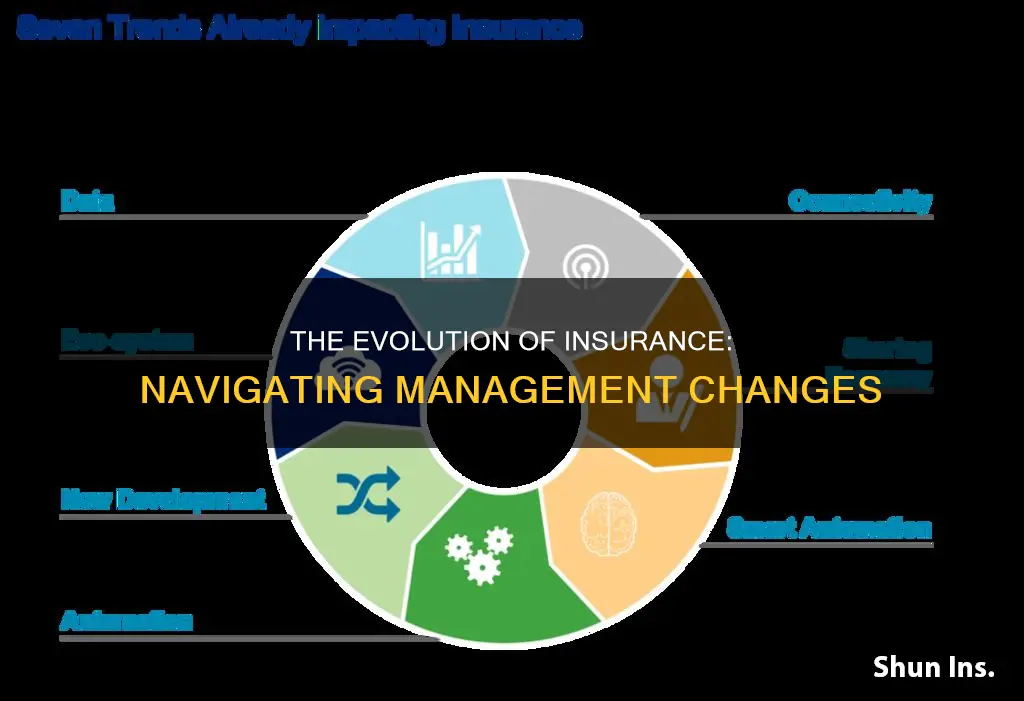

The insurance industry is undergoing a period of rapid change, with digital transformation and technological advances playing a key role in shaping the future of the sector. The industry, which was once considered stable and predictable, is now facing a number of challenges, including the impact of the COVID-19 pandemic, changing customer expectations, and the emergence of new technologies such as artificial intelligence, big data, and the Internet of Things (IoT). As a result, insurance companies are having to adapt and evolve their business models and operations to keep up with the competition and meet the changing needs of their customers.

A key aspect of this transformation is the increasing reliance on digital technology to develop products, assess claims, and provide customers with a satisfying experience. This includes the use of data analytics to better understand customer needs and preferences, as well as the development of new digital tools and platforms to improve the customer experience and enhance operational efficiency.

In addition to technological changes, the insurance industry is also facing pressure to address environmental, social, and governance (ESG) concerns, particularly around sustainability and risk management. As the world becomes increasingly interconnected and vulnerable to natural disasters, insurance companies are having to re-evaluate their business models and find new ways to manage risk and protect their customers.

Overall, the insurance industry is undergoing a period of significant change and transformation, with digital technology and changing customer expectations playing a key role in shaping the future of the sector.

| Characteristics | Values |

|---|---|

| Customer expectations | Shifting at the rate of digital; expect 24/7 support, digital-first experiences, and quick delivery |

| Management changes | Must be open to change and innovation; focus on digitisation, data and integration, brand and distribution, superior and innovative products, strategic partnerships, and effective structuring |

| Technology | Use of Artificial Intelligence (AI), big data, the Internet of Things (IoT), and robotics |

| Data | Data analytics to understand customer needs and identify growth opportunities |

| Business | Focus on customer experience, data-driven decision-making, and providing innovative products |

What You'll Learn

- Embracing Digital Transformation: Adopting new technologies like AI, machine learning, and data analytics to enhance operations and customer experience

- Change Management Challenges: Addressing employee concerns, communicating the purpose of changes, and fostering a change-ready culture to reduce resistance

