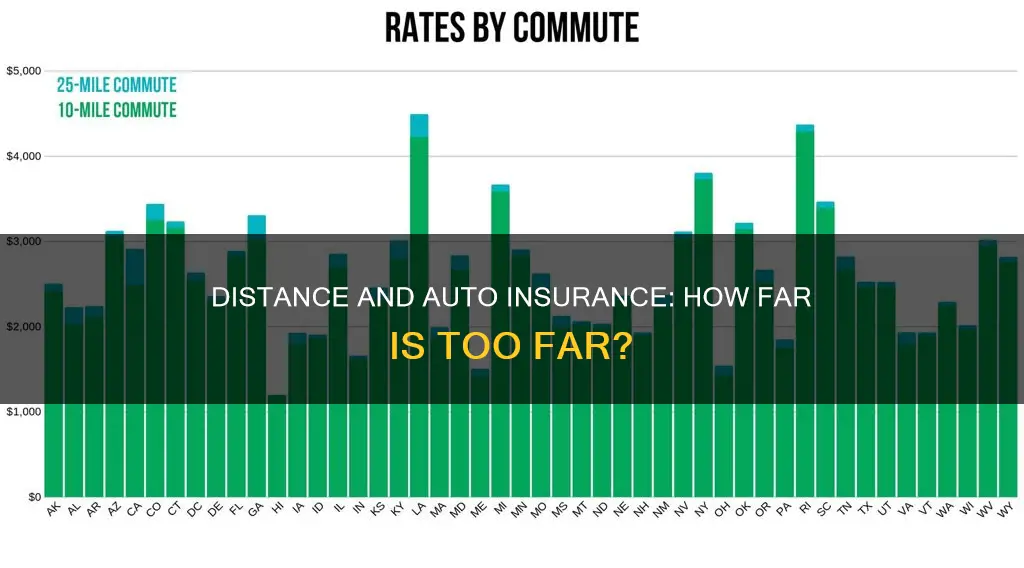

The distance of your commute can affect your auto insurance, but this is not the case for all insurance companies. Some insurance companies base their rates on the miles driven by the average driver, while others take into account your overall expected driving distance every year. The more you drive, the higher the risk of a collision, so longer commutes can equal higher insurance premiums. However, it's important to note that other factors, such as your driving record, vehicle model, age, gender, and location, also play a significant role in determining your insurance rates.

| Characteristics | Values |

|---|---|

| Overall expected driving distance | The more you drive, the higher the risk of collision, and therefore, the higher the insurance premium |

| Annual mileage | Insurance companies use annual mileage to assess the risk of insuring your vehicle |

| Location | Where you drive is more important than how far. Some locations experience more accidents than others |

| Type of car | Cars with high vehicle safety ratings are more likely to get low insurance rates |

| State | Car insurance companies are regulated by state, and different areas may have higher rates of crime and accidents |

| Driving record | A history of traffic violations or accidents increases the likelihood of making a claim, and therefore, the insurance premium |

| Credit score | People with bad credit tend to get into more accidents |

| Age, sex, and marital status | Young, single males are more likely to make claims than anyone else |

What You'll Learn

The impact of a long commute on insurance rates

The distance of your commute can affect your auto insurance rates. The more you're on the road, the higher the risk of a collision, meaning longer commutes can equal higher insurance premiums. However, this is not the case for all insurance companies.

How insurance companies determine your insurance rates

Insurance companies use your annual mileage to assess the risk involved with insuring your vehicle and price your auto insurance policy accordingly. They also consider other factors such as your age, gender, where you live, the make and model of your car, and your driving record.

The primary way you use your car is an important factor when calculating your insurance rate. If you use your car for commuting, insurance companies typically view this as anything you do regularly, such as driving to work or college, or driving a family member to and from work.

How to save on insurance rates with a long commute

If you have a long commute, there are ways to save on your insurance rates. One way is to shop around and compare insurance rates from multiple providers. You can also take advantage of discounts offered by insurance companies, such as the multi-vehicle discount or the home and auto insurance or multi-line discount.

Another way to save is to consider usage-based insurance (UBI), where insurance providers encourage good driving behaviours by monitoring your driving performance through telematics. By signing up for UBI, you can get a discount of up to 10% on your auto insurance premium.

