The world of insurance can be a complex and confusing one, especially when it comes to understanding the different roles and how they are compensated. One such role is that of the independent insurance adjuster, who plays a crucial role in evaluating and settling insurance claims. So, how are these professionals paid? Let's delve into the intricacies of their compensation.

Independent insurance adjusters are unique in that they are not directly employed by an insurance company but are hired on a contract basis, often by a third-party claims-handling company. This arrangement provides an extra layer of objectivity and fairness to the claims process. When it comes to their compensation, there are a few different models in place.

One common model is the fee-split arrangement, where the adjuster splits the fee earned from handling a claim with the Independent Adjuster (IA) Firm. Typically, the adjuster takes home between 50% and 70% of the amount billed to the insurance company, with the remaining going to the IA firm. This fee-split arrangement incentivizes adjusters to secure fair settlements for claimants while ensuring a portion of the fee goes to the firm for overhead and administrative costs.

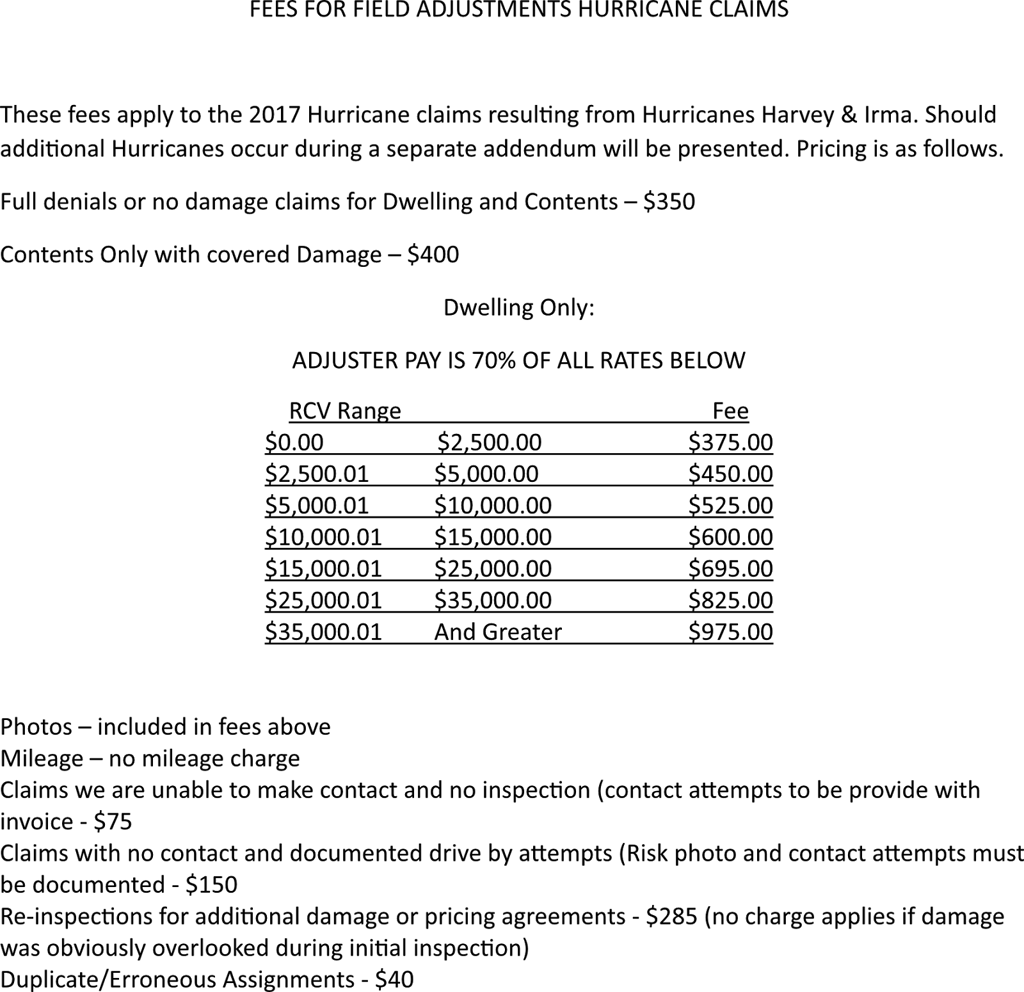

During catastrophic events, such as hurricanes or natural disasters, independent adjusters are often paid according to a fee schedule. These fee schedules vary across insurance companies and IA firms, and they outline the compensation for handling different types of claims. For example, an adjuster handling hurricane claims might receive a fee schedule that pays a certain amount for claims falling within specific dollar ranges.

