Life insurance is a cost-effective way to protect your family and finances in the event of your passing. It ensures that your loved ones are taken care of financially and that short and long-term financial obligations can be met. When considering life insurance, it is important to evaluate your needs and choose a policy that best suits your circumstances. MetLife is one of the many insurance providers that offer various life insurance options, including term and permanent policies, which can be obtained individually or through an employer. Their policies include additional benefits such as financial planning and grief counselling. However, it is always a good idea to review your coverage regularly and explore other options in the market to ensure that your plan continues to meet your needs.

| Characteristics | Values |

|---|---|

| Types of Life Insurance | Term, Permanent, Whole Life |

| Availability | All 50 states and Washington, D.C. |

| Customer Service Number | 1-800-638-5433 |

| Website | https://www.metlife.com |

| Additional Services | Dental Insurance, Vision Insurance, Pet Insurance, Retirement Solutions, Grief Counselling, Funeral Planning Services, Will Preparation Services, Transition Planning |

What You'll Learn

MetLife's life insurance coverage options

MetLife offers two main types of life insurance: term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance is a cost-effective way to protect your family and finances. It pays a specific lump sum to your loved ones and provides coverage for a specified period, usually from one to 20 years. If you stop paying premiums, the insurance coverage stops. Term life insurance does not build cash value, but it may give you the option to port your coverage to another company.

Term life insurance is ideal for covering specific financial responsibilities like a mortgage or college expenses, or supplementing a permanent policy.

Permanent Life Insurance

Permanent life insurance policies do not expire and are intended to protect your loved ones as long as you pay your premiums. Some permanent life insurance policies accumulate cash value, meaning the value of the policy will grow each year, tax-deferred, until it matches the face value of the policy. This cash value can generally be accessed via loans or withdrawals and used for a variety of purposes. This type of plan is typically portable, so coverage can continue if employment terminates.

Consider a permanent insurance policy if you want to put additional money into the policy on a tax-favored basis or if you want cash value that you can use while you're alive.

Advantages of Purchasing Life Insurance Through Work

MetLife also highlights the advantages of purchasing life insurance through your employer, if they offer a group plan. These advantages may include:

- Competitive group rates

- Guaranteed issue, meaning you can get coverage without answering health questions or taking a medical exam

- Convenient payroll deductions

- Easy access to enrollment and educational tools

- Confidence that your employer has reviewed and selected the plan

Calculating Your Coverage and Costs

MetLife provides a Life Needs Calculator to help you determine the amount of coverage you need. This will take into account factors such as your income, retirement savings, and personal expenses.

The cost of life insurance depends on factors such as age, gender, health status, and whether you smoke. Life insurance gets more expensive as you get older, and permanent policies typically have higher rates than term insurance.

Life Insurance Proceeds: Tax-Free Transfer for Beneficiaries

You may want to see also

MetLife's life insurance riders

MetLife offers two main types of life insurance: term and permanent. Term life insurance provides coverage for a specified period, usually one to 20 years, and pays a lump sum to your loved ones if you pass away during that time. Permanent life insurance, on the other hand, does not expire and provides lifelong protection as long as you continue paying premiums.

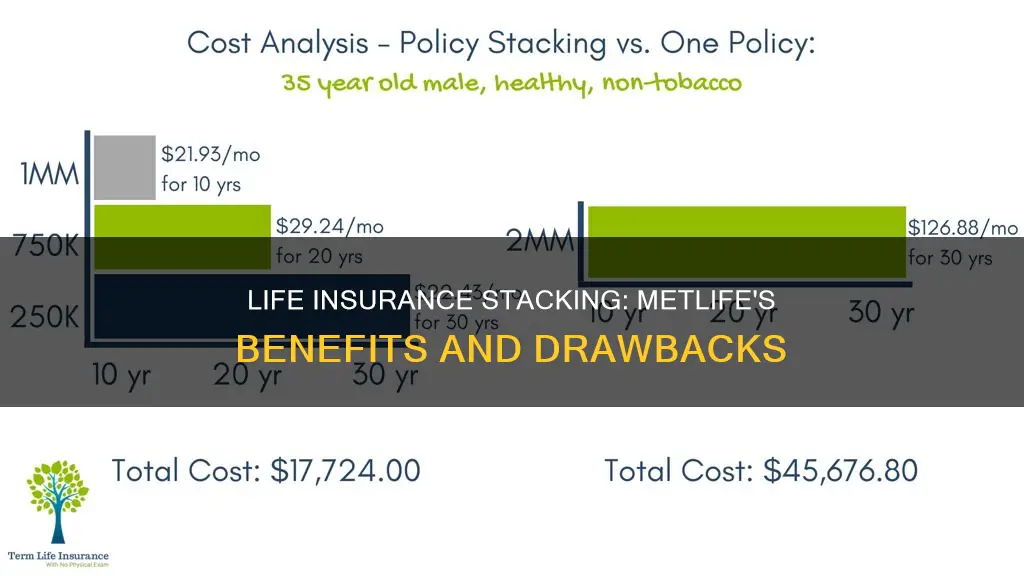

While the website does not explicitly mention stacking insurance, it does provide information on riders, which are additional benefits that can be added to a policy. Here is a detailed overview of MetLife's life insurance riders:

Riders are add-ons or amendments to a life insurance policy that provide additional benefits and coverage. They allow you to customise your policy to meet your specific needs and ensure that you have the protection you require. MetLife offers a range of riders that can be attached to their life insurance policies, although the specific riders available will depend on the type of policy you have.

