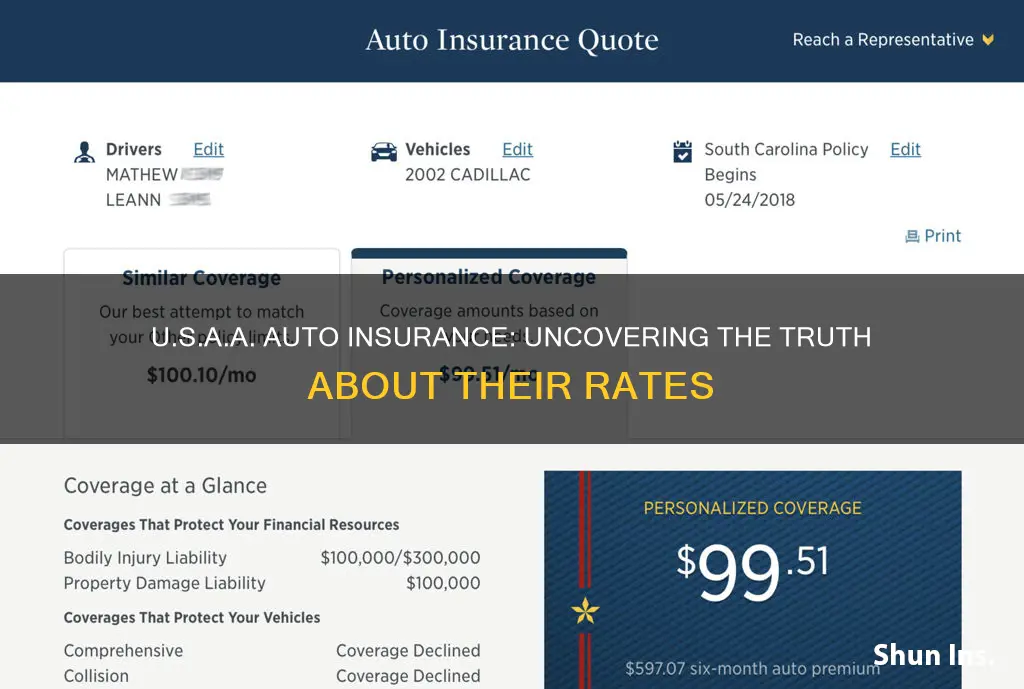

USAA is a great option for cheap car insurance, but it is only available to current and former members of the military and their families. USAA's average rate for a good driver is $1,364 per year, according to a 2023 analysis. That’s 33% cheaper than the average cost of car insurance nationwide. USAA has the cheapest rates for many driver profiles, including drivers with a speeding ticket or accident on their record. USAA also offers a wide variety of car insurance discounts.

| Characteristics | Values |

|---|---|

| Available to | Current and former military personnel and their families |

| Average annual rate | $1,364 |

| Average annual rate for full coverage | $1,432 |

| Average annual rate for minimum coverage | $405 |

| Average monthly rate | $74 |

| Average monthly rate for full coverage | $120 |

| Average monthly rate for minimum coverage | $34 |

| Customer service rating | High |

| NAIC complaints | Fewer than the expected number |

What You'll Learn

USAA's full coverage insurance

USAA offers full-coverage car insurance at rates below the national average. The company provides full-coverage car insurance for $1,741 per year, while the national average is $2,681. USAA's full-coverage insurance is also cheaper for 65-year-olds, costing an average of $1,840 per year, and for 75-year-olds, costing an average of $1,882 per year.

USAA's full-coverage insurance includes standard coverages such as liability, comprehensive, and collision insurance. It also offers additional coverages such as:

- Car replacement assistance coverage: Pays 120% of the current value of your vehicle if it is totaled.

- Rental reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside assistance: Covers the cost of towing your car to a repair shop, as well as gas delivery, tire changes, and labour.

- Rideshare gap protection: Protects you as a rideshare driver during times when there might be a gap between your insurance and the coverage provided by the rideshare company.

USAA also offers accident forgiveness, which means your rates will not go up after one at-fault accident. This can be earned after five years of safe driving or purchased for a small annual fee.

Slavage Vehicles: Insured in California?

