Navigating the world of health insurance can be complex, and it's often challenging to determine if you have Kaiser Permanente coverage. This guide aims to simplify the process by providing clear steps to verify your insurance status. Whether you're a current member or new to Kaiser, understanding your insurance details is crucial for accessing healthcare services and managing your health effectively. By following these steps, you can quickly and accurately confirm your Kaiser insurance status, ensuring you receive the care you need.

What You'll Learn

- Check Your ID Card: Your Kaiser ID card is a key indicator of your insurance coverage

- Review Your Membership Materials: Membership documents often outline your insurance details

- Contact Kaiser: Reach out to Kaiser's customer service for verification

- Online Account Access: Log in to your Kaiser online account to view your coverage

- Bill Statements: Review your bills for confirmation of Kaiser insurance

Check Your ID Card: Your Kaiser ID card is a key indicator of your insurance coverage

Checking your Kaiser ID card is a straightforward way to confirm your insurance coverage. This card is a physical representation of your insurance status and provides essential details about your Kaiser benefits. Here's a step-by-step guide on how to verify your insurance through your ID card:

Locate Your ID Card: Start by finding your Kaiser ID card. It is typically provided to you when you enroll in the Kaiser Permanente health plan. The card is usually valid for a specific period, so it's essential to keep it accessible. You can often find it in your mail, in your wallet, or with your medical records.

Examine the Card's Information: The ID card contains critical details that confirm your insurance coverage. Here are some key elements to look for:

- Your Name: Ensure that your full name is correctly spelled and matches your identification.

- Member ID: This unique identifier is crucial for billing and service purposes. It is usually a series of letters and numbers.

- Coverage Type: Check the type of coverage you have, such as individual, family, or dependent.

- Effective Dates: Verify the start and end dates of your coverage to understand the validity period.

- Network Information: Kaiser ID cards often include network details, indicating which medical facilities and providers are covered under your plan.

Contact Kaiser Support: If you are unsure about any information on the card or if it is missing, contact Kaiser's customer support. They can assist in verifying your coverage and provide guidance on any necessary actions, such as replacing a lost or damaged card.

Online Verification: In addition to checking the physical ID card, Kaiser may offer an online verification process. You can log in to your Kaiser account on their website or mobile app to access your member information, including coverage details. This method provides real-time updates and allows you to quickly confirm your insurance status.

By following these steps and utilizing the information on your Kaiser ID card, you can easily determine your insurance coverage and ensure that you have the necessary details to access healthcare services and manage your benefits effectively. Remember, keeping your ID card secure and up-to-date is essential for a smooth healthcare experience.

The Uninsurable Razer Phone: A Revolutionary Device's Insurance Conundrum

You may want to see also

Review Your Membership Materials: Membership documents often outline your insurance details

Reviewing your membership materials is a crucial step in confirming your Kaiser Insurance coverage. These documents, which may include membership cards, welcome packets, or online account summaries, often provide essential details about your insurance plan. Here's a breakdown of what to look for:

Membership Card: Your Kaiser membership card is a tangible indicator of your insurance status. It typically displays your name, member ID, and sometimes a unique identification number. This card is often your primary source of information regarding your coverage. Look for any mention of Kaiser Permanente or a similar name associated with your plan.

Welcome Packet: When you first enroll in Kaiser, you'll likely receive a welcome packet containing comprehensive information about your membership. This packet might include a summary of benefits, coverage details, and important contact information for customer service. Carefully review this document for any references to Kaiser Insurance and the specific plan you have enrolled in.

Online Account: Many Kaiser members have access to online account portals. Log in to your Kaiser account and navigate to the 'My Coverage' or 'Benefits' section. Here, you should find detailed information about your insurance plan, including coverage types, copayments, and network providers. This online resource can provide real-time updates on your membership status.

Contact Kaiser: If you're still unsure, don't hesitate to reach out to Kaiser's customer service. They can verify your membership status and provide clarification on your insurance coverage. You can typically find contact information on your membership materials or on the Kaiser website.

By carefully reviewing these membership materials, you can gain a clear understanding of your Kaiser Insurance coverage. This process ensures that you have the necessary information to access healthcare services confidently and take advantage of your benefits. Remember, keeping your membership materials organized and easily accessible is essential for quick reference.

