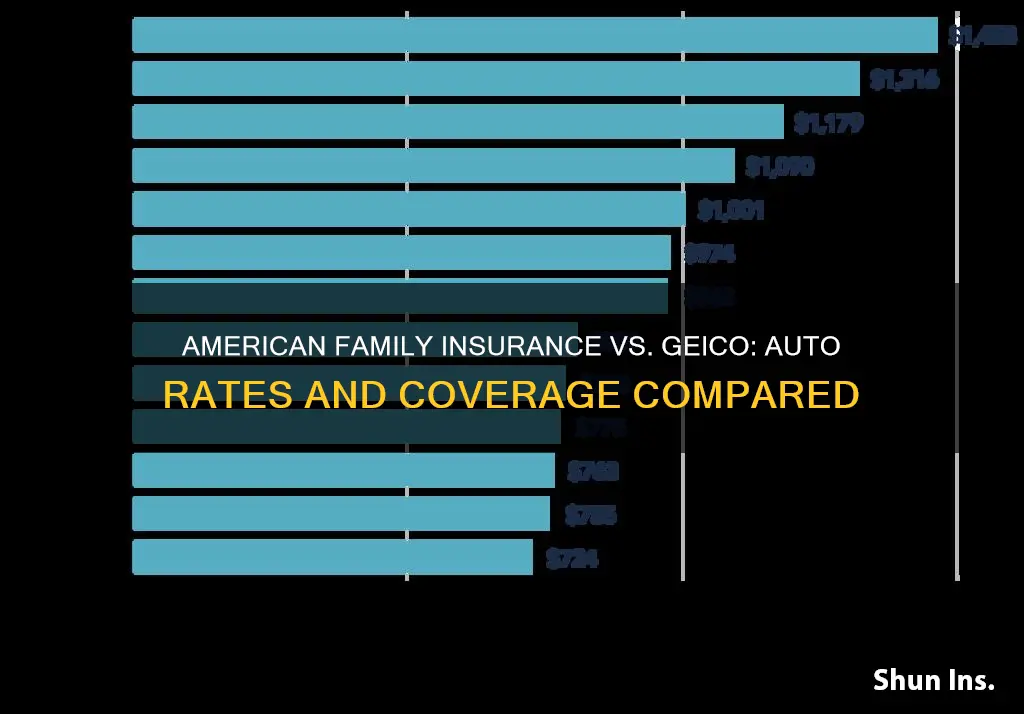

American Family and Geico are two of the top car insurance companies in the US, offering competitively priced insurance policies. Geico has higher financial strength ratings and is generally cheaper than American Family, especially for younger drivers and those with a clean driving record. However, American Family offers better rates for drivers with a history of accidents or DUIs. Both companies have excellent customer satisfaction ratings and low customer complaint ratios.

What You'll Learn

Customer satisfaction and complaint ratios

Customer satisfaction is an important metric when comparing insurance companies. American Family Insurance (AmFam) and Geico are both reputable companies with high customer satisfaction ratings and low customer complaint ratios.

AmFam has the edge when it comes to customer loyalty, with a higher percentage of customers stating they are likely to renew their policies. However, Geico comes out ahead in overall customer satisfaction, with higher ratings in most categories, including the ease of opening a new policy, contacting customer service, and handling claims. In a survey, 69% of Geico customers who opened a new policy stated they were completely satisfied with the process, compared to 57% for AmFam. Similarly, 74% of Geico customers were completely satisfied with opening a claim, compared to 59% for AmFam.

AmFam offers a wide range of discounts to help with costs, and in a survey, 43% of respondents said they were completely satisfied with the policy discounts offered. AmFam also scored well in claims handling, ranking third behind USAA and Auto-Owners.

Geico has the highest possible financial strength rating from A.M. Best and offers a long list of car insurance discounts. However, it does not offer gap insurance and has a limited network of local agents. AmFam, on the other hand, offers gap insurance and rideshare insurance (although this is not available in all states). It also has better rates for drivers with a poor driving record.

Both companies have positive feedback from customers who have gone through the claims process and manage customer complaints effectively. Ultimately, the choice between the two may depend on individual factors such as age, driving record, and credit score, as well as the specific coverage options and discounts offered by each company.

Pausing Auto Insurance: Is It Possible?

You may want to see also

Financial strength ratings

Financial strength is an important consideration when choosing an insurance company. A.M. Best, a reputable credit rating agency, assesses insurance companies' financial strength by evaluating their ability to meet their ongoing insurance obligations, such as balancing premiums collected and claims paid. The highest score A.M. Best awards is Superior A++.

Geico has the highest possible financial strength rating from A.M. Best, indicating that it has a strong ability to meet its insurance obligations. American Family, on the other hand, has stable financial strength and positive financial ratings, but does not hold the same highest rating as Geico.

While both companies are considered financially stable, Geico's higher rating from A.M. Best suggests that it may have a slight edge in terms of financial strength. This can be an important factor for customers who want assurance that their insurance company has the financial resources to handle their claims reliably.

In addition to financial strength, customer satisfaction and the claims process are also key considerations. Both American Family and Geico have positive feedback from customers who have gone through the claims process. They also have low customer complaint ratios, indicating effective management of customer concerns.

