Universal life insurance is a type of permanent life insurance that has an insurance component and a

| Characteristics | Values |

|---|---|

| Type of insurance | Universal life insurance is a type of permanent life insurance with an investment savings element, loan options, and flexible premiums. |

| Premium | Premium costs increase with age. |

| Age limit | Many insurers stop issuing new life insurance policies to seniors over 80 years old. |

| Premium flexibility | Universal life insurance allows you to raise or lower your premiums within certain limits. |

| Death benefit | Universal life insurance provides a death benefit. |

| Cash value | Universal life insurance accumulates cash value over time that you can borrow from. |

| Premium components | Universal life insurance premiums consist of two components: a cost of insurance (COI) amount and a saving component, known as the cash value. |

| Interest | The cash value earns an interest rate set by the insurer, which can change frequently, although there is usually a minimum rate that the policy can earn. |

| Tax implications | There are no tax implications for policyholders who borrow against the cash value of their policy, although some withdrawals may be taxed. |

What You'll Learn

Universal life insurance rates increase with age

Universal life insurance is a form of permanent life insurance that offers flexible premiums and a death benefit. It is designed to accumulate a cash value over time, which can be borrowed against or withdrawn. The cash value component is invested, usually in interest-bearing funds, and the interest rate is set by the insurer. As the policyholder ages, the cost of insurance increases, and this is reflected in higher premiums.

How Age Impacts Universal Life Insurance Rates

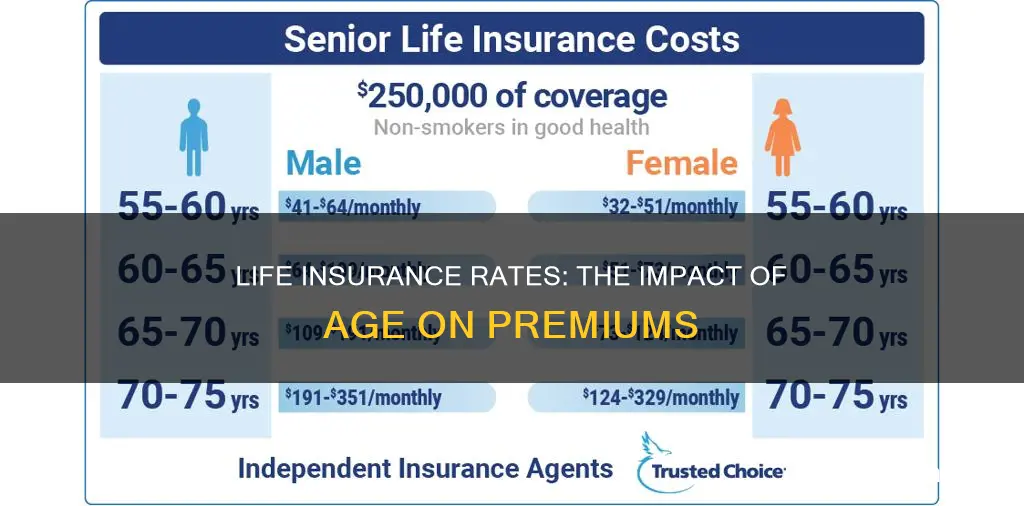

Age is a primary factor in determining life insurance rates. The likelihood of an insurance payout increases with age, as does the risk of illness or death. This is why older applicants can expect to pay higher premiums to offset the increased risk to the insurer. The difference in rates between age groups can be significant. For example, a 30-year-old might pay around $22 per month for life insurance, while a 50-year-old could pay more than triple that amount.

How Universal Life Insurance Premiums Change With Age

Universal life insurance premiums consist of two parts: the cost of insurance (COI) and the saving component, or cash value. The COI includes charges for mortality, policy administration, and other expenses associated with keeping the policy active. This cost increases as the insured person gets older. The saving component accumulates funds from premiums in excess of the COI, earning interest over time.

Factors Affecting Universal Life Insurance Rates

While age is a significant factor in determining universal life insurance rates, it is not the only one. Health is another critical factor, with applicants in better health generally paying lower premiums. Gender also plays a role, with men typically paying more than women due to their shorter average life expectancy. Lifestyle factors, such as risky hobbies or occupations, can also affect rates. Additionally, the type of policy, coverage amount, and add-on riders will influence the final premium.

Comparing Universal Life Insurance to Other Types

Universal life insurance offers more flexibility than whole life insurance, as policyholders can adjust their premiums and death benefits within certain limits. It also has an investment component, which whole life insurance lacks. However, universal life insurance premiums may be higher than those of term life insurance due to the permanent coverage and cash value component. Term life insurance only covers a set period and does not accumulate cash value.

Life Insurance Proceeds: Probate Triggered by Inheritance?

You may want to see also

Age is a primary factor in determining rates

The premium amount increases, on average, about 8% to 10% for every year of age; it can be as low as 5% annually if you're in your 40s, and as high as 12% annually if you're over 50. For example, a 45-year-old male will pay on average $1,125 for a new, 20-year term policy with $1,000,000 of coverage. The same policy purchased at age 46 will cost $1,225, and $1,345 a year if purchased at age 47.

The annual premium, or "rate", for a term life insurance policy is determined at the time of purchase and set for the duration of the policy. Insurers spread the premiums you would pay over 10, 20, or 30 years and average them into one payment, so instead of paying low premiums when you're young and very high premiums when you're older, you pay the same amount every year.

Universal life insurance is a type of permanent life insurance that has an insurance component and a savings component. It has the potential to accumulate cash value over time that you can borrow from. You have the option to select flexible premiums and coverage amounts, but your premiums will typically be higher than with term life insurance because of the cash value component and because it lasts for your entire life.

