State Farm offers AutoPay, a service that allows customers to make automatic payments for their auto insurance. This feature provides convenience by automatically deducting the amount due from the customer's bank account or credit card, eliminating the hassle of manual bill payment. AutoPay also enhances security by reducing the risk of identity fraud associated with paper bills and helps customers avoid late fees by ensuring timely payments. Additionally, State Farm provides flexibility in payment methods, accepting credit and debit cards, checks, money orders, and automatic withdrawals from checking or savings accounts. Customers can choose their payment due date between the 1st and 28th of each month and receive email reminders for upcoming payments.

| Characteristics | Values |

|---|---|

| Pros | Convenience, Security, No late fees, Saves money |

| Cons | Easy to forget, Unexpected charges, Overdraft fees, Fixed payments, Expired or lost credit/debit card |

| Payment Methods | Electronic Funds Transfers (EFT), Visa, MasterCard, American Express, Discover, Check, Money Order, Debit Card |

| Contact | 1-800-440-0998 |

Pros of AutoPay

State Farm offers AutoPay as a payment option for its customers. Here are some pros of using AutoPay:

Convenience

AutoPay helps make bill-paying easier. Instead of manually paying your bill, AutoPay allows State Farm to automatically deduct the amount due from your bank account or credit card. This means you don't have to worry about missing a payment or logging in to your account every time you need to pay.

Security

AutoPay can help reduce the risk of identity fraud. If you still receive paper bills, they may contain personal and sensitive information. If someone steals a bill from your mailbox or trash, you could be at higher risk of identity theft. Using AutoPay and going paperless can help eliminate this potential risk.

No Late Fees

AutoPay ensures that your bills are paid on time, so you can avoid late fee charges that could potentially hurt your credit score.

Saves Money

Many companies offer a small discount for going paperless. You can also save money on postage and checks if you currently pay by mail. Additionally, State Farm offers a range of other discounts and ways to save based on your policy, such as insuring multiple vehicles or bundling policies.

Liberty Mutual Auto Insurance: Are Rental Trucks Covered?

You may want to see also

Cons of AutoPay

State Farm does offer AutoPay services for its customers. However, before enrolling in AutoPay, it is important to consider the potential drawbacks. Here are some cons of AutoPay:

Easy to Forget

AutoPay is designed to make bill payments easier by automatically deducting amounts due from your bank account or credit card. However, this convenience can also lead to a lack of awareness about your finances. With multiple bills on AutoPay, it is easy to forget how much money is going out each month, making it challenging to budget and manage your expenses effectively.

Unexpected Charges

When bills are on AutoPay, there is a risk of overlooking unexpected charges or increases. If you don't review your bills carefully, you may miss extra fees or rate hikes, which can impact your budget and finances.

Overdraft Fees

One of the significant risks of AutoPay is the possibility of incurring overdraft fees. Since automatic payments will deduct funds from your checking account regardless of the available balance, insufficient funds can lead to overdraft fees charged by your bank. This can be especially problematic if you are living paycheck-to-paycheck or have a tight budget.

Fixed Payments

With AutoPay, you typically make the minimum payment or a set amount. If you want to pay more to reduce your balance faster, you may need to manually adjust the AutoPay amount or make additional payments. This lack of flexibility can make it challenging to manage your budget and pay down debt as quickly as you might prefer.

Expired or Lost Credit/Debit Card

In the event that your credit or debit card expires or is lost or stolen, you must remember to update your AutoPay accounts with the new card information. Failing to do so could result in missed payments and potential late fees or penalties.

While AutoPay can be a convenient option for some, it is essential to carefully consider these potential drawbacks and assess whether it aligns with your financial situation and preferences.

