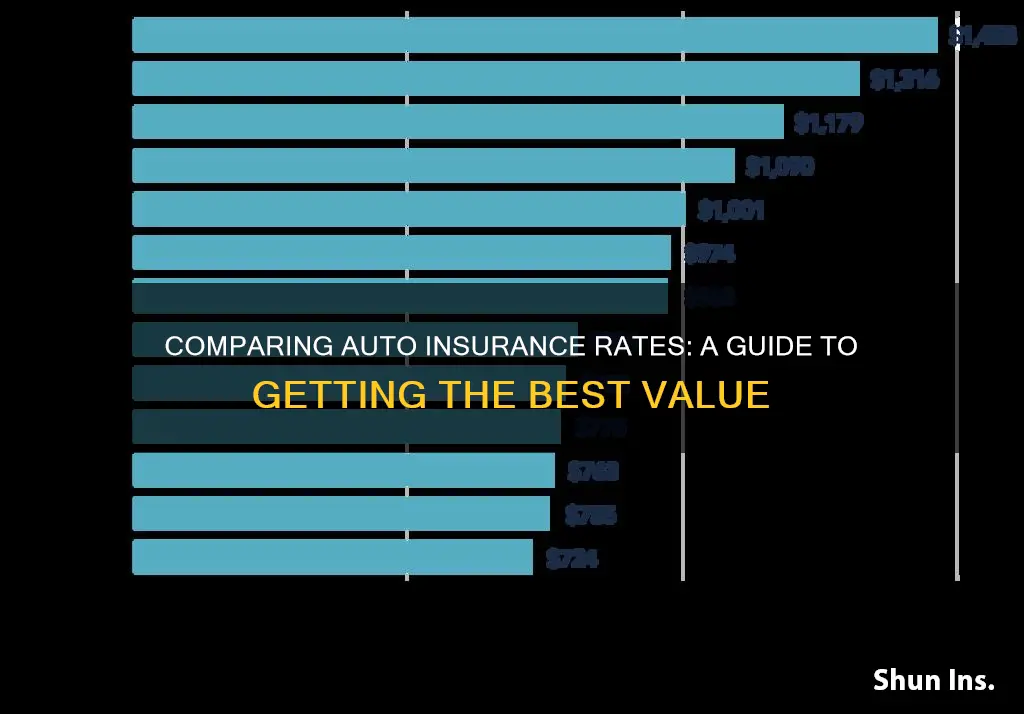

Comparing auto insurance rates is a great way to save money on your policy. Your auto insurance rates depend on a number of personal factors, including your driving record, age, credit history, vehicle, and the risk level of your area. Insurance companies' weighting of these attributes is reflected in your premium. For example, having a limited driving history or a poor credit score can raise your rates dramatically.

To find the best rates, compare many quotes at once using a trusted insurance comparison site. While shopping around can lead to affordable car insurance for all drivers, this is especially important if you have a poor credit history or lack a clean driving record. Rates for such drivers are already higher on average, even for the minimum coverage required by your state.

| Characteristics | Values |

|---|---|

| Age | Younger and older drivers tend to pay more for car insurance than those aged 25-60. |

| Driving history | Drivers with a history of accidents, speeding tickets, DUIs, or other violations will pay more for car insurance. |

| Credit score | Drivers with poor credit scores will pay more for car insurance, as they are deemed more likely to file claims. |

| Location | Car insurance rates vary depending on the state and area in which the driver lives. |

| Vehicle type | The make and model of the car will affect insurance rates, with trucks and luxury vehicles typically being more expensive to insure than sedans. |

What You'll Learn

Compare car insurance rates by age

Comparing car insurance rates by age can be a useful way to find the best deal for your circumstances. Age is a major component of how your car insurance premium is calculated, and younger drivers tend to pay the highest rates. This is because teens and older drivers are more likely to get into car accidents and are therefore considered higher-risk.

Car Insurance Rates for Teenagers

Car insurance costs the most for 16-year-olds, with an average cost of $7,581 per year, or $632 per month, for a 16-year-old with their own insurance policy. However, if a teenager is added to a family plan, they will see cheaper rates.

Car Insurance Rates for Young Adults

Drivers around the age of 20 typically get higher car insurance rates because they are more likely to get into accidents than older drivers. According to one source, the average cost of car insurance for an 18-year-old is $5,096 per year for full coverage and $2,358 for minimum coverage. Another source gives a slightly lower estimate of $4,872 per year for full coverage and $1,812 for minimum coverage.

Car Insurance Rates for Adults

Car insurance rates decrease as drivers gain more experience, and by the time a driver reaches their 30s, their rates will likely have decreased significantly. For 35-year-olds, the average cost of car insurance is $1,629 per year for full coverage and $840 for minimum coverage.

Car Insurance Rates for Seniors

Seniors are also considered high-risk, as they have a substantially higher car crash death rate than middle-aged drivers. Car insurance rates usually start to increase again around age 70, and by age 80, drivers are paying about 37% more than they were at age 60.

Vehicle Insurance: Property Damage Explained

You may want to see also

Compare car insurance rates by driving history

When comparing car insurance rates, it's important to know how insurance companies arrive at the quotes they give you. Your auto insurance rates depend on a number of personal factors, including your driving record, age, credit history, vehicle, and the risk level of your area.

Insurance companies use your driving history as an indicator of how you will drive in the future. It can be challenging to find affordable car insurance if you have a history of accidents or violations. While it's unlikely that you'll find an insurance company that won't increase your premium after an accident or violation, the degree of rate increase will vary by company.

- At-fault accidents: On average, an at-fault property damage accident can raise your premium by $658 per year. Most insurance providers will charge you for three years after an accident, so this can add up to over $1,900 in total fees.

