Variable life insurance is a type of permanent life insurance policy that offers a death benefit and has an investment component. It is designed to last for the insured person's entire life and provides benefits to the policyholder during their lifetime and their beneficiaries upon their death. The cash value of a variable life insurance policy is invested, typically in mutual funds, offering the potential for greater returns than other types of permanent life insurance but also carrying more risk. The unique feature of variable life insurance is that its cash value can vary depending on the performance of the underlying investments, and it may rise or fall in value.

| Characteristics | Values |

|---|---|

| Type of insurance | Permanent life insurance |

| Investment component | Yes |

| Investment options | Mutual funds, stocks, bonds, equity funds, money market funds, bond funds |

| Death benefit | Paid to beneficiaries |

| Cash value | Variable, can be invested |

| Risk | Higher than other life insurance policies |

| Tax advantages | Yes |

| Premium | Fixed |

| Policy lapse | Possible if cash value is insufficient |

What You'll Learn

- Variable life insurance is a form of permanent life insurance

- It has a cash value that varies according to the performance of investments

- It is designed for those who want to actively manage their life insurance

- Variable life insurance policies are securities and must follow federal securities laws

- Variable life insurance policies carry more risk than other life insurance policies

Variable life insurance is a form of permanent life insurance

Variable life insurance policies are designed to financially benefit the insured person while they are alive and their beneficiaries upon their death. The cash value of the policy can be used to increase the death benefit, withdrawn as cash, or used as collateral for a loan. The unique feature of this type of policy is that it allows the policyholder to choose how to invest their cash value, providing the opportunity for higher returns but also carrying more risk.

Variable life insurance policies are considered more volatile than standard life insurance policies due to their investment component. The returns on these policies can provide tax-free income, making them attractive to investors who can assume additional risk. However, it is important to note that the policy carries the risk of losing money if the investments perform poorly, and the insurance company does not guarantee a rate of return.

Variable life insurance policies have fixed premiums throughout the length of the policy, and death benefits are guaranteed under most circumstances. Policyholders can borrow against the cash value, but this may reduce the final death benefit if not paid back and may incur additional taxes and fees. The fees and expenses associated with variable life insurance policies tend to be higher than those of other life insurance policies due to the investment component.

Life Insurance: First Group's Offerings and Benefits Explored

You may want to see also

It has a cash value that varies according to the performance of investments

Variable life insurance is a permanent life insurance product with a cash value that varies according to the performance of investments. It is a type of permanent life insurance policy, meaning coverage will remain in place for the lifetime of the insured, as long as premiums are paid. Variable life insurance policies have a higher potential for earning cash compared to traditional policies because the policyholder gets to decide how to invest the cash value.

Variable life insurance policies are considered securities contracts because of investment risks. The cash value of a variable life insurance policy is invested in a portfolio of securities – most commonly mutual funds – that the policyholder selects. The value of the cash account will depend on the premiums paid, how the investments perform, and the associated fees and expenses. The more money paid in premiums, the lower some of the policy's fees and expenses may be.

Variable life insurance policies are often more expensive than other life insurance products, like term life. The premiums paid help cover administrative fees and the management of the plan's investments. The policyholder may need to increase payments to keep the policy active or to maintain a specific death benefit according to the performance of investment products and the premiums remitted.

Variable life insurance is a good option for individuals who don't mind risk. The cash value in a variable life insurance policy can be invested, but returns aren't guaranteed. When the market is doing well, the policy's cash value may be too. If the market is performing poorly, the policy could lose value. Many policies have a floor to protect against negative returns.

