Life insurance is important for protecting your loved ones, but getting covered can be stressful and challenging. Drug tests are a common part of the life insurance application process, with insurers typically ordering a full drug panel during the medical exam. While insurance companies have the right to require drug tests, requests for testing are uncommon. However, if signs of drug abuse are detected, insurers may demand higher premiums or refuse to provide coverage. The tests are usually done on blood or urine samples, and sometimes hair, to determine current drug use and identify any medical conditions. It is important to be honest during the application process, as lying about drug use can lead to serious consequences, including policy voidance or reduced death benefits.

| Characteristics | Values |

|---|---|

| How common are drug tests for life insurance? | Uncommon, but insurers have the right to require them |

| Who is most likely to be drug tested? | Those applying for an individual private policy |

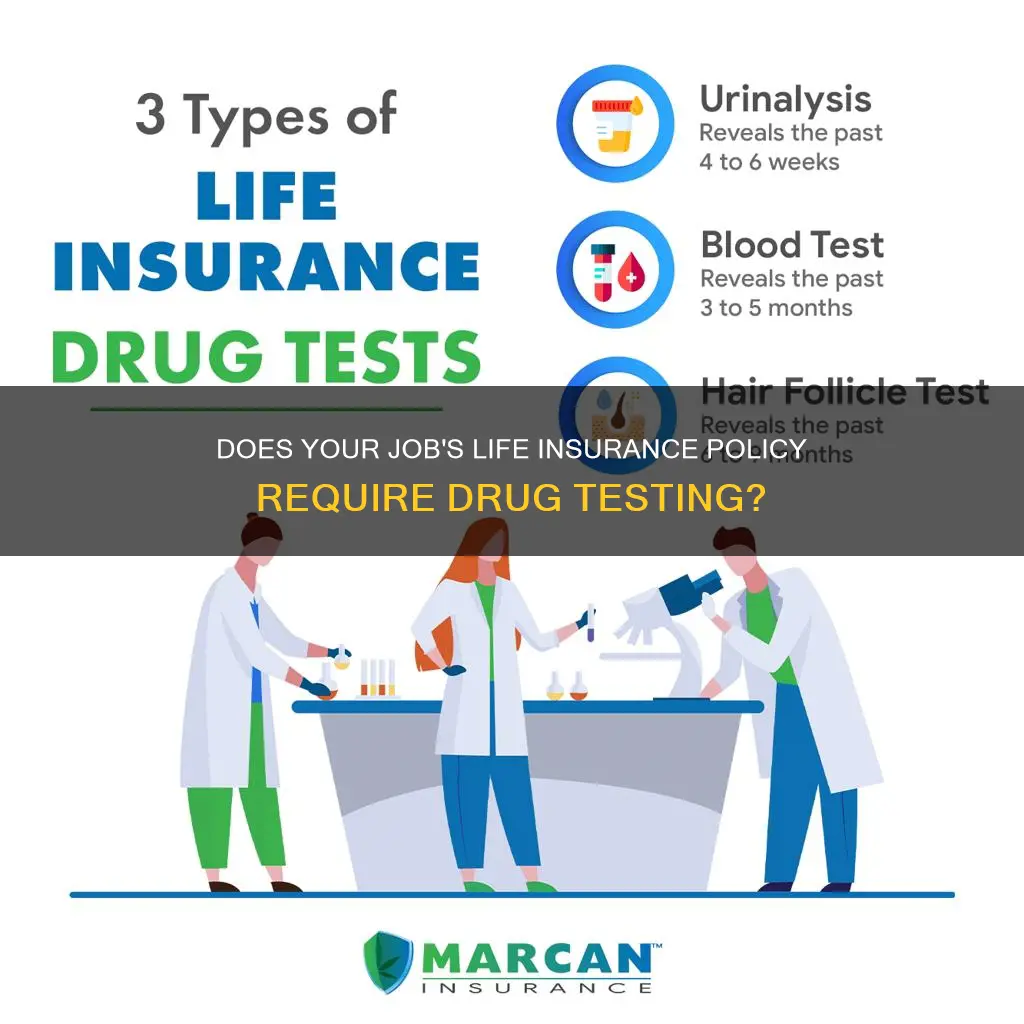

| What types of drug tests are used? | Urine, blood, hair follicle |

| What do insurers test for? | Amphetamines/methamphetamines, cocaine, opiates, phencyclidine (PCP), barbiturates, benzodiazepines, methadone, nicotine, prescription drugs, marijuana |

| What happens if you fail a drug test? | You may be denied coverage, charged higher premiums, or lose your job |

What You'll Learn

What substances are tested for?

Life insurance companies test for a variety of substances, including prescription and illegal drugs. The tests can be done on blood, urine, or hair samples. The tests can detect substances that have been consumed in the past 3 to 5 months for blood tests, 3 to 6 weeks for urine tests, and 6 to 9 months for hair follicle tests.