- DUI/DWI: In many states, a DUI is the most costly violation you can receive. For example, in California, a DUI can stay on your insurance record for up to ten years and increase your rates by an average of $1,000 per year during that period.

- Reckless driving: Similar to a DUI, a reckless driving citation can significantly raise your insurance rates.

Tips for comparing car insurance rates:

- Compare rates from multiple insurers: Your rates can vary widely depending on the company, so it's important to shop around and get quotes from at least three different insurers.

- Consider your driving record: Your driving history heavily influences your insurance rates. Be sure to disclose any accidents, violations, or tickets you've had in the past.

- Choose the right coverage: Decide on the level of coverage you need, such as liability, collision, or comprehensive insurance. Keep in mind that minimum coverage is usually the cheapest option, but it may not provide sufficient protection.

- Research and compare insurers: Look into the reputation, customer service, and claims handling of different insurance companies. Also, consider which companies offer discounts that you may be eligible for.

- Provide accurate information: When getting insurance quotes, be honest and accurate about your personal information, driving history, vehicle details, and current insurance status. This will help ensure that the quotes you receive are tailored to your specific situation.

Gap Insurance: Comprehensive Coverage?

You may want to see also

Compare car insurance rates by credit score

Your credit score can have a significant impact on your car insurance rates. In most states, insurance companies are allowed to factor in your credit history when determining your rates. Research has shown that individuals with a good credit history are less likely to file insurance claims, and as a result, carriers often reward these customers with preferential rates. On the other hand, drivers with poor credit scores are perceived to be higher-risk and are therefore charged more.

When evaluating your credit history, insurance companies use what is called a credit-based insurance score. While each insurer has its own proprietary formula for calculating this score, common factors that are usually taken into account include:

- Outstanding debt

- Credit history length

- Credit mix

- Payment history

- Pursuit of new credit

To improve your credit score, it is advisable to pay your bills on time, minimize hard credit inquiries, regularly monitor your score, maintain old lines of credit, and keep your credit utilization ratio low.

When comparing car insurance rates, it is important to consider multiple quotes from different insurance companies, as rates can vary widely depending on various factors. In addition to your credit score, other factors that can influence your car insurance rates include your age, location, driving record, vehicle type, and coverage level.

Auto Injury Claims: Beyond Policy Limits?

You may want to see also

Compare car insurance rates by state

Comparing car insurance rates by state can be a helpful way to find the best deal for your needs. The Zebra notes that location is one of the primary factors used in car insurance pricing, with average rates varying based on state regulations and the differing road risks of each place. For example, drivers in no-fault states such as Michigan and Florida often pay more for insurance than those in other areas.

The cheapest states for car insurance include Ohio, New Hampshire, and North Carolina, with average auto insurance rates at least 40% lower than the national average of $124 per month. On the other hand, the most expensive states for car insurance include Michigan, Rhode Island, Nevada, Florida, and New Jersey.

In addition to your location, car insurance rates are also affected by factors like age, gender, profession, driving record, credit score, coverage level, and specific location. For instance, young drivers tend to pay more for car insurance than older drivers, as they are considered a greater risk. Similarly, men often pay more for car insurance than women, especially teens and men in their mid-20s.

When comparing car insurance rates by state, it's important to consider your state's minimum coverage requirements, as well as your car's mileage and features, which may require additional coverage. You can use online tools and comparison sites to obtain and compare quotes from multiple insurers at once, ensuring that you get the best deal for your needs.

Vehicle Insurance: Valid in Scotland?

You may want to see also

Compare car insurance rates by accident history

Comparing car insurance rates by accident history can be done by following these steps:

- Understand the impact of accidents on rates: Accidents can significantly increase your insurance rates, with the degree of increase varying by company. On average, an at-fault property damage accident can raise your premium by $658 per year, and most insurance providers will charge you for three years after the accident.

- Compare rates from different companies: Different insurance companies will offer varying rates for drivers with accidents on their record. It is essential to shop around and compare rates from multiple companies to find the best option for you.

- Consider the type of accident: The type of accident, such as an at-fault accident with property damage or an accident resulting in injuries, can also impact your insurance rates. Be sure to provide accurate information about the accident when comparing rates.

- Review your policy and coverage options: After an accident, it is a good idea to review your current policy and consider different coverage options. You may want to increase your liability coverage or add comprehensive and collision coverage to protect yourself financially in the event of future accidents.

- Look for companies that offer accident forgiveness: Some insurance companies offer accident forgiveness programs that can help reduce the impact of an accident on your rates. This can be a valuable feature to look for when comparing insurance rates.

- Improve your driving record: Maintaining a clean driving record after an accident can help improve your insurance rates over time. Safe driving, completing defensive driving courses, and avoiding further accidents or violations can positively impact your rates.

- Compare rates regularly: Insurance rates can change over time, and it is a good idea to compare rates from different companies regularly. This allows you to stay informed about the latest rates and potentially find more affordable options.

Auto Insurance: To Cancel or Not?

You may want to see also

Frequently asked questions

Comparing car insurance rates is a simple process. You can use an insurance comparison site, or go to individual insurance companies' websites to get a quote. You will need to provide some personal information, such as your age, address, vehicle information, and driving history. You can then compare the rates offered by different companies for the same level of coverage.

To compare car insurance rates, you will need to provide some personal information, such as your age, address, vehicle information, and driving history. You may also need your driver's license number and Vehicle Identification Number (VIN).

It is recommended that you compare car insurance rates at least once a year, or whenever your personal circumstances change. For example, if you move to a new state, buy a new car, or get a ticket, you should compare rates to make sure you are getting the best deal.

Many factors affect your car insurance rate, including your age, location, vehicle, driving record, and credit score.