- IT Modernization: Overhauling core IT systems to improve efficiency, reduce costs, and enable digital capabilities for better decision-making

- Regulatory Compliance: Navigating the highly regulated insurance industry to avoid financial penalties and reputational damage

- Customer Expectations: Meeting evolving customer demands for personalized, digital-first experiences to retain policyholders and attract new ones

Embracing Digital Transformation: Adopting new technologies like AI, machine learning, and data analytics to enhance operations and customer experience

The insurance industry is in the midst of a digital revolution, with carriers encouraged to adopt new technologies to enhance their operations and customer experience. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of this transformation, offering numerous benefits to insurers and customers alike.

Improving Operations and Customer Experience

AI and ML enable insurers to streamline and automate various aspects of their operations, from claims processing to risk assessment and underwriting.

Claims Processing

AI tools can rapidly analyse images, sensor data, and historical information to determine the costs involved in a claim, providing accurate forecasts that benefit both the insurer and the customer.

Risk Assessment and Underwriting

In the past, insurance underwriters relied solely on applicant-provided information to assess risk, which could be inaccurate or dishonest. With AI and ML, insurers can now analyse abstract data sources, such as social media postings and reviews, to better gauge risk and offer tailored premium pricing. This results in more accurate risk assessments and more appropriate premiums for customers.

Fraud Detection

AI is also a powerful tool in the fight against fraudulent claims. AI algorithms can detect patterns in claims data that may escape human cognition, helping to identify suspicious claims and reduce fraud.

Customer Service

The adoption of AI-powered chatbots and digital assistants has revolutionised customer service in the insurance industry. These tools are available 24/7 and can guide customers through various queries and issues without human intervention, providing timely and efficient support.

Embracing Innovation

The digital transformation in the insurance industry is not just about improving existing processes but also about enabling innovation and the development of new insurance products.

Data-Driven Innovation

Insurers have access to vast amounts of data, and AI and ML enable them to analyse and make sense of this data effectively. By leveraging data analytics, insurers can identify new business opportunities, develop more targeted products, and reach new audiences.

New Insurance Products

The digital transformation is paving the way for innovative insurance products, such as pay-as-you-go or usage-based insurance. For example, car insurance that is charged based on actual usage rather than a fixed premium.

Benefits for Insurers and Customers

The adoption of AI and ML in the insurance industry brings advantages for both insurers and their customers.

Benefits for Insurers

- Streamlined and automated operations, reducing workloads and manual errors.

- Improved accuracy in risk assessment and claims processing.

- Enhanced customer service through the use of chatbots and digital assistants.

- Ability to develop innovative products and reach new markets.

Benefits for Customers

- More accurate risk assessments and tailored premium pricing.

- Reduced human error in the application process, resulting in more suitable insurance plans.

- Expanded customer service options and faster claims approval processes.

- Access to innovative insurance products that better meet their specific needs.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Change Management Challenges: Addressing employee concerns, communicating the purpose of changes, and fostering a change-ready culture to reduce resistance

The insurance industry is undergoing significant changes, and management must effectively address employee concerns, communicate the purpose of changes, and foster a culture that embraces innovation to reduce resistance to change. Here are some key considerations for insurance industry management:

Addressing Employee Concerns

When changes are introduced, it is crucial to address employee concerns promptly and transparently. For instance, if an organisation shifts from providing employer-sponsored health insurance to defined contribution plans, employees may perceive this as a reduction in benefits. Management should clarify that this transition does not entail cutting health benefits but rather offers improved benefits and lower costs through individual health insurance plans. Being proactive in addressing concerns and providing clear, timely communication can alleviate employee worries and foster a smoother transition.

Communicating the Purpose of Changes

Effective communication is essential when introducing changes. Organisations should utilise various communication channels such as benefit packets, brochures, presentations, and trainings to educate employees about the shift to defined contribution health care. By sharing cost analyses and individual cost breakdowns, companies can illustrate the financial advantages of the new system to employees. Additionally, keeping communication bidirectional between HR and employees enables concerns to be addressed early on and ensures long-term employee satisfaction.

Fostering a Change-Ready Culture

To thrive in a dynamic environment, insurance organisations must cultivate a culture that embraces innovation and change. This involves encouraging “what if” thinking, challenging traditional business processes, and promoting digital transformation. By adopting new technologies, such as digital records and online portals, insurance companies can enhance data management, personalise customer service, and meet evolving customer expectations. Moreover, leveraging big data and analytics can provide valuable insights for understanding customer needs and making data-driven decisions.

