Travelers is one of the largest insurance providers in the US, offering a wide range of coverage options and add-ons for drivers. The company has a good reputation, with an A++ financial strength rating from AM Best and a rating of 4.2 out of 5 from customers.

Travelers' auto insurance rates are affordable, with full coverage costing around $1,595 per year, which is 20% lower than the national average. The company also offers a safe driving app that can help motorists save money.

In addition to standard coverage options, Travelers offers add-ons such as accident forgiveness, gap insurance, and new car replacement coverage. The company also provides non-owner and rideshare insurance, although the latter is not available in all states.

Overall, Travelers is a reliable and affordable option for drivers seeking customizable coverage.

| Characteristics | Values |

|---|---|

| Industry standing | Ranked first out of 130 insurance providers by MarketWatch. Rated 4.7 stars out of 5 by Forbes. Rated 3.7 stars out of 5 by U.S. News. |

| Availability | Available in 42 states and Washington, D.C. |

| Coverage | Offers standard types of car insurance, including bodily injury liability, property damage liability, collision insurance, comprehensive insurance, medical payments, personal injury protection, uninsured motorist/underinsured motorist. Optional coverage includes accident forgiveness, diminishing deductible, gap insurance, new car replacement coverage, rental car reimbursement, rideshare insurance, roadside assistance, usage-based insurance. |

| Cost | Full coverage auto insurance costs around $1,595 per year. Minimum liability coverage is about $648 annually. |

| Customer experience | Rated 4.2 out of 5 in a MarketWatch survey. Rated 3.4 stars out of 5 by Forbes. Rated 3.7 stars out of 5 by U.S. News. |

What You'll Learn

Discounts and add-ons

Travelers Insurance offers a wide range of discounts and add-ons to help you customise your car insurance policy.

Discounts

- Multi-policy discount: Save up to 13% when you buy multiple types of insurance from Travelers.

- Multi-car discount: Save up to 8% when you insure more than one car on the same policy.

- Home ownership discount: Save up to 5% if you own your home instead of renting.

- Safe driver discount: Save up to 10% if you have no accidents, violations or major comprehensive claims for at least three years.

- Continuous insurance discount: Save up to 15% for maintaining car insurance consistently, without any gaps in coverage.

- Hybrid/Electric vehicle discount: Save if your vehicle is a hybrid or electric car.

- New car discount: Save up to 10% for insuring a brand-new car.

- EFT discount: Save 2-3% if you set up autopay for your premium.

- Paid-in-full discount: Save up to 7.5% for paying your entire premium upfront.

- Good payer discount: Save up to 15% if you haven't been charged any late payment fees within the past 12 months.

- Early quote discount: Save 3-10% if you get a quote before your new policy goes into effect.

- Good student discount: Save if you have at least a B average and are enrolled full-time in high school or college.

- Student away at school discount: Save up to 7% if a driver on your policy attends school at least 100 miles away from where the car is parked.

- Driver training discount: Save up to 8% for taking a driver's education or driver training course.

- IntelliDrive discount: Save up to 30% if you allow Travelers to track your driving habits, including speed and acceleration. You must drive less than 13,000 miles per year to qualify.

Borrowed Cars: Am I Covered?

You may want to see also

Customer reviews

"They are top notch. Customer service is great. Their technology is 1st level. Price-wise they beat everyone including Geico. I am impressed. Roadside assistance which I had to use..."

"I know that they have to look out for their shareholders first and then their workers. Also, it's a business that needs to make money. There have been several claims recently, lawsuits, etc. according to reports. On the other hand, it seems that when these big companies cough, the small guys get sick."

"Travelers increased my premiums to over $2,000 for 6 months. Slowly over 5 years they did this. I changed to Progressive on 4/7/23 for the same coverage but $600 for 6 months. Then Travelers took the premium out of my bank account, even though I canceled in person. I know I will be refunded the $200 Travelers stole, but DAMN they are ruthless. Travelers will steal your money then make you fight to get it back. DO NOT CONTRACT WITH TRAVELERS INSURANCE."

"I was just informed that Travelers Auto Insurance charges "processing fees" no matter how you pay unless you "pay the policy in full" or "trick the system by paying the monthly fee twenty-two days early". This is fraud at its finest. Don't do business with Travelers."

