Life insurance is not compulsory for SMSFs, but trustees are legally required to consider the insurance needs of their members and document this annually. SMSFs can pay for life insurance for their members, and this can be a cost-effective way to provide for dependants. However, it is important to be aware of the potential drawbacks, such as higher premiums and the impact on retirement savings.

| Characteristics | Values |

|---|---|

| Life insurance policy owner | The SMSF is the legal owner of the life insurance policy |

| Premium payments | Paid from the SMSF bank account |

| Premium payments and tax | Premium payments could be tax-free, but they will reduce the fund balance over time |

| Benefits | Protection for members, tax effectiveness, reduced cash flow pressure |

| Drawbacks | Higher premiums, tax payable on some benefits, reduced retirement savings |

| Types of insurance cover | Death (life insurance), permanent incapacity (total and permanent disability insurance or TPD), temporary incapacity (income protection insurance) |

What You'll Learn

- SMSF trustees must consider the insurance needs of each member and document this annually

- SMSFs are not required to provide a default level of insurance for members

- SMSF members are more likely to hold insurance outside super

- SMSFs can hold insurance cover for death, permanent incapacity, and temporary incapacity

- SMSF members can pay life insurance premiums through their super

SMSF trustees must consider the insurance needs of each member and document this annually

SMSF trustees are legally required to consider the insurance needs of each member and document this annually. This is part of the fund's investment strategy, which must be reviewed regularly to ensure it continues to meet member needs and circumstances. Trustees must consider each member's financial situation to determine if they have an appropriate level of insurance cover. Important considerations include the member's current level of debt and whether they have any dependants.

The insurance strategy must be documented at least annually in the SMSF investment strategy or in the minutes of a trustee meeting. There are penalties for trustees who fail to address insurance in their SMSF. SMSF trustees can be fined if they do not consider the insurance needs of each member and document this annually.

SMSFs can hold insurance cover that meets one of the following superannuation conditions of release:

- Death (life insurance), including terminal illness benefits

- Permanent incapacity that causes the fund member to permanently cease working in any occupation that suits their education, training and experience (total and permanent disability insurance or TPD)

- Temporary incapacity that causes the fund member to temporarily cease working (income protection insurance)

SMSF trustees can apply for comprehensive life insurance cover and optional TPD cover to be held within an SMSF. Income protection cover is also available. Insurance premiums are paid from the SMSF, not out of the member's post-tax income. This can make insurance more cost-effective for members, as holding cover outside super requires payment from their personal cash flow and does not have tax benefits for life and TPD insurance.

SMSF life insurance policies can be tailored to meet the individual needs of members, including waiting periods and sums insured. This flexibility can be advantageous, especially when compared to group insurance cover provided by retail or industry super funds. However, group insurance can sometimes be more cost-effective.

PTSD and Life Insurance: What You Need to Know

You may want to see also

SMSFs are not required to provide a default level of insurance for members

While SMSFs are not required to provide a default level of insurance for members, SMSF trustees are legally obliged to consider the insurance needs of each member and review this annually. This is part of the requirement to prepare a documented investment strategy during the SMSF's set-up process. SMSF trustees must consider each member's financial situation to determine if they have an appropriate level of insurance cover. Important considerations include the member's current level of debt and whether they have any dependants.

SMSFs are allowed to provide any type of insurance cover that meets one of the following superannuation conditions of release:

- Death (life insurance), including terminal illness benefits

- Permanent incapacity that causes the fund member to permanently cease working in any occupation that suits their education, training and experience (total and permanent disability insurance or TPD)

- Temporary incapacity that causes the fund member to temporarily cease working (income protection insurance)

SMSF trustees can also choose to hold insurance outside of the SMSF or not have insurance at all. However, it is important to note that insurance premiums paid from the SMSF will reduce the retirement savings of members.

Nicotine Gum: Impact on Life Insurance and Your Health

You may want to see also

SMSF members are more likely to hold insurance outside super

The Super System Review by the Federal Government in 2015 found that SMSF members were more likely to hold insurance outside their super. This means that SMSFs are not required to provide a default level of insurance for its members. However, the ATO does require SMSFs to note in the investment strategy that insurance protection for each member has at least been considered.

SMSF trustees must consider whether to take out appropriate insurance cover for each member of their fund as part of preparing their investment strategy. It is a legal requirement for all SMSFs to prepare a documented investment strategy during the set-up process. This strategy (including any insurance coverage) must be reviewed regularly by the fund's trustees to ensure it continues to reflect member needs and circumstances as they change over time.

There are several reasons why SMSF members may prefer to hold insurance outside of their super. Firstly, individual insurance policies can be tailored to their specific needs, giving them more control over the type and level of coverage. Secondly, benefits paid from individual insurance policies are typically tax-free, ensuring that beneficiaries receive the full amount. Thirdly, individual insurance policies are more portable, allowing members to maintain coverage even if they switch super funds. Finally, individual policies provide immediate access to insurance benefits without any restrictions tied to the super preservation age.

