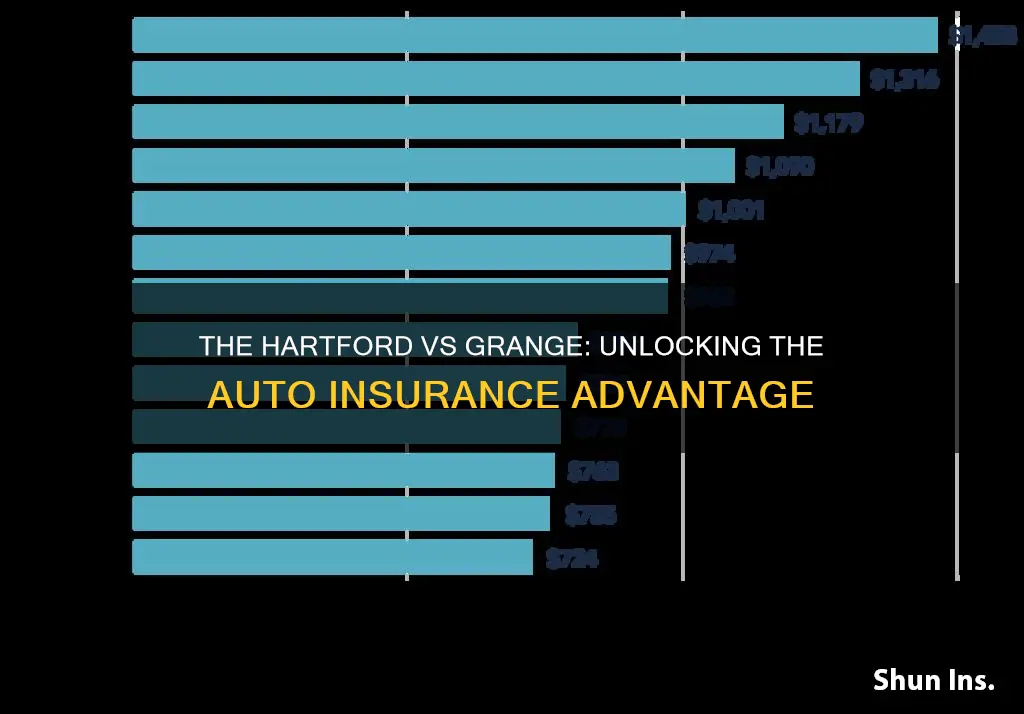

If you're looking for a new auto insurance policy, you might be wondering how The Hartford and Grange Insurance compare in terms of pricing and discounts. Based on national averages, Grange offers slightly cheaper premiums than The Hartford. However, it's important to note that rates can vary depending on factors such as age, driving record, and location. The Hartford, on the other hand, offers more affordable prices for drivers with an at-fault accident on their record.

What You'll Learn

- Grange Insurance vs The Hartford: Which Company Has the Cheapest Rates

- Grange or The Hartford: Which is the Best Company for Young Drivers

- Grange vs The Hartford: Which Company is Best for Retired Drivers

- Grange Insurance vs The Hartford: Average Rates by Gender

- Grange or The Hartford: Compare State Minimum vs Full Coverage Rates

Grange Insurance vs The Hartford: Which Company Has the Cheapest Rates?

If you're looking for a new auto insurance policy, you might be wondering how The Hartford and Grange Insurance compare when it comes to pricing. Here's a detailed comparison of the two companies to help you decide which one is the best fit for your wallet.

Average Rates by State

According to national averages, Grange Insurance offers slightly cheaper premiums than The Hartford. Grange is about $16 per month less expensive than The Hartford, but it's important to note that rates can vary depending on individual factors such as age, driving record, and location.

Best Company for Different Types of Drivers

Young Drivers

Young and inexperienced drivers typically pay higher insurance rates due to their higher risk of getting into accidents. Grange Insurance offers more affordable rates for young drivers, with monthly premiums of $205 for 25-year-olds, compared to The Hartford's $320.

