When you start driving for Uber Eats, it's important to understand how your insurance coverage might change. While your personal auto insurance policy may cover you while you're driving for Uber Eats, there are specific considerations and potential gaps in coverage that you should be aware of. This includes understanding the terms and conditions of your policy, any additional coverage you may need, and how to ensure you're properly protected while delivering food. Knowing these details can help you make informed decisions and ensure you have the right insurance coverage in place to handle any unexpected situations that may arise while you're on the job.

| Characteristics | Values |

|---|---|

| Type of Insurance | Car insurance, Personal injury protection (PIP), Medical payments coverage, Uninsured/underinsured motorist coverage |

| Impact on Premiums | May increase, No change, Potential decrease (if you have a good driving record) |

| Coverage Considerations | Comprehensive coverage, Collision coverage, Liability coverage, Personal belongings coverage |

| Additional Policies | Commercial auto insurance, Ride-sharing insurance, Endorsements |

| Driving Requirements | Age, Driving record, Vehicle specifications, License type |

| Company Policies | Uber's insurance program, Partner insurance, Third-party insurers |

| Legal Implications | Compliance with local regulations, Insurance fraud, Liability claims |

| Benefits | Financial protection, Peace of mind, Legal compliance |

| Challenges | Higher premiums, Limited coverage options, Complex claims process |

| Alternatives | Self-insurance, Additional personal insurance, Ride-sharing insurance providers |

What You'll Learn

- Insurance Coverage for Ride-Hailing: Understanding how insurance policies adapt for drivers using ride-hailing apps like Uber Eats

- Liability and Risk Assessment: Exploring the insurance implications of delivering food, including potential risks and liability coverage

- Policy Adjustments: How insurance companies modify policies for drivers who use their vehicles for food delivery services

- Claims and Compensation: The process of filing insurance claims for accidents or damage while working for Uber Eats

- Rate Changes and Discounts: Insights into how insurance rates and potential discounts may vary for Uber Eats drivers

Insurance Coverage for Ride-Hailing: Understanding how insurance policies adapt for drivers using ride-hailing apps like Uber Eats

The rise of ride-hailing apps has transformed the way many people commute, offering convenience and flexibility. However, for drivers using these services, such as Uber Eats, there are important considerations regarding insurance coverage. When you sign up to drive for a ride-hailing company, your insurance policy may need to adapt to cover the unique risks associated with this type of work.

Firstly, it's crucial to understand that standard auto insurance policies might not always provide comprehensive coverage for ride-hailing activities. Most personal auto insurance plans are designed for everyday driving and may not account for the specific risks and responsibilities that come with driving for hire. These risks include the potential for more frequent and varied trips, longer driving hours, and the increased likelihood of accidents or incidents during deliveries.

When you drive for Uber Eats, your insurance policy may need to be adjusted to include commercial coverage. This type of insurance is tailored to the unique needs of drivers who use their vehicles for business purposes. Commercial auto insurance typically offers higher liability limits, which are essential in the event of an accident, as you may be held responsible for any damages or injuries sustained by passengers or pedestrians. It also covers the vehicle while it is being used for business, including during delivery trips.

Additionally, ride-hailing companies often provide their own insurance policies or work with insurance providers to offer coverage specifically for their drivers. These policies can vary, so it's essential to review the terms and conditions carefully. Some companies may offer liability coverage, personal injury protection, and other benefits, but the extent of coverage can differ. Understanding these additional insurance options can help drivers ensure they have the necessary protection while on the job.

In summary, when you drive for Uber Eats or similar services, your insurance coverage may require adjustments to accommodate the commercial nature of your work. This includes considering commercial auto insurance and understanding any additional policies provided by the ride-hailing company. By taking the time to review and adapt your insurance coverage, you can ensure that you are adequately protected and comply with the requirements of the ride-hailing platform you are using.

U.S. Auto Insurance and Lost Keys: What You Need to Know

You may want to see also

Liability and Risk Assessment: Exploring the insurance implications of delivering food, including potential risks and liability coverage

The rise of food delivery services has transformed the way we order meals, and with it, the nature of the risks and liabilities associated with the delivery process. When you sign up to deliver food for platforms like Uber Eats, it's essential to understand the insurance implications to ensure you're adequately protected. This is especially crucial as it pertains to the potential risks and liabilities that come with operating a vehicle for commercial purposes.

