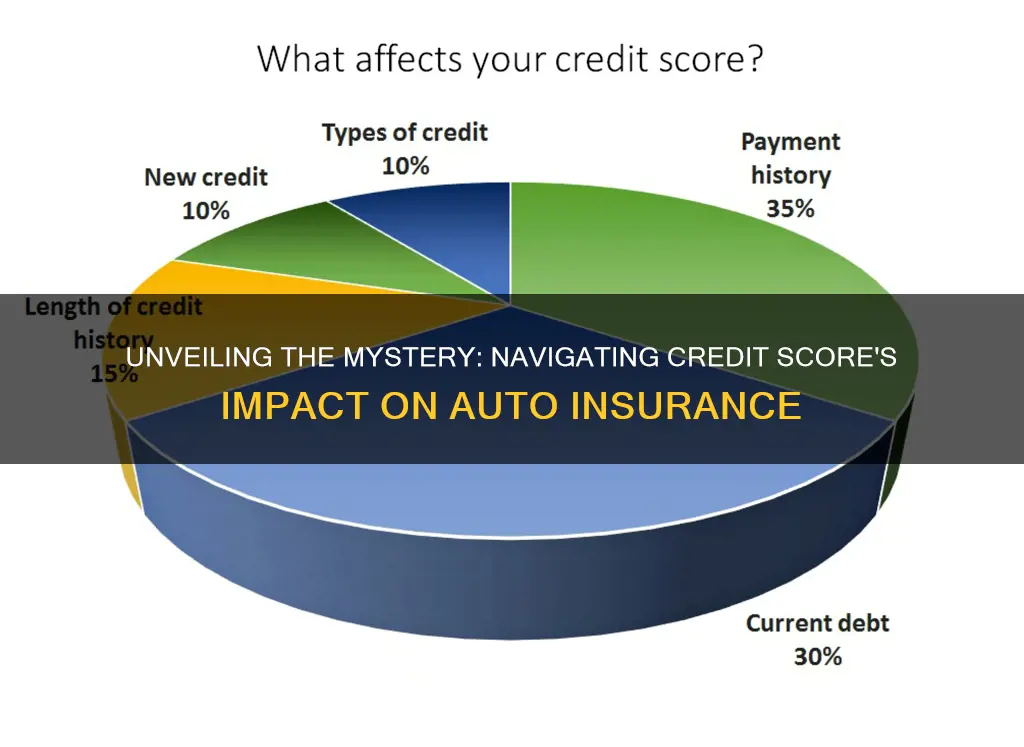

Your credit score can have a significant impact on your auto insurance rates. In most states, insurance companies use a credit-based insurance score to predict the likelihood of you filing a claim. This, in turn, helps them decide how much to charge you for coverage. While the specific factors that go into calculating this score vary by company, they generally include your payment history, outstanding debt, length of credit history, pursuit of new credit, and mix of credit experience.

You can find out your auto insurance score by requesting it from LexisNexis or contacting your insurance company directly. While improving your credit score can take time, it is worth the effort to ensure you are getting the lowest possible rate for your policy.

| Characteristics | Values |

|---|---|

| Credit score impact on car insurance rates | In all except a few states, your credit score may impact your car insurance rates. Someone with an excellent credit score of 800 or above pays an average annual rate of $1,988 for full coverage car insurance, while someone with a poor credit score may pay an average of $4,262 or more. |

| Credit-based insurance score | Your credit-based insurance score is used to determine how likely you are to file a claim and is calculated using factors such as payment history, outstanding debt, credit history length, pursuit of new credit, and credit mix. |

| Credit score vs. credit-based insurance score | Your credit-based insurance score is not the same as your regular credit score. While the factors used to determine your score are the same, they are weighted differently. |

| Improving credit-based insurance score | To improve your credit-based insurance score, you can make timely bill payments, keep hard credit inquiries to a minimum, monitor your score regularly, maintain old lines of credit, and manage your credit utilization ratio. |

| Finding your auto insurance score | You can find your auto insurance score by requesting it from LexisNexis or contacting your insurance company directly. TransUnion and FICO are also sources of auto insurance scores but do not make them available to consumers. |

What You'll Learn

How does credit history affect auto insurance rates?

