Borrowing against your Americo whole life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it's important to understand the specifics before making any decisions. Firstly, it's crucial to know that you can only borrow against a permanent life insurance policy, such as whole life insurance or universal life insurance. These policies are designed to provide coverage for your entire lifetime and build cash value over time. In contrast, term life insurance is temporary and does not have a cash value component, so borrowing against it is not possible.

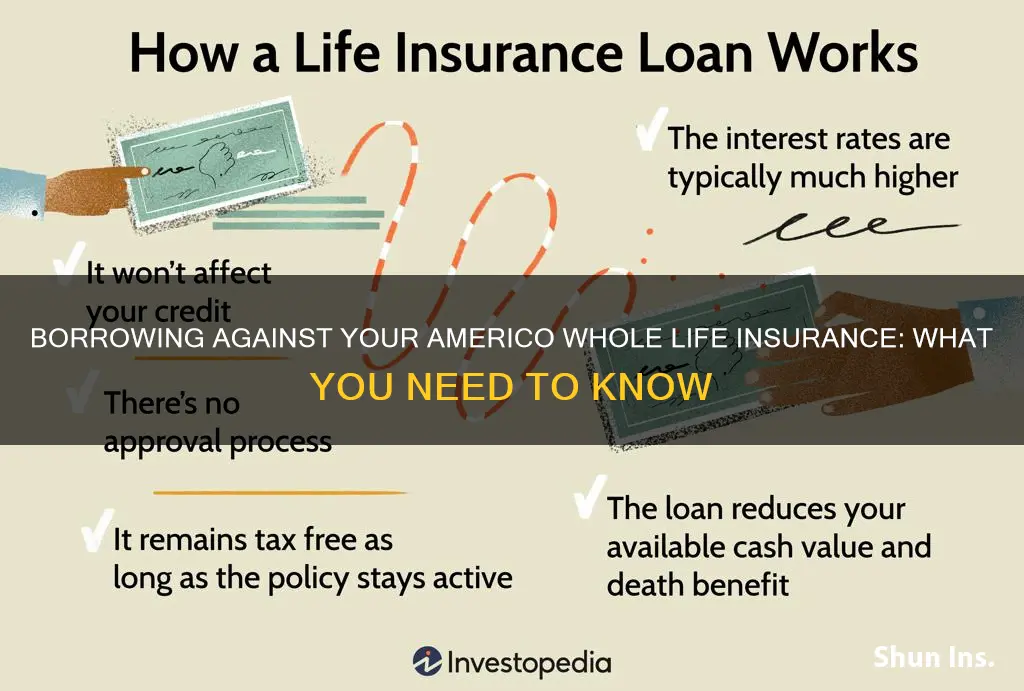

When you borrow against your whole life insurance policy, you are essentially borrowing from yourself, with the policy's cash value serving as collateral. This means that there is no impact on your credit score, and the loan is not recognized by the IRS as income, so it remains tax-free. However, it's important to note that if the loan is not repaid before the policyholder's death, the outstanding balance, including any interest owed, will be deducted from the death benefit, resulting in a lower payout for your beneficiaries.

To borrow against your Americo whole life insurance policy, ensure that your policy has accrued sufficient cash value, as lenders typically require a minimum cash value for approval. The approval process is usually straightforward and involves submitting a simple form and verifying your identity. It's also essential to understand the potential risks, such as the reduced death benefit and the risk of policy lapse if the loan and interest accrue and exceed the cash value.

| Characteristics | Values |

|---|---|

| Borrowing against life insurance | Possible if the policy has a cash value |

| Cash value | A portion of the life insurance payment put into a savings-like account that grows tax-free over time |

| Borrowing from whole life insurance | Yes, if the plan has a cash value |

| Borrowing from term life insurance | No |

| Borrowing from universal life insurance | Yes |

| Borrowing from final expense insurance | Yes |

| Borrowing process | Taken out with the life insurance company |

| Interest | Charged by the life insurance company |

| Loan approval process | Simpler |

| Loan repayment | Flexible |

| Loan impact on credit score | None |

| Loan recognition by the IRS | Not considered income |

| Loan impact on death benefit | Reduces the death benefit |

| Maximum borrowing amount | Up to 90% of the cash value |

What You'll Learn

Borrowing against whole life insurance: pros and cons

Borrowing against your Americo whole life insurance policy can be a quick and easy way to get cash in hand when you need it. However, there are a few specifics to know before borrowing.

Pros

- There is no formal approval process for a life insurance loan, as the value of the plan is technically yours.

- Life insurance loans will not affect your credit score.