One of the primary concerns for drivers is the coverage of their personal insurance policies when they are delivering food. Standard auto insurance policies often have limitations or exclusions when it comes to commercial use. For instance, if you're involved in an accident while delivering food, your personal insurance might not cover the damages or injuries, leaving you financially vulnerable. This is where understanding the specific insurance requirements of the food delivery platform becomes vital.

Uber Eats, for example, provides its delivery partners with a combination of personal and commercial insurance coverage. This typically includes liability insurance, which covers damages or injuries you might cause to others during the delivery process. However, it's important to note that this coverage may have certain limitations, such as a per-incident or aggregate limit, which could leave you responsible for significant costs if the damages exceed these limits. Therefore, it's crucial to review the terms and conditions of the platform's insurance policy to understand the extent of the coverage.

Additionally, drivers should be aware of the potential risks associated with the job. These may include accidents caused by road hazards, adverse weather conditions, or even malicious acts. For instance, a delivery driver might encounter a slippery road due to rain, leading to a minor collision. In such cases, the liability coverage from the platform's insurance can provide financial protection. However, it's essential to document the incident promptly and report it to the platform's support team to ensure a smooth claims process.

To mitigate risks and ensure comprehensive coverage, drivers can consider the following steps. Firstly, review and understand the insurance policies provided by the food delivery platform. This includes liability, medical payments, and possibly commercial auto insurance if the platform offers it. Secondly, assess your personal insurance policy to identify any gaps in coverage that might need to be addressed. Finally, consider additional insurance options, such as personal injury protection or umbrella insurance, to provide extra layers of financial security. By taking these proactive measures, delivery drivers can better manage the risks and liabilities associated with their profession.

Auto Insurance Refunds: Getting Your Money Back in Michigan

You may want to see also

Policy Adjustments: How insurance companies modify policies for drivers who use their vehicles for food delivery services

The rise of food delivery services has led to an increase in the number of drivers using their personal vehicles for these services, and insurance companies are taking note. When individuals drive for platforms like Uber Eats, their insurance policies may require adjustments to account for the unique risks associated with food delivery. Here's an overview of how insurance companies approach policy modifications for these drivers:

Increased Mileage and Usage: Food delivery drivers often rack up significantly more miles on their vehicles compared to regular commuters. Insurance companies recognize this and may adjust the policy's mileage limit or introduce a usage-based rating system. This means that the premium could be calculated based on the actual miles driven for deliveries, ensuring a more accurate reflection of the risk. For instance, a driver who covers 10,000 miles annually for food delivery might be charged a premium that accounts for this higher usage.

Specialized Coverage: To cater to the specific needs of food delivery drivers, insurance providers may offer specialized coverage options. These can include enhanced liability coverage, which is crucial given the potential for more frequent and higher-value claims. Additionally, comprehensive coverage might be extended to include damage caused by food spills or accidents related to the delivery process. For example, if a driver accidentally drops a package, causing damage, the insurance policy could cover the repairs or replacement.

Risk-Based Premiums: Insurance companies often employ risk assessment models to determine premiums. For food delivery drivers, factors like driving record, age, and the vehicle's make and model are considered. However, the nature of the work also plays a significant role. Drivers with a history of safe driving and a low-risk profile might receive lower premiums, while those with more frequent claims or traffic violations could face higher rates. This risk-based approach ensures that the insurance company's costs are managed while providing coverage tailored to the driver's needs.

Additional Perks and Discounts: Some insurance providers offer incentives to attract food delivery drivers. These can include discounts for safe driving behavior, loyalty rewards, or partnerships with food delivery platforms. For instance, a driver who completes a certain number of deliveries for Uber Eats might be eligible for a premium reduction. Such perks not only benefit the drivers but also encourage insurance companies to support the growing gig economy.

In summary, insurance companies are adapting their policies to accommodate the unique demands of food delivery drivers. By adjusting coverage, introducing specialized options, and implementing risk-based pricing, they aim to provide adequate protection while managing potential risks. As the food delivery industry continues to grow, these policy adjustments will likely become even more prevalent, ensuring that drivers and insurance providers can operate with a clear understanding of the associated risks and benefits.

Motorcycle Riders: Does Auto Insurance Cover Your Medical Needs?