Reducing Resistance to Change

To mitigate resistance to change, management can implement several strategies. Firstly, early and frequent communication about upcoming changes can prevent initial panic and uncertainty among employees. Secondly, providing context for changes, such as explaining the impact of rising prescription drug costs on health insurance decisions, can help employees understand the rationale behind organisational shifts. Lastly, by prioritising employee welfare and keeping pace with technological advancements, insurance companies can adapt to evolving customer and employee expectations in a post-pandemic world.

IT Modernization: Overhauling core IT systems to improve efficiency, reduce costs, and enable digital capabilities for better decision-making

IT modernization is essential for the insurance industry to remain competitive and meet evolving customer expectations. By overhauling their core IT systems, insurance companies can improve operational efficiency, reduce costs, and enable better decision-making through enhanced data capabilities.

Enhancing Operational Efficiency

The insurance industry often relies on complex, legacy IT systems with limited functionalities. Modernizing these systems can streamline operations, eliminate redundancies, address bottlenecks, and improve overall efficiency. This enables insurers to optimize their resources and enhance the employee and policyholder experience.

Reducing Costs

Outdated IT systems can be costly to maintain and hinder cost-saving opportunities. By migrating to modern platforms, insurers can reduce IT costs by up to 41%, as evidenced by the McKinsey Insurance 360° benchmark. This cost reduction is achieved through the use of commodity hardware instead of expensive mainframe systems and the elimination of redundant or underutilized systems.

Improving Decision-Making

Modern IT systems enable insurers to harness the power of data and make more informed decisions. By consolidating data from various sources, insurers can gain a comprehensive view of their customers and the market. This enables data-driven decision-making and helps insurers stay ahead of trends, identify demand-supply markers, and proactively respond to changes.

Enabling Digital Capabilities

Digital transformation is no longer an option for the insurance industry. By modernizing their core IT systems, insurers can leverage digital technologies to enhance the customer experience. This includes faster time-to-market for rate changes and new products, improved customer service through personalized offerings, and increased support for agency and broker sales processes.

In conclusion, IT modernization is crucial for the insurance industry to stay competitive and meet evolving customer demands. By overhauling their core IT systems, insurance companies can achieve significant improvements in efficiency, cost reduction, and decision-making capabilities, ultimately driving business growth and success.

Understanding Dental Insurance Billing: Why the Wait on Claims?

You may want to see also

Regulatory Compliance: Navigating the highly regulated insurance industry to avoid financial penalties and reputational damage

The insurance industry is subject to a complex web of regulatory compliance, with rules varying across jurisdictions. In the US, insurance is regulated at the state level, with each state having its own statutes and rules. This system stems from the McCarran-Ferguson Act of 1945, which established that state regulation and taxation of the industry are in "the public interest". State insurance departments oversee insurer solvency, market conduct, and requests for rate increases.

Compliance in the insurance industry is challenging due to the variety of rules and requirements that apply based on jurisdiction and product offerings. Companies must also comply with federal laws and international standards, particularly when dealing with international customers.

To avoid financial penalties and reputational damage, it is crucial for insurance companies to adhere to the set of regulations imposed on them. These regulations include licensing requirements, data protection, and anti-money laundering (AML) compliance.

Licensing Requirements

Insurance companies and agents must hold a license to sell insurance, which is regulated at the state level in the US. Licenses need to be renewed periodically to ensure compliance. Companies can apply for licenses in other states as "foreign" insurers after obtaining a primary license in their domestic state.

Consumer Data Protection

With the insurance industry collecting vast amounts of personal and sensitive information, data protection is a critical aspect of regulatory compliance. Compliance requirements aim to set standards that help mitigate the risk of data breaches, thereby safeguarding consumer information. Failure to comply can result in severe penalties and reputational damage.

Anti-Money Laundering (AML) Compliance

Insurance companies are prime targets for money laundering due to the large volume of financial transactions they process. AML compliance aims to prevent criminals from using insurance platforms to launder money. Manual AML processes are time-consuming and resource-intensive, so many companies utilize AML compliance management solutions to streamline and optimize their workflows.

