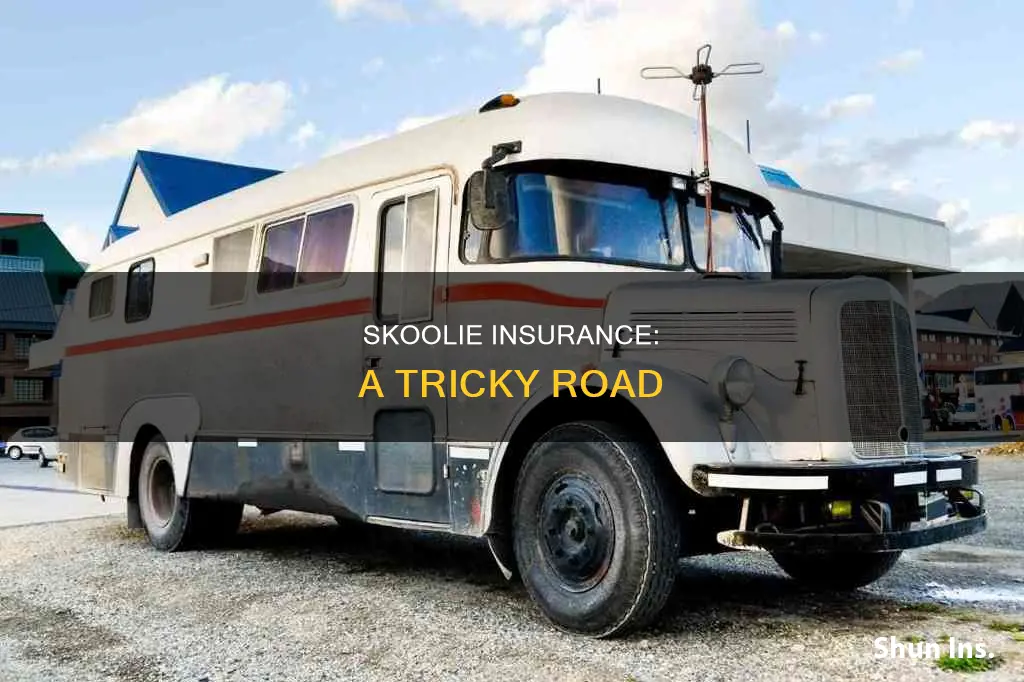

Insuring your Skoolie: What You Need to Know

Insuring a skoolie can be a tricky business, with requirements varying from state to state and insurer to insurer. However, it is a necessary step to take, as driving without insurance is not only a big financial risk but also generally illegal.

Where to Start?

The first step is to get your conversion titled as an RV. This process differs from state to state, with some states, such as Washington, having a simple and inexpensive process, while others, like New Jersey, have stricter requirements.

Finding an Insurer

Once you have your conversion titled as an RV, the next step is to find an insurer. This can be challenging, as many insurers, including major companies like Progressive, will not insure converted school buses at all. However, some companies, like State Farm, will provide coverage, depending on the state. It is important to shop around and not be discouraged, as you will eventually find an insurer that meets your needs.

The Role of an Agent

Engaging the services of an insurance agent who specializes in unusual vehicles can be extremely helpful. Agents have access to policies from multiple companies and can help you navigate the complex world of skoolie insurance. They can also explain the different types of coverage available and ensure that you understand what you are purchasing.

Providing Proof

Insurers will typically require proof that your skoolie meets certain criteria to be insured as an RV. This may include providing photos of the front and back of the bus, as well as proof of a bed, kitchen facilities, a bathroom, and running water.

Additional Considerations

In addition to insuring your skoolie, you may also want to consider renter's insurance to cover your belongings and a roadside assistance program in case you need a tow or other emergency services.

