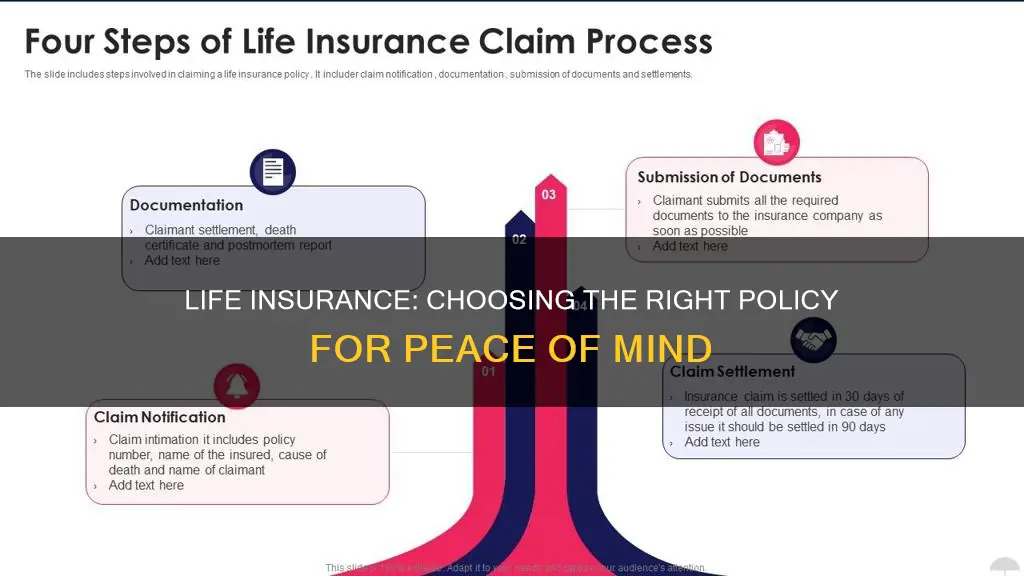

Completing a life insurance claim is a relatively straightforward process, but it can be difficult when grieving the loss of a loved one. The first step is to determine which life insurance company holds the policy. This can be done by reviewing the person's bank accounts, records, and income tax returns, or by contacting their previous employer. Once the insurance company has been identified, the next step is to obtain a certified death certificate, which can usually be obtained from a local health department or funeral home. After that, the claimant can file the claim with the insurance company, either online or by contacting the company directly. The claimant will likely need to provide information such as the policy number, the cause of death, and their relationship to the policyholder. Finally, the claimant will need to choose how to receive the life insurance payout, such as a lump sum or an annuity. It's important to note that there is no time limit for filing a life insurance claim, but it's advisable to do so in a timely manner to expedite the process.

| Characteristics | Values |

|---|---|

| Purpose | Provide a financial safety net for loved ones in the event of the policyholder's death |

| Contract | Between the policyholder and the insurance company |

| Premium | Cost of the insurance, paid by the policyholder |

| Death benefit | Sum of money paid to the beneficiaries upon the insured person's death |

| Beneficiaries | Person(s) who receive the death benefit |

| Types | Term, permanent, whole, universal, variable universal, indexed universal, and burial insurance |

| Application | Requires personal and family medical history, beneficiary information, and a medical exam |

| Payout | Lump sum, annuity, life income, specific income, or retained asset account |

What You'll Learn

Understanding the different types of life insurance

There are two basic types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically between 10 and 30 years. It is sometimes referred to as "pure life insurance" because, unlike permanent life insurance, there is no cash value component to the policy. Once the term is over, the policy ends. Permanent life insurance, on the other hand, provides coverage for the entire life of the insured as long as premiums are paid. It includes a cash value component that helps make coverage last while the insured is alive and provides other financial benefits.

Permanent life insurance comes in various forms, including whole life insurance and universal life insurance. Whole life insurance has a fixed premium, death benefit, and cash value growth rate. Universal life insurance can be cheaper than whole life insurance, but the premiums, death benefits, and cash value growth rate can vary, making the policy more complex. Another type of permanent life insurance is variable universal life insurance, which allows the policyholder to invest their cash value into assets like mutual funds. The cash value growth will depend on the performance of these investments.

Term life insurance is generally best for those who need affordable coverage during a period when they have large financial responsibilities, such as a mortgage or dependent children. Whole life insurance is suitable for those who want lifelong coverage and are willing to pay higher premiums for the guarantees provided by the policy. Universal life insurance can be a good option for those who want permanent coverage but also want more flexibility in their monthly payments. Variable universal life insurance is a good choice for those who are investment-savvy and want more control over their cash value's growth.

KeyBank's Life Insurance Offerings: What You Need to Know

You may want to see also

Knowing who can be a beneficiary

Choosing a beneficiary is a very personal decision, and different for everyone. Here are some key points to keep in mind when deciding who will benefit from your life insurance policy.

Who can be a beneficiary?

Almost anyone can be a life insurance beneficiary, including people, organisations and trusts. Some common examples are:

- A person, like your spouse.

