Life insurance payouts are usually tax-free, but there are some exceptions. If you're a spouse receiving a life insurance payout, you generally won't have to pay taxes on the amount you receive. However, there are certain scenarios where taxes may apply. For example, if the payout is in the form of installments and earns interest, the interest accrued would be subject to income tax. Additionally, if the total value of the estate, including the life insurance payout, exceeds the federal and state estate tax thresholds, taxes may be levied on the excess amount. It's important to consult with a tax professional or advisor to understand the specific tax implications for your situation.

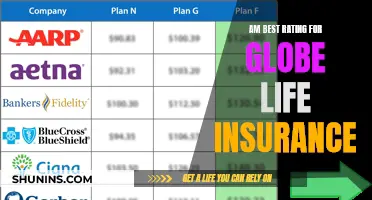

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | In most cases, life insurance proceeds are not taxable as income. |

| Are there exceptions? | Yes. If the death benefit is paid out in installments and the remaining portion earns interest, that interest would be taxable. A life insurance payout might also be taxable if it’s paid to the insured’s estate instead of an individual or entity. |

| What if my spouse is the beneficiary? | If your spouse is your beneficiary, the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate that was left to them. Spouses typically have an unlimited exemption with regards to estate taxes. |

| What if someone other than my spouse is the beneficiary? | If your beneficiary is anyone besides your spouse, your life insurance payout will typically be added to the value of your estate. If the total value of your estate exceeds the federal and state exemptions, any amount over the exemption is subject to estate and inheritance taxes. |

| What is the federal estate tax exemption? | $12.06 million per individual. |

| What is the state estate and inheritance tax exemption? | 17 states, plus Washington, D.C., have an inheritance or estate tax. The exemption amount varies by state but ranges from $1 million to $7 million. |

| How can I avoid estate taxes? | You can set up an irrevocable life insurance trust (ILIT) and transfer ownership of the policy to the trust. However, you cannot be the trustee and you must be careful that the policy's cash value does not exceed the gift tax exemption. |

What You'll Learn

If the beneficiary is the insured's spouse

If the insured's spouse is the beneficiary, the life insurance payout will not be taxed, even if it exceeds the federal limit. This is because proceeds left to a spouse are typically exempt from estate tax.

If the beneficiary is anyone other than the insured's spouse, such as a child or parent, the life insurance payout will typically be added to the value of the estate. If the total value of the estate is less than the federal and state exemptions, the payout is unlikely to be taxed. However, if the total value exceeds the exemption, any amount over that limit is subject to estate and inheritance taxes.

Federal estate taxes apply when the value of an estate exceeds $12.06 million per individual or $13.61 million per couple. The tax rate can be up to 40%, depending on the taxable amount.

State estate and inheritance taxes vary, with 17 states and Washington, D.C., having an inheritance or estate tax. The exemption amount ranges from $1 million to $7 million, and tax rates can be as high as 20%.

Life Insurance for Farmers: Is It Worth the Harvest?

You may want to see also

If the beneficiary receives interest

If your spouse is the beneficiary of your life insurance policy, they will generally not need to pay taxes on their life insurance payout. However, there are a few exceptions to this rule. One of these exceptions is if your spouse, as the beneficiary, receives interest on the policy.

If the death benefit is paid out in installments, the remaining portion that has not yet been disbursed could accrue interest. This interest is considered taxable income. The specific income payout option, where the death benefit is placed by the insurer into an interest-bearing account, is one such payout option that would result in taxable interest. Similarly, a retained asset account, where the insurer keeps the money in an interest-bearing account and the beneficiary can withdraw funds as needed, would also result in taxable interest.

If your spouse chooses to receive their life insurance payout in the form of a lifetime or fixed-period annuity, they will only pay taxes on any interest earned if the total amount, including interest, exceeds certain thresholds. In 2024, for example, estates valued over $13.61 million are subject to estate tax.

It is important to note that the tax laws regarding life insurance payouts can be complex and may vary depending on your location. Therefore, it is always a good idea to consult with a qualified financial advisor or tax planner to understand the specific tax implications for your situation.

Group Term Life Insurance: Cash Value or Not?

You may want to see also

If the money is paid to the insured's estate

If the money from a life insurance policy is paid to the insured's estate, it could be subject to estate tax. This is different from income tax, which does not apply to life insurance payouts.

If the payout is added to the value of the estate, it will be fine if the total value is less than the federal and state exemptions. However, if the total value exceeds the exemption, any amount over that limit is subject to estate and inheritance taxes.

The federal estate tax exemption limit was $13.61 million for an individual in 2024. So, if the total taxable value of assets is greater than this amount, the IRS will levy an estate tax. This means that the payout could push the estate's total taxable value over the limit, and heirs would have to pay an estate tax on any assets above the threshold within nine months of the insured's death.