You may want to see also

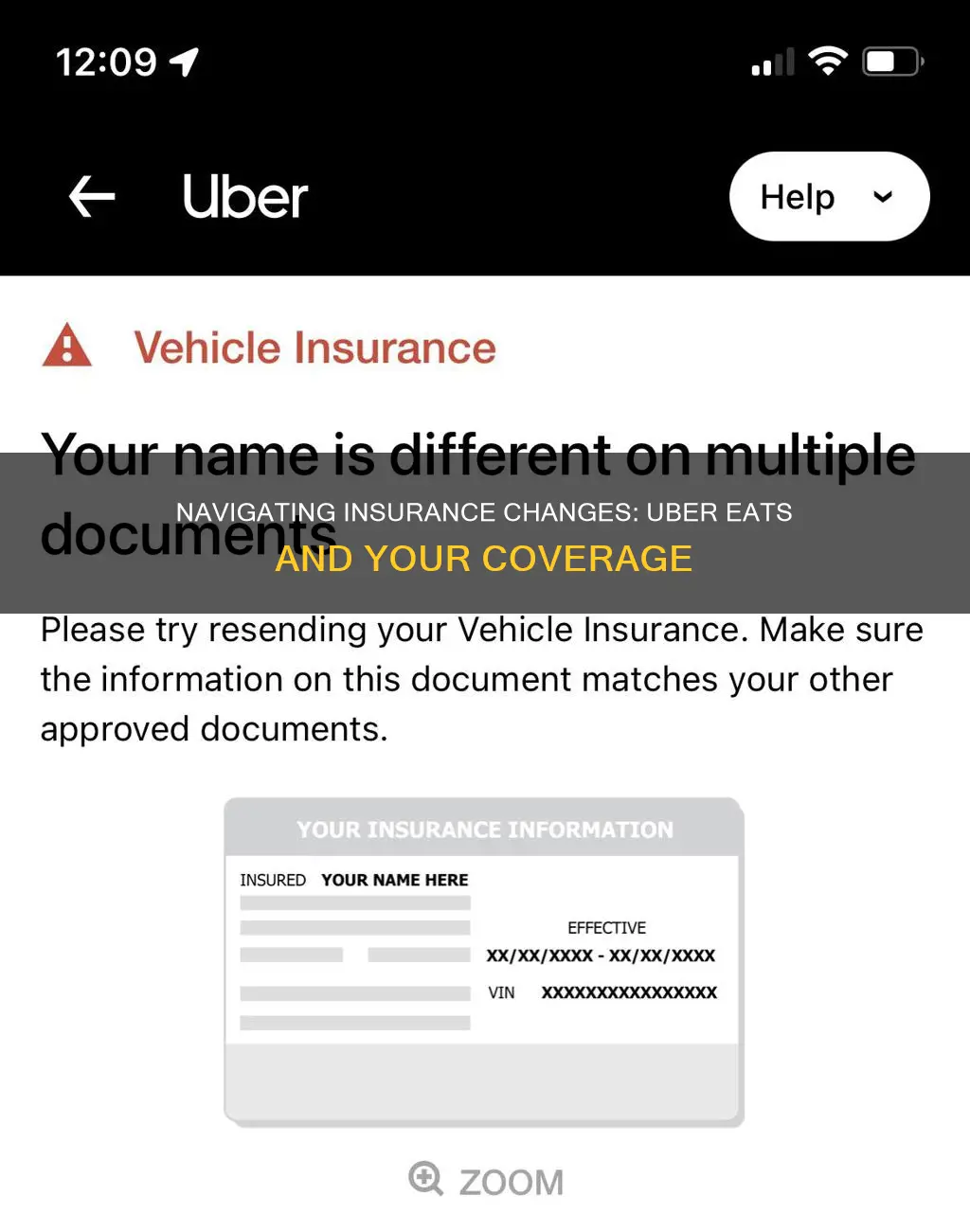

Claims and Compensation: The process of filing insurance claims for accidents or damage while working for Uber Eats

When you drive for Uber Eats, your insurance coverage can be a bit complex, and understanding the process of filing claims is essential for any driver. Here's a comprehensive guide to help you navigate the claims and compensation process:

Understanding Your Insurance: Before diving into the claim process, it's crucial to know your insurance coverage. If you're already a driver with a personal insurance policy, you might have coverage for commercial activities, but it's essential to review the policy's terms. Many personal insurance policies have exclusions for commercial driving, so it's best to confirm with your insurer. If you're new to the gig economy, consider obtaining a commercial driver's insurance policy specifically tailored for food delivery services. These policies often provide comprehensive coverage for accidents and damage while working for Uber Eats.

