American Equity Investment Life Holding Company, or simply American Equity, is a leading issuer of fixed index annuities. The company was founded in 1995 by David J. Noble and is currently made up of three member companies: American Equity Investment Life Insurance Company, Eagle Life Insurance Company, and American Equity Investment Life Insurance Company of New York. American Equity has over 500,000 clients and is licensed to sell annuity products in all 50 states and Washington, D.C. The company's philosophy centres on exemplary customer service and product integrity, and it offers a range of annuities, including fixed indexed, fixed, and immediate annuities. So, how are salesmen for American Equity annuities paid?

| Characteristics | Values |

|---|---|

| Commission | Up to 9% |

What You'll Learn

Salesmen can earn up to 9% commission on American Equity Bonus Gold Annuity sales

American Equity Bonus Gold is one of the best-selling indexed annuities of all time. Indexed annuities are a form of fixed annuity that combines a guaranteed minimum interest rate with an interest rate linked to the performance of an index, such as the S&P 500. In the case of the American Equity Bonus Gold Annuity, the guaranteed minimum interest rate is 1.35%, and the potential interest rate linked to the S&P 500 is 1.6%.

However, it's important to understand that you are not investing directly in the underlying securities of any index. The insurance company invests your money in its own portfolio and only has to earn a return higher than the interest crediting option it offers to you. This is why index annuities tend to generate low single-digit returns. Over the long term, you are likely to make a return of around 1-3% on this type of annuity.

Another important consideration is liquidity. Annuities should never be a significant part of your investment portfolio because they are very illiquid, with high surrender fees for the first 12 years. This means that if you need to access your money during this period, you will pay a heavy penalty.

In summary, the American Equity Bonus Gold Annuity offers principal protection and the potential for modest upside from index choices. It also offers a 10% bonus with immediate vesting and a guaranteed income for life. For these reasons, it may appeal to extremely conservative investors who are looking for guaranteed income with no market risk and are happy with low single-digit returns. However, it's important to understand the nuances of this complex product and to be aware of the high surrender fees.

Who Can Be Your Life Insurance Beneficiary?

You may want to see also

American Equity is a top-tier provider of annuity products

American Equity Investment Life Holding Company, or simply American Equity, is a top-tier provider of annuity products. The company was founded in 1995 by David J. Noble, and is currently headquartered in West Des Moines, Iowa. With a focus on exemplary customer service and product integrity, American Equity has grown from a team of three employees to a staff of over 800 people and 24,000 agents.

American Equity is a leading issuer of fixed index annuities, which provide premium protection with growth potential. Earnings are tied to a specific stock index, such as the S&P 500. The company also offers fixed annuities, which provide a reliable income stream with a guaranteed interest rate, and immediate annuities, which provide periodic payments for life or a chosen timespan.

American Equity's fixed index annuities are its largest set of offerings and include four different series: IncomeShield, EstateShield, AssetShield, and FlexShield. Each series offers unique features such as access to a Wellbeing Benefit feature, multiple index options, and various payout choices.

The company's fixed annuities, known as the Guarantee Series and GuaranteeShield Series, offer industry-standard benefits such as terminal illness and nursing home riders, along with the ability to grow money at a fixed rate. Meanwhile, its immediate annuities are simple products that don't vary significantly between companies, providing periodic payments over a chosen period.

American Equity is licensed to sell annuity products in all 50 states and the District of Columbia, currently serving more than 500,000 contract owners across the United States. The company has built a solid reputation for national expansion, establishing itself as a secure and effective annuity provider. It holds strong financial strength ratings and has consistently scored well in customer satisfaction.

In summary, American Equity is a top-tier provider of annuity products, specialising in fixed index and fixed-rate annuities. With a range of offerings, a strong financial position, and a commitment to customer service, American Equity has established itself as a major player in the annuity space.

Haven Life Insurance: Exciting Career Opportunities and Benefits

You may want to see also

The company was founded in 1995 by David J. Noble

On December 15, 1995, David J. Noble founded American Equity as a private company in West Des Moines, Iowa. The company, initially founded to sell life insurance and annuities to customers in Iowa, has since expanded to become a major provider of annuities, with a focus on fixed index and fixed-rate annuities.

Noble's vision for the company was to create a full-service underwriter of annuity and life insurance products, and this remains a key aspect of American Equity's business model. The company has three member companies: the original American Equity company, the Eagle Life Insurance Company, and the American Equity Investment Life Insurance Company of New York. As of 2024, American Equity has over 500,000 clients across all 50 states and Washington, D.C.

American Equity's rapid growth is a testament to Noble's leadership and business acumen. Just eight years after its founding, the company had already accumulated $8 billion in assets, and by 2021, this figure had skyrocketed to over $60 billion. This impressive growth has solidified American Equity's position as a significant player in the annuity and life insurance industry.

Noble served as the Chairman and Chief Executive Officer of American Equity, steering the company's success and expansion. However, in March 2010, he faced charges from the Securities and Exchange Commission (SEC) related to the misleading disclosure of a related-party transaction. As a result, he agreed to a settlement that included a $900,000 penalty and a permanent injunction from committing future violations of securities laws.

