Can I Insure a Vehicle That Isn't Registered in My Name?

You generally cannot insure a vehicle that is not registered in your name. However, there are exceptions and alternative options to ensure you're covered when driving a vehicle that isn't yours.

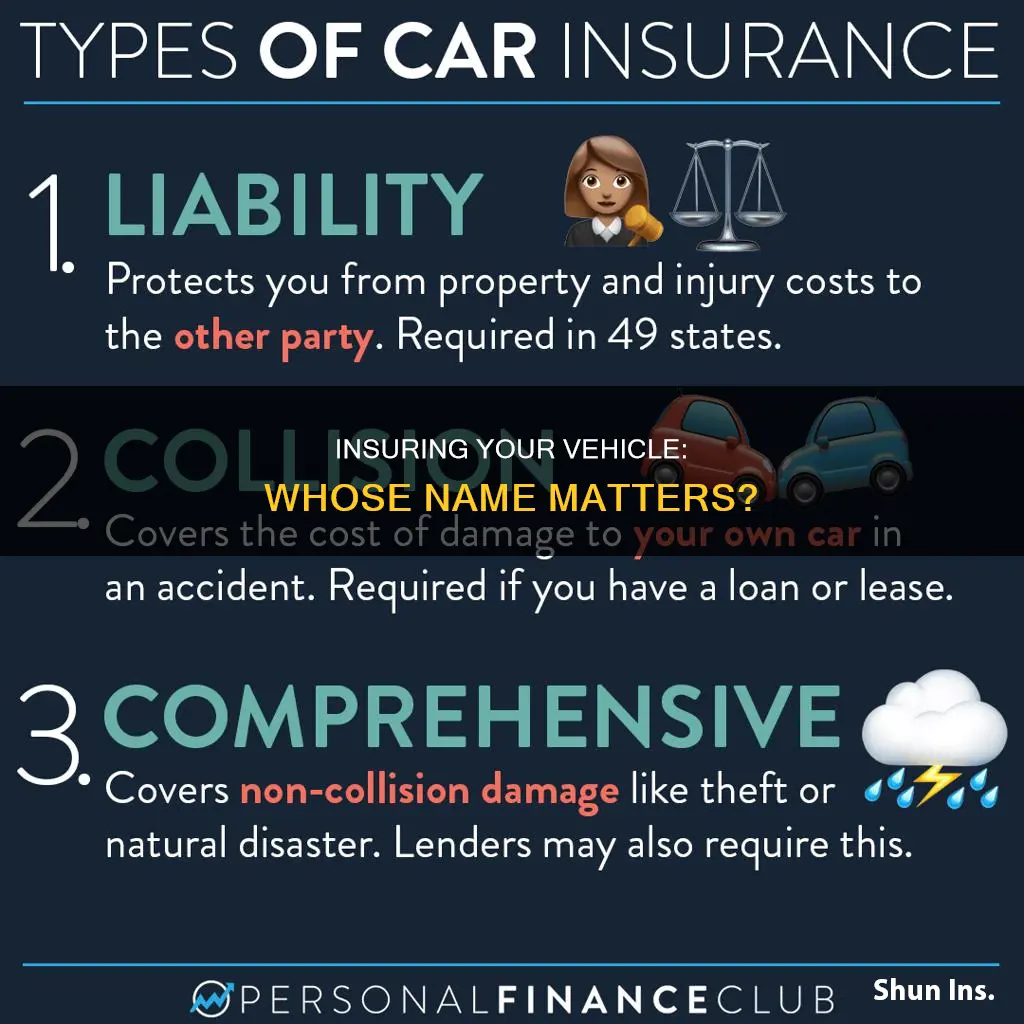

| Characteristics | Values |

|---|---|

| Can I insure a car that isn't in my name? | Generally, you cannot insure a car that you do not own. |

| How to insure a car you don't own | Buy non-owner car insurance, get added to the car owner's insurance policy, transfer or get added to the car registration, or get a co-title with the vehicle's owner. |

| Non-owner car insurance | Non-owner car insurance acts as secondary coverage to the car owner's insurance policy. It provides liability coverage for any property damage or bodily injury caused when driving a car you don't own. |

| Insurable interest | Insurable interest is a valid motivation someone might have to get insurance for a vehicle and keep it in good condition. Being the owner of the vehicle qualifies as insurable interest. |

| Proving insurable interest | If you're not the owner of the vehicle, it'll be tougher to prove insurable interest. Many insurance providers may be hesitant to insure you due to potential fraud. |

| Claims | If the car is insured by someone else, the owner may not receive the money in the event of a claim. The funds might go to the person that insured the vehicle instead. |

| State laws | In some states, local laws could keep you from insuring a vehicle you don't own. Some states require the name on the car's registration to match the one on the insurance policy. |

What You'll Learn

Proving insurable interest

In the context of life insurance, insurable interest typically arises from familial or marital relationships, where the death of the insured would result in emotional and financial loss. It can also exist between business partners, creditors, and debtors, where financial hardship would occur due to lost income or unpaid debts. Proving insurable interest in these cases may require signatures, medical exams, and relevant paperwork, such as business contracts.

In the case of auto insurance, insurable interest is established by legal ownership of the vehicle. The insurance policyholder must have a financial stake in the vehicle, as they would receive funds for damage claims. This requirement ensures that only those with a legitimate interest in maintaining the vehicle's condition are insured, preventing fraudulent claims.

While it is generally challenging to insure a vehicle that is not in your name, there are exceptions and alternative options. Some insurance companies may allow you to insure a vehicle if you share the same address as the owner or have their permission to drive the car occasionally. In other cases, you may need to be added as a co-owner on the vehicle's registration or get added to the owner's insurance policy. Additionally, non-owner insurance policies can provide liability coverage for those who frequently borrow or rent cars.