Other Regulatory Compliance Areas

In addition to the areas mentioned above, insurance companies must also navigate other regulatory requirements, such as:

- Regulatory oversight of AI use: As the insurance industry adopts AI and machine learning, companies must adapt their compliance strategies to balance rewards with regulatory expectations, such as preventing bias and discrimination in AI models.

- Safeguarding solvency: Regulators are implementing new compliance frameworks to maintain the solvency of insurers and protect consumers.

- Consumer protection and care: Regulators are creating initiatives to ensure access and inclusion for consumers while managing threats, such as scrutinizing third-party vendors' access to consumer data.

- Climate change and risk fitness: The impact of climate change is pressuring the industry to build policies addressing changing environmental and weather conditions.

Navigating the highly regulated insurance industry requires a strong understanding of the applicable rules and regulations. By staying on top of regulatory shifts and adapting compliance strategies, insurance leaders can avoid financial penalties and protect their reputation.

Understanding Certificate Holders: Decoding Insurance Jargon for the Uninitiated

You may want to see also

Customer Expectations: Meeting evolving customer demands for personalized, digital-first experiences to retain policyholders and attract new ones

The insurance industry is facing a period of change, with customer expectations evolving rapidly. Customers now demand a digital-first approach, with online options and apps, but also want personalized experiences and customized products.

Meeting Customer Demands

The insurance industry has traditionally been slow to change, but the COVID-19 pandemic accelerated the need for digital transformation. Insurers now need to meet the evolving demands of customers, who are increasingly looking for digital-first experiences. This means insurers must offer online options and apps, but also provide personalized experiences and customized products.

Understanding Customer Needs

In the past, insurance agents built personal relationships with customers, knowing a lot about their lives. Now, customers can educate themselves and make decisions about insurance before ever contacting an agent. This shift means that insurers need to find new ways to understand their customers' needs and quickly address them. Data-driven interactions and the use of customer data are key to forging loyalty and providing relevant, personalized experiences.

Digital Tools

Digital tools and platforms can make the insurance process more efficient and convenient. For example, customers value online interfaces with self-service features and the ability to track interactions in real time. Digital tools also allow insurers to engage with customers more efficiently and effectively, with personalized messages, and improve speed, service, and consistency to raise satisfaction.

Overcoming Barriers

One of the main barriers to improving customer journeys is understanding what customers value. This requires deep customer insights, solid analytics, and modeling customer journeys. Insurers need to align on the type of experience they want to deliver and take a holistic approach to transforming the customer experience. This includes creating a comprehensive vision, developing customer insights, making improvements, and building a customer-centric culture.

Prioritizing Innovation

Insurers need to prioritize innovation and embrace new technologies to meet evolving customer demands. This includes investing in technology and talent, even if it is not an immediate profit center. By cultivating these areas, insurers can tap into future opportunities and continue to evolve.

Focusing on the Human Element

While digital services can generate efficiencies, the insurance industry still requires human interaction. It is important to automate responsibly, ensuring that automation and artificial intelligence are used to supplement human connections, rather than replace them. Engaged employees with strong soft skills, creativity, and emotional intelligence are crucial to driving innovation and connecting with customers.

In summary, to meet evolving customer demands, insurers need to offer digital-first experiences and provide personalized, customized products. This requires a deep understanding of customer needs, the use of digital tools, and a focus on innovation and human connections. By prioritizing these areas, insurers can retain policyholders and attract new ones.

Frequently asked questions

The insurance industry has been undergoing a digital transformation to keep up with the times. This includes the use of Artificial Intelligence (AI), big data, the Internet of Things (IoT), and robotics. This transformation has helped insurance companies enhance product development and offer new channels such as digital-first experiences and 24/7 support.

Management in the insurance industry has had to adapt to the digital transformation by focusing on their employees. Employees will be concerned about personal change, which can create resistance and anxiety. To address this, leaders should clearly articulate the changes being made and how they will impact individuals. Leaders should also listen carefully to employees' responses and address any concerns, fears, or apprehensions.

The digital transformation in the insurance industry has brought about several benefits, including increased efficiency, improved customer interactions, automated claims processing, and more accurate decision-making. It has also helped insurance companies to become more agile and scalable, enabling them to adapt to new technologies and market demands.

The digital transformation in the insurance industry also presents several challenges, including data privacy and security concerns, the need for significant IT infrastructure investments, regulatory compliance, and increased operational risks.