Term life insurance is a type of life insurance policy that provides coverage for a specific period, typically ranging from 10 to 40 years. It is designed to offer financial protection to your loved ones in the event of your death during the policy term. While term life insurance provides a fixed death benefit, it does not accumulate cash value over time, which is a feature of permanent life insurance policies such as whole life or universal life insurance. This means that the value or benefit of a term life insurance policy does not decrease over its duration. However, it is important to distinguish between standard term life insurance and decreasing term life insurance.

| Characteristics | Values |

|---|---|

| Type of Insurance | Temporary |

| Coverage | Decreases over the life of the policy |

| Premiums | Constant throughout the contract |

| Coverage Reductions | Monthly or annually |

| Terms | 1 year to 30 years |

| Use | Guaranteeing the remaining balance of an amortizing loan |

| Death Benefit | Gets smaller each year |

| Premium | $25 per month for a 15-year $200,000 decreasing term policy |

| Permanent Policy Premium | $100 or more per month |

| Whole Life Insurance | Combination of a standard decreasing term policy and a very low-interest savings account |

What You'll Learn

Term life insurance does not build cash value

Term life insurance is a type of life insurance policy that has an expiration date, usually 10 to 40 years from the start of the policy. It is designed to provide a death benefit payout to beneficiaries when the insured person dies. Term life insurance does not have a cash value component, which means you cannot borrow against the policy. This is in contrast to some permanent life insurance policies, such as whole life and universal life insurance, which do have a cash value component.

The absence of a cash value component in term life insurance policies makes them more affordable than permanent life insurance policies. Term life insurance policies are designed for the singular purpose of providing a death benefit payout, without any additional features that can be utilised while the policyholder is alive. This makes term life insurance simple and significantly cheaper than permanent life insurance.

However, the lack of a cash value component also means that term life insurance policies do not offer the added benefits that come with a cash value account, such as the ability to borrow from the account. In addition, term life insurance policies do not last a lifetime, and if the policyholder outlives the policy term, they will need to purchase another policy if they still need life insurance.

In summary, term life insurance is a popular choice due to its low rates and no-frills coverage. It is important to note that term life insurance does not build cash value, and its primary purpose is to provide a financial safety net for loved ones in the event of the policyholder's death.

Primerica Life Insurance: Job Loss Protection and Benefits

You may want to see also

It is a temporary type of insurance

Term life insurance is a temporary type of insurance. It is a type of life insurance policy that expires after a certain amount of time, typically 10 to 40 years from the start date. This type of insurance is suitable for people with temporary insurance needs, such as protecting a house mortgage. It is also a popular choice due to its low rates, providing coverage at an affordable price.

Term life insurance does not come with any supplemental features, like a cash value. Instead, it offers no-frills coverage, keeping costs low for the policyholder. The policy only lasts for a specific period and does not build up cash value over time, as seen in whole or universal life insurance policies. The lack of a cash value component is a defining feature of term life insurance and contributes to its temporary nature.

When purchasing a term life insurance policy, individuals select a coverage amount and term length that matches their financial obligations. For example, if an individual has a 20-year $250,000 mortgage, they may opt for a $250,000 coverage amount and a 20-year policy term. This ensures that the insurance coverage aligns with their financial needs during the specified period.

At the end of the term life insurance policy, individuals have several options. They can choose to renew or convert their policy, purchase a new term or permanent life insurance policy, or let the coverage lapse if they no longer require insurance. The choice depends on factors such as the policyholder's age, health, and changing financial obligations.

In summary, term life insurance is a temporary form of insurance that provides coverage for a fixed period without building cash value. It is designed to meet individuals' temporary insurance needs and offers an affordable option to protect their loved ones during the specified term.

How My Dad's Death Impacts My Insurance Rates

You may want to see also

It is a cheaper option than permanent life insurance

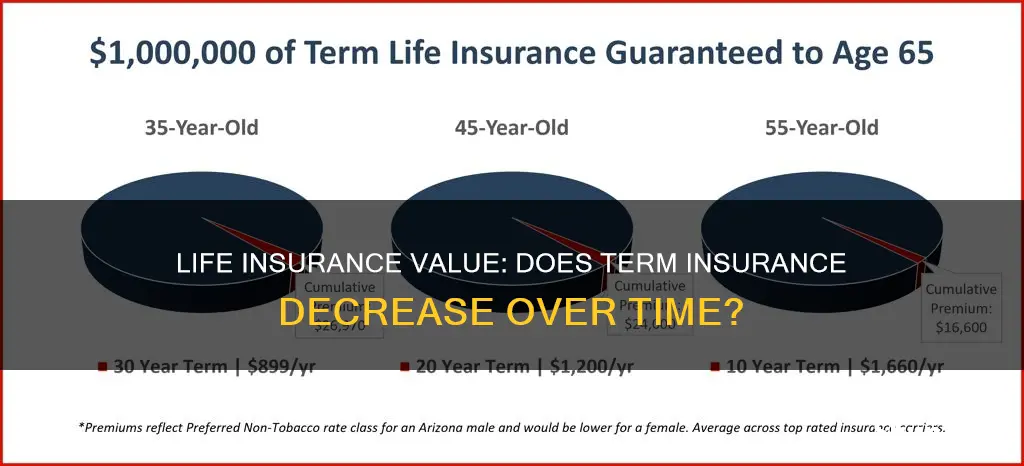

Term life insurance is a type of life insurance policy that is active for a set period, typically ranging from 10 to 40 years. It is a popular and affordable choice for people who want to ensure their loved ones are financially secure in the event of their death. Unlike permanent life insurance, term life insurance does not accumulate cash value, which helps to keep costs low.