Labor Fees: Insurance Vehicle Repairs

You may want to see also

Adding the car owner to your policy

- Proving your insurable interest in the vehicle: To add the car owner to your policy, you must prove to the insurance company that you have a financial stake in the vehicle. This can be challenging, as it requires demonstrating that you would be severely affected financially if something happened to the car, such as theft or damage.

- Living at the same address: If you share the same address as the car owner, it is easier to be added to their insurance policy. The owner simply needs to contact their insurance company and request to have your name included.

- Adding your name to the vehicle title: In some states, you may be able to get added as a co-owner on the vehicle's registration. This can help prove your insurable interest, but it may also increase the insurance premium. Additionally, the car needs to be paid off to make this change.

- Non-owner car insurance: If you plan on borrowing the car regularly, you can consider purchasing non-owner car insurance, which provides liability coverage for any vehicle you drive. However, this type of insurance won't cover the vehicle against loss or damage if you're at fault in an accident.

- Permission from the owner: Before driving a vehicle that is not yours, it's important to get permission from the owner and ensure that their insurance policy covers permissive use. This means that you, as a licensed driver with permission to use the vehicle occasionally, are covered without being named on the policy.

Tracking Devices: Are They in Your Car?

You may want to see also

Getting added to the car owner's policy

If you are looking to get added to the car owner's policy, there are a few things to keep in mind. Firstly, it's important to note that you can typically only be added to the policy if you share the same permanent residence as the car owner. This is because insurance providers are more likely to insure family members or roommates living in the same household.

To get added to the car owner's policy, the vehicle owner will need to contact their insurance company and request to have your name included in their auto insurance policy. Some insurance companies may also require you to be listed as a driver on their policy, especially if you will be driving the car regularly. It's important to be transparent about your situation to avoid any issues with coverage in the event of an accident.

If you are frequently borrowing cars but not always the same car, you may want to consider purchasing a non-owner car insurance policy. This type of policy provides liability coverage and may also offer additional protections such as personal injury protection, medical payments, or uninsured motorist coverage. However, keep in mind that non-owner insurance is not the right choice if you live with a car owner or should be listed as a driver on the main policy.

Salvage Vehicle: Insurance Reporting

You may want to see also

Getting non-owner insurance

In general, you cannot get an auto insurance policy for a car that you do not own. However, there are some exceptions. For instance, if you share the same address as the car owner, you can be added to their insurance policy. Some major insurers, like Progressive, also offer insurance for vehicles not in your name.

If you don't own a car but drive regularly, you can get a non-owner insurance policy. This provides liability coverage for bodily injury and property damage, meaning that it will cover you if you're liable for damages or injuries in an accident. Non-owner insurance is typically cheaper than standard car insurance.

- You borrow cars often

- You're in between cars

- You need to provide proof of insurance

- You drive a company car for work

- You frequently use a car-sharing or short-term rental service

- You rent cars often

Non-owner car insurance does not cover damage to the vehicle you're driving, or your own injuries after an accident.

Illinois Vehicle Insurance: What's the Law?

You may want to see also

Getting added to the car title

Adding a name to a car title is a relatively straightforward process, similar to selling a vehicle. When you add a name to the title, you give that person equal authority over the car and extend ownership to them. The requirements for adding a name may vary slightly depending on the state, but the general procedure is as follows:

Provide the Existing Title

You will need to present the current title to prove ownership of the vehicle. Sign the seller section to indicate yourself as the seller, then provide your name and the name of the person being added in the buyer section. Enter both names with the appropriate conjunction ("and" for common ownership, "or" for joint ownership) to indicate the type of ownership.

Apply for a New Title

Request an application for a certificate of title from your local Department of Motor Vehicles (DMV). Both you and the person being added must complete the form with your valid signatures.

Submit Your Application to the DMV

Make an appointment with the DMV to submit the completed application. Submission is subject to a fee, which varies by state. The DMV will issue the new title after all fees have been paid and signatures are verified.

Update Your Registration

Since a car's title and registration go together, you will need to update the registration to reflect the new ownership. Some states allow the person to be added to the existing registration, while others require a separate registration.

Update Your Insurance

It is a requirement that both persons listed on the title have insurance coverage. Update your insurance policy by submitting a copy of the new title and registration to your insurer.

Removing a Name from the Car Title

If you need to remove a name from the title due to divorce, name change, or death, the process is similar. The person whose name is being removed signs the seller section of the title, and the remaining person signs the buyer section. Submit the signed title to the DMV and request a new title.

Adding or Removing a Name with a Lien Holder

If there is a lien holder on the vehicle, you will need their permission to add or remove a name from the title. The lien holder has the right to the car because they financed it, so they are responsible for applying for the name change. After gaining their approval, visit your local DMV to initiate the process.

White Cars: Cheaper Insurance?

You may want to see also

Frequently asked questions

Generally, you cannot insure a car that is not in your name. However, there are exceptions, such as non-owner insurance policies or adding yourself as a driver to the owner's policy.

Non-owner car insurance provides liability coverage for those who regularly borrow or rent a car. It is secondary coverage, meaning it only applies after the primary policy's coverage has been exhausted.

Proving insurable interest can be challenging. You must demonstrate to the insurance company that you have a financial stake in the vehicle and are motivated to keep it in good condition.

Temporary car insurance is not commonly offered by insurance carriers. However, you may be able to explore options such as non-owner insurance, rental car insurance, or being added as a temporary driver on the owner's policy.

In addition to limited coverage options, you may encounter difficulties in proving insurable interest and navigating the claims process if the car is involved in an accident.