In addition to fee-split and fee schedule arrangements, independent adjusters may also be paid based on time and expense, particularly for large or complex claims. In such cases, adjusters track their time spent on different parts of the claims process and submit their hours and expenses to the IA firm for reimbursement. The hourly rate can vary, typically falling between $65 and $95 per hour.

Another payment model is the daily rate, which is common for adjusters who work in an office reviewing files or during the later stages of a catastrophe deployment. This model provides a set dollar amount per day to complete a defined amount of work, offering a more consistent income stream during busy periods.

It's worth noting that independent adjusters have the flexibility to choose when and where they work, allowing them to structure their workload to suit their preferences. This independence also means that their earnings can vary significantly from year to year, depending on the volume and complexity of claims they handle.

In summary, independent insurance adjusters are compensated through a variety of payment models, including fee-split arrangements, fee schedules, time and expense billing, and daily rates. Their earnings can vary based on the type of claims, the volume of work, and their experience level. Understanding these compensation structures is essential for anyone considering a career in this dynamic and challenging field.

| Characteristics | Values |

|---|---|

| Salary Structure | Hourly, salary, or fee-based |

| Salary Range | $25/hr to $48/hr |

| Annual Salary | $40,000 to $100,500 |

| Fee Schedule | 60-70% of the fee goes to the adjuster |

| Time and Expense | $65 to $95 per hour |

| Daily Rate | Set dollar amount per day |

What You'll Learn

- Independent adjusters are paid a percentage of the claim fee, splitting the bill with the IA firm

- During catastrophes, they are paid according to a fee schedule, receiving 60-70% of the fee

- They can also be paid a daily rate, or on a 'time and expense' basis, submitting hours and expenses

- Salaries vary by state, employer, and type of adjuster, with a US median of $65,000

- Independent adjusters can earn over $100,000 working on multiple catastrophes in different states

Independent adjusters are paid a percentage of the claim fee, splitting the bill with the IA firm

Independent insurance adjusters are typically hired by insurance companies when there is a high volume of claims, such as during natural disasters. They are also hired for their expertise in remote or highly specialised areas, such as damage caused by a rare animal. In some cases, the use of an independent adjuster may be mandated by state rules or insurance contract provisions.

Independent adjusters are usually paid by splitting the fee bill with the IA firm. The adjuster will make between 50% and 70% of the amount the IA firm bills the insurance company for the claim. For example, on a $10,000 claim, an adjuster could take home between $600 and $700. During catastrophes, adjusters are usually paid according to a fee schedule, which varies between insurance companies and IA firms.

There are other ways that independent adjusters can be paid. One way is on a "time and expense" basis, where the adjuster keeps track of the time spent on all parts of the claims process and submits their hours and expenses to the IA firm. The hourly rate can vary from $65 to $95 per hour. Another way is a daily rate, which is common for those who work in the office reviewing files. This is usually a set dollar amount per day to complete a defined amount of work.

It's important to note that independent adjusters are paid as independent contractors, so they need to set aside sufficient funds to pay taxes either quarterly or at the end of the year.

The Art of Negotiation: Understanding Insurance Adjuster Tactics

You may want to see also

During catastrophes, they are paid according to a fee schedule, receiving 60-70% of the fee

During catastrophes, independent insurance adjusters are paid according to a fee schedule, receiving 60-70% of the fee. This means that they split the fee bill with the IA (Independent Adjuster) Firm. The fee schedule is an accounting method in which the insurance company reimburses the independent adjuster firm for each successfully settled claim. The fee is calculated as a percentage of the overall claim settlement amount or on a graded scale.

The fee schedule varies widely between insurance companies and IA firms. IA firms contract with, and agree to, a fee schedule which they ultimately pass along to the field adjusters. For example, an independent adjuster handling hurricane claims may receive a fee schedule that pays $500 for claims between $3,000 to $5,000, $650 for claims between $5,000 and $7,500, and $750 for claims between $7,500 and $10,000.

Hurricane adjusters can easily average a $10,000 settlement per claim, which would put between $400 and $500 in the pocket of the adjuster per claim. A good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7. This means that independent adjusters working catastrophe claims commonly earn more than $1,000 per day, and sometimes a lot more.

It's important to note that these percentages can change with demand and experience. Veteran adjusters with years of experience can command better fee schedules. Similarly, when demand for adjusters skyrockets after a series of catastrophes, employers might create more lucrative fee schedules to attract adjusters away from their competitors.

ACA Profits: Unraveling the Risk Adjustment Factor

You may want to see also

They can also be paid a daily rate, or on a 'time and expense' basis, submitting hours and expenses

Independent insurance adjusters are typically paid in one of two ways: a daily rate or a time and expense basis.

