The Federal Employees' Group Life Insurance (FEGLI) Program is the largest group life insurance program in the world, covering over 4 million federal employees, retirees, and their family members. Established in 1954, most federal employees are eligible for FEGLI coverage, which provides group term life insurance. As a new federal employee, you are typically automatically covered by Basic life insurance, and your premiums are deducted from your paycheck unless you waive coverage. In addition to Basic, there are three forms of Optional insurance you can elect within 31 days of becoming eligible. To elect any of the options, you must first have Basic insurance. To apply for FEGLI, you can submit form SF 2817, Life Insurance Election, to the Retirement and Benefits Portal or by mail.

What You'll Learn

Who is eligible for Federal Group Life Insurance?

The Federal Employees' Group Life Insurance (FEGLI) Program was established on August 29, 1954, and is the largest group life insurance program in the world, covering over 4 million Federal employees and retirees, as well as many of their family members.

Most employees are eligible for FEGLI coverage. In most cases, if you are a new Federal employee, you are automatically covered by Basic life insurance and your payroll office deducts premiums from your paycheck unless you waive the coverage. This Basic insurance is shared between you and the government—you pay 2/3 of the total cost and the government pays 1/3. Your age does not affect the cost of Basic insurance.

In addition to the Basic coverage, there are three forms of Optional insurance you can elect. However, you must have Basic insurance to elect any of the options. Unlike Basic, enrollment in Optional insurance is not automatic—you must take action to elect the options. You must specifically elect the types of optional insurance you wish to carry within 31 days of becoming eligible. The cost of Optional insurance depends on your age, and you pay the full amount.

Occupations: Impacting Life Insurance Rates and Policy Coverage

You may want to see also

How do I enrol?

Most employees are eligible for Federal Employees Group Life Insurance (FEGLI) coverage. If you are a new federal employee, you are likely to be automatically covered by Basic life insurance, and your payroll office will deduct premiums from your paycheck unless you waive the coverage.

If you are a new or newly eligible employee, you have 60 days to enrol or increase coverage. You can also do this within 60 days of a life event (such as marriage, divorce, or the death of a spouse), during a life insurance Open Season, or when you pass a physical exam (Option C excluded).

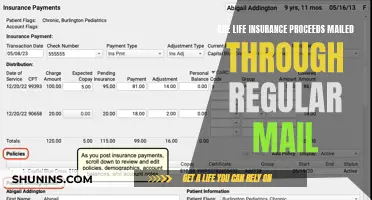

To enrol or increase coverage, you must submit form SF 2817 Life Insurance Election: FEGLI to the Retirement and Benefits Portal or mail the original to:

U.S. Customs and Border Protection, Retirement and Benefits Advisory Services (RABAS), 90 K Street NE, 5th Floor, Washington, DC 20229, Mail Stop 1400.

Upon completing the required form and passing a physical examination (if applicable), submit form SF 2822 Request for Insurance to the Retirement and Benefits Portal. RABAS will complete Part A, you will need to complete Part B, and the examining physician will complete Part C and submit it directly to the Office of Federal Employees' Group Life Insurance (OFEGLI). OFEGLI will inform RABAS of their decision, and they will notify you of the outcome and request or provide any additional forms, if applicable.

Life Insurance: Protecting Your Loved Ones' Future

You may want to see also

How much does it cost?

The Federal Employees' Group Life Insurance (FEGLI) Program offers Basic Life Insurance and three types of optional insurance: Option A (Standard), Option B (Additional), and Option C (Family). The cost of insurance depends on the type of insurance and the age of the employee.

Basic Life Insurance

The cost of Basic insurance is shared between the employee and the government. The employee pays 2/3 of the total cost, while the government pays 1/3. The cost of Basic insurance does not depend on the age of the employee. The Basic Insurance Amount (BIA) is calculated by taking the employee's annual basic pay rate, rounding it up to the nearest $1,000, and adding $2,000. For example, if an employee's annual salary is $48,108, the insurance amount would be $51,000 ($49,000, rounded up to the nearest $1,000, plus $2,000). The cost to the employee is $0.16 biweekly for each $1,000 of coverage.

There is also an Extra Benefit for employees aged 35 or younger, which doubles the amount of Basic insurance payable at no extra cost. This benefit decreases by 10% each year starting from the employee's 36th birthday until it ends at age 45.

Optional Insurance

The employee pays the full cost of Optional insurance, and the cost depends on the employee's age. The cost increases when the employee reaches a new age band. Age bands are 35, 40, 45, 50, 55, 60, 65, 70, 75, or 80.

- Option A (Standard Optional Insurance): Provides $10,000 worth of coverage. If the employee is under 35, the cost is $0.20 biweekly.