In addition to federal estate tax, some states levy their own estate or inheritance taxes. Exemption limits vary among states. For example, New York's estate tax comes into effect after $6.94 million.

If you are a high-net-worth individual with a sizable estate, you can keep your life insurance death benefit from being counted as part of your estate by transferring ownership to an irrevocable life insurance trust (ILIT). This puts the policy and the disbursement of the payout under the trust's control, so it is excluded from the value of your estate.

It is important to note that the rules around ILITs are complex and must be followed precisely. For example, according to the 'three-year rule', a policy will still be considered part of your estate if the transfer of ownership occurs within three years of your death.

Health Insurance: High Costs and Life Changes

You may want to see also

If the owner and insured are different

If the owner and the insured are different people, the payout to the beneficiary could be considered a taxable gift. This is because, in this case, the proceeds of the policy are usually included in the taxable estate for estate tax purposes.

To avoid this, you can transfer ownership of the policy to another person or entity. This can be done by following these steps:

- Choose a competent adult or entity to be the new owner (this can be the policy beneficiary) and contact your insurance company for the correct forms.

- New owners must pay the premiums on the policy. You can gift up to $16,000 per person in 2022 ($17,000 in 2023) to cover the cost of the premiums.

- You will give up all rights to make changes to the policy in the future. However, if a child, family member, or friend is named the new owner, they can make changes at your request.

- Obtain written confirmation from your insurance company as proof of the ownership change.

Another way to avoid the taxable gift issue is to create an irrevocable life insurance trust (ILIT). In this case, you transfer ownership of the policy from yourself to an ILIT and remove it from your estate. However, you cannot be the trustee of the trust and you cannot retain any rights to revoke the trust.

Merrill Lynch: Life Insurance Options and Opportunities

You may want to see also

If the beneficiary is not a spouse

Generally, a life insurance beneficiary is a person or entity named as the recipient of a policy's death benefit. While most people name their spouses as insurance beneficiaries, the policyholder can choose anyone to be their beneficiary, including their children, parents, siblings, friends, or even a charity or other organisation. The policyholder can also name more than one beneficiary and assign a percentage of the death benefit to each.

If you live in a community property state, your life insurance payout will automatically go to your spouse, even if you have named someone else as the beneficiary. This is because the state considers you and your spouse to be equal owners of all joint assets, including income earned during the marriage, property purchased with that money, and life insurance benefits. Community property states include:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Additionally, Alaska and Tennessee are considered "opt-in states," where spouses can decide to opt in and participate in the state's community property laws.

If you live in a community property state and want to name someone other than your spouse as your beneficiary, you must get your spouse's consent in writing. This is because if you buy a life insurance policy with community funds, it belongs to both you and your spouse.

In most cases, beneficiaries won't need to pay taxes on their life insurance payout. However, there are a few exceptions. A beneficiary may have to pay tax on a life insurance payout in the following instances:

- The beneficiary receives interest. Although the lump-sum proceeds of the life insurance policy are typically not considered taxable income, any interest earned would be taxable, and funds that haven't been disbursed could accrue interest.

- The money is paid to an estate. If the money is paid to the insured's estate rather than a particular beneficiary, it could be taxable.

- The owner and the insured are different. If the owner of the policy is not the same as the insured, the payout to the beneficiary could be considered a taxable gift.

To avoid taxes on a life insurance policy, you may consider the following tips:

- Transfer policy ownership: You can transfer ownership of the policy, but note that value beyond what was paid for the policy will be regarded as taxable. Additionally, if you transfer it within three years of your death, the IRS will treat it as though it still belongs to you.

- Create an irrevocable life insurance trust (ILIT): You can transfer ownership of the policy from yourself to an ILIT, removing it from your estate. However, this kind of trust cannot be revoked after you set it up.

- Be aware of gift tax limits: The 2024 annual gift tax exemption is $18,000, and the lifetime exclusion amount is $13.61 million. If you ensure your policy's cash value does not exceed these limits, you may be able to avoid taxation.

Geico's Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

In most cases, beneficiaries, including spouses, do not pay taxes on their life insurance payout, especially if they receive it as a lump sum.

Yes, there are some specific scenarios where your spouse may have to pay federal or state taxes on my life insurance. For example, if the life insurance policy goes into an estate, or if they choose to receive the death benefit as an annuity.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person are not considered taxable income and do not need to be reported. However, any interest received is taxable and should be reported.

Yes, there are a few ways to potentially avoid taxes on a life insurance payout. One way is to set up an irrevocable life insurance trust (ILIT) and transfer ownership of the policy to the trust. Another option is to be aware of gift tax limits and ensure your policy's cash value does not exceed these limits.