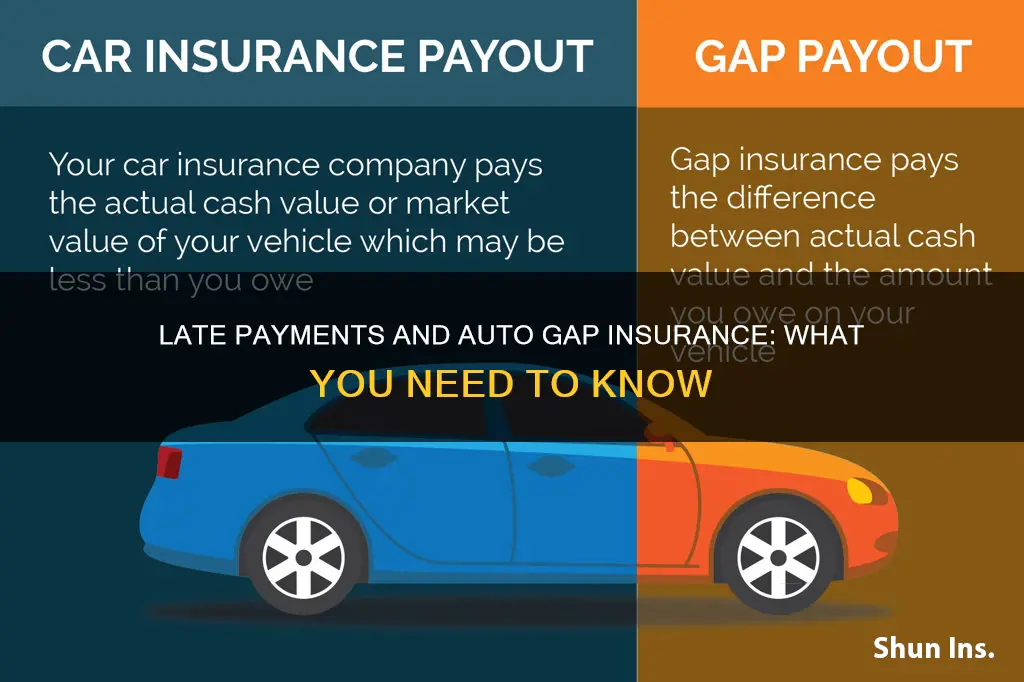

Late payments can affect auto gap insurance payouts by reducing the amount of money that the policyholder receives. Gap insurance covers the difference between the actual cash value of a car and the remaining balance of a loan or lease in the event of a total loss. However, it does not cover overdue payments or late fees. Therefore, if a car is totalled before the policyholder catches up on late payments, the gap insurance payout will not cover the payments that are in arrears.

| Characteristics | Values |

|---|---|

| Effect of late payments on auto gap insurance payouts | Auto gap insurance won't cover overdue payments or late fees on car loans or leases. Gap insurance also won't pay out for any past-due payments if the car is totalled before catching up on payments. |

What You'll Learn

- Late payments won't void your gap insurance policy, but they won't be covered in the payout

- Gap insurance covers the difference between the depreciated value of the car and the loan amount owed

- Gap insurance is optional but often required by lenders or leasing companies

- You can skip gap insurance if you made a large down payment or are paying off the car in under five years

- Gap insurance doesn't cover engine failure or other mechanical repairs

Late payments won't void your gap insurance policy, but they won't be covered in the payout

If you have overdue payments or were granted a payment holiday, these amounts won't be covered by your gap insurance policy. This is because, if you had made your payments on time, these amounts wouldn't be due at the time of the total loss. In other words, your gap insurance won't pay for any past-due payments if you total your vehicle before catching up on late payments.

Being late with your car payments can have consequences for your gap insurance coverage. While your policy won't be voided, you may not receive the full expected payout if you have outstanding balances or late fees. It's essential to stay current on your car loan payments to ensure that your gap insurance provides the intended financial protection in the event of a total loss.

Additionally, gap insurance has other limitations. It won't cover the cost of replacing your car with a brand-new vehicle. Instead, it reimburses you for the depreciated value of your car, which is what your regular insurance would typically pay. Gap insurance also doesn't cover extended warranties, credit life insurance, or other insurance purchased with the loan or lease. It's important to understand the terms and conditions of your gap insurance policy to know what is and isn't covered.

Chubb Auto Insurance: What You Need to Know

You may want to see also

Gap insurance covers the difference between the depreciated value of the car and the loan amount owed

Gap insurance, sometimes short for "guaranteed auto protection", covers the difference between the depreciated value of a car and the loan amount owed. This type of insurance is particularly useful if you owe more on your car loan than the car is worth.