Credit history can have a significant impact on auto insurance rates, with poor credit leading to substantially higher premiums. This is because insurers believe that drivers with poor credit are more likely to file claims, making them a higher risk to insure.

How Credit History Affects Auto Insurance Rates

In most states, insurance companies use credit scores or credit-based insurance scores to help determine insurance rates. A credit-based insurance score is designed to predict the likelihood of a driver filing insurance claims that will cost the company more than it collects in premiums. While these scores are based on consumer credit reports, they are not the same as the credit scores used by lenders to evaluate creditworthiness.

Research has found a correlation between credit scores and the number and cost of insurance claims. Drivers with poor credit are viewed as higher-risk, resulting in increased insurance premiums. On average, drivers with poor credit pay 114% more for full-coverage car insurance than those with excellent credit. This can translate to an annual increase of nearly $1,180.

Factors Affecting Credit-Based Insurance Scores

While insurance companies have their own proprietary formulas for calculating credit-based insurance scores, common factors include:

- Outstanding debt

- Length of credit history

- Credit mix (e.g., auto loans, mortgage loans, credit cards)

- Payment history

- Pursuit of new credit

State Regulations

It is important to note that not all states allow credit history to be used in determining insurance rates. California, Hawaii, Massachusetts, and Michigan prohibit or limit the use of credit scores in setting auto insurance rates. In these states, insurance rates are based on factors such as driving records, location, and other characteristics.

Improving Credit Scores

Improving credit scores can take time but is worth the effort to ensure lower insurance rates. Some strategies to enhance credit scores include:

- Paying bills on time

- Minimizing hard credit inquiries

- Monitoring credit scores regularly

- Maintaining old lines of credit

- Managing credit utilization ratio

Gap Insurance: The General's Coverage

You may want to see also

What is a credit-based insurance score?

A credit-based insurance score is used by insurance companies to determine how likely you are to file a claim. It gives them an idea of how big a risk you are and helps them decide how much to charge for coverage.

These credit-based insurance scoring models are created by data analytics companies like LexisNexis and FICO. A 2007 study by the Federal Trade Commission showed that credit scores are an accurate indicator of whether someone will file an insurance claim.

A credit-based insurance score is not the same as a regular credit score or VantageScore. The factors used to determine your score are the same, but they are weighted differently. A credit score estimates the likelihood that you will pay your debts, whereas a credit-based insurance score looks at how likely you are to file an insurance claim.

Factors that may be considered when calculating a credit-based insurance score include:

- Payment history

- Outstanding debt

- Credit history length

- Pursuit of new credit

- Credit mix

It's important to note that no single piece of information will determine your credit-based insurance score. Also, your score does not consider your race, gender, age, income, nationality, religious affiliation, disability, or marital status, as this is prohibited by law.

Insurance Recovery Vehicles: Towing and Transporting

You may want to see also

How can I check my credit-based insurance score?

Your auto insurance score is a numerical score used to predict the likelihood that you'll have an accident or make a claim. It's calculated using information from your credit reports, such as your payment history, outstanding debt, length of credit history, pursuit of new credit, and credit mix.

To check your credit-based insurance score, you can request it directly from LexisNexis, one of the main sources of auto insurance scores, or contact your insurance company. Your insurer may provide you with a reference number to use when contacting LexisNexis, which will prevent a hard inquiry on your credit report that could negatively impact your credit score. Alternatively, you can check your latest credit score for free on WalletHub to get an idea of what your auto insurance score might be, as both scores are based on the same information.

It's worth noting that auto insurance scores are not the same as credit scores. While they are calculated using similar factors, they serve different purposes. A credit score assesses your ability to repay borrowed amounts, while an insurance score predicts the likelihood of you making a claim. Additionally, insurance scores are not publicly available, and each company has its own method for calculating them.

Canceling Auto Insurance Early: Options?

You may want to see also

How can I improve my credit-based insurance score?

Improving your credit-based insurance score can take time, but it's worth doing to ensure you're getting the lowest possible rate for your policy. Here are some ways to improve your credit-based insurance score:

- Pay your bills on time: A pattern of late payments or credit delinquencies might signal to insurers that you are a potential risk in financial management, possibly indicating a higher likelihood of claim submissions for minor damages. Making it a habit to settle your bills on or before their due dates can positively impact your credit and, consequently, your insurance scores.