The low rates of term life insurance make it a more affordable option than permanent life insurance. Term life insurance is designed to provide financial protection for a fixed period, after which the policy expires. On the other hand, permanent life insurance offers lifelong coverage and often includes a savings component, resulting in higher premiums.

Term life insurance is particularly suitable for individuals with temporary insurance needs, such as protecting a mortgage on a house. The premiums for term life insurance are typically fixed for the duration of the policy, making it a predictable and budget-friendly option. In contrast, permanent life insurance premiums can be significantly higher, especially for younger individuals.

Another factor contributing to the affordability of term life insurance is the absence of a cash value component. Term life insurance solely focuses on providing a death benefit, whereas permanent life insurance policies often include a savings element. This means that permanent life insurance not only covers the cost of death but also allows the policyholder to build up cash value over time. As a result, permanent life insurance policies are more complex and tend to be more expensive.

In summary, term life insurance is a cheaper option than permanent life insurance due to its limited duration and lack of cash value accumulation. It is an excellent choice for individuals seeking straightforward financial protection for their loved ones at a reasonable cost.

Geico: Life Insurance Options and Benefits Explored

You may want to see also

The death benefit remains constant throughout the term

Term life insurance is a type of insurance policy that offers coverage for a fixed period, typically ranging from 10 to 40 years. It is designed to provide financial protection for your loved ones in the event of your death during the policy term. One important aspect of term life insurance is that the death benefit, or the payout, remains constant throughout the term. This means that the beneficiaries will receive a predetermined amount of money if the insured person passes away within the specified period.

The death benefit from term life insurance can be used by the beneficiaries in a variety of ways. It can help cover funeral expenses, pay off debts such as mortgages, or replace lost income. The beneficiaries have the flexibility to use the funds as they see fit, ensuring that they can maintain their standard of living during a difficult time.

Unlike other forms of life insurance, term life insurance does not accumulate cash value over time. This means that the policy does not build up a savings component. Instead, it offers a pure death benefit, keeping the costs relatively low for the policyholder. This makes term life insurance an attractive option for individuals seeking affordable coverage without additional features.

When considering term life insurance, it is essential to understand the different types available. There are two main variations: level term and decreasing term. Level term life insurance provides a fixed payout if the insured person passes away during the policy term, with the payments and coverage amount remaining constant. On the other hand, decreasing term life insurance is designed to mirror the amortization schedule of a mortgage or other debt. The payout decreases over time, along with the premiums, according to a predetermined schedule.

While term life insurance offers a constant death benefit, it is important to note that the policy does have an expiration date. Once the term ends, the coverage ceases to exist, and the policy needs to be renewed or converted to a permanent policy to maintain protection. This is a key distinction from permanent life insurance, which offers lifelong coverage as long as the premiums are paid.

Gerber Life Insurance: Adult Coverage Options Explored

You may want to see also

It is a good option for those with temporary insurance needs

Term life insurance is a type of insurance policy that is temporary and does not come with any supplemental features, like a cash value. It is a good option for those with temporary insurance needs, such as protecting a house mortgage. This type of insurance is also good for those who want to keep costs low as it is relatively inexpensive. For a relatively low monthly cost, term life insurance pays out a death benefit to your beneficiaries if you die. The benefit then enables your loved ones to maintain their standard of living and pay for any outstanding financial obligations, like a mortgage.

Term life insurance is also a good option for those with temporary insurance needs as it is a no-frills coverage option. It is a straightforward type of insurance that simply offers a death benefit for a certain length of time. This means that if you were to die within the term, your family will be paid the pre-agreed cash sum. This type of insurance is also good for those who want to protect their family financially when they are no longer able to. For instance, if the policy pays out, it could be used to pay off an existing mortgage, help with ongoing household bills, pay for a funeral, or provide a good standard of living for your family.

Term life insurance is also a good option for those with temporary insurance needs as it is often used to guarantee the remaining balance of an amortizing loan, such as a mortgage or business loan. It can also be used to provide personal asset protection. For example, if one partner in a small business dies, the death benefit proceeds from the decreasing term policy can help to fund continuing operations or retire the percentage of the remaining debt for which the deceased partner is responsible.

Term life insurance is a good option for those with temporary insurance needs as it is a pure insurance product, with no bells and whistles. It is a very good instrument to cover the remaining earning capacity of the insured as this capacity decreases with age.

Life Insurance and Suicide: What Coverage Entails

You may want to see also

Frequently asked questions

No, the death benefit amount of a standard term life insurance policy remains constant throughout the term. However, the value of the policy does not build up cash value as it does in whole or universal life policies.

Term life insurance is a type of life insurance policy that expires after a certain amount of time, usually 10 to 40 years from when the policy starts. It is a popular choice due to its low rates and it pays a death benefit to your beneficiaries if you die during the policy term.

Term insurance is temporary, and is best suited for people who have temporary insurance needs, like protecting a house mortgage. Whole life insurance is permanent and is best suited to protect a person's estate or create and leave a meaningful estate for their heirs.

When a term life insurance policy matures, you have a few choices. You can renew the policy year-to-year, convert your term life insurance to a permanent policy, get a new term life insurance policy, or buy a new permanent life insurance policy.