Hospice Care: Understanding Insurance Coverage and Costs

You may want to see also

Contact Kaiser: Reach out to Kaiser's customer service for verification

If you're unsure about your insurance coverage, the most direct way to verify whether you have Kaiser Insurance is to contact their customer service. Kaiser offers a range of health plans and services, and their customer service team is equipped to provide you with accurate information about your specific coverage. Here's a step-by-step guide on how to reach out to them:

- Gather Your Information: Before making the call, have your personal details ready, including your full name, date of birth, and any other identifying information you can recall. Also, have your Kaiser membership number or any other relevant documentation at hand. This information will help the customer service representative quickly access your account and provide accurate details.

- Contact Kaiser's Customer Service: You can reach Kaiser's customer service by calling their toll-free number, which is typically provided on their website or on the back of your ID card. When you call, you will be prompted to select your preferred language. Choose the language you are most comfortable with to ensure clear communication.

- Speak to a Representative: After selecting your language, you will be connected to a customer service representative. Clearly state your concern or question regarding your insurance coverage. For example, you could say, "I'm calling to verify if I am covered under Kaiser's insurance plan." Provide the representative with the necessary details they may ask for to confirm your identity.

- Request Verification: Ask the representative to verify your insurance status. They might ask for specific details, such as the type of plan you have, the effective date of coverage, or any recent changes to your membership. Provide these details accurately to ensure a smooth verification process. If the representative confirms your coverage, they will also provide you with information about your benefits, copayments, and any other relevant details.

- Follow Up if Necessary: If you still have doubts or require further clarification after the call, don't hesitate to follow up with Kaiser's customer service. They can provide additional documentation or explain any complex aspects of your plan to ensure you have a comprehensive understanding of your Kaiser Insurance coverage.

Remember, Kaiser's customer service team is there to assist you, so providing accurate and timely information will make the verification process more efficient.

Affordable Insurance: Am I Covered?

You may want to see also

Online Account Access: Log in to your Kaiser online account to view your coverage

To determine if you have Kaiser Insurance, you can start by checking your Kaiser online account. Kaiser offers a secure online portal that provides members with easy access to their account information. Here's how you can log in and view your coverage:

First, visit the Kaiser website and locate the 'Online Account Access' section. This is typically found on the homepage or in the 'For Members' tab. Click on the 'Log In' button and enter your unique username and password. If you don't have an account, you will need to create one by providing your personal details and insurance information. The registration process is straightforward and usually requires basic personal and contact information.

Once logged in, you will be directed to your personalized dashboard. This is where you can find comprehensive details about your Kaiser coverage. Look for sections labeled 'My Coverage,' 'Benefits,' or 'Plan Information.' Here, you should see a summary of your insurance plan, including the type of coverage, any additional benefits, and the duration of your membership. You can also view important documents such as your membership card, insurance card, and any relevant notices or updates.

In addition to viewing your coverage, the online account provides other useful features. You can manage your personal information, update your contact details, and make changes to your account settings. You might also have the option to view your medical records, schedule appointments, and access online resources related to your health and well-being. Kaiser's online platform aims to provide a convenient and secure way to manage your insurance and healthcare needs.

Remember, having an online account with Kaiser Insurance offers a quick and efficient way to verify your coverage and stay informed about your healthcare benefits. It is a valuable resource for members to access important information and manage their insurance-related tasks conveniently.

Healthcare Administrators: Insurance Savvy or Just Pretending?

You may want to see also

Bill Statements: Review your bills for confirmation of Kaiser insurance

When it comes to confirming your insurance coverage, reviewing your bill statements is a crucial step. Kaiser Permanente, a well-known healthcare provider, offers various insurance plans, and understanding your coverage is essential for accessing the care you need. Here's a guide on how to review your bill statements to confirm your Kaiser insurance:

Understanding Your Bill Statements:

Bill statements from Kaiser Permanente provide detailed information about your healthcare services and insurance coverage. These statements are typically sent to you after a medical visit, procedure, or hospitalization. It is important to carefully examine these statements to ensure accuracy and identify your insurance details. Look for the following key elements:

- Insurance Information: Your bill statement should clearly indicate the insurance provider and plan type. It might show Kaiser Permanente as the billed party and list your specific insurance plan number or member ID. This information confirms that Kaiser is the primary payer for your healthcare services.

- Date of Service: Review the dates associated with each bill item. These dates should align with the services you received, ensuring that the charges are for the correct period.

- Service Description: Pay attention to the descriptions of the services billed. They should match the treatments or procedures you received, providing a clear picture of what was covered by your insurance.

Steps to Confirm Kaiser Insurance:

- Check for Kaiser Branding: Look for any references to Kaiser Permanente on the bill statement. This could include the company name, logo, or specific terminology related to Kaiser.