When it comes to whole life policies, MetLife mentions that riders can be added during the conversion process. They state that "only those riders that are convertible on the existing policy and are available with the new policy can be added". Unfortunately, the website does not provide a comprehensive list of the riders available for whole life policies. However, they do recommend referring to their Client Fact Sheet for more detailed information on this topic.

In terms of universal life insurance, MetLife offers the option of a partial withdrawal. This rider allows you to request a partial withdrawal from your universal life policy, providing you with access to the cash value of your policy without surrendering it entirely.

Additionally, MetLife mentions disability waivers as a potential rider for life insurance policies. This rider allows the policyholder to apply for a waiver of premium payments if they become disabled and are unable to work. This can provide financial relief during a difficult time by ensuring that your life insurance policy remains active even if you are unable to make the regular premium payments.

It is important to carefully review the terms and conditions of any life insurance policy you are considering, including the available riders. MetLife encourages individuals to utilise their online resources, such as MetOnline, to manage their policies and review their coverage. They also provide a customer service phone number (800-638-5000) for further assistance and to help with accessing additional forms.

Life Insurance for Army Personnel: What You Need to Know

You may want to see also

MetLife's customer satisfaction

MetLife has a strong focus on customer satisfaction, aiming to provide peace of mind and support during challenging times. The company's claims support team is dedicated to going above and beyond for its customers, understanding that the loss of a loved one is never easy, especially when sudden.

MetLife's commitment to customer satisfaction is evident in its implementation of IBM Cognos, which improved operational accuracy and increased customer satisfaction. With this system, customers receive accurate and timely statements and can easily interrogate their statements and payments online, providing clarity and convenience.

The company also prioritises sustainability and social responsibility, striving to create a positive impact for its customers and communities. MetLife has a longstanding commitment to environmental stewardship, implementing energy efficiency, water conservation, and waste reduction practices across its global operations.

In addition, MetLife offers a range of life insurance solutions to meet diverse customer needs, including term and permanent policies, with benefits such as guaranteed level premiums, tax advantages, and the ability to build cash value. The company provides educational resources and tools to help customers make informed decisions about their coverage and offers competitive group rates, guaranteed issue policies, and convenient payroll deductions.

MetLife's customer testimonials reflect its dedication to customer satisfaction, with stories of how its insurance solutions have provided financial security and peace of mind during difficult times, such as a sudden loss of a loved one or a health crisis. The company's commitment to its customers is evident in its efforts to ensure their loved ones' futures are secure and their financial needs are met.

Gina and Life Insurance: What You Need to Know

You may want to see also

MetLife's life claims satisfaction

MetLife understands that filing a life insurance claim can be a difficult process, and they aim to make it as simple as possible for their customers. The company offers a life insurance claim kit, which includes a process summary to guide claimants through the necessary steps. There are two types of claim kits: the individual beneficiary claim kit and the trust/entity claim kit. The former is for those who are the named beneficiary of the policy, while the latter is for those claiming proceeds on behalf of an estate, trust, or company. It is important to carefully review the kit, complete the required claim form, and gather necessary documents such as the death certificate.

For individual claimants, personal details about both the claimant and the insured individual are required. This includes the social security number, relationship to the insured, and insurance policy number. For trust/entity claims, additional information about the trust/estate/entity, such as its full name, address, and tax identification number, is also necessary.

Once the claim form and required documents are assembled, there are several submission options. Claims can be submitted online, via email, fax, or mail. MetLife's customer service team can provide support and status updates throughout the process, and they can be reached via a dedicated phone line during business hours.

MetLife's life insurance claim process demonstrates their commitment to assisting customers during challenging times. The company strives to make the claim process straightforward and accessible, providing clear instructions, multiple submission methods, and responsive customer support to ensure a smooth and timely resolution for those navigating the complexities of a difficult period in their lives.

Life Insurance and Paramotoring: What's Covered?

You may want to see also

MetLife's customer complaints

MetLife has a complaints process in place, which involves several steps. Firstly, they will acknowledge a customer's complaint via email or phone call and provide a reference number. Within two working days, they will provide an update on the case investigation, and within five working days, they aim to deliver a resolution. If the customer is not satisfied with the response, they can contact the appeals committee within three months of the initial resolution, and a representative will respond within five working days.

There are several online customer reviews that highlight complaints about MetLife. One review mentions an issue with billing for a loan taken out against a life insurance policy, with the customer suspecting fraud. Another review mentions a negative experience with employer-ended coverage, where the customer claims that MetLife did not call them as promised, leading to issues with coverage.

MetLife has also faced regulatory issues, with the New York State Department of Financial Services announcing in 2014 that the company would pay $60 million for Insurance Law and other violations at its subsidiaries.

Cigna Life Insurance: Drug Testing Requirements Explained

You may want to see also

Frequently asked questions

Life insurance is a cost-effective way to protect your family and finances. It ensures that your family is taken care of financially in case something unforeseen happens to you.

MetLife offers two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, usually 1-20 years, while permanent life insurance offers lifelong coverage as long as premiums are paid.

Purchasing life insurance through an employer-provided group plan from MetLife can offer advantages such as competitive group rates, guaranteed issue without a medical exam, convenient payroll deductions, and easy access to enrollment and educational tools.

The amount of life insurance coverage needed depends on various factors, including your age, income, expenses, and financial goals. It's recommended to calculate your current financial contributions and future goals to determine the appropriate coverage amount.

The cost of life insurance from MetLife depends on factors such as age, health status, and the type of coverage chosen. MetLife's group life insurance plans offer competitive rates, and exact rates can be found in the enrollment materials provided by your employer.