- Keep hard credit inquiries to a minimum: Credit inquiries come in two forms: hard checks and soft checks. Whenever you apply for a line of credit, a hard inquiry is made, which does affect your score. Too many hard inquiries can negatively impact your score, so if you are trying to build your credit, consider waiting to apply for a loan or line of credit.

- Monitor your score regularly: Keeping a close eye on your credit score can help you take proactive measures toward improvement. Routine checks of your credit reports can also help uncover errors or signs of identity theft early on.

- Maintain old lines of credit: The duration of your credit history can contribute significantly to your score, so consider keeping old credit accounts open. Instead of closing an unused credit card, try to use it sparingly and ensure payments are made on time. This can help fortify your credit history and minimize your credit utilization ratio.

- Be aware of your credit utilization ratio: Your credit utilization ratio measures how much credit you have available compared to how much you use. While there is no set rule, many finance professionals recommend that you utilize no more than 30% of your total available credit at any given time. Paying off some of your debt to bring your credit utilization score below 30% may help improve your credit-based insurance score.

- Make credit card and loan payments on time: Paying your credit card and loan payments on time can help improve your credit score.

- Keep your credit utilization below 30%: Keeping your credit utilization below 30% is generally recommended to improve your credit score.

- Get a credit card: If you don't already have one, consider getting a credit card, but keep spending low.

Government Auto Insurance: Understanding Eligibility and Benefits

You may want to see also

What are some good no-credit-check auto insurance companies?

While most auto insurance companies perform credit checks, there are a few no-credit-check auto insurance companies and other options to consider. Here are some good no-credit-check auto insurance companies and alternatives:

Usage-based insurance companies: These companies base your insurance premiums on how many miles you drive and your driving behaviour, rather than a fixed annual or semi-annual rate. Some usage-based insurance companies that don't check credit scores include:

- Root Insurance: While Root Insurance has recently vowed to phase out the use of credit when setting rates, it still uses credit as a rating factor as of 2022.

- MetroMile

- Milewise from Allstate

- SmartMiles from Nationwide

Telematics insurance companies: Telematics insurance uses a device or mobile app to track your driving habits, such as average speed and braking. Some telematics insurance companies that may not require a credit check include:

- Progressive Snapshot

- State Farm Drive Safe and Save

- Nationwide SmartRide

- State-specific options: There are a few states that do not allow insurance companies to use credit scores when determining insurance rates. These include California, Hawaii, Massachusetts, Michigan, and Washington. If you live in one of these states, you can shop for insurance without worrying about your credit score affecting your rates.

- No-credit-check insurance companies: There are a few insurance carriers that specifically base their rates on factors other than credit scores. These include:

- CURE (Citizens United Reciprocal Exchange): A nonprofit insurance carrier that offers auto insurance in Michigan, New Jersey, and Pennsylvania, basing rates on customers' driving records.

- Dillo Insurance: Provides auto insurance in Texas to customers with tickets, accidents, lapses in coverage, or no prior coverage, without checking credit.

- Empower Insurance: Offers car insurance options in Texas, some of which don't use credit when calculating premiums.

It's important to note that purchasing car insurance from a company that doesn't check credit scores doesn't necessarily mean you'll pay lower rates. Be sure to shop around, compare quotes, and consider your specific needs when choosing an auto insurance company.

U-Haul Rental Coverage: What You Need to Know About American Family Auto Insurance

You may want to see also

Frequently asked questions

You can find out your auto insurance score by requesting it from LexisNexis or contacting your insurance company directly.

In all except a few states, your credit score may impact your car insurance rates. Research shows that individuals with better credit history are less likely to file a claim against their insurance company, and carriers often reward customers who are less likely to file claims with a preferential rate.

While there is no clear answer to what a "good" credit score for auto insurance is, FICO defines a good credit score as anywhere from 670 to 739.

You can improve your credit score by making all of your debt payments on time, keeping your credit utilisation down, and having numerous accounts in good standing.