DirectGap Auto Insurance: Gap Coverage for US Residents

You may want to see also

Payment methods

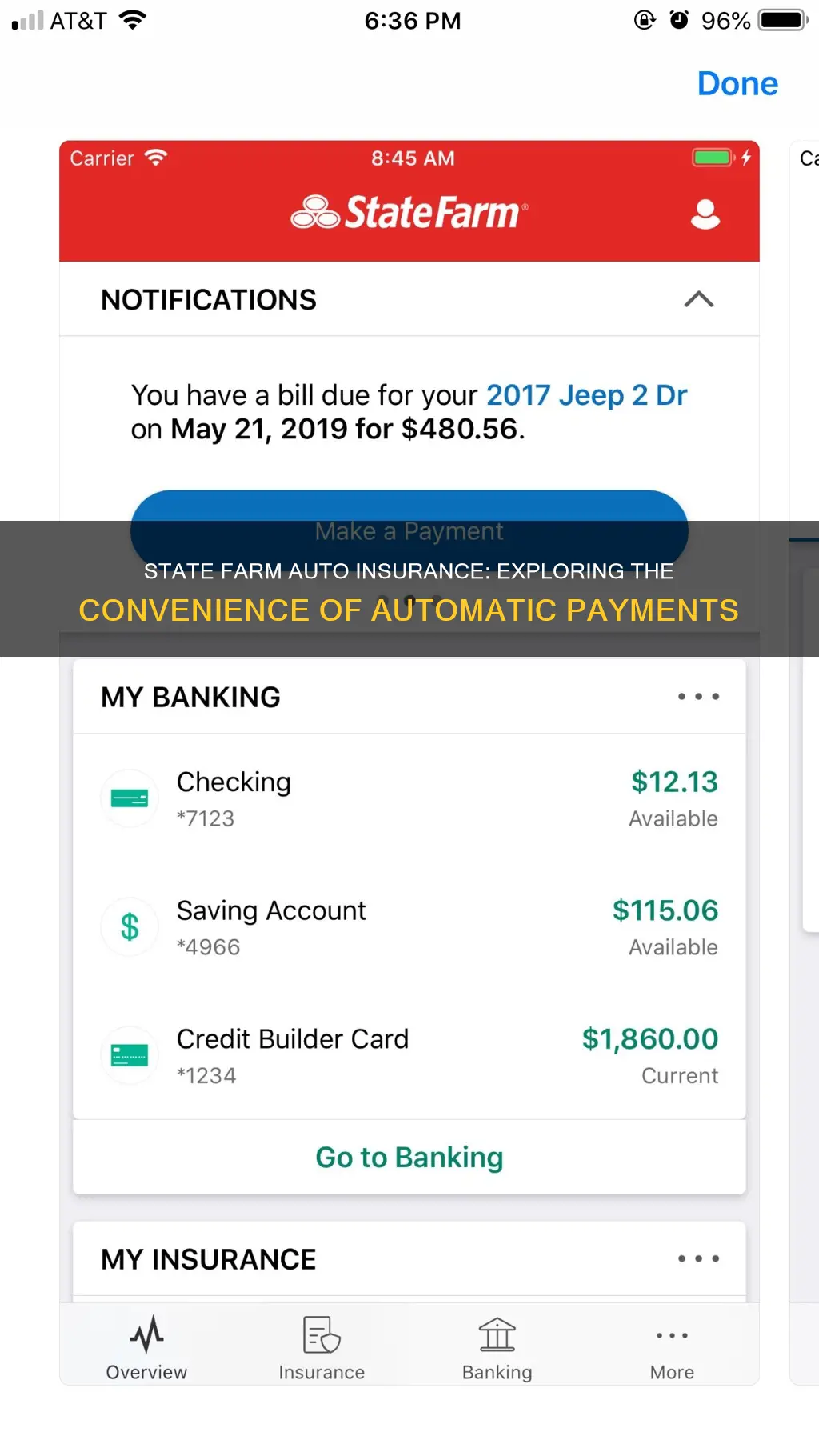

State Farm offers a variety of payment methods for its customers' convenience. Customers can pay their insurance bills online, through the State Farm mobile app, by telephone, at any office location, or by mail.

State Farm accepts payments from debit cards, credit cards (Visa, MasterCard, American Express, Discover, Diners Club, and JCB), checks, money orders, and automatic withdrawals from a checking or savings account. Customers can also pay by cash at a State Farm agent's office.

For online payments, customers can log in to their State Farm account and schedule a payment, review billing history, update payment methods, and more. They can also set up AutoPay, which automatically deducts the bill amount from their chosen payment method on the due date. This feature helps save time and effort, eliminates the risk of late fees, and ensures that payments are made on time.