- Option B (Additional Optional Insurance): Provides coverage in multiples of 1, 2, 3, 4, or 5 times the employee's annual basic pay rate (after rounding up to the next $1,000). It does not include the extra $2,000 added for Basic Insurance. The cost depends on age bands. If the employee is under 35, the cost is $0.02 per $1,000 of coverage biweekly.

- Option C (Family Optional Insurance): Provides coverage for the employee's spouse and eligible dependent children. The employee may elect 1, 2, 3, 4, or 5 multiples of coverage. Each multiple is equal to $5,000 for the spouse and $2,500 for each eligible child. The cost depends on the employee's age. If the employee is under 35 and elects 3 multiples, the cost would be $0.20 per multiple for a total of $0.60.

To obtain the total cost of FEGLI coverage, add together the costs for Basic and any Optional Insurance coverage elected.

Life Insurance and Acts of War: What's Covered?

You may want to see also

What is covered?

Federal Group Life Insurance (FEGLI) provides comprehensive life insurance coverage for federal employees and their families. The program offers several types of coverage, ensuring that enrollees receive the financial protection they need.

FEGLI's Basic Insurance coverage provides a standard level of protection, offering a benefit worth your annual salary rounded up to the nearest thousand, plus an additional $2,000. This benefit is designed to provide financial security for your loved ones in the event of your passing. It is important to note that this coverage ends at age 65 if you retire; however, you have the option to convert it to an individual policy or continue paying premiums to maintain coverage until age 69 and 6 months.

In addition to Basic Insurance, FEGLI offers three optional types of coverage: Option A, Option B, and Option C. Option A provides a supplemental benefit of $10,000, serving as a valuable safety net for your family or designated beneficiaries. Option B allows you to purchase up to five multiples of your salary in additional insurance, ensuring that your loved ones receive a substantial benefit. This option is particularly advantageous for those with higher salaries, as it enables them to secure a more significant financial cushion. Option C, on the other hand, is tailored to protect your eligible family members, including your spouse and dependent children. This option ensures that your family is financially secure in the unfortunate event of their passing.

The program also includes an Accidental Death and Dismemberment (AD&D) benefit, augmenting the financial support provided in the event of an accident resulting in death, loss of limbs, or loss of sight. This benefit, included with Basic Insurance, offers added peace of mind for enrollees and their families. FEGLI's coverage extends its umbrella of protection to both active and retired federal employees, ensuring uninterrupted coverage throughout your career and into retirement.

It is important to diligently review the eligibility requirements and enrollment options to ensure a comprehensive understanding of the specific coverage available to you and your family. By doing so, you can make well-informed decisions regarding your life insurance choices and maximize the benefits afforded by the FEGLI program.

DFAS: Life Insurance and Annuities for Survivors

You may want to see also

How do I make changes to my coverage?

To make changes to your Federal Employees' Group Life Insurance (FEGLI) coverage, you must complete an SF 2817, Life Insurance Election form. Changes to your FEGLI coverage cannot be made using Employee Express. You may decrease your FEGLI coverage at any time.

If you waived all insurance or did not elect any Optional insurance when you were first hired, or you simply want different coverage than you currently have, you have three opportunities to make FEGLI coverage changes: an open enrollment, a physical exam, or a life event.

Open enrollment is relatively rare and is normally linked to some change in the program, such as the addition of a benefit or a change in premium costs. If you wish to get a physical exam, at least one year must have passed since the effective date of your last waiver of life insurance coverage. You may get a physical exam at your own expense using the Request for Life Insurance (SF 2822). You and your agency must complete part of the form, after which a medical professional will examine you, complete the rest of the form, and send it to the Office of Federal Employees' Group Life Insurance (OFEGLI). If OFEGLI approves your request, your human resources office will automatically enroll you in Basic insurance unless you already have it.

You may elect or increase FEGLI coverage up to the maximums based on a life event such as marriage or the birth of a child. You must complete a Life Insurance Election (SF 2817) and submit it to your human resources office.

Life Insurance and Physicals: What's the Connection?

You may want to see also

Frequently asked questions

To apply for Federal Group Life Insurance, you need to complete and submit an SF 2817, Life Insurance Election form. You can submit this form to the Retirement and Benefits Portal or mail it to the relevant address.

The cost of Basic insurance is shared between you and the Government. You pay 2/3 of the total cost, while the Government pays 1/3. The cost of Basic insurance does not increase with age. For Optional insurance, you pay the full cost, and the price depends on your age.

Yes, you can decrease your Federal Group Life Insurance coverage at any time by completing an SF 2817, Life Insurance Election form.

To designate a beneficiary, you need to complete form SF 2823 Designation of Beneficiary, Federal Employees' Group Life Insurance Program and mail the original form to the relevant address.