Life insurance is a financial risk management instrument that covers you and your business from financial losses arising from unforeseen events. The rate of a life insurance policy varies based on the possibility of risk materialising, and age is one of the most influential factors in determining this rate. The older you are, the more expensive the premiums will be as the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. This means that the premium amount increases on average by about 8% to 10% for every year of age. Term life insurance is a type of life insurance that provides a death benefit for a specified period of time, and the premium for this type of insurance is based on a person's age, health and life expectancy. While term life insurance does not offer a payout if the policy expires before your death, you can choose to renew it for another term, but the premiums will be recalculated based on your age at the time of renewal.

| Characteristics | Values |

|---|---|

| Does the term life insurance payout decrease with age? | No, the payout does not decrease with age. However, the premium increases with age. |

| What is the basis for determining the premium? | The premium is determined based on the mortality rate, which refers to the rate of deaths at a certain age during a specific period. |

| How is the mortality rate calculated? | The mortality rate is calculated using a mortality table, which is created based on previous data about life expectancy, health conditions, diseases, and medical advancements. |

| How does age affect the premium? | Age is a primary factor that influences the premium. As age increases, the likelihood of death also increases, resulting in a higher premium. |

| Are there other factors that impact the premium? | Yes, health, gender, lifestyle choices, occupation, policy type, coverage amount, and add-ons also affect the premium. |

What You'll Learn

Term life insurance premiums increase with age

Term life insurance is an affordable and straightforward option for many people. You pay premiums every month, and the coverage lasts for the term length, which can be 10, 15, 20, 25, or 30 years. However, the type of term life insurance coverage you buy determines what happens to your premium as you age.

If you choose a term life insurance policy with guaranteed level premiums, you pay the exact same premium rate every month through the end of the term, no matter how long your coverage lasts. For example, a 35-year-old woman in excellent health can buy a 30-year, $500,000 Haven Term policy, issued by MassMutual, starting at $29.15 per month. Over the next 30 years, while the policy is in place, the cost of the coverage will not change over the term period.

On the other hand, with renewable term life insurance, the premiums will go up over time as the policyholder ages. The premium payment will change from year to year and might cost you more money than level term life insurance. In the first few years of an annually renewable policy, the premium might be less than what you'd pay for a similar level term policy. But since an annually renewable policy increases in cost every year, over time, it's possible to pay more in premiums than what you would have paid for a level term policy.