You may want to see also

USAA's minimum coverage insurance

Overall, USAA's minimum coverage insurance is a great option for those who are eligible, offering low rates, a wide range of discounts, and strong customer service.

Motor Vehicle Insurance: Protection and Peace of Mind

You may want to see also

USAA's insurance for young drivers

USAA is a great option for young drivers, offering some of the lowest car insurance rates for this age group. An 18-year-old driver can get rates from USAA that are around half the national average. Young soldiers living on base can also get a discount for keeping their car on base.

USAA's rates for 17-year-old female and male drivers are some of the lowest available. The company also has the lowest sample premiums for both female and male young adult drivers, which are hundreds of dollars less than the national average.

USAA also offers a range of discounts for young drivers, including:

- Good student discount: For full-time high school or college students with at least a B average, ranked in the top 20% of their class, or included in the Dean's List, Honor Roll, or another school list designating scholastic achievement.

- Safe driver discount: For enrolling in the SafePilot program and for maintaining a clean driving record for more than five years.

- Defensive driving discount: For completing an approved defensive driving course.

- Driver training discount: For completing a driver's education course.

- MyUSAA Legacy Discount: For dependents of a USAA member under 25 years old with a clean driving record for the past three years.

It's important to note that USAA's auto insurance policies are only available to current and former members of the military and their families.

Auto Insurance: Your Rights as a Consumer

You may want to see also

USAA's insurance for senior drivers

USAA is a top-rated insurance company that offers cheap rates and good customer service. However, only current and former members of the military and their families are eligible for their insurance policies.

USAA offers low-cost car insurance for senior drivers who are active military members, veterans, or their immediate families. They also offer good rates for drivers with various driving record problems, such as speeding tickets or accidents. USAA provides accident forgiveness and new car replacement options, as well as rideshare insurance. They also provide SR-22s and non-owner policies.

USAA's rates for female and male senior drivers were the lowest among insurers in a US News study, hundreds of dollars cheaper than the national average. The study included survey responses from consumers 55 and older. USAA also offers a variety of discounts for its policyholders, and approximately 44% of respondents said they were completely satisfied with the number of discounts offered.

USAA's SafePilot program tracks your time behind the wheel and rewards you for safe driving habits. You can receive a discount of up to 30% by downloading the SafePilot app to your smartphone and enrolling in the program.

USAA is available in all 50 states and Washington, D.C.

Gap Insurance: Ramsey's Take

You may want to see also

USAA's insurance for drivers with a poor credit score

USAA is a good option for drivers with a poor credit score. While USAA is not available to everyone, those who qualify for its services can benefit from its low rates. USAA offers car insurance to current and former members of the military and their families.

USAA has the second-lowest sample rate for drivers with poor credit, averaging $2,268 annually. This is more than $1,800 below the national average.

USAA also has lower sample rates than average for drivers with a single accident or DUI on their record. In some cases, USAA's rates can amount to thousands of dollars less per year compared to the national average.

In addition, USAA offers a wide range of discounts, including:

- Military on-base discount

- Good student discount

- Clean driving record discount

- Safe driver discount

- Defensive driver training discount

- Basic driver training course discount

- Newer vehicle discount

- Anti-theft devices discount

- Deployment/storing discount

- Driving less discount

- Multi-vehicle discount

- MyUSAA Legacy discount

USAA also offers an optional SafePilot Program, which tracks your time behind the wheel and rewards you for safe driving habits.

While USAA is a good option for drivers with poor credit scores, it's important to note that it is not available to everyone. If you do not meet the eligibility criteria, there are other insurance companies that offer competitive rates and discounts that may be a better fit.

Florida DMV: Updating Vehicle Insurance

You may want to see also

Frequently asked questions

USAA auto insurance is available to current and former military members and their families.

The cost of USAA auto insurance depends on factors such as age, driving record, and credit score. However, USAA's rates are generally cheaper than the national average.

USAA offers the standard types of auto insurance coverage, as well as optional add-ons like accident forgiveness, rideshare insurance, and car replacement assistance.

USAA offers a wide range of discounts, including those for good students, multiple policies, safe driving, and storing your vehicle in a secure location.

You can get a quote from USAA online or by contacting their customer service.