Universal life insurance quotes for a healthy, non-smoker looking for $250,000 of coverage can vary depending on factors such as coverage need, geographic location, and health. On average, a $500,000 universal life insurance policy would cost a 30-year-old male non-smoker $2,069 per year, while a 45-year-old male non-smoker can expect to pay around $3,648 per year on the lower end.

Life Insurance and Long-Term Disability: What's the Deal?

You may want to see also

Older people tend to pay the highest rates

Age is a primary factor in determining life insurance premium rates. The older one gets, the higher the premium as one is closer to their life expectancy, which poses a higher risk to the insurance company of having to pay death benefits to beneficiaries.

Universal life insurance is a type of permanent life insurance that has an insurance component and a savings component. It has the potential to accumulate cash value over time that one can borrow from. The flexibility of universal life insurance is a key asset, allowing the policyholder to adjust their premiums and death benefits. The premium consists of two components: a cost of insurance (COI) amount and a saving component, known as the cash value. As the insured person ages, the cost of insurance will increase. However, if there is sufficient cash value accumulated, it will cover the increases in the COI.

Universal life insurance is typically more expensive than term life insurance due to its flexibility and the presence of a cash value component. The older the policyholder, the higher the premium to compensate for the increasing risk of a payout. For example, a 30-year-old male non-smoker may pay around $2,069 per year for a $500,000 universal life insurance policy, while a 45-year-old male non-smoker can expect to pay around $3,648 per year for the same coverage.

Additionally, the health of the policyholder is another major factor contributing to the cost of universal life insurance. Pre-existing medical conditions and family history of diseases can result in higher rates as they increase the likelihood of a claim. The presence of other risk factors, such as tobacco use, risky hobbies, and certain occupations, can also drive up premiums.

While universal life insurance offers flexibility and the potential for cash value growth, it is important to carefully monitor the cash value. If the cash value drops too low, the policyholder may be required to make large payments to keep the policy active. Furthermore, interest rate changes can impact the performance of the cash value, potentially affecting the death benefit or causing the policy to lapse.

In summary, older individuals tend to pay the highest rates for universal life insurance due to their proximity to life expectancy and the increased likelihood of health issues. Health status, lifestyle choices, and other risk factors also influence the premiums. It is crucial to carefully consider one's needs, compare policies, and seek expert advice when purchasing universal life insurance to ensure a suitable plan at a reasonable cost.

Group Life Insurance: Cash Surrender Value Explained

You may want to see also

Age affects whether a person qualifies for coverage

Age is one of the most important factors in determining whether a person qualifies for universal life insurance coverage. As people get older, their likelihood of becoming ill or dying while under coverage increases, which makes them more of a financial risk for insurance companies. This means that older applicants are often subject to more stringent qualifying medical exams and may be denied coverage altogether.

The age limit for universal life insurance varies depending on the insurance provider and the specific policy. Some companies may only offer coverage to individuals up to a certain age, usually around 80 years old, while others may have no upper age limit. It's important to carefully review the terms and conditions of different policies to understand their age restrictions.

In addition to age, insurance companies also consider other factors such as overall health, gender, lifestyle choices, and medical history when determining eligibility and premium rates for universal life insurance coverage. Applicants who are in good health and have a positive medical history are more likely to be approved for coverage, regardless of their age.

It's worth noting that universal life insurance is a type of permanent life insurance that offers flexible premiums and coverage amounts. This means that policyholders can adjust their premiums and death benefits to some extent, making it a more accessible option for older individuals who may have limited choices when it comes to life insurance. However, as with any insurance product, it's crucial to carefully review the terms and conditions of universal life insurance policies to understand their specific age-related restrictions and requirements.

Heart Disease: Is Life Insurance Coverage Possible?

You may want to see also

Universal life insurance is more expensive than term life insurance

Universal life insurance is a type of permanent life insurance that includes a savings component, which is often referred to as the cash value of the policy. This cash value component is one of the main reasons why universal life insurance is more expensive than term life insurance.

The Cash Value Component

The cash value of a universal life insurance policy builds up over time on a tax-deferred basis. This means that the policyholder can access the cash value, for example, by taking out a life insurance policy loan, and use the money for other expenses. This is not possible with term life insurance.

Premium Payments

Term life insurance has more affordable premium payments and a set end date, whereas universal life insurance premiums are significantly more expensive but last for the life of the policyholder. Generally, term life insurance is cheaper when policyholders are younger and their risk of death is lower. Prices typically rise with age and increased risk.

Coverage Length

Term life insurance covers the policyholder for a specific period, such as 10 or 20 years, whereas universal life insurance is a type of permanent coverage that can last for the policyholder's lifetime.

Risk Factors

Universal life insurance policies are designed to last until the policyholder's death. During the initial years of the policy, a large portion of the premiums paid by the policyholder will go towards the savings component. During the later years, when the policyholder is older and the cost of insuring them is higher, more of each premium will go towards the cost of insuring them, and less into savings.

Life Insurance: Geico's Accelerated Rider Option Explained

You may want to see also

Frequently asked questions

Age is one of the most influential factors affecting life insurance premiums. Insurers assess premiums based on multiple personal rating factors, but an emphasis is placed on mortality risk, and the probability of death rises steadily as we get older.

The cost of universal life insurance for a $500,000 policy can range widely from around $1,683 to $10,315, depending on your age when you buy the insurance.

Yes, universal life insurance rates typically increase with age as health issues become more frequent.

The cash value of a universal life insurance policy earns an interest rate set by the insurer, and it can change frequently. Over time, the cost of insurance will increase as the insured ages.