traditional life insurance, or suffer from chronic, pre-existing medical conditions. The application process is simplified and can be completed online or by phone, and applicants can get coverage quickly, sometimes instantly.

There are two types of no-exam life insurance: simplified-issue and guaranteed-issue. Simplified-issue policies do not require a medical exam, but the application process involves health questions and often uses technology to gain insights into your medical history. Guaranteed-issue policies, on the other hand, do not require an exam or any questions about the applicant's health. As a result, these policies tend to have higher premium prices and lower levels of coverage.

- Mutual of Omaha: Offers no-exam options for both whole life and term life.

- Fidelity Life: Offers several no-exam coverage options, including whole life, term life, final expense, and accidental death benefit policies.

- Transamerica: Provides two no-exam plans that vary based on qualifying issue ages and the length of the premium-paying period.

- John Hancock: Offers ExpressTrack, which provides up to $3 million in coverage without a medical exam for applicants aged 18 to 60.

- State Farm: Offers two no-exam coverage options, including Instant Answer term life plan and guaranteed issue final expense plan.

- Lincoln Financial: Waives the medical exam requirement for the healthiest individuals aged 18 to 60 seeking coverage of up to $1 million.

- AAA: Offers no-exam options for both term and whole life, with online coverage estimates and important policy details available on their website.

Depression's Impact: Higher Life Insurance Premiums

You may want to see also

Life insurance rates by risk class

Life insurance rates are determined by placing applicants into different risk classes. These risk classes are based on factors such as overall health, participation in risky hobbies, and age. The higher the risk of the applicant, the higher the insurance premium they will pay.

Preferred Plus/Elite

Applicants in the Preferred Plus or Elite category are in excellent health, typically younger, and have no other immediate health concerns. They pay the lowest premiums for life insurance.

Preferred

The Preferred category is a small step down from Preferred Plus. Applicants in this category enjoy lower premiums due to excellent health but may have some subtle red flags like higher cholesterol.

Standard Plus

The Standard Plus category is for those with above-average health. Applicants may have slightly high blood pressure or a body mass index (BMI) outside the ideal range. Premiums are more favourable than the Standard risk class, but they may pay more than those in the Preferred or Preferred Plus groups.

Standard

The Standard risk class is for those with average overall health. They may be taking multiple medications, not fit within the published life insurance height and weight chart, and/or have a family history of cancer or other diseases.

Substandard/Rated

The Substandard or Rated risk class refers to people with significant health impairments. These individuals may have to pay an extra fee, known as a "table rating", to the issuing life insurance company.

Smoker

Smokers will pay significantly more due to increased health risks. Insurers will ask about smoking status and may test for nicotine in routine blood work.

It's important to note that the risk classification is not set in stone, and individuals can improve their risk class and lower their premiums by making lifestyle changes such as losing weight, quitting smoking, or switching to a safer occupation.

Understanding Health Insurance Coverage for Life Support Procedures

You may want to see also

Frequently asked questions

Yes, life insurance rates typically increase with age as health issues become more frequent and the likelihood of needing to use the insurance rises.

The best time to buy life insurance is as early as possible, as the cost increases by about 8% on average for each year of age.

The cost of life insurance depends on various factors, including gender, health, and lifestyle. For example, a 35-year-old non-smoking male in good health could expect to pay around $2,172 per year for a $1 million, 20-year term policy.