- Amphetamines/Methamphetamines: These include Meth, Crystal Meth, and Adderall. They are highly addictive and can cause an increased heart rate and blood pressure.

- Barbiturates: These are downers that can provide a feeling of euphoria and are often prescribed for headaches, seizures, and insomnia.

- Benzodiazepines: This family of drugs includes Xanax and Valium, which are commonly prescribed for anxiety or given to patients before surgery.

- Caffeine: Caffeine is a stimulant that can be found in coffee and tea. While it is not illegal, some insurance companies may view it as a risk factor.

- Cocaine: Cocaine is a stimulant that can give users energy and combat fatigue. It is illegal and can lead to health issues.

- Marijuana: Marijuana contains THC, which is the chemical that insurance companies test for. While marijuana is becoming legal in more places, it can still affect insurance rates.

- Methadone: Methadone is an opioid used for pain treatment and to help recovering heroin addicts. It can be prescribed, but if used recreationally, it will likely lead to a declined application.

- Nicotine: Found in cigarettes, cigars, patches, gum, and e-cigarettes, nicotine can lead to higher insurance rates and is often tested for.

- Opiates: This includes drugs such as Oxycontin, Morphine, Heroin, and Hydrocodone. Opiates can be prescribed, but if used recreationally, they will likely lead to a declined application or higher rates.

- Phencyclidine (PCP): PCP is a drug that can cause delirium and has no medical use. It will likely lead to a declined application if found in the system.

It is important to note that the substances tested for may vary between insurance companies, and it is always best to be honest on insurance applications and during medical exams. Providing false information or withholding information can have serious consequences.

Crate Carriers: Life Insurance Provision and Employee Benefits

You may want to see also

How long do they stay in your system?

The length of time that drugs remain in your system depends on several factors, including the type of drug, the method of ingestion, the dosage, and individual factors such as age, weight, sex, and physical health. Here is a detailed breakdown of how long specific drugs can stay in your system:

Marijuana/THC

THC, the active compound in marijuana, can be detected in the body for varying durations depending on the type of test. Urine tests can detect THC for 1 to 7 days, while blood tests can detect it for 3 to 5 months. Hair follicle tests have the longest detection window, with THC traces remaining for up to 6 to 9 months. It is recommended to abstain from marijuana use for at least 6 weeks before a life insurance drug test to ensure it does not show up in your system.

Amphetamines/Methamphetamines

Amphetamines and methamphetamines are stimulants that can remain in your system for a few days to a week. Urine tests can typically detect these drugs for 2 to 5 days, while blood tests can detect them for up to 3 to 5 months. Hair follicle tests are less common but can reveal amphetamine use for up to 6 to 9 months. To be safe, it is recommended to stop using these substances for at least a year before applying for life insurance.

Opioids

Opioids, including heroin, oxycodone, and morphine, are highly addictive substances that can be detected in the body for a few days after use. Urine tests can typically detect opioids for 1 to 3 days, while blood tests can detect them for 3 to 5 months. Hair follicle tests are not commonly used for opioids but can reveal opioid use for up to 3 months.

Benzodiazepines

Benzodiazepines, such as Xanax and Valium, are prescription medications used to treat anxiety and sleep disorders. They can be detected in the body for several days to a week. Urine and blood tests can typically detect benzodiazepines for up to 10 days, while hair follicle tests can reveal their use for up to 3 months.

Cocaine

Cocaine is a stimulant that can be detected in the body for a relatively short period. Urine tests can typically detect cocaine for 2 to 4 days, while blood tests can detect it for 3 to 5 months. Hair follicle tests are not commonly used for cocaine but can reveal its use for up to 3 months.

Nicotine

Nicotine, found in tobacco products, can be detected in the body through various tests. Urine tests can detect nicotine for up to 20 days, while blood tests can detect it for 1 to 10 days. Hair follicle tests can reveal nicotine use for a much longer period, typically up to 3 months.

It is important to note that these are general guidelines, and the detection windows can vary based on individual factors and the sensitivity of the test. The best way to ensure that drugs do not show up in a life insurance drug test is to abstain from using them for an extended period before the test.

Life Insurance and Coronavirus: What's Covered?

You may want to see also

What are the consequences of failing?

Failing a drug test for life insurance can have a range of consequences, from increased premiums to outright denial of coverage. Here are some key points to consider:

- Increased Premiums: If you fail a drug test, the insurance company may view you as a higher risk and demand higher premiums for coverage. This is especially true if you are applying for an individual private policy. They may also request more frequent drug testing to monitor your substance use.

- Denial of Coverage: In some cases, insurance companies may outright deny you coverage if you fail a drug test. This is more likely if you test positive for illegal substances or if your drug use indicates a serious health issue that increases their risk.