Huntington Bank: Life Insurance Options and Benefits

You may want to see also

It is designed for those who want to actively manage their life insurance

Variable life insurance is a type of permanent life insurance with a death benefit and cash value. It is designed for those who want to actively manage their life insurance and are willing to take on more risk in exchange for higher potential returns. Here's how it works and why it might appeal to those who want to be more hands-on with their life insurance:

Actively Managing Your Investments

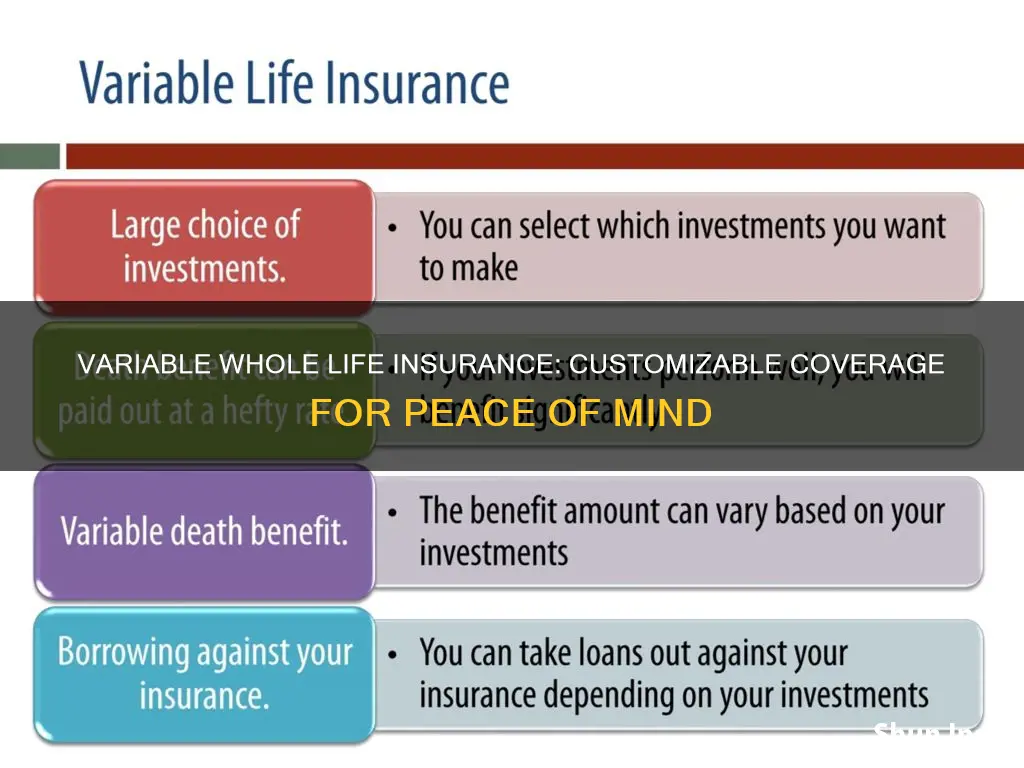

Variable life insurance gives policyholders control over how their cash value is invested. The cash value component of the policy can be invested in a range of securities, often similar to mutual funds, and sometimes including stocks and bonds. Policyholders can choose from a variety of investment options, allowing them to pursue different strategies, from conservative to aggressive. This level of control means that policyholders can actively manage their investments and try to maximize their returns.

Flexible Premium Payments

Variable life insurance, and particularly variable universal life insurance, offers flexibility in premium payments. Policyholders can adjust their premium payments within certain limits, allowing them to align their payments with their financial goals and circumstances. This flexibility is particularly appealing to those who want to actively manage their finances and have more control over their cash flow.

Potential for Higher Returns

The investment component of variable life insurance offers the potential for greater returns compared to traditional whole life insurance policies. Since policyholders can choose how to invest their cash value, they have the opportunity to pursue investments with higher returns. This feature makes variable life insurance attractive to those who are comfortable with risk and want to actively grow their wealth through their life insurance policy.

Accessing Cash Value

Variable life insurance policies provide policyholders with access to their cash value. Policyholders can borrow against the cash value or withdraw it for other purposes. This feature gives policyholders liquidity and the ability to use their life insurance policy as a financial tool during their lifetime. For those who want to actively manage their finances, this can be a valuable option.