Final Thoughts

While insuring a skoolie can be a complex and frustrating process, it is not impossible. With patience and persistence, you will be able to find the coverage you need to legally and safely hit the road in your unique vehicle.

| Characteristics | Values |

|---|---|

| Difficulty of obtaining insurance | It can be difficult to find an insurer who will write a policy for a skoolie. Many insurers, including Progressive, won't insure converted school buses at all. However, some major insurance companies like State Farm and Progressive will cover self-converted school buses with no hassle in certain states. |

| Necessity of insurance | It is generally illegal and a big financial risk to not insure a skoolie. |

| Type of insurance | Skoolie insurance is typically an additional policy to the primary vehicle insurance. It can be covered under commercial vehicle insurance for personal use, full-time RV insurance, part-time RV insurance, travel insurance, renter's insurance, etc. |

| Factors affecting insurance | The factors that affect skoolie insurance include the age, make and model of the bus, the type of motor, whether the conversion was done professionally or not, the mechanical soundness of the vehicle, the state of registration, etc. |

| Cost of insurance | The cost of skoolie insurance depends on the type of coverage purchased, whether the owner owns or rents a home, etc. |

What You'll Learn

Getting insurance for a self-converted skoolie

- Contact an independent insurance agent: An independent agent can be your best resource for finding the right insurance coverage for your self-converted skoolie. They have access to policies from multiple companies and can help you navigate the requirements set by insurers.

- Understand the criteria for bus conversions: From an insurance company's perspective, a bus conversion must meet certain criteria to qualify for insurance. These criteria typically include having a refrigeration appliance, heating and air conditioning, a drinkable water supply, and a standard power supply.

- Consider the challenges of finding bus conversion insurance: Non-professional bus conversion insurance can be hard to find, and some insurers may only provide coverage under certain conditions. School bus conversions, in particular, may be more difficult to insure as companies often favour commercial bus conversions.

- Factors affecting insurance availability: The age, make, and model of the bus, the type of motor, and the transmission type can all impact the availability of insurance. Some insurers may also require an appraisal before providing coverage.

- Types of insurance coverage: When insuring your self-converted skoolie, consider the following types of coverage: RV liability coverage, collision coverage, comprehensive insurance, uninsured and underinsured motorist insurance, personal items coverage, towing and roadside assistance, and full-timer insurance if you live in your skoolie full-time.

- Be honest and transparent: Always be honest and transparent with your insurance agent about the nature of your vehicle and any modifications made. Misrepresenting information or withholding details may result in your claim being denied.

- Insurance companies to consider: State Farm, National General, Good Sam, and RVInsurance.com are some companies that have provided insurance for self-converted skoolies in the past. Progressive and Allstate have stopped providing new policies for skoolies but may still insure vehicles that were previously insured with them.

- Understand the insurance process: Before starting the conversion process, consult an insurance professional to understand the requirements and coverage options. During the conversion, you will need insurance that covers the initial drive from the place of purchase to the property where the bus will be stored and during the renovation. Once the conversion is complete, you will need full-coverage insurance.

Autonomous Vehicles: Insurable Future?

You may want to see also

Getting skoolie insurance in a specific state

The process of insuring a skoolie varies from state to state, with some states like New Jersey and Massachusetts being known for their strict requirements. Here is a comprehensive guide to help you navigate the process of getting skoolie insurance in a specific state.

Understanding Skoolie Insurance

Skoolie insurance is a type of specialty coverage that adventure enthusiasts need when they convert a school bus into a recreational vehicle (RV). This process involves removing seats and adding living amenities such as a bed, cooking facilities, and a bathroom.

Finding the Right Insurance Provider

The first step in getting skoolie insurance is finding an insurance company that offers coverage for converted school buses. Some major insurance providers like Progressive and Allstate have stopped providing new policies for skoolies, while others like State Farm and National General are known to offer coverage. It is important to note that insurance requirements vary by state, so it is advisable to consult an independent insurance agent familiar with the regulations in your specific state.

Types of Skoolie Insurance Coverage

There are several types of insurance coverage to consider when insuring your skoolie:

- Liability Insurance: This covers damages and injuries caused by the driver of the skoolie to other people and their property. It is typically required by law in most states.

- Comprehensive Insurance: This covers damage to your skoolie from incidents other than collisions, such as fire, theft, storms, or vandalism.

- Collision Insurance: This covers damage to your skoolie caused by a collision with another vehicle or object.

- Roadside Assistance Plan: This is an add-on coverage for costs incurred while traveling, such as engine issues or flat tires.

- Personal Property Insurance: This covers the contents of your skoolie, including furniture, electronics, and personal belongings.

- Travel Insurance: This covers medical treatment, emergency transportation, and other expenses while on the road.

