State Farm offers SR-22 insurance to drivers who have been classified as high-risk by their state. An SR-22 form, also known as a Certificate of Financial Responsibility, is required for drivers who are trying to reinstate or maintain their license after being convicted of certain driving violations. State Farm will file an SR-22 form with the state on behalf of the customer and provide the necessary insurance coverage to meet the state's SR-22 requirements. The average premium for SR-22 insurance from State Farm is 11% higher than that of drivers with clean records.

| Characteristics | Values |

|---|---|

| Does State Farm offer SR-22 insurance? | Yes |

| Who is SR-22 insurance for? | Drivers who have been classified as "high-risk" by their state |

| Does State Farm file an SR-22 form with the state? | Yes, on a customer's behalf |

| Does State Farm provide the insurance coverage necessary to meet the state's SR-22 requirements? | Yes |

| How long do drivers need to maintain SR-22 insurance? | On average, three years |

| How much does State Farm charge for SR-22 filing? | $15-$25 |

| How much more do drivers with an SR-22 pay for State Farm car insurance? | 11% more on average |

| How much more do drivers who are required to file an SR-22 after a DUI conviction pay? | 213% more on average |

| What happens if a State Farm SR-22 policy lapses? | State Farm is required by law to notify the DMV, which will likely result in a license suspension until the policy is reinstated |

| Does State Farm offer SR-22 insurance for drivers in Florida and Virginia who are required to file an FR-44? | Yes |

| Does State Farm offer non-owner SR-22 insurance? | Yes |

| What is the phone number to get a quote for SR-22 insurance from State Farm? | 1-800-872-8332 |

| Is State Farm the cheapest option for SR-22 insurance? | Yes, according to WalletHub and Policygenius |

What You'll Learn

State Farm SR-22 insurance for high-risk drivers

If you're a high-risk driver, you may be required to obtain an SR-22 form, or a Certificate of Financial Responsibility. This is usually associated with multiple traffic offences, DUIs, DWIs, or other serious moving violations. If you are required to obtain an SR-22, State Farm can help.

State Farm offers SR-22 insurance to drivers who have been classified as high-risk. They will file an SR-22 form with your state on your behalf, and provide the insurance coverage necessary to meet your state's SR-22 requirements. State Farm typically charges a $15-$25 filing fee for the mandatory SR-22 form, which may vary by state.

Drivers with an SR-22 pay, on average, 11% more for State Farm car insurance than drivers with a clean record. If you are required to file an SR-22 after a DUI conviction, you will pay, on average, 213% more for State Farm car insurance than drivers with a clean record.

State Farm also offers non-owner SR-22 insurance for those who do not own a vehicle. This is an important option that could save you money if you don't own a car, as purchasing SR-22 coverage may be the only way to regain your driving privileges.

State Farm also offers insurance for drivers in Florida and Virginia who are required to file an FR-44, which is similar to an SR-22 but requires drivers to have more insurance coverage.

To get a quote for SR-22 insurance from State Farm, you can call 1-800-872-8332.

Stacking Auto Liability Insurance: Is It Possible?

You may want to see also

SR-22 form and state requirements

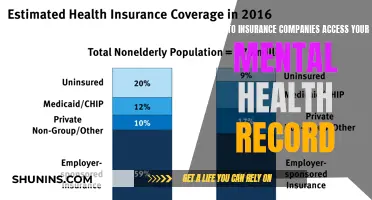

An SR-22 is a certificate of financial responsibility that some states require for high-risk drivers. It is not a type of insurance but a form filed with your state to prove that your auto insurance policy meets the minimum liability coverage required by state law. It is usually required for drivers who have been convicted of offences such as DUI, driving without insurance, or multiple traffic violations.

The SR-22 form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV) and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period. The requirement to have an SR-22 is usually associated with multiple traffic offences, DUIs, DWIs or other serious moving violations, driver's license suspension or revocation, and violations for failure to maintain the mandatory insurance coverage required in a state.

If you need an SR-22, you will typically be notified by the traffic court where you appeared or the Department of Motor Vehicles by mail. Your insurance company will charge a fee for providing an SR-22 certificate on your behalf, and this amount may differ by state. In most states, you will need to retain the SR-22 and your auto insurance policy for approximately three years.

There are three types of SR-22 certificates: owner certificates, operator or non-owner certificates, and owner-operator certificates. Owner certificates are for people who drive their own car, operator or non-owner certificates are for those who don't have a car but may rent or borrow a vehicle to drive, and owner-operator certificates apply to those who drive both their own car and vehicles owned by someone else.

