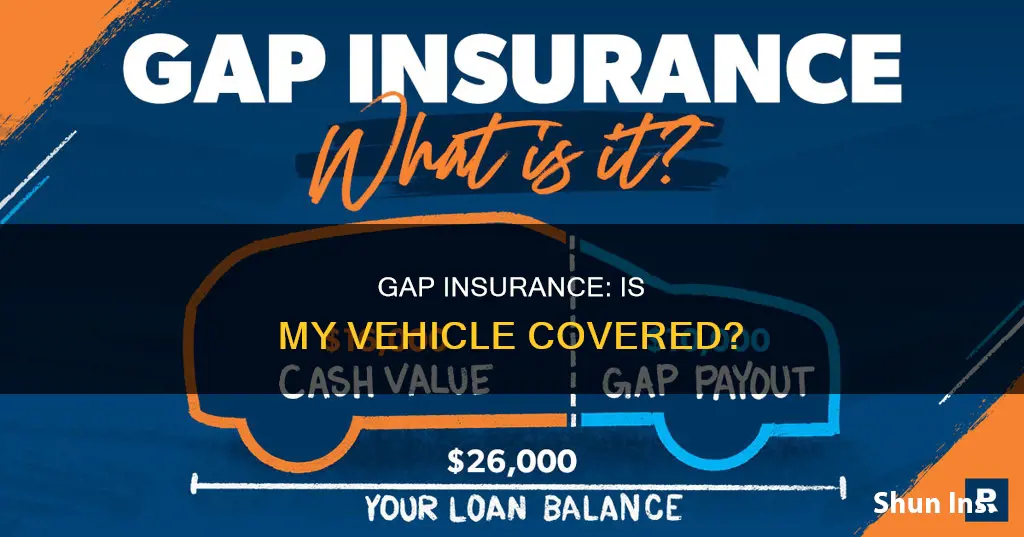

If you're unsure whether you have gap insurance, it's important to check before shopping for a new auto policy. Gap insurance covers the difference between what you owe and what your insurance company pays if your car is stolen or damaged. It is optional and intended for those who lease or finance a new car and owe more on the car than it's worth at the time of the incident. To find out whether you have gap insurance, check your existing car insurance policy and the terms of your loan or lease. Drivers can get gap insurance through their insurance company as an add-on or separately through their auto lender, so it's important to look for gap coverage in the list of coverages provided by both.

| Characteristics | Values |

|---|---|

| How to know if your vehicle has gap insurance | Check your existing car insurance policy and the terms of your loan or lease |

| Check with your car insurance company | |

| Check with your auto lender | |

| Check your financial documents | |

| Review your current lease | |

| Speak with your dealership | |

| Contact your insurance agency |

What You'll Learn

Check your car insurance policy

To find out whether you have gap insurance, the first thing you should do is check your existing car insurance policy and the terms of your loan or lease. Gap insurance is often offered as an add-on by car insurance companies, so you should look for it in the list of coverages provided. You can look through your recent bills or log in to your account on the company's website. If you can't find the information you need, you should call your insurance company and ask about your coverage.

If you didn't buy gap insurance from your car insurance company, you might have purchased it from the dealership, bank, or credit union that supplied your loan or lease. It can sometimes be included in your contract automatically, so check your lease or loan paperwork carefully. If you're leasing a vehicle, your lease agreement may require that you have gap insurance in case of a total loss.

If you're still unsure, you can contact your car dealership to see if gap insurance is included through them. Dealerships often recommend that new vehicle owners buy gap insurance when they purchase a new car, so they should be able to tell you if you have it.

Finally, if you can't find any evidence of gap insurance in your car insurance policy, financial documents, or lease/loan agreement, then you probably don't have it. However, as a last resort, you can look through your financial records, such as online bills, credit card statements, and chequebook, for any clues.

Assurant: Vehicle Insurance Available?

You may want to see also

Check with your auto lender

If you didn't buy gap insurance from your car insurance company, you might have purchased it from the dealership, bank, or credit union that gave you a loan or lease. It can be easy to overlook gap insurance from these sources as it's sometimes included in your contract automatically.

If you financed your vehicle through a bank or other lender, check the documents from both the dealer and the lender. Either of them might have included gap coverage automatically. Many dealers will automatically include gap coverage, but you can decline their coverage if you prefer to buy through your insurer or if your loan terms don't require gap coverage.