Additionally, you can reduce your annual mileage by using public transportation or carpooling, which will not only save you money on insurance but also on fuel costs.

The impact of a shorter commute on insurance rates

On the other hand, if your commute time and distance have reduced, you may be eligible for lower insurance premiums. Be sure to inform your insurance company of any changes in your situation, as misrepresenting or lying about how you use your vehicle or your annual mileage is considered insurance fraud.

Auto Insurance Lapses: What's the Risk?

You may want to see also

How insurance companies determine your mileage

The distance of your commute can affect your auto insurance rates. The more you're on the road, the higher the risk of a collision, meaning longer commutes can equal higher insurance premiums. When determining your car insurance premium, one factor most insurance companies consider is your mileage. The more you drive, the higher your insurance premium can be.

Insurance companies have a variety of ways to determine how much you drive. They may ask you directly, or they may obtain the information from third-party vendors, such as dealerships, oil change companies, or telematics technologies if you have a monitoring device plugged into your car. Repair shops also record mileage when you take your car in for an oil change or a repair after an accident. In some cases, insurance companies may even purchase your mileage data from the company that services your car.

While it may be tempting to lie about your driving patterns to get a lower rate, this is not advisable. Insurance companies have many ways to verify your mileage, and if they find that you have misrepresented your driving habits, it could result in higher premiums or even the cancellation of your policy. Additionally, it is important to note that insurance companies are only required to ask about your mileage every three years, so they may be using other sources to monitor your driving habits in the meantime.

It is also worth noting that not all insurance companies use the same criteria to determine rates. For example, Farmers Insurance, except in California, does not use annual mileage to determine auto insurance rates. Instead, their rates are based on the miles driven by the average driver, and they consider the location of your driving to be more important than the number of miles driven. Therefore, it is essential to shop around and compare rates from multiple insurance providers to find the best option for your specific circumstances.

Retirement Planners: Auto Insurance Allies?

You may want to see also

The importance of disclosing your driving patterns

The distance of your commute can impact your auto insurance rates. While it is not the only factor that determines your insurance premium, it is an important consideration. Being transparent about your driving patterns is essential when obtaining auto insurance. Misrepresenting or lying about your driving habits is considered insurance fraud and can have serious consequences.

Insurance companies view commuting as any regular trip, such as driving to work or school, or even daily carpools. The key factor is the frequency of these trips, as it increases the likelihood of accidents. The more you're on the road, the higher the risk of a collision. Therefore, insurance companies consider the number of miles driven and the purpose of your trips when calculating your insurance rate.

If you have a long commute, it is crucial to disclose this information to your insurance company. While it may result in higher premiums, failing to do so could lead to issues in the event of a collision. Insurance companies may deny your claim or even cancel your policy if they find that you have misrepresented your driving patterns.

Additionally, it is important to keep your insurance company updated about any changes in your driving habits. For example, if you change jobs and your new workplace is closer to your home, reducing your commute distance, make sure to inform your insurance provider. This can help you take advantage of lower insurance premiums.

Furthermore, insurance companies also consider the location of your commute. Driving in an urban area with heavy traffic is considered riskier than driving the same distance in a rural setting. Therefore, it is essential to provide accurate information about your driving patterns and locations to ensure you are appropriately covered by your insurance policy.

While a shorter commute is generally preferable for keeping insurance rates low, there are other factors at play. Your driving record, the type of car you drive, your age, gender, and marital status all contribute to determining your insurance premium. Insurance companies also offer various discounts and safe driving programs that can help offset higher rates due to longer commutes.

Canadian Road Rules: Understanding Auto Insurance Recognition

You may want to see also

Factors that affect insurance premiums

The distance of your daily commute is just one of many factors that can affect your auto insurance premiums. While the number of miles you drive annually is a consideration, it is not the only thing that determines your insurance rate.

Firstly, insurance companies view commuting as anything you do regularly, such as driving to work or college, or driving a family member to and from work. The more you're on the road, the higher the risk of a collision, and so longer commutes can equal higher insurance premiums. However, this is not always the case, as Farmers Insurance states that they no longer consider how many miles are driven, basing their rates instead on the average driver.