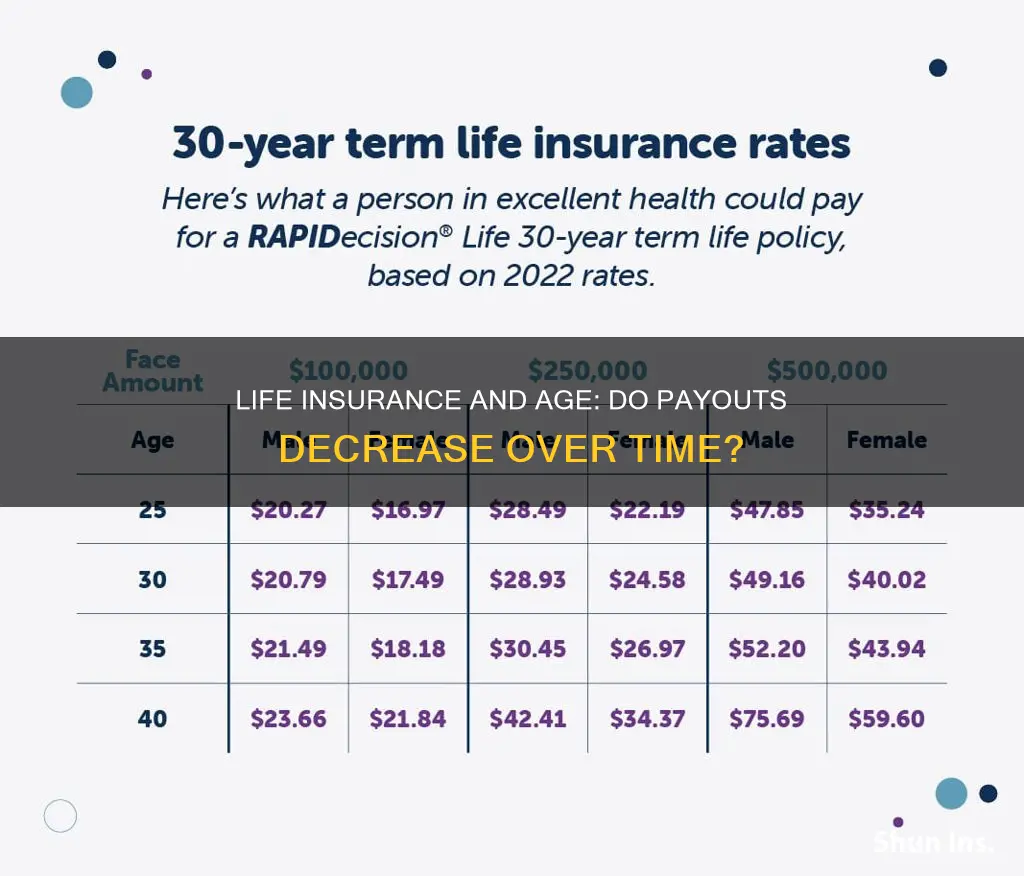

Your age is one of the primary factors influencing your life insurance premium rate, whether you're seeking a term or permanent policy. Typically, the premium amount increases by about 8% to 10% for every year of age; it can be as low as 5% annually if you're in your 40s and as high as 12% annually if you're over 50.

The reason the cost of term life insurance increases with age is simple math: every birthday puts you one year closer to your life expectancy, and thus, you are more expensive to insure.

Term life insurance premiums are based on a person's age, health, and life expectancy. When you buy a term life insurance policy, the insurance company determines the premium based on the policy's value (the payout amount) and factors such as age, gender, and health.

Life insurance companies use several criteria to calculate your premium, including your age, overall health, gender, lifestyle factors (e.g., your job or hobbies), the type of life insurance policy you need, and the amount of coverage you choose.

Life insurance rates usually increase as you get older because advanced age typically corresponds to health complications or a shorter lifespan. This means insurance companies can generally expect a claim payout will come sooner for an older person and will often charge a higher premium to offset that risk.

New York Life: Exploring Disability Insurance Options

You may want to see also

Premium rates are locked in for the duration of the policy

Term life insurance is an affordable and straightforward option for many people. You pay premiums every month, and the coverage lasts for the term length, which can be 10, 15, 20, 25, or 30 years. The premium amount is established when you buy a policy and remains the same every year.

When you buy level term life insurance coverage, your rate is locked in. As long as you continue to pay your insurance premiums each month, you’ll pay the same rate during the entire term length. For example, a 35-year-old woman in excellent health can buy a 30-year, $500,000 Haven Term policy, issued by MassMutual, starting at $29.15 per month. Over the next 30 years, while the policy is in place, the cost of the coverage will not change over the term period.

Your level term rate is determined by a number of factors, most of which are related to your age and health. Other factors include your specific term policy, insurance provider, benefit amount, or payout. During the life insurance application process, you’ll answer questions about your health history, including any pre-existing conditions like a critical illness. You’ll also be asked about your family’s health history so that insurers can evaluate whether you might be at risk for serious health issues in the future. You’ll also answer questions about potentially risky lifestyle behaviors, such as smoking.

Most applicants will need to complete a short medical exam. All of this information will help place you in a health class that will, in turn, help determine your monthly premium and financial obligation.

The premium amount increases on average by about 8% to 10% for every year of age. A 45-year-old male will pay on average $1,125 for a new, 20-year term policy with $1,000,000 of coverage. The same policy purchased at age 46 will cost $1,225, and $1,345 a year if purchased at age 47.

The reason every year inches up the cost of term life insurance is simple math. Every birthday puts you one year closer to your life expectancy, and thus, you are more expensive to insure.

To be able to hold term life insurance prices steady, insurers spread the premiums you would pay over 10, 20, or 30 years and average them into one payment. Instead of paying low premiums when you’re young and very high premiums when you’re older, you pay the same amount every year.

Term life insurance is a good option for people who cannot afford or will not pay the much higher monthly premiums associated with whole life insurance.

Life Insurance: Is It a Permanent Solution?

You may want to see also

Older people tend to pay the highest rates

Age is a primary factor in determining life insurance premiums. The older you are, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. In other words, the older you are, the more likely you are to become ill or die while under coverage.

The premium amount increases, on average, about 8% to 10% for every year of age. This can be as low as 5% annually if you're in your 40s, and as high as 12% annually if you're over 50. So, a 45-year-old male will pay on average $1,125 for a new, 20-year term policy with $1,000,000 of coverage. The same policy purchased at age 46 will cost $1,225, and $1,345 a year if purchased at age 47.

The annual premium, or "rate", for a term life insurance policy is determined at the time of purchase and set for the duration of the policy. The reason the cost of term life insurance increases each year is simple mathematics. Every birthday puts you one year closer to your life expectancy, and thus, you are more expensive to insure.