If you're unsure where you got your gap coverage in the first place, you'll likely need to check several places to get a definitive answer. If you know you bought gap coverage initially and are unsure whether you still have it, you can usually check by calling your agent or insurance company.

If you didn't get gap insurance from your auto lender, you can still ask them about buying it or adding it to your existing policy. It will probably be cheaper to add it to an existing policy rather than getting a separate gap insurance policy.

Vehicle Insurance: Comprehensive Coverage Explained

You may want to see also

Check your financial documents

If you are unsure whether you have gap insurance or not, it is a good idea to check your financial documents. This is because gap insurance is often offered as an optional add-on by car insurance companies or car dealers.

Your current lease or loan paperwork may include gap insurance, so check your lease documents. Some lease agreements include gap insurance as standard, but in most cases, you will have to pay extra for it. Your lease will detail if you have gap insurance through your dealership. That is the best way to know for certain if you need to invest in a separate policy. If it is not mentioned in the paperwork, you can purchase it at any time after from a car insurance company.

If gap insurance is not included in the lease or loan agreement, check with your car dealership to see if it is included through them. Dealers will often strongly suggest that new vehicle owners buy gap insurance when they purchase a new car. Your dealership may recommend a trusted provider for gap insurance and help you get started.

If you financed your vehicle through a bank or other lender, check the documents from both the dealer and the lender. Either of them might have included gap coverage automatically.

Insurance First: Buying a Car

You may want to see also

Contact your car dealership

If you are unsure whether you have gap insurance, it is a good idea to contact your car dealership. This is because gap insurance is often included when purchasing a vehicle, although you can decline it. Dealerships may also include a gap waiver in your loan or lease, which eliminates the need for gap insurance.

Your dealership may also recommend a trusted provider for gap insurance and help you get started with a policy. It is worth shopping around to get the best deal, as dealership gap insurance can be more expensive.

If you have leased your vehicle, gap insurance may be included as standard. It is worth checking your lease documents to see if this is the case. If it is not mentioned in the paperwork, you can purchase it from a car insurance company.

If you are still unsure whether you have gap insurance, it is worth checking with your car insurance company and your auto lender, as well as looking through your financial documents.

Marriage and Auto Insurance: What Changes?

You may want to see also

Contact your insurance company

If you are unsure whether you have gap insurance, it is a good idea to contact your insurance company. They will be able to provide you with the information you need to determine whether you have gap coverage.

Firstly, you can look through your records, such as recent bills, or log in to your account on the company's website. If this does not provide any clarity, you should call your insurance company to ask about your coverage. It is worth noting that gap insurance is often provided as an add-on to your standard insurance policy, so it is important to check the list of coverages provided by your insurance company.

If you did not purchase gap insurance from your standard insurance company, you may have bought it from your auto lender. In this case, you should check with the dealership, bank, or credit union that supplied your loan or lease. It can be easy to overlook gap insurance from these sources, as it is sometimes included in your contract automatically.

If you are still unsure whether you have gap insurance, you can review your current lease or loan paperwork. Some lease agreements include gap insurance as standard, so this may be included in your contract without a separate payout. However, it is important to note that you may need to pay extra for gap coverage if you purchased it through the lease company.

If you are still unsure, your insurance agent will be able to provide you with the necessary information to determine whether you have gap insurance and, if not, advise you on the best course of action.

Leased Vehicles: Gap Insurance Essential?

You may want to see also

Frequently asked questions

Check your existing car insurance policy and the terms of your loan or lease. Drivers can get gap insurance through their insurance company as an add-on or separately through their auto lender, so it’s important to look for gap coverage in the list of coverages provided by both.

Check with your car insurance company. You can look through records such as your recent bills, or you can log in to your account on the company’s website. If this fails, call to ask about your coverage.

Check with your auto lender. If you didn’t buy gap insurance from your normal insurance company, you could have purchased it from the dealership, bank, or credit union that supplied you with a loan or lease. It can be easy to overlook gap insurance from one of these sources since it’s sometimes included in your contract automatically.

Check your financial documents. If you do not have gap insurance through your dealership, lender, or car insurance company, you probably are not covered. But as a last resort, you can look through your financial records – such as your online bills, credit card statements, and checkbook – to try to find some clues.