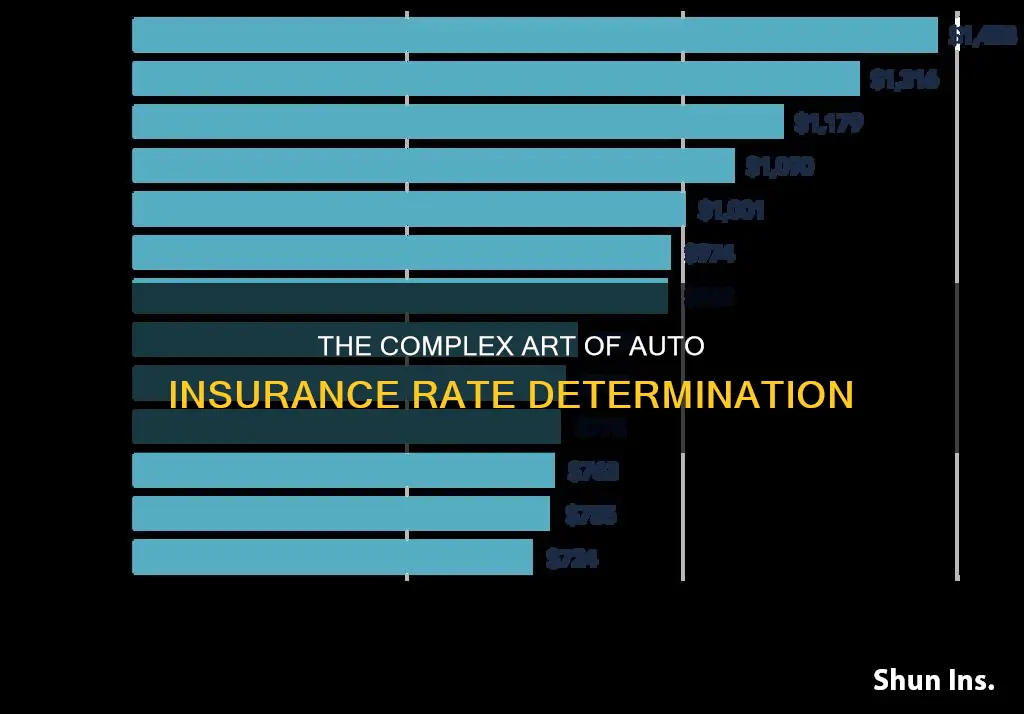

Auto insurance companies use multiple factors to determine insurance rates, with the primary goal of assessing the risk of the driver filing a car insurance claim. The lower the risk, the better the car insurance rates. These factors include age, gender, location, marital status, vehicle type, driving record, claims history, credit score, and insurance history.

| Characteristics | Values |

|---|---|

| Age | Younger, less experienced drivers are considered more likely to drive dangerously and be involved in fatal accidents. Therefore, teens and young adults typically pay the highest rates for auto insurance. |

| Gender | Women are statistically less likely to be involved in car accidents, and the accidents they do have tend to be less severe. In states that allow insurance companies to consider gender when setting insurance premiums, women usually pay less than men. |

| Marital Status | Married people are less likely to file auto insurance claims than single people. Married couples typically enjoy premiums 5% to 15% lower than singles. |

| Driving History | Insurance companies review your driving record when setting your insurance premiums. Safe drivers are less likely to get into accidents, so they typically pay less for auto insurance. |

| Vehicle | Auto insurance rates may vary based on the vehicle's repair costs, replacement costs, popularity with thieves, engine size, safety record, and likelihood of causing damage in a collision. |

| Type and Amount of Insurance Coverage | State laws generally require drivers to purchase a minimum amount of liability coverage. Beyond these basic requirements, you can purchase additional insurance, such as comprehensive and collision coverage. Typically, premiums rise as you add more coverage. |

| Deductible | The deductible is the amount you must pay out of pocket when you file a car insurance claim. Opting for a higher deductible can lower your insurance premiums. |

| Vehicle Usage | High-mileage drivers may pay more for car insurance, as they are statistically more likely to be involved in a car accident. |

| Claims History and Insurance History | Car insurance companies examine your history of filing claims when setting premiums. Having many claims suggests that you're likely to file more claims in the future, leading to increased rates. |

| Credit Score | Insurance companies in most states can consider your credit score when calculating your car insurance premiums. A higher score typically results in lower premiums. |

| Location | Urban drivers tend to pay more for auto insurance than those in rural areas due to higher rates of theft, vandalism, and accidents. |

What You'll Learn

Driving record

A driving record is a record kept by the Department of Motor Vehicles (DMV) that stores your personal identification, license information, and any tickets or other infractions. It follows you from the day you get your license until you stop driving.