- Most of the time, life insurance loans are not recognised by the IRS as income, so you won't have to pay taxes on them.

- There are no qualifiers for a policy loan—there's no credit check, no need to provide proof of income, and the loan doesn't appear on your credit report.

- Life insurance collateral loans can be a great solution if you need money quickly, such as for an emergency medical expense.

- Policy loans have low interest rates, typically lower than you would get with a personal loan or credit card.

- You don't have to pay the loan back within a specific time frame.

- The cash value remains within the life insurance policy and continues to accumulate interest.

Cons

- If you are unable to make monthly loan payments in a timely fashion, you may lose your life insurance plan.

- If the life insurance loan is not paid back before the policy owner passes, the beneficiary will only receive a portion of the death benefit.

- If the life insurance policy lapses, you may have to pay taxes on it since the tax structure will change.

- If you don't make interest payments, your policy could lapse and the entire loan amount could become taxable.

- If you pass away, the loan amount and any interest owed will be taken out of the death benefit, which could significantly impact your beneficiaries.

- If you default on paying the interest on the loan, you could lose your policy and its cash value and end up with a big tax bill.

Life Insurance: A Worthless Investment or Smart Move?

You may want to see also

Borrowing against whole life insurance: how it works

Whole life insurance is a type of permanent life insurance that offers lifetime protection. As long as you continue to pay the premiums, your policy remains active, and your rates will not increase due to age or health issues. This type of insurance also has a cash value component, which is a savings-like account that grows tax-free over time. This cash value can be borrowed against, but there are some important things to know before doing so.

First, it is important to understand that you can only borrow against the cash value of a whole life insurance policy if it has been active long enough to build up a substantial cash value. This usually takes several years, depending on the structure of your policy and the amount of premiums paid. The cash value must exceed a certain threshold, which varies by insurer, before you can take out a loan.

When you borrow against your whole life insurance policy, you are taking out a loan from the insurance company using the policy's death benefit and cash value as collateral. The loan approval process is typically simple and does not require a credit check or income verification. The interest rates on these loans are generally low, ranging from 0% to 2%, but it's important to note that the insurance company will charge interest on the loan amount.

While there is no formal repayment schedule for policy loans, it is crucial to make regular interest payments to avoid the loan amount and interest exceeding the policy's cash value. If this happens, your policy could lapse, and you may owe taxes on the amount borrowed. Additionally, if the loan is not repaid before the policyholder's death, the loan amount and any interest will be deducted from the death benefit, reducing the payout to beneficiaries.

There are both pros and cons to borrowing against your whole life insurance policy. On the positive side, policy loans have fewer credit and tax implications than other loan types. They do not affect your credit score, and the IRS does not recognize them as income, making them a tax-free funding source. You also have the flexibility to use the money however you like. However, it's important to consider the potential drawbacks, such as the reduced death benefit for your beneficiaries if the loan is not repaid before your death, and the risk of policy lapse if the loan amount and interest exceed the cash value.

In conclusion, borrowing against your whole life insurance policy can be a convenient way to access cash, but it is important to understand the potential risks and implications involved. Be sure to carefully review the terms of your policy and discuss your options with a financial advisor or estate planning attorney before making any decisions.

Life Insurance and Type 2 Diabetes: What's the Verdict?

You may want to see also

Borrowing against whole life insurance: how much can you borrow?

Borrowing against your whole life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it's important to understand the specifics before borrowing.

Firstly, it's important to note that you can only borrow against a permanent life insurance policy, such as a whole life insurance or universal life insurance policy. These policies are more expensive than term life insurance but have no predetermined expiration date. If sufficient premiums are paid, the policy remains in force for the lifetime of the insured. While the monthly premiums are higher, money paid into the policy that exceeds the cost of insurance builds up a cash value that is part of the policy. This cash value can be borrowed against.

The amount you can borrow against your whole life insurance policy depends on the rules set by your insurer and the cash value of your policy. In general, you can borrow up to 90% of the policy's cash value. However, it's important to note that this may take several years to accrue, depending on the structure of your policy.

When you take out a loan against your policy, the life insurance company lends you the money and uses the cash value as collateral. The loan does not affect your credit score and there is no approval process or credit check. The interest rates on these loans are typically much lower than bank loans or credit cards, ranging from 5% to 8%. However, it's important to pay back the loan in a timely manner, as interest accrues and can cause your policy to lapse if left unpaid. If the policy lapses, you may owe taxes on the amount borrowed.

Additionally, it's important to consider the impact on your death benefit. If you pass away while owing money on a life insurance loan, it will reduce the amount your beneficiaries receive.