Daily Rate

Independent insurance adjusters can be paid a daily rate, which is a set amount for each day they are on duty. This can range from $250 to upwards of $750 per day, depending on the complexity of the work and the severity of the situation. Adjusters usually have to meet certain expectations or stipulations regarding the amount of work they must complete each day, such as inspecting an average of three claims or submitting two files per day. This payment arrangement is less common than a fee schedule.

Time and Expense Basis

On large losses or complex claims, independent adjusters may be paid on a time and expense basis. They keep track of the time spent on all parts of the claims process and submit their hours and expenses to the IA firm. The hourly rate can vary depending on the company, typically ranging from $65 to $95 per hour worked.

Navigating the Path to Becoming an Insurance Adjuster in Texas

You may want to see also

Salaries vary by state, employer, and type of adjuster, with a US median of $65,000

Salaries for insurance claims adjusters vary depending on location, type of adjuster, and employer. The median base salary for a claims adjuster in the US is around $65,000 annually. However, salaries can range from $40,000 to over $100,000 per year.

Independent adjusters typically earn a percentage of the amount of each claim they settle, known as a 'fee schedule'. This can vary widely between insurance companies and independent adjuster firms, with the adjuster usually taking between 50% and 70% of the fee. During catastrophes, independent adjusters may be paid according to a fee schedule, with the potential to earn over $100,000 in a good year. For example, during the 2017 hurricane season, adjusters were making $65,000 to $100,000 in one month.

Staff adjusters, on the other hand, are typically salaried employees of an insurance carrier and earn less than independent adjusters. A reasonable salary range for a staff claim adjuster is $40,000 to $70,000 per year, with entry-level salaries averaging about $40,000. Staff adjusters often receive standard employment benefits such as insurance, vacation and sick leave, and company equipment, which are not provided to independent adjusters.

The earning potential for claims adjusters also differs from state to state. For example, adjusters in New Jersey, Alaska, and California earn higher salaries compared to those in Arizona, Illinois, and Iowa.

An Insured's Guide to Insurance Adjuster Rights: Can They Contact Your Employer?

You may want to see also

Independent adjusters can earn over $100,000 working on multiple catastrophes in different states

Independent insurance adjusters are paid in a few different ways, but they almost always split the fee bill with the IA Firm. This means they split the money made from handling the claim with the IA firm, with the adjuster usually making between 50% and 70% of the amount the IA firm bills to the insurance company. During catastrophes, adjusters are usually paid according to a fee schedule basis, which varies widely between insurance companies and IA firms.

Independent adjusters who work on catastrophic claims have the potential to earn over $100,000 in a year. If an adjuster is licensed to operate in multiple states and multiple natural disasters occur within their domain, they could earn well over $100,000 annually. For example, during the peak of the 2017 hurricane season, adjusters were making $65,000 to $100,000 in one month.

The income of a catastrophic adjuster can exceed $100,000, depending on how many days of the year they are deployed to disaster areas. Independent catastrophic adjusters, or adjusters who are for rent or hire, have even higher earning potential because they do not have a guaranteed salary.

An established independent claims adjuster can earn between $40,000 and over $100,000 per year if they are consistently working. Payment is generally arranged using an independent adjuster fee schedule.

Hurricane adjusters can easily average a $10,000 settlement per claim, which would put between $400 and $500 in their pocket per claim. A good adjuster should be closing 2 to 4 claims per day, and a superb adjuster closes 4 to 7. With $400 earned per claim and up to 7 claims settled per day, independent adjusters working catastrophe claims commonly earn more than $1,000 per day, and sometimes a lot more.

The hardest part about becoming an independent adjuster is getting started. Finding someone to take a chance on you is difficult because most companies are looking for people with experience.

Understanding the Flexibility of Insurance Quotes: Are They Set in Stone?

You may want to see also

Frequently asked questions

Independent insurance adjusters can be paid in a few different ways, including a fee schedule, time and expense, or a daily rate. They are almost always paid a percentage of the claim, typically between 50% and 70% of the amount billed to the insurance company. The median base salary for a claims adjuster in the US is around $65,000 annually, but this can vary depending on the state, type of adjuster, and their employer.

During catastrophes, independent insurance adjusters are usually paid according to a fee schedule. The fee schedule varies between insurance companies and IA firms, and the adjuster will receive a percentage of the fee, typically between 60-70%. For example, an adjuster handling hurricane claims may receive $500 for claims between $3,000 and $5,000, $650 for claims between $5,000 and $7,500, and $750 for claims between $7,500 and $10,000.

Independent adjusters usually have more flexibility in their schedules and may have more remote work opportunities due to the travel often required for their assignments. They can also choose when and where they work and typically have access to weekly pay and discounts at hotels or car rentals. However, they are responsible for their own benefits, such as insurance and retirement savings.