Retired Drivers

When it comes to retired drivers, The Hartford offers slightly more affordable rates, with average monthly premiums of $192 compared to Grange's $200. However, the difference is minimal, and other factors may come into play when determining the best option.

Married Drivers

Married couples often benefit from discounts on car insurance. Grange Insurance offers more significant savings for married policyholders, with monthly premiums that are nearly 15% lower than those of single drivers.

Best Company After a Ticket, Accident, or DUI

Drivers with Speeding Tickets

Both Grange and The Hartford increase premiums for drivers with speeding tickets, but Grange has the lower rate increase at $55 per month, compared to The Hartford's $71.

Drivers After an Accident

Both companies significantly increase rates after an at-fault accident. The Hartford offers more affordable rates for drivers with an at-fault collision, with monthly premiums of $262 compared to Grange's $266.

Drivers with a DUI

A DUI charge will result in a significant increase in premiums for both companies. Grange Insurance offers more affordable rates for drivers with a DUI, with an average monthly premium of $314 compared to The Hartford's $474.

Impact of Credit Score

Drivers with Good Credit

Grange Insurance rewards drivers with excellent credit scores, offering savings of around 15% for those with "good" or "excellent" credit. The Hartford, on the other hand, does not seem to use credit scores as a factor in calculating rates.

Drivers with Bad Credit

Grange Insurance typically charges higher premiums for drivers with poor credit scores. The difference in rates between those with "poor" and "fair" credit can be around $90 per month. The Hartford, by not considering credit scores, may offer better rates for drivers with bad credit.

Commute Distance

Work-from-Home Drivers

The Hartford is the more affordable option for people who work from home, with rates that are about 4% lower than Grange Insurance for those who drive 6,000 miles annually.

Short Commute Drivers

Grange Insurance offers better rates for drivers with short commutes. For those who drive 12,000 miles annually, Grange's rates are about 14% lower than The Hartford.

Urban, Suburban, and Rural Drivers

Rural Drivers

Grange Insurance is the cheaper option for drivers in rural areas, with monthly premiums of $220 compared to The Hartford's $255.

Suburban Drivers

In suburban areas, Grange Insurance also offers more affordable rates, with an average monthly premium of $235 compared to The Hartford's $265.

Urban Drivers

The Hartford is the preferred choice for drivers in urban areas, with monthly premiums of $273, which is slightly lower than Grange's $292.

Discounts Offered

Grange Insurance offers a wider range of discounts than The Hartford, with 28 different discounts compared to The Hartford's 13. Grange provides discounts for advanced safety features, annual mileage, continuous insurance, and more, while The Hartford offers lay-up credit and umbrella policy discounts, among others.

Final Thoughts

Both Grange Insurance and The Hartford have their strengths and weaknesses when it comes to pricing and discounts. Grange tends to be more affordable for young drivers, those with short commutes, and rural or suburban residents. On the other hand, The Hartford may be a better option for retired drivers, those with at-fault accidents, and urban residents. Ultimately, the best choice depends on your unique circumstances and preferences.

Navigating Auto Registration and Insurance: A Guide for Non-Citizens

You may want to see also

Grange or The Hartford: Which is the Best Company for Young Drivers?

Grange Insurance and The Hartford are two insurance companies that offer auto insurance policies. But which is the best for young drivers?

Grange Insurance

Grange Insurance offers cheaper premiums than The Hartford, based on national averages. It also has more affordable rates for policyholders who drive a short distance to work every day. Additionally, Grange has a greater number of discounts available, with 28 compared to The Hartford's 13.

The Hartford

The Hartford has more affordable average prices for drivers who have an at-fault accident on their record. It also has better average rates for young drivers, with 18-year-olds paying over $100 less than those with Grange Insurance. The company also offers a discount of up to 10% for AARP members aged 50 and above.

Both companies offer competitive rates and unique benefits. Grange Insurance may be more suitable for young drivers who do not have an at-fault accident on their record and are looking to take advantage of a wider range of discounts. On the other hand, The Hartford could be a better option for young drivers with an at-fault accident on their record, as well as those who are AARP members or over the age of 50.