When it comes to customer satisfaction, Geico consistently ranks highly across various categories, including opening a new policy, contacting customer service, and handling claims. American Family, while close behind, tends to have higher premiums, which may influence customers' overall satisfaction.

Switching Auto Insurance: Mid-Policy Changes

You may want to see also

Rates for drivers with a poor driving record

When it comes to auto insurance rates for drivers with a poor driving record, American Family and Geico differ in several ways. While both companies have great customer satisfaction and low customer complaint ratios, American Family is generally considered a better option for drivers with a history of speeding tickets, accidents, or DUIs.

American Family Insurance offers lower rates for drivers with a poor driving record compared to Geico. American Family's rates are more forgiving for drivers with a DUI on their record, making them a more affordable option for high-risk drivers. On the other hand, Geico penalizes drivers with more serious infractions, such as accidents or DUIs, with significantly higher rates. Geico's rates for drivers with a clean record are lower than American Family's, but their rates increase dramatically for drivers with a poor driving history.

It's important to note that both companies have different rates based on age, gender, and marital status. Geico, for example, offers cheaper rates for teen drivers, especially males, compared to American Family. Additionally, Geico has the highest possible financial strength rating from A.M. Best, while American Family has lower overall rates but higher customer loyalty.

In summary, if you have a poor driving record, American Family Insurance is likely to offer you more competitive rates compared to Geico. However, it's always a good idea to compare quotes from multiple insurance providers to find the best option for your specific circumstances.

Gap Insurance: Pre-Tax or Not?

You may want to see also

Rates for teen drivers

Teen drivers are considered a higher risk, and their insurance rates reflect this. However, GEICO is known for offering cheaper rates for teen drivers than its competitors, including American Family Insurance.

GEICO's rates for teens are lower than the national average by more than $1,000 for both male and female drivers. In contrast, American Family Insurance's rates are higher than the national average and are on the upper end of the rates among all insurers.

For example, the average rate for full coverage car insurance for a 16-year-old driver is $7,149, while a 17-year-old pays $5,954 annually. GEICO offers female teens an average annual rate of $4,783 and male teen drivers an average rate of $5,315.

GEICO also offers various discounts that can help reduce the cost of insurance for teen drivers. These include:

- Good student discount: Full-time students with a "B" average or honours can get up to a 15% discount on certain coverages.

- Good driver discount: Teenage drivers who have not been in an accident within the last five years can save up to 22% on most coverages.

- DriveEasy discount: This program monitors safe driving habits through the GEICO mobile app and offers a discount of up to 10% for enrolled drivers.

- Defensive driving course discount: GEICO offers a discount for completing a defensive driving course, which is not offered by American Family Insurance.

Additionally, adding a teen driver to an existing policy is usually cheaper than getting them a separate policy. GEICO allows teens to be added to their parents' policies, and they can benefit from the same great customer service.

While GEICO offers more affordable rates for teen drivers, it's important to shop around and compare rates and discounts from multiple insurers to find the best deal for your specific circumstances.

Alberta's Auto Insurance Advantage: Understanding the No-Fault System

You may want to see also

Discounts

GEICO offers a wide range of discounts to its customers, including:

- Good Driver Discounts

- Multi-Car Discounts

- Anti-Lock Brakes Discount

- Anti-Theft System Discount

- Daytime Running Lights Discount

- New Vehicle Discount

- Five-Year Accident-Free Good Driver Discount

- Seat Belt Use Discount

- Defensive Driving Discount

- Driver's Education Discount

- Good Student Discount

- Emergency Deployment Discount

- Federal Employee Discount (Eagle Discount)

- Membership and Employee Discounts

- Multi-Vehicle Discount

- Multi-Policy Discount

American Family Insurance also offers a variety of discounts, such as:

- Student Discount

- Multiple-Product Discount

- Multiple-Vehicle Discount

- Safe Driving Discount

- Young Driver Discounts

- Student Away From Home/Storage Discount

- Bundling/Multi-Policy Discount

- Good Driver/Clean Record Discount

- Defensive Driving Course Discount

- Employer/Affinity Group Discount

- New Car/Safety/Anti-Theft Equipment Discount

- Auto-Pay/Pay-Up-Front Discount

- Pay-How-You-Drive Safe Driving Program

- Paperless/Online Billing Discount

- Customer Full Pay Discount

Comparison

GEICO offers more discounts than American Family Insurance. GEICO provides 14 discounts, while American Family Insurance offers three. The only discount they share is for vehicles with air bags. GEICO also gives higher discounts for having multiple vehicles insured, at 25% compared to American Family Insurance's 23%.

Verify Auto Insurance: Active or Not?

You may want to see also

Frequently asked questions

American Family is a better choice for drivers with a poor driving record, including speeding tickets, accidents, and DUIs. Geico, however, has cheaper rates for drivers with a clean record.

Geico offers cheaper rates for drivers with a good credit score. However, American Family is more lenient towards drivers with a poor credit score, as their rates increase by a smaller percentage than Geico's.

Geico offers much lower rates for teen drivers, especially males. Their rates are up to 23% cheaper than American Family's.

Geico offers a wider range of discounts, including those for anti-theft devices, vehicle recovery, military deployment, and more. American Family offers fewer discounts but has unique ones like completing a defensive driving course and using their mobile driving app.