Filing a Claim: In the event of an accident or damage to your vehicle while delivering food, follow these steps: 1. Report the Incident: Immediately inform Uber Eats about the accident or damage. They will provide you with the necessary reporting procedures, which may include filling out an incident report. 2. Document Everything: Gather evidence and documents. Take photos of the accident scene, any damage to your vehicle, and the food delivery. Also, collect contact information from any witnesses and keep records of all communication with Uber Eats and your insurance company. 3. Contact Your Insurance Provider: Inform your insurance company about the incident. Provide them with the details of the accident, including the date, time, location, and any relevant information you have. Your insurance provider will guide you through the claims process and may ask for additional documentation.

Claim Process and Compensation: The insurance company will investigate the claim and assess the damage. They may request a detailed report from Uber Eats, including the delivery details and any relevant information. Here's what you can expect: - Damage Assessment: The insurance adjuster will evaluate the damage to your vehicle and determine the repair costs. - Compensation: If the damage is covered under your policy, you will receive compensation for the repairs. Some policies may also provide coverage for rental car expenses during the repair period. - Claim Settlement: The insurance company will settle the claim, and you may need to provide proof of repair and payment. Keep all receipts and documentation for your records.

Tips for a Smooth Process: - Always be prompt in reporting incidents to both Uber Eats and your insurance company. - Keep detailed records of all communication and documentation. - Understand your policy's coverage and limitations to manage expectations. - If you have any doubts or concerns, consult with your insurance agent or a legal professional.

Remember, the key to a successful claim is prompt action and thorough documentation. By following these steps, you can ensure that your insurance coverage supports you during unexpected events while working for Uber Eats.

Full Coverage Auto Insurance: Oklahoma's Essential Requirements

You may want to see also

Rate Changes and Discounts: Insights into how insurance rates and potential discounts may vary for Uber Eats drivers

When you start driving for Uber Eats, it's important to understand how your insurance might be affected. Many drivers are curious about whether their insurance rates will change, and if so, how. The answer is that it can vary depending on several factors, including your insurance company's policies and your driving record.

One of the most significant considerations is the type of insurance coverage you currently have. If you have a personal auto insurance policy, you might be covered while driving for Uber Eats, but the extent of coverage can vary. Some policies provide coverage specifically for ridesharing activities, while others may require a separate endorsement or policy add-on. It's crucial to review your existing policy or consult with your insurance agent to determine your coverage and any potential exclusions.

In some cases, driving for Uber Eats may lead to an increase in your insurance premiums. Insurance companies often consider the additional risk associated with ridesharing. Factors such as the number of trips, the time spent driving, and the overall usage of the app can influence the premium calculation. For instance, if you drive for Uber Eats frequently during peak hours or in areas with high traffic, your insurance provider might view you as a higher-risk driver, resulting in higher rates.

On the other hand, some insurance companies offer discounts specifically for ridesharing drivers. These discounts can help offset the potential rate increase. For example, some insurers provide usage-based discounts, where the more safely you drive and the fewer claims you make, the lower your premiums could be. Additionally, certain insurance providers offer loyalty discounts or multi-policy discounts, which can further reduce your costs. It's worth comparing quotes from different insurance companies to find the best rates and discounts available to you.

To navigate these changes effectively, consider the following steps. First, review your current insurance policy and understand its terms regarding ridesharing. Then, reach out to your insurance agent or broker to discuss any adjustments or additional coverage you may need. They can provide tailored advice based on your specific circumstances. Finally, shop around and obtain quotes from multiple insurance providers to find the most competitive rates and discounts for Uber Eats drivers.

Auto Insurance Premiums: Under 25s Pay More

You may want to see also

Frequently asked questions

Yes, your insurance coverage should generally remain the same even if you take on additional driving tasks like delivering food for Uber Eats. However, it's essential to inform your insurance provider about any changes in your driving habits or the types of vehicles you will be operating.

Yes, it is advisable to inform your insurance company about your side gig. They might offer specific coverage options or endorsements tailored to drivers using their personal vehicles for commercial purposes.

Insurance rates can vary based on several factors, including your driving history, the frequency of your side gig, and the type of coverage you have. While driving for Uber Eats might slightly impact your rates, it's unlikely to cause a significant increase unless you have a history of accidents or traffic violations.

Using your personal car for Uber Eats deliveries is generally acceptable, but it's crucial to ensure that your insurance policy covers commercial use. Some policies might require an additional endorsement or have specific conditions for such usage.

Yes, many insurance companies offer discounts for drivers who use their personal vehicles for commercial purposes, including food delivery. These discounts can help offset the potential increase in insurance rates associated with side gigs.