Long-Term Financial Planning

Variable life insurance is designed for long-term financial planning. It provides lifelong coverage and can help meet long-term financial objectives. Policyholders can use it as a tool for retirement planning, investing for the future, and providing financial security for their beneficiaries. Those who want to actively manage their finances often appreciate the ability to incorporate variable life insurance into their long-term financial strategies.

Tax Advantages

Variable life insurance offers tax advantages that can be beneficial for those who want to maximize their wealth. The cash value of the policy grows tax-deferred, and policyholders can take loans against the cash value without paying taxes on the borrowed money. Additionally, the death benefit paid to beneficiaries is typically tax-free. These tax advantages make variable life insurance appealing to those who want to actively optimize their tax situation.

Unclaimed Life Insurance: Does It Gain Interest Over Time?

You may want to see also

Variable life insurance policies are securities and must follow federal securities laws

Variable life insurance is a permanent life insurance product with separate accounts made up of various instruments and investment funds, such as stocks, bonds, equity funds, money market funds, and bond funds. Due to the investment risks, variable policies are considered securities contracts and are regulated under federal securities laws.

Variable life insurance policies are considered more volatile than standard life insurance policies. They carry more risk and are often more expensive than other life insurance products. The cash value component of variable life insurance is invested in assets, and therefore may rise or fall in value. This means that the cash value of a variable life insurance policy can be influenced by the performance of the market.

Variable life insurance policies are regulated under federal securities laws. Sales professionals must provide a prospectus of available investment products to potential buyers. The prospectus will describe the policy in detail, including fees and expenses, investment options, death benefits, and other features. The prospectus is available free of charge.

The federal tax rules that apply to variable life insurance can be complicated, and there may also be state tax implications. Before investing, it is recommended that individuals consult a tax advisor about the tax consequences of investing in variable life insurance.

Equitable Life Insurance: Does It Cover Medicare in Florida?

You may want to see also

Variable life insurance policies carry more risk than other life insurance policies

Variable life insurance policies are permanent life insurance policies that have a higher potential for earning cash compared to traditional policies. This is because the policyholder gets to decide how to invest the cash value. However, this also means that variable life insurance policies are complex and require more hands-on attention. They also come with higher premiums than other cash value life insurance policies.

The cash value of a variable life insurance policy can be invested, offering the potential for greater returns than other types of permanent life insurance. However, returns are not guaranteed. If the market is doing well, the policy's cash value may increase, but if the market is performing poorly, the policy could lose value. Many policies have a floor to protect against negative returns, but depending on the company and policy language, gains may be capped at a certain percentage.

Variable life insurance policies have greater earning potential than universal life policies but can also carry more risk if the market is performing poorly. Premiums are fixed throughout the length of the policy, and death benefits are guaranteed under most circumstances. Policyholders can borrow against the cash value of the policy, but this can reduce the final death benefit if not paid back and may incur additional taxes and fees.

Variable life insurance policies are designed for individuals who don't mind risk. They are typically more expensive than other types of permanent life insurance policies because the premiums cover management fees, and there is a greater potential for earnings and losses depending on the market's performance.

AIG Life Insurance: A Reliable Payout History?

You may want to see also

Frequently asked questions

Variable life insurance is a permanent life insurance policy with an investment component. It is designed to last for the insured person's lifetime and combines a death benefit with a cash-value account that can be invested, usually in mutual funds.

Variable life insurance works similarly to a mutual fund. The insured pays premiums into a separate investment account that they own. The cash value of the policy is then invested, and the performance of these investments determines the value of the policy, which can increase or decrease.

Variable life insurance offers the potential for greater returns than other types of permanent life insurance. It also provides benefits while the policyholder is alive, such as the ability to borrow against the cash value of the policy.

Variable life insurance carries more risk than other types of life insurance due to its investment component. The value of the policy can decrease if the underlying investments perform poorly, and there is a risk of losing money, including the initial investment.