Insurance companies review your driving record when setting your insurance premiums. Safe drivers are generally less likely to get into accidents, so they typically pay less for auto insurance. Conversely, you might pay more for car insurance if you have a history of moving violations for dangerous habits such as speeding or reckless driving. Being at fault in an accident or having a DUI/DWI on your record will also likely boost your car insurance costs.

Each US state uses a points system to codify the severity of various violations and keep track of how serious a driver's offences are. You usually only get points for moving violations—when you do something dangerous while driving a vehicle—since they are seen as more severe and more likely to cause damage or harm than other violations. Each state has a different formula for what violations are worth in terms of points. For example, in California, each offence is worth fewer points than in New York.

In California, you can take an online traffic school course whenever you receive a citation to keep the points from affecting your insurance rates.

In terms of insurance, minor moving violations will tend to increase your insurance premiums by 10 to 15%. Insurance companies typically look back at approximately three years of your driving record, so it will take a while for a violation to disappear. You can wait it out if possible before applying for a new policy or switching insurers. You can also shave some points off your record by taking a defensive driving course, although this varies by state.

Major violations may result in insurers refusing to offer a policy or refusing to renew an existing one. If you have a major violation on your record, or one that the insurer knows about when your policy is up for renewal, you may find yourself without insurance.

The best way to keep your driving record from raising your insurance rates is to keep it clean.

U-Turn: Exploring USAA Auto Insurance Coverage for Turo Rentals

You may want to see also

Age and experience

The cost of auto insurance usually begins to decrease when a driver reaches their early 20s, with a more significant reduction often occurring around the age of 25. This reduction in rates is due to the driver gaining more experience and becoming less likely to be involved in accidents. The rates generally continue to decrease as the driver ages, assuming they maintain a clean driving record.

However, there is typically another increase in insurance rates around the age of 65, and even more so around the age of 75. This is because, as people age, their physical abilities may decline, affecting their vision, hearing, and response time, which can increase the risk of accidents. Despite this, senior drivers are unlikely to pay rates as high as those of teen drivers, provided their driving record remains clean.

It is worth noting that not all states in the US allow age to be used as a rating factor. For example, Hawaii and Massachusetts have banned the use of age in determining insurance rates, while Michigan considers years of driving experience instead, which may still result in higher rates for younger drivers.

Auto Insurance and Truck Campers: What You Need to Know

You may want to see also

Location

Insurers calculate your likelihood of an auto accident based on the county or state in which you live. This is because your odds of being involved in an auto accident depend on the number of vehicles on the roads on which you travel. Therefore, living in a densely populated area can lead to higher car insurance premiums as accidents are more likely to happen with more vehicles on the road. Packing lots of people into one area increases the chance of traffic congestion and car accidents.

Insurers also calculate your risk of vehicle theft or vandalism based on the city or neighborhood in which you live. This is because car theft and vandalism typically occur while a vehicle is parked, so the location where your car is parked plays a crucial role in determining the odds of theft or vandalism.

- Crime rates: Vehicle crimes, such as theft and vandalism, drive up claim costs.

- Population density: Living in a densely populated area can lead to higher car insurance premiums due to an increased likelihood of accidents and congestion.

- Weather: Severe weather, such as tornadoes, snow, and major storms, can affect your area, increasing the potential for vehicle damage and thus your insurance costs.

- State laws: Each state has its own laws on coverage types and minimum limits. Some states require personal injury protection (PIP), which can lead to cheaper premiums as the coverage limits when you can sue and lowers legal costs.