- Loss of Existing Coverage: If you already have a life insurance policy and fail a drug test during a routine medical exam, you may void your policy or face a reduction in the death benefit paid out. This is especially true if you were not honest about your drug use during the application process.

- Impact on Future Insurance Options: Failing a drug test for life insurance may affect your ability to obtain coverage in the future. Some insurance companies may view this as a red flag and be hesitant to offer you a policy, or they may charge even higher premiums.

- Legal Consequences: While rare, there can be legal ramifications if your failed drug test causes harm to others. For example, if you operate heavy machinery under the influence and cause an accident, you could face legal consequences in addition to losing your insurance coverage.

- Impact on Employment: In some cases, failing a drug test for life insurance may also impact your employment, especially if your job requires drug testing as a condition of employment. It could result in disciplinary action or even termination, depending on your company's policies.

It's important to remember that insurance companies are in the business of managing risk. They want to avoid payouts as much as possible, so they closely evaluate your health status and any factors that could increase the likelihood of a payout. Drug use, especially current or recent use, is often seen as a significant risk factor.

Additionally, be honest during the application process. Lying about your drug use could be considered insurance fraud, which can have serious consequences. If you die and the insurance company discovers fraud, your beneficiaries may not receive any payout.

Cancer and Life Insurance: What You Need to Know

You may want to see also

How can you prepare for the test?

Preparing for a life insurance drug test is a serious matter. It is important to note that lying on your application or to your medical examiner is insurance fraud and can result in serious consequences. If you are caught, no other insurance company will offer you a policy. Therefore, it is always best to be honest and prepare for the test in the right way.

Firstly, it is important to understand what the test will involve. Most life insurance companies will require a blood and urine test. In rare cases, they may also test your hair follicles. These tests can detect drug use from the last 6 months in the case of blood tests, and up to 9 months for hair follicle tests. Urine tests are less accurate but can usually detect drug use within the last 4 to 6 weeks.

If you have used drugs recently, it is recommended to wait at least a year before applying for life insurance. This will give your body enough time to clear any traces of the substance. In the meantime, you can prepare for the test by following a healthy lifestyle. This includes exercising regularly (30 minutes a day, 5 days a week), maintaining a healthy diet by avoiding processed and sugary foods, and drinking plenty of water.

In the days leading up to the test, there are a few specific things to keep in mind. Avoid consuming protein bars, Vitamin B12 supplements, cold medications, tonic water, and tea leaves. Stay away from nicotine, caffeine, and alcohol for at least 24 hours before the test. Get a good night's sleep and drink a glass of water about an hour before your appointment.

On the day of the test, bring a photo ID and be prepared to discuss any health issues. Answer all questions honestly, including those about your drug use history. Remember, it is always better to be truthful and give full disclosure.

If you are currently taking any prescription medications, be sure to disclose this information to the insurance company. They will compare the detected drugs with your medical history and prescriptions. It is also a good idea to consult with your doctor before stopping or altering any medications.

By following these preparation tips, you can increase your chances of passing the life insurance drug test and securing a policy that protects your loved ones.

Farm Bureau Life Insurance: Accelerated Payment Options Explained

You may want to see also

What are the legal ramifications of testing?

While insurance companies have the right to require drug tests for health and life insurance policies, requests for testing are uncommon. Generally, a failed drug test will not have any legal ramifications, except in the case of the drug use causing harm to others. Drug test results are regarded as private, and in most cases, it is illegal for insurance companies to release the results to a third party.

However, a failed drug test can have other consequences. If you don't disclose that you've used prescription or illegal drugs when asked by an insurance company, you could void your policy, or the insurer may be allowed to reduce the death benefit paid out. Testing positive for drugs could also result in insurance companies denying you coverage or charging much more.

Insurance companies are in the business of managing risk, and those who use drugs, even recreationally, tend to have higher risks for illness and disease than those who don't. Managing risk and keeping it low means insurers can better manage their payouts.

If you are concerned about the legal ramifications of drug testing for life insurance, it is important to review the laws in your specific state or country. It is also crucial to be honest on your insurance application and disclose any drug use, as insurance fraud can have serious consequences.

Life Insurance and Suicide in Arizona: What's Covered?

You may want to see also

Frequently asked questions

Life insurance companies usually require a medical exam that includes a drug test. This is to assess your health and determine the risk of insuring you. The test is typically done through a urine or blood sample.

The tests look for a variety of substances, including amphetamines/methamphetamines, cocaine, opiates, phencyclidine (PCP), barbiturates, benzodiazepines, and methadone. They also test for nicotine and cotinine, which is found in tobacco.

Testing positive for drugs such as cocaine and heroin will likely result in your application being automatically declined. For marijuana and nicotine, most companies will still insure you but may charge higher rates.