Factors Affecting Skoolie Insurance

When assessing your skoolie for insurance, providers will consider various factors, including:

- The age, make, and model of the bus. Some insurers may not cover buses older than 20 years.

- The type of motor and transmission (manual or automatic).

- The mechanical soundness and overall condition of the bus.

- Whether the conversion was done professionally or by the owner.

- The presence of certain amenities, such as a refrigeration unit, heating and air conditioning, and a drinkable water supply.

Tips for Getting Skoolie Insurance

- Be honest and transparent with your insurance agent about the details of your skoolie conversion.

- Consult an insurance professional before beginning the conversion process to understand the requirements for coverage.

- Provide detailed documentation, including pictures, of your skoolie to the insurance provider.

- Consider combining your skoolie insurance with other policies to get RV insurance discounts.

- Be prepared to shop around and be patient when looking for skoolie insurance, as it can be a challenging process.

Vehicle Insurance: Am I Covered?

You may want to see also

Getting skoolie insurance with a roof deck

Getting insurance for a skoolie can be a challenging process, and it may be difficult to find an insurer who will provide a policy for a converted school bus. Many insurers, including Progressive, won't insure converted school buses at all. However, it is not impossible, and there are a few options available for those seeking coverage for their skoolie with a roof deck.

One option is to be strategic and refer to the roof deck as a "platform" for your solar panels rather than a deck or lounge area. This may increase your chances of obtaining insurance as the insurance company will not view it as a liability risk. However, it is important to note that insurance companies are aware that most skoolie owners are not structural engineers, and they may still consider the roof deck a risk due to the forces placed on it while driving.

Another option is to contact a local insurance agent who can work with you to get your application approved by the underwriters. State Farm and National General are two companies that have provided insurance for skoolies in the past, although requirements and policies may have changed. It is always best to be honest and transparent with your insurance agent about any modifications to your skoolie, including the roof deck, to ensure that you have adequate coverage in the event of a claim.

Additionally, some insurance companies may require "proof" of a fully converted RV and may request pictures of the skoolie from different angles, including the roof. This can be a challenge for skoolies with roof decks as the insurance company may quickly deny coverage upon seeing the deck.

In terms of cost, the premium for skoolie insurance will depend on various factors, including the type of coverage purchased, whether you own or rent a home, and your driving record. It is recommended to shop around and get quotes from multiple insurance providers to find the best rate.

Overall, while it may be challenging, it is not impossible to obtain insurance for a skoolie with a roof deck. Being proactive, honest, and working with a local insurance agent can increase your chances of finding the coverage you need.

Cars with the Cheapest Insurance Rates

You may want to see also

Getting skoolie insurance with a specific company

- Be Honest: When obtaining skoolie insurance, it is crucial to be honest and transparent about the nature and condition of your vehicle. Misrepresenting or withholding information may result in claim denials or policy cancellations.

- Contact a Local Insurance Agent: Engaging with a local insurance agent is often the best approach. They are trained and licensed to find suitable coverages and have a financial interest in helping you secure a policy. They can also guide you through the underwriting process and ensure your application is approved.

- Understand Coverage Needs: Familiarize yourself with the different types of insurance coverages available, such as liability insurance, comprehensive insurance, collision insurance, roadside assistance, and personal property insurance. Select the coverages that align with your specific needs.

- Compare Insurance Companies: Not all insurance companies offer the same level of coverage for skoolies. Research and compare multiple companies, including State Farm, National General, Good Sam, RVInsurance.com, Progressive, and Allstate. Policies and availability may vary by state, so be sure to inquire about specific options in your area.

- Provide Detailed Information: When applying for skoolie insurance, be prepared to provide comprehensive information about your vehicle. This may include pictures, documentation of build costs, mechanical and safety inspections, and details about the conversion process.

- Consider an Independent Agent: In some cases, working with an independent insurance agent who can access quotes from multiple companies may be beneficial. They can help you find the best coverage options and rates.

- Bundle Policies: If you have other insurance policies, such as homeowners or auto insurance, consider bundling them with your skoolie insurance. This may result in cost savings and streamline your insurance management.

- Understand Cost Factors: The cost of skoolie insurance will depend on various factors, including the type of coverages purchased, your driving record, claims history, and personal circumstances (e.g., whether you own or rent a home).