"I was provided two account numbers. I sent the annual auto payment $1,500. They sent it to my mortgage co. I owed nothing there so they sent it back. Fiasco started 6/16/22. 7/8/22 zero refund."

"After months of them failing to notify me of arbitrary forms, they canceled me without warning and caused a massive amount of lapsed insurance fees from the DMV, and to top it off they refused to reinstate my policy when the mistake was discovered entirely on my end."

"On 6/23/21 a 18 wheel Truck hit my car in the rear while on 75 north in Jonesboro, Ga. I called Travelers Auto Insurance whom I have coverage with. I got assigned a claim Manager Velma . She provided very brief info, considering the fact that I have never been involved in a car accident. In this case I would have needed some guidance. Anyways whenever advised me to not use my insurance since I was not at fault. She explained that she is very busy and if I need to call her and she don’t pick up, select 0 and get her coworker to assist. Needless to say that every time you call no one from her Team pick up. So as a result you needed up leaving texts, voicemails and emails. The time I did get a rep, she was very informative and rude and. Pasha."

"I was just informed that Travelers charges "processing fees" no matter how you pay unless you "pay the policy in full" or "trick the system by paying the monthly fee twenty-two days early". This is fraud at its finest. Don't do business with Travelers."

Alabama's New Vehicle Insurance Grace Period

You may want to see also

Availability and cost

Travelers Insurance is one of the largest providers of auto insurance policies in the nation. It offers insurance in 42 states and Washington, D.C. It is not available in Alaska, Hawaii, West Virginia, Louisiana, Michigan, South Dakota, North Dakota, or Wyoming.

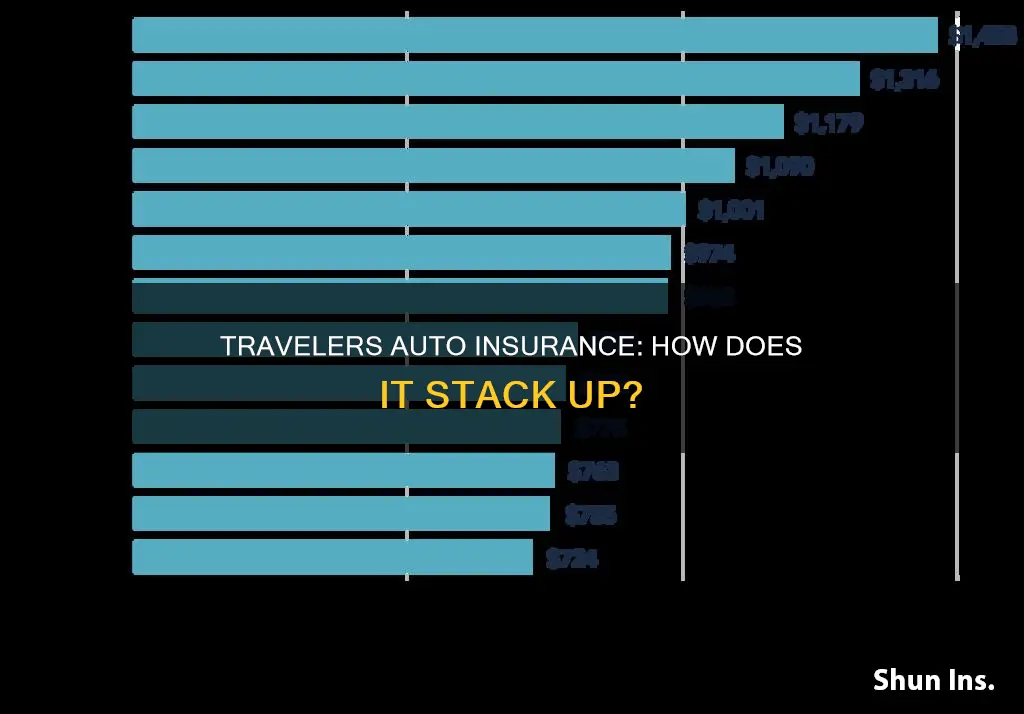

The average cost of car insurance with Travelers is $1,521 per year, according to Forbes Advisor. This is 25% cheaper than the national average of $2,026.