On the other hand, holding insurance within an SMSF also has its advantages. Cost efficiency is one of the primary reasons, as superannuation funds often have access to group insurance policies that are generally more cost-effective than individual policies. Additionally, contributions made to superannuation funds are typically taxed at a lower rate of 15%, resulting in lower costs for non-deductible insurance. Paying insurance premiums within the superannuation fund can also help with cash flow management, as premiums are deducted from the super balance instead of disposable income. Lastly, group insurance policies often come with automatic acceptance levels, eliminating the need for medical examinations or detailed health questions.

Does the FBI Offer Life Insurance Policies to Agents?

You may want to see also

SMSFs can hold insurance cover for death, permanent incapacity, and temporary incapacity

Self-managed super funds (SMSFs) are not required to provide insurance cover for their members. However, SMSF trustees are legally required to consider the insurance needs of each member and determine whether to take out appropriate insurance cover for them. This consideration must be documented in the fund's investment strategy and reviewed regularly. SMSFs can provide insurance cover for death, permanent incapacity, and temporary incapacity, which are all superannuation conditions of release.

Death (Life Insurance)

Life insurance policies can be purchased by an SMSF for its members, and the premiums are often tax-deductible. However, life insurance under superannuation does not permit certain ancillary benefits, such as funeral advancement, grief counselling, financial planning, and accommodation benefits. It is important to note that the payout from a life insurance policy owned by an SMSF will be paid to the fund, and the trustees will have discretion over how the funds are distributed. To direct the trustees, members need to register a binding beneficiary nomination. While payouts to a member's spouse are typically tax-free, beneficiaries over the age of 18 who are not financially dependent may be subject to taxes of up to 32%.

Permanent Incapacity (Total and Permanent Disability Insurance)

SMSFs can provide permanent incapacity insurance, also known as total and permanent disability (TPD) insurance. However, SMSFs are only allowed to provide "Any Occupation" TPD policies, which means the member must be unlikely ever to work again in any occupation they are suited to. "Own Occupation" TPD policies, which provide benefits if the member is unable to work in their usual role, are prohibited for SMSFs unless the policy was issued before July 1, 2014. It is important to note that SMSF trustees must determine if the member reasonably satisfies the TPD requirements before accessing their superannuation balance.

Temporary Incapacity (Income Protection Insurance)

SMSFs can also provide temporary incapacity insurance, also known as income protection insurance. This type of insurance provides monthly payments to members who are unable to work temporarily due to sickness or injury. However, SMSFs can only provide "Standard" income protection policies, which comply with the conditions for temporary disability payments under superannuation legislation. Comprehensive income protection policies with additional benefits, such as partial disability payments and rehabilitation cost reimbursement, cannot be purchased by SMSFs. The insurance proceeds are paid to the trustee, who then allocates them to the member's account balance and determines the salary to be paid to the member.

Clinical Trials: Are You Covered by Life Insurance?

You may want to see also

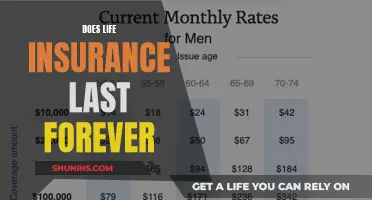

SMSF members can pay life insurance premiums through their super

Another advantage of paying life insurance premiums through an SMSF is the potential tax savings. Contributions to superannuation funds are often tax-deductible, and SMSF trustees may be able to claim a tax deduction on the insurance premiums paid by the fund, reducing tax paid on capital gains, investment earnings, and other taxable contributions received. This can make super ownership more tax-effective compared to buying life insurance policies personally.

Additionally, using the funds in the SMSF to pay premiums can reduce cash flow pressure for members. However, it is important to consider that these payments will reduce the funds available for investment and, therefore, member retirement balances.

There are also some potential drawbacks to paying life insurance premiums through an SMSF. Premiums may be higher than the group rates provided by large super funds, and tax may be payable on some life insurance and TPD benefits under super. Super contributions used to pay insurance premiums also count towards the Super Cap.

SMSF members should carefully consider their personal circumstances, including their income, assets, and existing insurance cover, to determine if paying life insurance premiums through their super is the right choice for them.

Life Insurance: Quitting Job, Forfeiting Coverage?

You may want to see also

Frequently asked questions

No, but SMSF trustees are legally required to consider the insurance needs of their members and document this annually. This may result in the SMSF taking out insurance cover for members.

Life insurance premiums paid through an SMSF are typically tax-deductible, making insurance more cost-effective for members. SMSFs can also tailor their life insurance policies to meet the individual needs of members, making it more flexible than group insurance cover.

Life insurance premiums paid through an SMSF will reduce the funds available for investment and, therefore, member retirement balances. Life insurance through SMSF typically only covers core benefits, with ancillary benefits such as advance funeral payments being unavailable.

You can apply for life insurance for your SMSF through an insurance provider. Some insurance providers offer policies designed specifically for SMSFs, which can include group discounts.