Remember that insurance requirements and availability can vary across states and insurance providers, so it is essential to do your research and consult with insurance professionals to ensure you are adequately covered.

Vehicle Insurance: Mexico's Mandatory Law

You may want to see also

Getting skoolie insurance with a specific type of coverage

Understanding Skoolie Insurance:

Skoolie insurance refers to insurance for a converted school bus or "skoolie," which is now used as a recreational vehicle (RV). This type of insurance is typically an additional policy to your primary vehicle insurance. It can be challenging to find insurers who offer skoolie insurance, and the process may involve contacting multiple companies and agents.

Types of Coverage:

When considering skoolie insurance, there are several types of coverage to choose from:

- Liability Insurance: This covers damages and injuries caused by the driver of the skoolie to other people and their property. It is usually required by law in most states.

- Comprehensive Insurance: This covers damage to your skoolie resulting from incidents other than a collision, such as fire, theft, storms, or vandalism.

- Collision Insurance: This covers damage to your skoolie caused by a collision with another vehicle or object.

- Roadside Assistance: This is an add-on coverage for costs incurred while travelling, such as engine issues or flat tires.

- Personal Property Insurance: This covers the contents of your skoolie, including furniture, electronics, and personal belongings.

- Travel Insurance: This covers medical treatment, emergency transportation, and other expenses while on the road.

- Commercial Vehicle Insurance for Personal Use: This type of policy provides coverage for vehicles classified as commercial but used for personal purposes.

- Part-Time RV Insurance: This is for skoolie owners who use their vehicle recreationally and not as their primary residence. It typically includes liability, collision, and comprehensive coverage.

- Full-Time RV Insurance: This is for individuals living in their skoolies full-time and includes liability, comprehensive, and collision insurance, along with additional coverage for towing, emergency expenses, and personal liability.

- Renters Insurance: If you plan to rent out your skoolie, this type of insurance covers your personal possessions.

Factors Affecting Skoolie Insurance:

When shopping for skoolie insurance, several factors come into play:

- Professional vs. Non-Professional Conversion: Insurers may offer coverage only for professionally converted skoolies or may charge higher rates for non-professional conversions.

- Age, Make, and Model of the Bus: Some insurance carriers have age limits, typically not insuring buses older than 20 years.

- Mechanical Soundness: The condition and mechanical state of the skoolie can impact insurance rates and coverage options.

- State Requirements: Insurance requirements vary from state to state, so it's important to consult with an agent familiar with your location.

- Mileage and Usage: The intended usage and expected mileage of the skoolie can also affect insurance rates. Full-time usage will generally result in higher premiums.

Recommendations for Obtaining Skoolie Insurance:

To obtain skoolie insurance with the coverage you need, consider the following steps:

- Contact a Local Insurance Agent: Reach out to a local independent insurance agent who has experience with skoolie insurance. They can guide you through the process, explain different coverage options, and help you find the right policy.

- Be Honest and Transparent: When discussing coverage with an agent, be honest about the details of your skoolie, including any modifications, conversions, and intended usage. This ensures that your policy accurately reflects your needs and reduces the risk of claims being denied.

- Compare Quotes: Shop around and compare quotes from multiple insurance carriers. This will help you find the best coverage at a competitive rate.

- Consult an Agent Before Converting: If possible, consult an insurance agent before beginning the conversion process. They can advise you on the requirements and criteria needed to qualify for insurance, potentially saving you time and money.

- Provide Detailed Information: When applying for skoolie insurance, be prepared to provide detailed information about your vehicle, including pictures, documentation of build costs, and proof of professional conversion if applicable.

- Consider Bundling Policies: You may be able to combine your skoolie insurance with other policies, such as homeowners or auto insurance, to take advantage of potential discounts and savings.

CTP Insurance: Queensland Vehicle Registration

You may want to see also

Frequently asked questions

No, it is not impossible to get skoolie insurance. However, it is not as easy as insuring a regular vehicle. It is best to contact a local insurance agent who can help you find the right coverage.

The factors that affect skoolie insurance include the age, make, and model of the bus, whether it has been professionally converted, whether it has a deck, and the state in which you are trying to insure it.

The types of insurance coverage you may need for your skoolie include liability insurance, collision coverage, comprehensive insurance, towing and emergency service, and uninsured motorist insurance coverage.