Gap Insurance Tax in Florida

You may want to see also

Grange vs The Hartford: Which Company is Best for Retired Drivers?

If you're a retired driver looking for a new auto insurance policy, you might be wondering how The Hartford and Grange compare. While both companies offer competitive rates, there are some key differences to consider.

Based on national averages, Grange offers slightly cheaper premiums than The Hartford. Grange is particularly competitive for retired drivers who drive a short distance to work or have a clean driving record. On the other hand, The Hartford offers more affordable rates for drivers with an at-fault accident on their record.

When it comes to discounts, Grange knocks The Hartford out of the park, offering 28 different discounts compared to The Hartford's 13. Grange also offers unique discounts such as advanced safety feature discounts and agency transfer discounts.

However, The Hartford shines when it comes to customer satisfaction. The company has above-average customer satisfaction ratings for auto insurance shopping and offers free benefits like new car replacement included with AARP auto insurance policies. Additionally, The Hartford primarily caters to customers aged 50 and older through its partnership with AARP, which may be attractive to retired drivers.

In terms of financial strength, The Hartford has received strong ratings from reputable organizations such as AM Best and Standard and Poor's.

In conclusion, both Grange and The Hartford have their advantages for retired drivers. Grange offers lower premiums and a wider range of discounts, while The Hartford excels in customer satisfaction and has strong financial ratings. The best choice for you will depend on your specific needs and preferences. To make an informed decision, be sure to compare quotes and consider the features that are most important to you.

Aspen Insurance Auto: Understanding SR-22 Requirements

You may want to see also

Grange Insurance vs The Hartford: Average Rates by Gender

When it comes to average rates by gender, men tend to be offered more expensive premiums than women because they are more likely to get into collisions and receive tickets. Grange Insurance and The Hartford's rates reflect this trend, with Grange Insurance offering men premiums that are around 5% higher than those for women, and The Hartford offering the same rates for both men and women.

However, despite offering the same rates for both men and women, The Hartford's rates are still higher than those of Grange Insurance. On average, Grange Insurance's premiums are 4% less for men and 8% less for women than The Hartford's.

Travelers Auto Insurance: Understanding Coverage for Non-Policy Drivers

You may want to see also

Grange or The Hartford: Compare State Minimum vs Full Coverage Rates

Grange Insurance and The Hartford are two companies offering auto insurance. When it comes to state minimum vs full coverage rates, there are a few differences between the two.

Grange Insurance

Grange offers more affordable rates for policyholders who have a short commute to work. It also has cheaper premiums for those with a poor driving record, with prices increasing by an average of $55 per month following a ticket, and by over $85 following an accident. Grange's rates are also influenced by age and gender, with younger drivers and men offered more expensive rates.

The Hartford

The Hartford offers cheaper rates for drivers with an at-fault accident on their record. It also offers cheaper rates for older drivers, with prices decreasing by a third for 25-year-olds when compared to 18-year-olds. The Hartford's rates are influenced by location, with cheaper rates offered to those in urban areas.

Grange vs The Hartford

When it comes to state minimum vs full coverage rates, The Hartford offers the cheapest average rates for state minimum liability limits. Grange, on the other hand, has the cheapest rates for full coverage policies.

Overall, Grange Insurance offers slightly cheaper premiums than The Hartford, with a difference of around $16 per month based on national averages. However, it's important to remember that car insurance rates are highly dependent on individual factors, so it's always worth comparing quotes from multiple companies to find the best rate for your specific needs.

Elephant Auto Insurance: Early Cancellation

You may want to see also

Frequently asked questions

Grange Insurance is available to all, whereas The Hartford primarily caters to customers aged 50 and older, offering policies through a partnership with AARP.

Grange offers slightly cheaper premiums than The Hartford, based on national averages for insurance. Grange is about $16 per month less expensive than The Hartford. However, this doesn't necessarily mean Grange will be the more affordable option for every driver.

Grange is the best option for young drivers as The Hartford's rates are higher for this demographic.

The Hartford is the best option for retired drivers, with average prices coming in at around $192 per month compared to Grange's $200.

Grange is the best option for married drivers, with average prices around $205 per month.