- Road conditions: Poor road conditions, such as potholes, a lack of traffic lights, or unclear traffic patterns, can increase the risk of accidents, leading to higher insurance premiums.

While it is often said that city dwellers pay higher car insurance rates than those in rural areas, this is not always the case. For example, Vermont, South Carolina, and Maine, which are predominantly rural states, have some of the lowest average auto insurance rates. On the other hand, some largely rural states, such as Oklahoma and Montana, have higher-than-average car insurance rates due to factors such as long travelling distances and a high percentage of uninsured drivers.

Insurance: No License, No Problem?

You may want to see also

Vehicle type

The type of car you drive is a significant factor in determining your auto insurance rates. Insurance companies take into account the cost of repairs, the likelihood of theft, the size of the engine, and the overall safety record of the car, including safety equipment.

The cost of repairs is influenced by several factors. Firstly, the age of the vehicle—older cars are generally cheaper to insure as they have less overall value and are thus less expensive to repair or replace. Newer cars with advanced technology and modern safety features are more costly to fix, leading to higher insurance premiums. Additionally, the ease of repairing a vehicle is a factor, with certain car brands requiring specialised tools and training for mechanics, which increases the cost of repairs and, consequently, insurance rates. Electric vehicles, for instance, may have fewer moving parts, but they are not as easily repairable, affecting their insurance costs.

The likelihood of a vehicle being stolen also impacts insurance rates. Luxury brands like Mercedes-Benz and Audi tend to be more expensive for insurance companies to pay claims on if they are stolen, resulting in higher insurance rates for these vehicles.

The size of a car's engine is another factor influencing insurance costs. Automobiles with larger engines are often deemed riskier and more powerful, which can lead to higher insurance premiums. Conversely, compact and practical vehicles are usually associated with lower insurance rates as they are generally driven at safer speeds and are less likely to be involved in accidents.

Lastly, the safety record of a car plays a significant role in determining insurance rates. Vehicles equipped with safety features such as anti-lock brakes, dual airbags, and side-impact door reinforcements often receive better insurance ratings and lower premiums. Strong crash ratings for a particular model can also result in reduced insurance costs. Conversely, a vehicle with poor crash ratings will require a larger insurance premium as it is deemed riskier and more prone to sustaining damage in an accident.

Rent-a-Car Coverage: Understanding Your CA Auto Insurance Policy

You may want to see also

Credit score

The impact of a credit score on insurance rates varies across states, as some states prohibit or limit the use of credit scores in setting insurance premiums. However, in most states, a poor credit score can lead to substantially higher insurance rates. For example, in New York, drivers with poor credit pay an average of $7,506 per year for full coverage insurance, which is one of the highest rates in the country.

The specific factors that contribute to a credit-based insurance score include:

- Payment history: A history of late payments or credit delinquencies can negatively impact a credit score and increase insurance rates.

- Length of credit history: A longer credit history can contribute positively to a credit score, as it demonstrates a longer track record of responsible financial management.

- Types of credit: The mix of credit cards, loans, and other forms of credit can impact a credit score.

- Outstanding debt: The amount of debt an individual currently has can affect their credit score.

- Pursuit of new credit: Recent attempts to open new lines of credit can also impact a credit score.

It is important to note that insurance companies do not use the same credit scores as lenders or credit card companies. Instead, they calculate their own insurance scores based on consumer credit data. Additionally, insurance companies consider various other factors in addition to credit scores when determining insurance rates, such as driving record, location, demographics, vehicle type, and insurance coverage.

Electric Cars: Cheaper Insurance?

You may want to see also

Frequently asked questions

The main factors that determine auto insurance rates are age, gender, location, the type of car, driving history, credit score, and insurance history.

In general, younger and less experienced drivers pay higher auto insurance rates because they pose a higher risk for accidents.

Urban drivers pay higher auto insurance prices than those in small towns or rural areas due to higher rates of vandalism, theft, and accidents.

The cost of the car, the likelihood of theft, the cost of repairs, engine size, and the safety record of the car all influence auto insurance rates.

A history of accidents, traffic violations, or DUIs will result in higher auto insurance rates.

A higher credit score typically leads to lower auto insurance premiums, as insurance companies associate lower credit scores with a higher risk of filing claims.