Auto insurance premium rates are influenced by a multitude of factors, including the number of drivers on the policy. Generally, the more drivers on a policy, the higher the premium. This is because insurers perceive additional drivers as an increased risk, particularly if they are young or inexperienced. However, adding a driver with a good driving record could reduce the premium.

Other factors that influence premium rates include the age, gender, and marital status of the drivers, as well as their driving history, credit score, and location. The type of car being insured also plays a role, with newer and more expensive vehicles typically costing more to insure.

| Characteristics | Values |

|---|---|

| Number of drivers | The more drivers there are, the higher the premium. |

| Driving record | A better driving record results in a lower premium. |

| Driving frequency | Driving more frequently and over longer distances leads to a higher premium. |

| Location | Urban drivers pay more than those in rural areas due to higher rates of theft, vandalism, and accidents. |

| Age | Younger and older drivers tend to pay more as they are considered higher-risk. |

| Gender | Women often pay less than men as they have fewer and less serious accidents. |

| Car type | The cost of the car and the likelihood of theft influence the premium. |

| Credit score | A higher credit score may lead to a lower premium. |

| Marital status | Married drivers usually pay less than single drivers. |

What You'll Learn

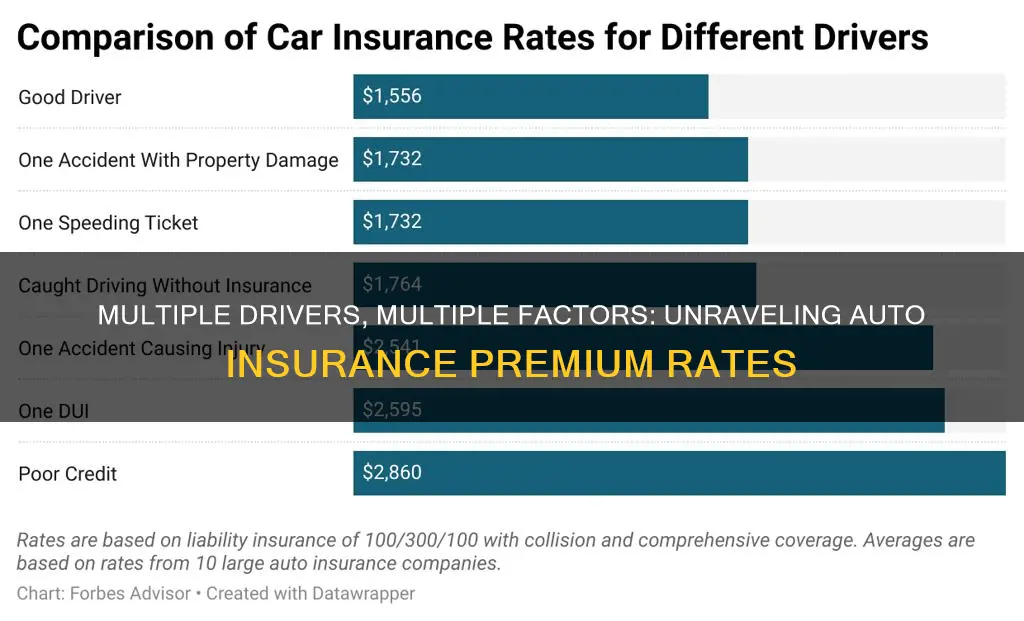

Driving history

A driver's history is a key factor in determining their insurance premium. A good driving record generally results in lower premiums. Conversely, a history of accidents, traffic violations, and serious infractions like DUIs will increase the premium as the driver is considered a higher risk.

Insurance companies will typically look at a driver's record for the last three to five years, but more serious violations may be considered for longer. For example, at-fault collisions are reflected on the record for three years but can affect insurance costs for up to five years, and DUI convictions can stay on a person's record for six to ten years.

The driving record includes details such as total demerit points, suspensions and reinstatements, driving convictions, and driver education courses completed. In some places, like North Carolina, it also includes the driver's name and address, license status, convictions related to motor vehicle violations, accident information, and driver control actions.

While accidents and violations can eventually age off a driving record, they can have a significant impact on insurance premiums in the meantime. A single speeding violation can result in a sharp increase in annual insurance costs, and multiple accidents can lead to a substantial rise in rates.

However, it's important to note that not all insurance companies weigh pricing factors the same, and rates can vary across providers. Additionally, there are steps drivers can take to improve their driving record and lower their premiums over time, such as taking a driver safety course, improving their credit score, or removing high-risk drivers from their policy.

Auto Insurance for Storage Units: What's Covered?

You may want to see also

Number of drivers

The number of drivers on a car insurance policy can impact the premium rates. Generally, if someone is licensed, lives with you, and has regular access to your car, they should be added to your policy. This can include spouses, roommates, teenage children, or any other person living in your home. When adding a new driver, the premium can increase, decrease, or stay the same, depending on their driving history and the insurance company's perception of risk.

Adding a Teen Driver:

When your child gets a license, you are legally required to inform your insurance carrier within 60 days. Since insurance companies view new drivers as a greater risk, your premium will likely increase, sometimes significantly (up to 60% for a two-car family). The cost of insurance for your newly licensed driver will depend on four ownership scenarios:

- Your child uses your existing car (or someone else's car) occasionally.

- Your child uses your existing car and is listed as the principal driver.

- You purchase an additional car for your child, and they are listed as the principal driver.

- Your child buys a car in their name and is required to purchase their own insurance.