- Multiple people, like your children.

- A charitable organisation.

- A legal entity, like your company.

Some insurers place limits on how many beneficiaries you can name, so be selective when compiling your list.

Insurable interest

The person or entity named as a beneficiary must have an "insurable interest" in your life. This means they stand to lose more than they gain financially by your death, or are dependent on you in other ways. Most insurers will ask you to list the relationship you have with a beneficiary when you fill out the form.

Primary vs. contingent beneficiaries

Primary beneficiaries are first in line to receive the death benefit. Contingent, or secondary, beneficiaries will receive the benefit if the primary beneficiary dies before you.

Multiple beneficiaries

If you name multiple beneficiaries, you can choose how much of the payout each party receives. For example, you might allocate 50% to your spouse, 30% to your child, and 20% to a charity. No matter how you divide the payout, the percentages must add up to 100%.

Irrevocable vs. revocable beneficiaries

You cannot change an irrevocable life insurance beneficiary without the beneficiary's approval. For this reason, irrevocable designations are uncommon, but they can be useful if you want to ensure that a specific person, such as your child, receives the benefit.

A revocable life insurance beneficiary can be changed, updated, added or removed at any time.

Choosing a beneficiary

Ask yourself why you have life insurance in the first place:

- Who relies on you financially and would need help with ongoing bills if you died?

- Who would need financial support to cover costs incurred by your death, such as funeral expenses?

- Who would you like to leave money to, regardless of whether they rely on you, such as a charity or a trust for your children?

Be as specific as you can when designating a beneficiary. If you write "spouse" or "child", the insurer might not be certain who should receive the funds, especially if you remarry or have multiple children.

Naming children as beneficiaries

Naming your children as beneficiaries might seem like a sensible decision, but if they are minors when you die, the payout can be complicated.

You can appoint a legal guardian to receive payouts on their behalf, but this can be a lengthy and expensive process. Alternatively, you can set up a trust for your children and appoint a trustee to oversee the funds and distribute the money according to your wishes.

Naming your estate as your beneficiary

Although life insurance proceeds are typically not taxable, the payout may be subject to estate tax if left as part of a large inheritance. If you name a specific beneficiary on your life insurance policy, the funds go directly to them without being wrapped up in your estate.

Not naming a beneficiary

If you don't name a beneficiary, the insurer typically issues the death benefit to your estate. However, in some cases, insurers distribute the death benefit according to a specific order outlined in the policy.

Life Insurance Calculator: Haven's Smart Planning Tool

You may want to see also

How to take out a policy on someone else

Taking out a life insurance policy on someone else is less common than getting a policy for yourself. If you want to purchase a life insurance policy for someone else, you must meet two legal conditions.

Prove Insurable Interest

Firstly, you must prove to the insurance company that you would face a significant financial hardship in the event of the insured person's death. This means that you must be able to show that you would suffer financially if that person died. In other words, you are financially dependent on them or would otherwise experience significant financial hardship without them.

Get Consent from the Insured Person

Secondly, you must get consent from the insured person. The person on whom you are buying the policy must be involved in the application process. They will have to go through the underwriting process, which involves answering questions and, in most cases, taking a life insurance medical exam. The insured person will also have to sign the application.

Who Can You Take Out a Life Insurance Policy On?

- Spouse or partner: It’s not uncommon to take out a life insurance policy for a spouse if you and your loved ones rely on them financially.

- Business partner: If you have built a business with someone else and they were to pass away suddenly, your venture may suffer financially. Taking out a life insurance plan for your business partner may help protect your business.

- Parents: If you rely on your parents for financial support or may be responsible for their final expenses, it may make sense to help them get a life insurance plan.

- Child: The reasons for taking a life insurance policy out on a child are different. You can help your child get life insurance early on if they have a known health issue or are at risk of developing one.

- Former spouse: If you or your children still depend on your former spouse for income, childcare, or other needs, consider buying life insurance on them and naming yourself or your adult children as beneficiaries.

- Sibling: It’s usually unlikely that you have an insurable interest in your sibling. However, there are some cases in which you might, for example, if you bought a house with your sibling and would struggle to afford it if they died.

How to Buy Life Insurance for Someone Else

- Prove insurable interest: Report to the agent how you are tied financially to the person you’re insuring. In some cases, the insurer may ask for documentation to prove that you have a financial relationship.

- Get consent from the insured person: The person you’re insuring needs to consent to the application process and sign the policy. They will need to answer questions on the initial application and potentially take an in-person medical exam.

- Select a type of life insurance policy: The first decision is whether permanent or temporary coverage is necessary. Term life insurance is generally cheaper than permanent life insurance and is a temporary solution for a specific period, such as 10, 20 or 30 years. Whole life and universal life insurance are types of permanent life insurance designed to last your entire life.

- Get quotes from several life insurance carriers: Shop around for quotes from several life insurance carriers to find the best price and terms.

- Apply for coverage: As part of the application process, the life insurance provider will require detailed personal, health and financial information from the insured person.