Haven Life: Insurance Without the Medical Exam Hassle

You may want to see also

Borrowing against whole life insurance: tax implications

Borrowing against your Americo whole life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it's important to understand the tax implications before making any decisions.

Firstly, it's important to note that you can only borrow against a whole life insurance policy if it has a cash value component. Whole life insurance policies accumulate a cash value over time, which can be borrowed against. The cash value is essentially a savings-like account that grows tax-free. This is a feature typically found in whole life insurance plans and is not usually an option in term life insurance policies.

When borrowing against your whole life insurance policy, the loan is taken out with the life insurance company, and there is no formal approval process since the value of the plan is technically yours. The loan amount is typically limited to a maximum of 90% of the policy's cash value, and you can choose to pay interest as it accrues or let it build up and pay it all later.

Now, regarding the tax implications:

- The loan itself is generally not considered taxable income by the IRS, as long as the policy remains active and in force.

- If you repay the loan, the repayment is also not considered taxable income.

- However, if the loan is not repaid before the death of the insured, the loan amount and any accrued interest will be deducted from the death benefit paid to the beneficiaries. This reduction in the death benefit is not considered taxable.

- If the policy lapses or is surrendered with an outstanding loan, you may face tax consequences. The taxable amount is calculated as the gain realised, which is any amount received from the cash value of the policy minus the net premium cost (total premiums paid minus distributions received). In other words, you will owe taxes on any investment gains.

- If the loan is not repaid and the interest accrues, causing the loan value to exceed the policy's cash value, the policy could lapse and be terminated by the insurance company. In this case, you would owe income taxes on the overall gain in investments, regardless of the outstanding loan amount.

In summary, while borrowing against your Americo whole life insurance policy can provide quick access to cash, it's important to understand the potential tax implications, especially if the loan is not repaid or the policy lapses. It is always recommended to consult with a financial advisor or tax professional before making any decisions to fully understand the risks and consequences.

Understanding Face Value in Term Life Insurance Policies

You may want to see also

Borrowing against whole life insurance: alternatives

Borrowing against your whole life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it is important to understand the specifics and potential pitfalls of this option before making a decision. Here are some alternatives to borrowing against your whole life insurance policy:

Understand the Pros and Cons of Borrowing against Whole Life Insurance:

Before considering alternatives, it is important to weigh the pros and cons of borrowing against your whole life insurance policy. On the positive side, these types of loans typically have lower interest rates than bank loans or credit cards, and there is no formal approval process or impact on your credit score. However, if the loan is not repaid before the policyholder's death, the beneficiary will receive a reduced death benefit. Additionally, there is a risk of the policy lapsing if the loan plus interest exceeds the policy's cash value, which could result in tax consequences.

Explore Traditional Loans:

Traditional loans from banks or credit unions can be a viable alternative to borrowing against your whole life insurance. While they may have higher interest rates and a more formal approval process, they do not carry the same risk of reducing the death benefit for your beneficiaries. It is worth comparing interest rates and repayment terms to make an informed decision.

Consider Other Sources of Funding:

Depending on your financial needs and situation, there may be other sources of funding available to you. For example, you could explore options such as personal loans, home equity loans or lines of credit, retirement account loans, or even borrowing from friends or family. Each of these options will have its own set of advantages and disadvantages, so be sure to do your research and understand the terms and conditions before proceeding.

Review Your Financial Situation:

Before making any borrowing decisions, it is important to review your financial situation and explore options for improving your cash flow or reducing expenses. This could include creating a budget, cutting back on non-essential spending, or looking for ways to increase your income through salary negotiations, taking on additional work, or selling unwanted items.

Seek Professional Financial Advice:

Consulting with a financial advisor or planner can help you explore all your options and make an informed decision. They can provide personalized advice based on your unique financial situation and goals. A financial advisor can also help you understand the potential risks and benefits of each alternative, ensuring that you make a well-informed choice.

Applying for a Life Insurance License in New York

You may want to see also

Frequently asked questions

You can borrow against your life insurance policy if it has a cash value. This is usually the case with whole life insurance plans but not with term life insurance policies.

It can take several years for your policy to accumulate enough cash value to take out a loan.

Borrowing against your life insurance policy can give you quick access to cash without a credit check or affecting your credit score. It also has flexible repayment terms and low-interest rates.

Borrowing against your life insurance policy will reduce the death benefit. It also risks the policy lapsing and significant interest accumulation.

You can typically borrow up to 90% of the cash value of your life insurance policy.