State Farm also offers the option of paperless billing, where customers can receive and pay their bills electronically, instead of receiving paper bills. This not only helps save the environment but also reduces the risk of identity fraud in case a paper bill is stolen from the mailbox or trash.

For customers who prefer to pay by phone, State Farm offers a 24/7 toll-free number where they can make payments using their credit or debit card, or bank account information. They can also call their local State Farm agent to make payment arrangements.

For those who wish to pay by mail, State Farm accepts checks or money orders sent to their payment processing center.

Allstate: Your Health and Auto Insurance Partner

You may want to see also

Payment plans

State Farm offers a range of payment options for its customers, including automatic payments.

State Farm's payment plans allow customers to choose their payment due date between the 1st and 28th of each month. This flexibility means that customers can combine multiple State Farm policies into a single bill with smaller, more manageable monthly payments instead of a much larger payment once or twice a year.

Automatic Payments

State Farm customers can choose to have their premium payments automatically deducted from their bank account or credit/debit card. This option ensures that payments are never missed, and customers no longer need to worry about submitting payments manually or on time.

State Farm also offers the option of receiving bill pay reminder notifications. Customers can set up email reminders to be notified when their bill due date is approaching, when their bill is past due, or when their automatic payment has been declined.

Other Payment Methods

For those who prefer not to use automatic payments, State Farm accepts insurance payments via:

- Credit/debit card (VISA®, MasterCard®, American Express®, Discover®, Diners Club®, and JCB®)

- Check or money order

- Automatic withdrawals from a checking or savings account

Payments can be made online through the State Farm website or mobile app, by telephone, at any office location, or by mail.

Auto Insurance Glass Coverage: Does It Include Mirror Recalibration?

You may want to see also

Payment options

State Farm offers a range of payment options for its customers, allowing them to choose a method that suits their preferences and financial situation.

State Farm accepts payments from various sources, including:

- Debit cards

- Credit cards (Visa, MasterCard, American Express, Discover, Diners Club, and JCB)

- Checks

- Money orders

- Automatic withdrawals from a checking or savings account

Online Payment:

State Farm customers can pay their insurance bills online through the State Farm website or the State Farm mobile app. They can log in to their accounts and make one-time payments or set up AutoPay for automatic recurring payments.

Phone Payment:

Customers can also make payments over the phone by calling 1-800-440-0998. This service is available 24/7, and customers can use their credit or debit cards or provide their checking/savings account information to make payments.

Mail Payment:

For those who prefer to pay by mail, State Farm accepts checks or money orders sent to the following address:

State Farm Insurance

PO Box 588002

North Metro, GA 30029-8002

In-Person Payment:

Customers can also visit their local State Farm agent to pay in person using a credit card, check, or money order.

Payment Plans:

State Farm offers payment plans that provide flexibility in choosing a payment due date between the 1st and 28th of each month. Customers can also choose to pay upfront in one lump sum or opt for monthly installments.

Automatic Payments:

State Farm's AutoPay feature allows customers to set up automatic recurring payments. This feature offers convenience, security, and the assurance of timely payments without the risk of late fees. However, it is important to review bills regularly to avoid unexpected charges and ensure sufficient funds in the account.

Bill Reminders:

State Farm also offers bill pay reminder notifications. Customers can enrol in reminders from their online accounts and receive emails when their bill due date is approaching or if their payment is past due.

Paperless Billing:

State Farm encourages customers to go paperless, which can help save money and reduce the risk of identity fraud associated with paper bills.

Buy Auto Insurance Without Talking to Anyone

You may want to see also

Frequently asked questions

To set up automatic payments, visit your My Accounts portal. You can also speak to a State Farm agent to set up an insurance bill payment plan.

Automatic payments are convenient, as they allow you to give a company permission to automatically deduct the amount due from your bank account or credit card. They also save you money on postage and cheques if you currently pay by mail. Additionally, you won't have to pay any late fees.

With automatic payments, it's easy to forget how much money is going out each month. You might also miss unexpected charges or increases in your bill. There's also a risk of overdraft fees if the automatic payment deducts from your account when there's not enough money in it.