After your child gets their license, the insurance cost should reduce each year. After six years, they are no longer considered a new driver, and their experience will not affect your premium. In most cases, adding a teen driver will increase your premium, but it will still be more affordable than if they obtained a separate policy. However, some insurance companies offer new policy discounts that may be cheaper.

Adding an Adult Driver:

Adding an adult driver with driving experience to your policy is less predictable. If you add a driver with a poor driving record or an age that the insurance company considers high-risk, your premium will likely increase. On the other hand, adding a driver with a clean driving record could decrease your premium.

Ways to Save Money:

- Bundle your auto insurance policy with other personal insurance policies, such as homeowners or rental insurance. This can save you approximately 5-25%.

- Insure more than one car with the same policy or carrier (multi-car discount).

- Shop around for rates from different insurance companies, as prices can vary.

- Pay via Electronic Funds Transfer (EFT) or Automated Clearing House (ACH), or pay the premium upfront to eliminate billing fees.

- Choose a higher deductible plan. This means lower monthly payments but higher out-of-pocket costs in case of an accident.

- Ask your agent about available discounts, such as those for membership in associations, charitable donations, good grades, or safe driving.

- Remove optional coverages that you don't need, such as collision insurance for an older vehicle or substitute transportation insurance if you have an alternative vehicle.

- Enroll in telematics programs, which monitor your driving habits and can offer discounts of up to 30% for cautious or low-mileage drivers.

Does Auto Insurance Cover Lightning Strikes?

You may want to see also

Age and gender

Gender also influences insurance rates, with men typically paying more than women. This is because men are statistically more likely to engage in risky driving behaviours, get into accidents, and have more serious accidents than women. However, it's important to note that some states prohibit the use of gender as a factor in determining insurance rates.

Insurance Claims: Seat Belt Denial

You may want to see also

Location

Auto insurance providers consider several location-based factors when calculating premium rates. These factors are related to the state, city, and ZIP code where the insured party resides and keeps their vehicle.

State

The state in which a driver lives is a significant determinant of their auto insurance premium. States have differing regulations regarding auto insurance, and some states require drivers to carry specific types and amounts of coverage. For example, Michigan, a no-fault state, requires drivers to carry unlimited Personal Injury Protection (PIP) coverage, which results in higher insurance premiums. In contrast, Wisconsin has cheaper insurance rates due to its lower minimum coverage requirements.

City and ZIP Code

The city and ZIP code where a vehicle is located can also influence insurance rates. Urban areas tend to have higher insurance premiums due to increased risks of theft, vandalism, and accidents compared to small towns or rural regions. Additionally, insurance companies consider the frequency of claims, weather conditions, road conditions, and unemployment rates within specific ZIP codes when calculating premiums.

Population Density

Population density is another critical factor affecting insurance rates. Highly populated areas generally experience more accidents, leading to higher insurance premiums. Conversely, less populated regions often have lower insurance rates.

External Risk Factors

Insurance companies also consider external risk factors associated with specific locations. For instance, locales with a high number of drivers, frequent floods, wildfires, crimes such as vandalism or theft, or other risks typically face higher insurance rates.

In summary, auto insurance premium rates are influenced by various location-based factors, including state regulations, population density, accident and claim frequencies, weather conditions, road conditions, and external risk factors unique to specific areas. These factors collectively contribute to the determination of insurance premiums for drivers in different locations.

Gap Insurance: How to Remove It

You may want to see also

Vehicle type

The type of car you drive plays a significant role in determining your car insurance rates. Insurance companies consider past claims from similar models and evaluate repair costs, theft rates, and comprehensive claim payments.

Luxury vehicles with new technology and advanced safety features cost more to repair or replace, so they are typically more expensive to insure. A flashy sports car with high-end trim and extra features will likely have a higher premium than a standard SUV. The brand of the vehicle also matters; according to Quadrant Information Services, Dodge has the highest car insurance costs on average, while Mazda has the lowest.

The age of your car is also relevant. Newer cars are usually worth more and therefore cost more to insure. Electric cars can be more expensive to insure since repair costs tend to be higher. However, some insurance companies, like Lemonade, offer discounts for electric vehicles.

In addition, insurance companies perceive young and inexperienced drivers as high-risk for car accidents. As a result, drivers under 25, especially those between 16 and 19, will likely pay higher insurance premiums.

When setting rates, insurance companies also consider location-related factors such as weather claims (e.g., hail), accidents, and car theft. Drivers in metropolitan areas tend to pay more for coverage than those in suburban or rural areas due to higher theft, vandalism, and accident rates.

Understanding the Auto Insurance Claims Adjustment Process: A Comprehensive Guide

You may want to see also

Frequently asked questions

Adding a new driver to your insurance policy can increase your premium, especially if they are a new driver. However, the amount it increases is unpredictable and depends on factors such as the driver's age, gender, and driving record.

Several factors determine auto insurance premium rates, including age, gender, driving record, location, vehicle type, and credit score.

Generally, the more drivers on a policy, the higher the premium rates. This is because insurers consider the risk associated with each driver, such as their age, driving history, and claims history.

Yes, there are a few ways to reduce premium rates with multiple drivers on a policy. These include:

- Bundling your auto insurance policy with other personal insurance policies.

- Insuring more than one car with the same policy or carrier (multi-car discount).

- Shopping around for rates from different insurance companies.

- Paying via electronic funds transfer (EFT) or automated clearing house (ACH).

- Choosing a higher deductible plan.

- Enrolling in telematics programs that monitor driving habits and offer discounts for safe driving.