- Verify Plan Details: Ensure that the plan type and member information match your Kaiser insurance details. You can cross-reference this with your Kaiser membership card or online account information.

- Review Charges and Copays: Examine the charges for any services. Kaiser insurance typically covers a portion of the costs, and you might be responsible for copays or deductibles. Understanding these charges can help you track your out-of-pocket expenses.

- Contact Kaiser Support: If you have any doubts or need further clarification, reach out to Kaiser's customer support. They can provide accurate information about your insurance coverage and assist in resolving any billing discrepancies.

By carefully reviewing your bill statements, you can confirm that Kaiser insurance is covering your healthcare expenses. This process ensures that you have the necessary documentation to manage your healthcare and financial responsibilities effectively. Remember, staying informed about your insurance coverage is a proactive approach to maintaining your health and well-being.

Becoming a Pet Sitter: Bonding and Insurance Explained

You may want to see also

Frequently asked questions

You can verify your Kaiser coverage by logging into your online account on the Kaiser Permanente website. If you don't have an account, you can contact their customer service team, who will guide you through the process of creating one. Alternatively, you can also check your insurance card for the Kaiser logo and member information.

There are several methods to confirm your insurance status. You can call the Kaiser Permanente member services number and provide your personal details to verify your membership. Additionally, you can visit a local Kaiser facility and ask for a verification of your insurance coverage.

Yes, Kaiser Permanente offers a mobile app called 'My Kaiser' which provides members with easy access to their insurance information. You can download the app and log in using your member ID and password to view your coverage details, find healthcare facilities, and manage your account.

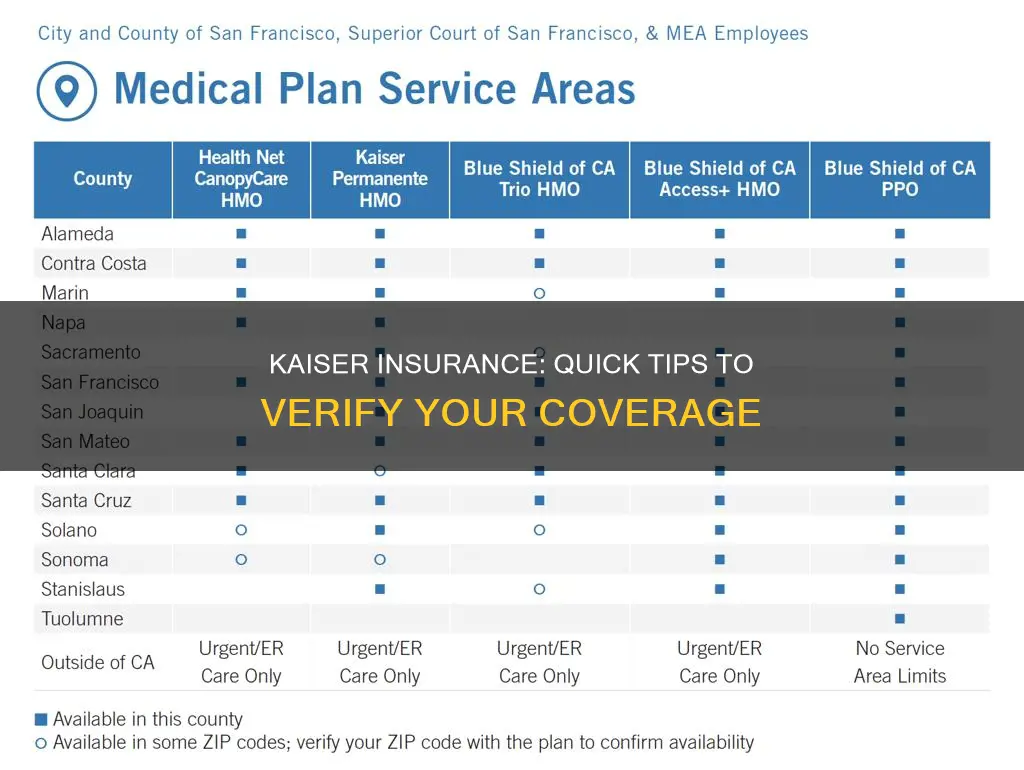

Kaiser Permanente offers insurance to individuals and families in specific regions. You can determine your eligibility by checking their website for coverage areas. If you live in a covered area, you can then apply for membership by providing necessary documentation, such as proof of residence and income.