Understanding Group Life Insurance: Factors Determining Employee Benefits

You may want to see also

American Equity has three member companies

American Equity is comprised of three member companies: the original American Equity company, the Eagle Life Insurance Company, and the American Equity Investment Life Insurance Company of New York. Headquartered in West Des Moines, Iowa, the company has satellite offices in Charlotte, North Carolina, and New York, New York.

American Equity was founded by David Noble in 1995 as a private company selling life insurance and annuities in Iowa. In 2003, the company went public and issued an initial public offering on the New York Stock Exchange. Since then, it has grown rapidly, achieving $8 billion in assets in 2004 and over $60 billion in 2021. As of 2024, the company has more than 500,000 clients across all 50 states and Washington, D.C.

The company primarily specializes in fixed index annuities, with its largest set of offerings falling under this category. These include the IncomeShield, EstateShield, AssetShield, and FlexShield series, each tailored to meet specific customer needs. For example, the IncomeShield series offers a Wellbeing Benefit feature that helps offset healthcare costs in retirement, while the EstateShield series provides a more robust death benefit, allowing beneficiaries to receive a lump-sum payment of up to 75% of the contract value.

In addition to its fixed index annuities, American Equity also offers fixed and immediate annuities. Its Guarantee Shield series of fixed annuities provides standard benefits such as terminal illness and nursing home riders, along with fixed-rate growth. The company's immediate annuities are simple products that are fairly standard across the industry.

Life Insurance Payouts: Are They Taxed by the US?

You may want to see also

The company is licensed to sell annuities in all 50 US states

The American Equity Investment Life Holding Company, or American Equity, is licensed to sell annuities in all 50 US states and the District of Columbia. Headquartered in West Des Moines, Iowa, the company was founded in 1995 by David J. Noble and has grown from a staff of three to over 800 employees and 24,000 agents today.

American Equity is a leading issuer of fixed index annuities, which protect premiums with growth potential. Earnings are tied to a specific stock index, such as the S&P 500. The company also offers fixed annuities, which provide a reliable income stream with a guaranteed interest rate, and immediate annuities, which provide periodic payments for life or a chosen timespan.

American Equity's annuities are marketed as "sleep insurance," offering guaranteed income for life so that policyholders can feel more secure about their retirement. The company takes pride in its personal approach to selling annuities for financial security, striving to provide stable annuity products backed by financial strength, disciplined investment practices, and award-winning customer service.

American Equity has three member companies: American Equity Investment Life Insurance Company, Eagle Life Insurance Company, and American Equity Investment Life Insurance Company of New York. The company serves more than 500,000 contract owners across the United States and has a strong financial standing with favourable ratings from major agencies.

Meemic's Life Insurance Offer: What You Need to Know

You may want to see also

Frequently asked questions

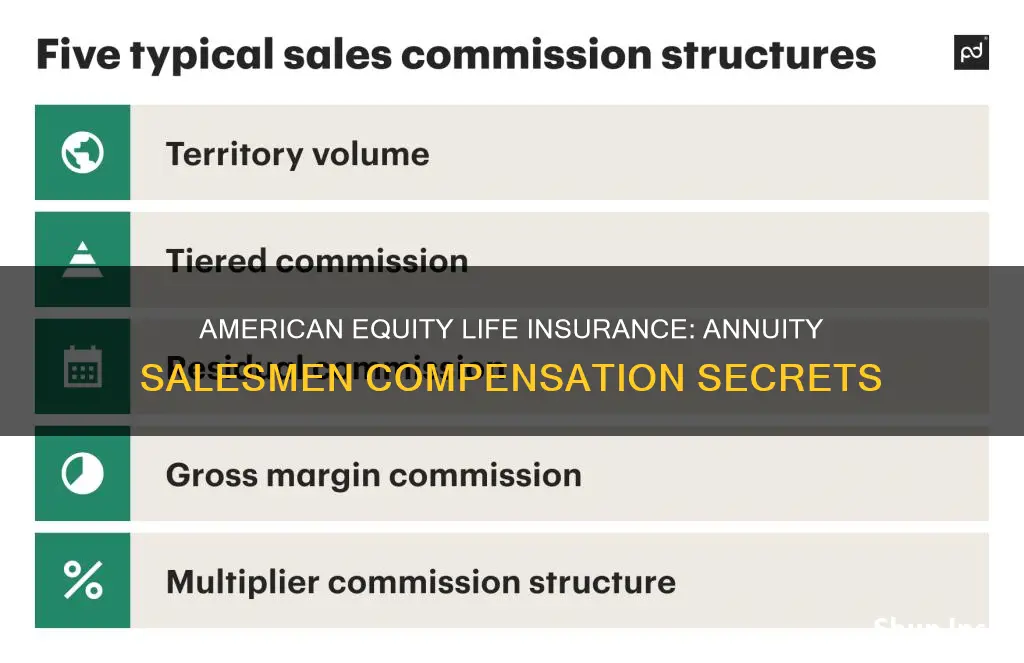

Salesmen for American Equity Life Insurance annuities are paid a commission on the sale of an insurance product.

The commission is usually a percentage of the total sale and can go up to 9%.

Yes, American Equity Life Insurance also provides its salesmen with marketing and operational support.

Yes, you can connect with American Equity Life Insurance through their website or contact them via phone to get started.

American Equity Life Insurance offers fixed index annuities, fixed annuities, and immediate annuities.