If you need an SR-22 in a state you don't live in, you will typically need to obtain an SR-22 from an insurance provider licensed in the state where the requirement originated. Your insurance company can assist in obtaining the SR-22 and ensuring compliance with the state's regulations, even if you reside elsewhere.

Virginia Vehicle Insurance Lookup: Quick Guide

You may want to see also

SR-22 insurance cost

The cost of SR-22 insurance varies depending on the state you live in and the insurance company providing coverage. The SR-22 itself is not a type of insurance but a certificate of financial responsibility, or a "Certificate of Financial Responsibility," "SR-22 Bond," or "SR-22 Form," that proves you have car insurance meeting the minimum coverages required by law. It is usually required after a major violation or license suspension, which results in higher car insurance rates.

The SR-22 filing fee typically ranges from $15 to $50, but this doesn't affect your car insurance rates. The violation that led to the SR-22 requirement will result in higher rates. The cost of SR-22 insurance depends on the reason for the SR-22. For example, a DUI conviction can increase your insurance rate by an average of $1,250 per year. The average cost of SR-22 insurance is $172 per month for a full-coverage policy, but drivers with traffic tickets can expect to pay more.

State Farm has the cheapest widely available SR-22 insurance quotes, at around $227 per month after a DUI. Country Financial has the cheapest rates for most drivers, with full coverage costing around $213 per month. USAA is the best option for military members, veterans, and their families, with rates of about $221 per month.

To Snitch or Not to Snitch: The Ethical Dilemma of Reporting Your Roommate to Auto Insurance

You may want to see also

Non-owner SR-22 insurance

If you don't own a car but are required to file an SR-22, you can purchase a non-owner car insurance policy. This type of insurance provides liability coverage that meets your state's requirements. It is important to note that not all insurers offer SR-22 filings for non-owner or standard car insurance policies, so you should check with your insurer beforehand.

The cost of filing an SR-22 form is generally between $15 and $25, although this can vary by state and insurer. The cost of a non-owner car insurance policy also varies, but it is typically less expensive than a standard car insurance policy. However, the addition of an SR-22 may increase your insurance rate. Once the SR-22 is no longer required, your rate may decrease.

To obtain non-owner SR-22 insurance, you need to contact an insurer to purchase coverage. Most major insurance companies offer non-owner insurance, but because it is a unique type of coverage, you may need to call a local agent to get a quote. Keep in mind that an SR-22 requirement classifies you as a high-risk driver, so you may need to contact multiple companies to obtain coverage.

After purchasing coverage, you need to ask your insurer to file the SR-22 form with your state's Department of Motor Vehicles (DMV). They will charge a filing fee, which is typically between $15 and $25. Remember to maintain continuous coverage during your mandated SR-22 filing period. If your coverage lapses, your license may be suspended or revoked, and you may be fined.

In summary, non-owner SR-22 insurance is designed for drivers who do not own a vehicle but need to meet their state's car insurance requirements, often due to serious driving infractions. It provides liability coverage and can be obtained by purchasing a non-owner car insurance policy from an insurer who offers this type of coverage.

Filing Progressive Auto Insurance Claims

You may want to see also

SR-22 insurance duration

The SR-22 insurance duration varies depending on the state and individual circumstances. In most states, drivers are required to maintain SR-22 insurance for three years. However, it can range from three to five years, and drivers should contact their state's Department of Motor Vehicles (DMV) to determine the exact duration. During this period, it is crucial to keep the SR-22 insurance active by retaining the insurance policy. If the policy lapses or is cancelled, the insurer is legally required to notify the DMV, which can result in a license suspension until the insurance is reinstated.

Once the SR-22 requirements are fulfilled, drivers should inform their insurance company to have the SR-22 removed. They may also be able to find cheaper insurance rates at this point, as premiums may decrease after a few years have passed since the traffic violation.

Am I Covered by My Parents' Auto Insurance?

You may want to see also

Frequently asked questions

Yes, State Farm offers SR-22 insurance to drivers who have been classified as "high-risk" by their state.

The cost of SR-22 insurance depends on the reason for the SR-22, the coverage options, and where you live. On average, drivers with SR-22s pay 11% more for State Farm coverage than drivers with clean records.

To get SR-22 insurance from State Farm, you can call 1-800-872-8332 for a quote.