- Prepare the insured person for medical exams: The person you're insuring may be required to undergo a medical examination to determine what coverage they qualify for, the death benefit, and the premium.

- Pay the insurance premium to activate the policy: Once the policy is approved, you'll need to make the first premium payment to activate the policy and begin its coverage.

A third party cannot take out a life insurance policy on you without your knowledge and consent. The person must first notify you of their intentions and obtain your formal agreement to the policy.

Suffolk County Correction Officers: Life Insurance Coverage Explained

You may want to see also

How to choose the right policy type

Choosing the right life insurance policy type is an important decision. Here are some key factors to consider when selecting the best policy for your needs:

Term Life Insurance

Consider term life insurance if you need coverage for a specific period. For example, if you have young children and want to ensure their college education is funded, or if you want to repay a debt within a specified time frame. Term life insurance is generally more affordable, but it doesn't build equity through cash savings. The premiums are lowest when you're young and increase upon renewal as you age.

Permanent Life Insurance

Permanent life insurance, on the other hand, covers you for your entire life, regardless of when you die. This type of policy includes a savings element that grows tax-deferred and can be borrowed against. It's a good option if you want lifelong coverage and the ability to accumulate savings. However, permanent life insurance policies generally have higher premiums than term insurance.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance with fixed premiums and a guaranteed death benefit. It can be a good choice for individuals with lifelong dependents or estate planning needs. While it offers stability, it is typically more expensive than term life insurance.

Universal Life Insurance

Universal life insurance offers flexible premiums and an adjustable death benefit, along with a cash value component that grows based on market interest rates. It's similar to whole life insurance but provides more flexibility and is generally less expensive. However, the death benefit and cash value growth are not guaranteed.

Variable Life Insurance

Variable life insurance is suitable for those with a higher risk tolerance who want more control over their cash value investments. It is tied to investment accounts such as bonds and mutual funds. While it offers the potential for considerable gains, it requires active management as the cash value can fluctuate daily based on market performance.

Final Expense/Burial Insurance

Final expense insurance, also known as burial insurance, is a type of whole life insurance with a small death benefit to cover funeral, burial, and end-of-life expenses. It doesn't require a medical exam, making it accessible to older individuals with pre-existing health conditions.

When choosing a policy, it's important to assess your financial situation, budget, and specific needs. Consider factors such as the length of coverage needed, the amount of coverage, affordability, and any additional riders or policy features that are important to you.

Ethos' Whole Life Insurance Offer: Is It Worth It?

You may want to see also

How to choose a beneficiary

Choosing a beneficiary for your life insurance policy is an important step in the process of owning a life insurance policy. Here are some key considerations to help you choose a beneficiary:

Insurable Interest

The person or entity named as a beneficiary must have an insurable interest in the insured person. This means that they have more to lose than gain by your death, whether financially or otherwise. In most cases, beneficiaries rely on the insured for financial support, such as a spouse or dependent children. It is worth noting that some states or insurance companies may restrict who you can name as your beneficiary, so it is important to consult an attorney for legal guidance on state-specific issues.

Age

Many insurance companies will not pay benefits to someone under the age of 18. In this case, a better option may be to create a trust for the minor and name a trustee to manage the account until the child reaches a specified age.

Ability to Manage Money

If your beneficiary is not able to manage money effectively, consider establishing a trust and naming a trustee to invest and disburse funds on their behalf.

Contingency

It is important to name a secondary beneficiary so that if your first beneficiary dies before you, the account proceeds pass directly to the secondary beneficiary without probate.

Options

Your beneficiary can be a spouse, child, or other individuals; a trust; a charity or organization. If you do not specify a beneficiary, your assets will be distributed according to your will.

Estate as a Beneficiary

It is generally not recommended to name your estate as a beneficiary, as this may subject your assets to probate, which can be a slow and expensive legal process.

Reviewing Your Beneficiaries

It is important to review your beneficiary designations every few years, or after significant life events such as marriage, the birth of a child, adoption, divorce, remarriage, or death. This ensures that your beneficiaries are current and helps to avoid leaving proceeds to an ex-spouse or someone who has died before you.

Maid Insurance and Life Insurance: How Are They Linked?

You may want to see also

Frequently asked questions

Life insurance is a contract between an insurance company and a policy owner. The policy owner pays a premium, which is the cost of the insurance, in exchange for a death benefit. The death benefit is the money that gets paid to the policy's beneficiaries if the insured dies.

Life insurance works by providing a death benefit payout to beneficiaries if the insured dies, but only if the policy is active when the insured passes away. The death benefit can be used for any purpose chosen by the beneficiaries.

Once you've determined how much coverage you need and what type of policy would be best for you, you can contact a local insurance agent or broker, use online marketplaces to find products from several insurers, or contact the insurance company directly to obtain coverage.

The cost of life insurance depends on several factors, including the type of policy and the amount of coverage. During the underwriting process, insurance companies evaluate factors such as the insured person's age, gender, health conditions, and occupation to determine the cost of the premium.