In addition to age, other factors that influence life insurance premiums include health, gender, lifestyle choices, and the type of policy chosen. Health status, medical history, and lifestyle choices can also sway pricing. For example, people who suffer from pre-existing medical conditions like diabetes, heart disease, or obesity may not live as long as healthy people with few or no medical conditions. As a result, insurance companies may charge higher rates for people with health issues.

Gender also plays a role, with men typically paying more for life insurance than women, as women tend to live longer than men. Lifestyle choices such as smoking, drinking, and participating in risky hobbies or occupations can also increase premiums.

When it comes to the type of policy, term life insurance is usually the least costly option, as it offers a death benefit for a restricted time and doesn't have a cash value component like permanent insurance. Permanent life insurance policies, on the other hand, are generally more expensive because they provide coverage for the entire lifetime of the policyholder.

Older adults might have a harder time purchasing life insurance, as many insurers stop issuing new life insurance policies to seniors over a certain age, usually around 80. Life insurance for seniors can also be cost-prohibitive, depending on their health and the type of coverage they qualify for.

Life Insurance and HIPAA: What's the Connection?

You may want to see also

Life insurance for seniors can be costly

Seniors under 70 can get term life policies at affordable rates, especially if they are in good health. However, even seniors over 80 can get affordable guaranteed or universal life insurance. Seniors may have to check with a few different companies to see if they will be covered, as each insurance company has its own age cut-offs for term life insurance. Older seniors may also have trouble getting approved depending on the amount of coverage needed and their overall level of health.

Term life insurance is usually the least costly life insurance available. It offers a death benefit for a restricted time and doesn't have a cash value component like permanent insurance. However, term life insurance premiums increase with age. The annual premium, or "rate", for a term life insurance policy is determined at the time of purchase and set for the duration of the policy. Typically, the premium amount increases on average by about 8% to 10% for every year of age.

Permanent life insurance policies, such as whole life insurance, are meant to provide coverage for as long as the insured person lives. As the coverage matures, the policy grows in value, and the policyholder can withdraw for any purpose. Thus, it can serve as an investment product as well as an insurance policy. However, permanent life insurance is often significantly more expensive than term life insurance.

While whole life insurance is the most popular type of permanent coverage, guaranteed universal life insurance is typically a better option for seniors. Whole life insurance policies build cash value over time, which can be borrowed against or withdrawn. However, a portion of the premiums goes toward the cash value, making whole life insurance much more expensive. For seniors, the cash value of whole life insurance is less valuable because there are fewer years for the cash value to grow with interest.

Guaranteed universal life insurance, on the other hand, is essentially a term life insurance policy that lasts until the insured reaches a certain age, such as 90, 100, or 121. Guaranteed universal policies offer lifelong coverage at cheaper rates than whole life insurance.

Life Insurance and Skydiving: What's Covered in Accidents?

You may want to see also

Permanent life insurance is more expensive than term life insurance

Term life insurance is a straightforward and affordable option for many. You pay premiums every month, and the coverage lasts for the term length, which can be 10, 15, 20, 25, or 30 years. The premium amount remains the same throughout the term. However, if you renew your policy, the premiums will increase annually.

Permanent life insurance, as the name suggests, provides long-term or lifelong coverage. As long as you continue to pay the premiums, your coverage will remain in force. Permanent life insurance policies have a cash value component that grows over time, and you can access this money while you're still alive. This feature can be especially helpful in meeting unexpected emergencies or milestone expenses like college and retirement.

The main reason permanent life insurance is more expensive than term life insurance is that it offers lifelong coverage and includes a cash value component. The cash value grows at a guaranteed rate set by the insurer, and you can borrow against it or surrender the policy for cash. Whole life insurance, a type of permanent life insurance, also has guaranteed premiums, guaranteed cash values, and guaranteed death benefits.

Term life insurance, on the other hand, is designed to provide coverage for a specific period. While it offers lower premiums, the coverage ends once the term is up, and there is no cash value accumulation. However, term life insurance is a good option for those who want substantial coverage at a low cost or those who are just starting out or on a budget.

Life Insurance: Personal Property Protection or Separate Policy?

You may want to see also

Frequently asked questions

The premium of a term life insurance policy will change with age if you are buying a fresh policy. Once you buy a life insurance policy, the premium remains the same throughout the term.

The best time to buy term life insurance is as soon as you realize you need it. For example, some people purchase life insurance when they get married, buy a home, or have their first child.

Age is one of the most influential factors affecting life insurance premiums. Insurers assess premiums based on multiple personal rating factors, but there is an emphasis on mortality risk, and the probability of death rises steadily as we get older.