Other factors that insurance companies take into account when setting your auto insurance rate include:

- Age, gender, and marital status: Young, single males are more likely to make claims than anyone else.

- Where you live: Urban areas tend to have higher insurance rates than rural areas due to higher rates of crime and accidents.

- Your driving record: A history of traffic violations or accidents increases the likelihood of you making a claim, leading to higher premiums.

- Your credit score: People with bad credit tend to get into more accidents, so insurance companies will use an insurance-based credit score when determining your rate.

- The type of car you drive: Cars with high safety ratings are more likely to get lower insurance rates, while cars meant for speed or style tend to have higher rates.

- How often you drive: The more you drive, the higher your insurance premium is likely to be.

- What you use your car for: Insurance companies classify car use as either "pleasure" or "commute". Commute use is considered a greater risk, as you are more likely to be involved in a collision when driving during peak hours.

- Your annual mileage: Insurance companies use your annual mileage to assess the risk of insuring your vehicle.

Married Children: Parent's Auto Insurance

You may want to see also

Ways to lower your insurance premium

The distance of your commute can affect your auto insurance premium. The more you're on the road, the higher the risk of a collision, meaning longer commutes can equal higher insurance premiums. However, this is not the case with Farmers Insurance, which does not use your annual mileage to determine auto insurance rates (except in California). Instead, rates are based on miles driven by the average driver.

- Multi-vehicle discount: If you own more than one vehicle, you can place them under the same auto insurance policy or with the same insurance provider. This can save you up to 20% on your insurance rate.

- Home and auto insurance or multi-line discount: Bundling your home and auto insurance policies under the same insurance provider can save you 5-15% off your combined premiums.

- Usage-based insurance (UBI) discount: Some insurance providers encourage good driving behaviours with a UBI discount. They use telematics to monitor your driving performance and can offer a discount of up to 10% on your auto insurance premium.

- Public transportation or carpool: Using public transit or carpooling can reduce your annual mileage, save fuel costs, and shrink your carbon footprint.

- Increase your deductible: You could consider increasing your deductible, which is the amount you'll pay when you file a claim. The higher your deductible, the lower your insurance premium. By increasing your deductible, you can knock 5-10% off your insurance premium. Just ensure you can afford the higher payment if you need to make a claim.

- Shop around for insurance: Seek out and compare at least three to four car insurance companies to see which offers the best rate for your situation.

- Buy a car with a high safety rating: Insurance companies reward safety, so if your car has safety features, you may benefit from lower insurance premiums.

- Consider alternative modes of transportation: If you want to qualify for an occasional driver discount or simply reduce how much you drive to save money on car insurance, consider carpooling, public transit, walking, or cycling.

- Look into alumni and employment discounts: There are various insurance discounts available, including alumni and employee discounts. Let your insurance broker know your educational and employment background to see if you qualify for any discounts.

- Raise your credit score: Some insurance companies offer reduced rates to drivers with high credit scores.

- Only buy the car insurance coverage you need: It can be tempting to purchase every type of coverage, but this will cost you. Choose your coverage wisely and only purchase what you need.

- Install winter tires: Many insurers offer a winter tire discount as this can reduce the likelihood of getting into an accident.

- Purchase a hybrid or electric vehicle: Buying an eco-friendly vehicle can lead to a reduced car insurance rate.

- Sign up for a driver's education course: Enrolling in a driver's education course can make you eligible for a car insurance discount.

- Add an anti-theft device: Installing an anti-theft or security system in your vehicle can make you eligible for an auto insurance discount.

Foremost Insurance: Unveiling the Auto Policy Spectrum

You may want to see also

Frequently asked questions

The distance of your commute can affect your auto insurance. The more you're on the road, the higher the risk of a collision, meaning longer commutes can equal higher insurance premiums. However, other factors such as your driving record, vehicle model, age, and location are also taken into account.

Insurance companies use various methods to obtain information about your driving patterns, including purchasing mileage updates from companies that service your vehicle or accessing your car's records.

There are several ways to lower your auto insurance premium despite having a long commute. You can shop around and compare rates among multiple providers, take advantage of discounts offered by insurance companies, or consider usage-based insurance, which monitors your driving performance to offer discounts for safe driving behaviours.