When a car is totalled or stolen, a basic auto insurance policy will pay out the actual cash value (ACV) of the car, which factors in depreciation and may not be enough to pay off the remainder of the loan or lease. Gap insurance covers this "gap" between the ACV and the remaining loan amount. For example, if you owe $20,000 on a financed car, but due to depreciation, the car's ACV is $15,000 when it is totalled, gap insurance will cover the $5,000 difference.

Gap insurance is especially important for car owners who have not made a down payment, or who have chosen a long loan term. It is also useful for those who have rolled over negative equity from an old car loan into a new loan. In these cases, gap insurance could protect against potentially negative financial consequences if the vehicle is declared a total loss.

Gap insurance is not mandatory, but it may be required by your financing agreement or lease contract. It is also worth noting that gap insurance does not cover overdue loan payments. While being late with a car payment will not void a gap insurance policy, it also means that if the vehicle is totalled before payments are caught up, the gap insurance will not pay out for the overdue payments.

U.S. Auto Insurance Availability in Michigan: Unraveling USAA's Offerings

You may want to see also

Gap insurance is optional but often required by lenders or leasing companies

Lenders and leasing companies may require gap insurance to protect themselves from car owners who walk away from a loan or lease if the car is totalled or stolen. Gap insurance can also be useful if you owe more on your car than it is worth. In this case, gap insurance can help bridge the financial gap and cover the remaining balance of your loan.

While gap insurance is not mandatory, it can provide valuable financial protection in certain situations. It is worth considering if you have a long financing term, a small down payment, or a vehicle that is likely to depreciate quickly. By purchasing gap insurance, you can ensure that you are protected in the event of a total loss or theft of your vehicle.

It's important to note that gap insurance does not cover overdue payments or late fees. If you have overdue payments, your gap insurance policy will not cover these amounts. Therefore, it is essential to stay up to date with your payments to ensure that you are fully covered by your gap insurance policy.

Insuring Other Drivers: Adding Names to Your Auto Insurance Policy

You may want to see also

You can skip gap insurance if you made a large down payment or are paying off the car in under five years

Gap insurance, or "guaranteed auto protection", covers the difference between the depreciated value of a car and the loan amount owed if the car is involved in an accident. It is useful if you have a long payoff period or have made no down payment, as you may owe more than the car's current value.

If you have made a large down payment of 20% or more, or are paying off the car in under five years, you may not need gap insurance. This is because you are less likely to owe more than the car is worth, reducing the financial risk.

Gap insurance is designed to protect drivers from losing out financially if their car is written off or stolen. It is an optional extra that can be purchased from car insurance companies, banks, or credit unions. It is also sometimes offered by car dealerships, but this can be a more expensive option.

If you are paying off your car within five years, you are less likely to owe more than the car is worth, and so you can skip the gap insurance. This is because the value of a car depreciates quickly over time. A large down payment also reduces the risk of being in negative equity, where you owe more than the car is worth.

It is worth noting that gap insurance does not cover overdue payments and late fees on car loans or leases. If you fall behind on payments, gap insurance will not cover the missed payments. However, it will not void your policy if you are late with a payment.

Auto Insurance: Tire Damage Covered?

You may want to see also

Gap insurance doesn't cover engine failure or other mechanical repairs

Gap insurance is an optional form of auto insurance that covers the difference between the book value of a totalled car and the amount still owed on it. It is designed to cover the gap between a vehicle's actual cash value and the amount owed on its lease or loan when it is stolen or totalled. However, gap insurance does not cover engine failure or other mechanical repairs.

Gap insurance is intended to protect drivers who finance or lease their vehicles and worry about being "upside down" on their loan or lease if their car is totalled in an accident. It is not required by any state as part of a car insurance policy, but it is often required by lenders or leasing companies. Gap insurance typically costs around $61 a year and must be purchased shortly after buying or leasing a new car, usually within 30 days.

While gap insurance covers the difference between the amount owed on a vehicle and its actual cash value, it does not provide coverage for overdue payments, security deposits, add-on equipment, or mechanical issues such as engine or transmission failure. These exclusions are important to understand, as they highlight the limitations of gap insurance. In the event of engine failure, alternative forms of coverage, such as mechanical breakdown insurance or a vehicle warranty, may provide the necessary protection.

Progressive Auto Insurance: Does Canada Get Covered?

You may want to see also

Frequently asked questions

No, being late with your car payment won't void your gap insurance policy. However, if you total your vehicle before catching up with payments, your gap insurance won't cover the payments you missed.

Gap insurance covers the difference between what you owe on a car lease or loan and the amount paid out in a total loss settlement from an auto insurer, minus your deductible.

Gap insurance does not cover overdue payments and late fees on your car loan or lease, extended warranties, carry-over balances from previous loans or leases, lease penalties for high mileage or excessive use, charges for credit insurance connected to the loan, and a down payment for a new car.

Gap insurance does not pay out if your vehicle is damaged but repairable. It only covers total losses. Gap insurance also does not cover other property or injuries resulting from an accident, nor does it cover engine failure or other repairs.