The cost of car insurance varies depending on age, driving record, and credit score. For example, the average cost of insurance for an 18-year-old driver is $2,964, which is 29% lower than the national average. For a driver with a speeding ticket, the average cost is $1,996, 19% below the national average of $2,533.

Full coverage auto insurance from Travelers costs around $1,595 per year, while minimum liability coverage is about $648 annually.

Travelers also offers a range of discounts to help reduce the cost of insurance. These include:

- Multi-policy discount

- Safe driver discount

- Good student discount

- Continuous insurance discount

- Hybrid/electric vehicle discount

- Multi-car discount

- Early quote discount

- Electronic funds transfer discount

Comparison to Other Providers

Compared to other insurance providers, Travelers offers competitive rates for most driver profiles. For example, its average cost for good drivers ($1,521 per year) is 51% cheaper than Farmers' average cost ($3,093).

However, Travelers' rates for parents adding a teen driver are higher than average. The average increase for adding a 16-year-old driver is $2,728 per year, 16% higher than the national average of $2,359.

Overall, Travelers Insurance offers affordable auto insurance with a wide range of coverage options and discounts. Its rates are lower than the national average for most driver profiles, making it a good choice for those looking for budget-friendly insurance. However, it is important to note that its rates for adding a teen driver are higher than average.

U.S. Auto Insurance: Family Members and USAA

You may want to see also

Claims

Travelers Insurance allows customers to file a claim by phone, on the company website, or through its mobile app. A claim professional will then contact the customer and walk them through the process. Customers can also track the status of their claim by creating a MyTravelers account on the Travelers website.

Travelers can assess the damage to a customer's vehicle through its network of trusted repair facilities or via virtual inspection. Once the vehicle has been repaired and the customer has paid their insurance deductible, Travelers will pay the customer or their loan/lease company.

Travelers' customer satisfaction rating for claims is below average. The company ranks 18th out of 24 insurance companies in the J.D. Power 2023 Auto Claims Satisfaction Study, with a score of 871 out of 1000. This score was seven points below the industry average.

However, in a NerdWallet survey conducted in June and July 2023, Travelers received an overall satisfaction score of 80 out of 10 from a pool of its customers. The average score among the seven insurers included in the survey was 78, and the highest was 82.

Auto Insurance Check Deposit: Is It Allowed?

You may want to see also

History and reputation

Travelers Insurance has been in the property casualty insurance business for over 165 years. It began as two separate companies: St. Paul Fire and Marine Insurance Co. and Travelers. St. Paul Fire and Marine Insurance Co. was established in 1853 and paid its first claim in 1855 when a fire spread from a bakery to offices. The name 'Travelers' comes from insuring railroad and steamboat passengers. The first Travelers policy was sold in 1864 for two cents. In 2004, the two companies merged to create The St. Paul Travelers Cos. In 2007, the company changed its name to The Travelers Cos.

Today, Travelers has 30,000 employees and 13,5000 independent agents and brokers serving customers for personal, business and specialty insurance. It is one of the largest property and casualty insurance companies in the United States, offering a range of coverage options in 49 states and Washington, D.C. The company has a fair number of discounts, plus a safe driving app that can help motorists save money.

Travelers has an A++ (Superior) financial strength rating with AM Best, the top available rating. A high financial strength rating indicates a company should be able to pay out on future claims.

Auto Insurance: Can They Snoop Bank Data?

You may want to see also

Frequently asked questions

Travelers offers low pricing, with full coverage auto insurance costing around $1,595 per year and minimum liability coverage costing about $648 annually. Its rates are 20% lower than the national average for full coverage and slightly cheaper than average for minimum liability coverage.

Travelers offers the standard types of car insurance, including bodily injury liability, property damage liability, collision insurance, comprehensive insurance, medical payments, and personal injury protection. It also offers optional coverage, such as accident forgiveness, gap insurance, new car replacement coverage, rental car reimbursement, and rideshare insurance.

Travelers has received mixed reviews from customers. While it has an A rating from the Better Business Bureau (BBB), it has a low average score of 1 out of 5 stars from customer reviews on the website. However, in a survey conducted by MarketWatch Guides, Travelers ranked fifth out of 15 companies for overall satisfaction, with customers reporting satisfaction with the shopping experience and website usability.