Specialty Life Insurance (SLI) is a Canadian insurance company that offers a range of no-medical life insurance products. Unlike traditional life insurance policies that require a medical exam, SLI specializes in providing coverage for individuals who have mild to moderate health issues, are afraid of needles, or want to secure coverage quickly. SLI's products include term and permanent life insurance, critical illness insurance, and accidental death insurance. Their application process is simple and can be completed online or over the phone, with coverage starting the same day in many cases. While SLI has received generally positive reviews for its customer service and range of options, its small size and short history may be a cause for concern for potential customers.

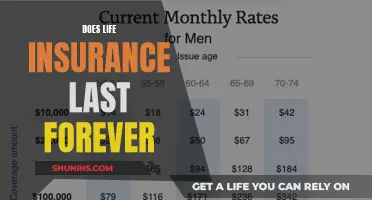

| Characteristics | Values |

|---|---|

| Type of Insurance | No-medical life insurance |

| Application Process | Online, simple, quick |

| Coverage Amounts | $1000-$1,000,000 |

| Age Eligibility | 18-79 |

| Waiting Period | 2 years for some policies |

| Premium Payment Options | Monthly, by credit card |

| Online Presence | specialtylifeinsurance.ca, specialtylife.ca, slinsurance.ca |

| Online Reviews | Google: 4.1-4.3/5 stars, Trustpilot: 1,961/5 stars |

What You'll Learn

No medical life insurance

Specialty Life Insurance (SLI) is a good choice for those who want to avoid the medical exam required by traditional life insurance policies. SLI offers several no-medical life insurance plans, with coverage starting the same day you apply. Their Excelsior plan offers coverage of up to $50,000, regardless of your health history.

Term life insurance provides coverage for a specific period, usually with lower premiums than whole life insurance. It is a good option for younger families or seniors who want to save money on premiums. However, the policyholder must pass away during the term for the beneficiary to receive the death benefit.

On the other hand, whole life insurance provides coverage for the entire life of the policyholder, which tends to be more expensive. The death benefit is certain, and the plan may accumulate cash value in a separate savings account. Whole life insurance may be useful for those who want to provide added financial security for family members or explore new investment opportunities.

No medical exam life insurance can help you find better rates and coverage options, but it may also cost more since insurers take on additional risk. You will likely still need to answer health questions, and there may be a cap on the coverage amount. It is important to shop around and compare premiums to ensure you get the best protection that meets your unique needs.

Divorce and Insurance: Life-Changing Impacts and Adjustments

You may want to see also

Simplified issue insurance products

Simplified issue life insurance is a good option for those who want to get life insurance quickly and without a medical exam. It is a permanent policy that offers coverage for the whole of your life. The application process is shorter than traditional life insurance policies, and you can get approved instantly.

Pros of Simplified Issue Life Insurance

The advantages of simplified issue life insurance include:

- No medical exam is required, which is ideal for those with needle phobia or a medical condition that makes it difficult to qualify for standard policies.

- The approval process is quick, and you can get coverage right away.

- The application is much shorter than traditional life insurance policies, with only a handful of health-related questions.

- It is cheaper than guaranteed issue life insurance.

- It offers more coverage than guaranteed issue life insurance, with death benefits typically higher than $25,000.

Cons of Simplified Issue Life Insurance

However, there are also some drawbacks to simplified issue life insurance:

- The premiums are higher than traditional term life insurance or whole life insurance because the insurer doesn't have as much information to evaluate your risk.

- The coverage amount may be smaller, with many companies capping coverage at $40,000 to $100,000 or $250,000.

- Some policies have a graded death benefit, where the full death benefit is only paid out if the policy has been active for two years.

Simplified issue life insurance is a good option for those who:

- Don't want to take a medical exam.

- Can't wait weeks or months for coverage.

- Are in poor health and wouldn't qualify for a decent rate with traditional underwriting.

- Don't like needles.

Universal Group Life Insurance: Good Idea or Not?

You may want to see also

Coverage for those over 50

Specialty Life Insurance (SLI) offers a no-medical life insurance plan for those over 50. This plan can cover both short-term and long-term needs.

Life insurance is important for people over 50, even if they do not have young families who rely on their income. People in this age group often have financial obligations that continue long after their children grow up. Additionally, there will always be final expenses, such as medical and funeral costs, that need to be covered.

When it comes to choosing a life insurance policy, it's important to understand the different types of policies available. Term life insurance provides coverage for a specific period, typically between 10 and 30 years, while permanent life insurance is designed to provide coverage for an entire lifetime. Permanent life insurance includes a wealth-building component, which helps make coverage last indefinitely and provides other advantages, such as tax-deferred cash value growth.

For those over 50, term life insurance is generally the most affordable option. However, permanent life insurance may be a better choice for those who want to leave a legacy or have lifelong dependents.

It's also worth considering final expense insurance, also known as funeral or burial insurance, which helps beneficiaries cover end-of-life expenses. These policies typically have lower benefit amounts and are more affordable, even for those in their 60s and 70s.

When choosing a life insurance policy, it's important to consider your unique situation, budget, and coverage needs. Consulting a financial professional can help you decide if term life insurance or permanent coverage is best for you and how the policy can be tailored to meet your specific needs.

Get Your Life Insurance License: Steps to Success

You may want to see also

Funeral expenses coverage

Specialty Life Insurance (SLI) is a good option for those seeking life insurance coverage for funeral expenses. SLI offers a range of no-medical life insurance plans that do not require a medical exam or health questionnaire, making it ideal for individuals with underlying medical conditions or needle phobia. Their life insurance for funeral expenses provides coverage of up to $25,000 for applicants between the ages of 40 and 80. This type of insurance ensures that your loved ones have financial support to cover end-of-life costs, including funeral arrangements, burial costs, and other expenses.

The cost of funerals can be a significant financial burden, with the median cost of a funeral being $8,300. Burial insurance, also known as funeral or final expense insurance, is specifically designed to cover these end-of-life expenses. It is a type of whole life insurance policy that ensures your beneficiaries have the financial means to handle your funeral, burial, and other related costs. This type of insurance is ideal for individuals who solely want coverage for end-of-life expenses without leaving a large sum of money to their beneficiaries.

There are typically three types of burial insurance: simplified issue, guaranteed issue, and pre-need insurance. Simplified issue insurance evaluates your health through a series of questions, while guaranteed issue insurance does not require any medical questions or exams but comes at a higher cost. Pre-need insurance involves a contract with a funeral service provider, and the payout goes directly to them. Burial insurance is often more affordable than traditional life insurance due to its lower coverage amounts, and it is available to individuals between the ages of 50 and 85.

When considering funeral expenses coverage, it is essential to plan ahead and estimate the cost of funeral and burial services. While term life insurance can also cover funeral costs, it expires if you outlive the policy term. On the other hand, burial insurance is typically a whole life policy that lasts until the insured person passes away. Therefore, if your primary concern is ensuring that your funeral costs are covered, a burial insurance policy might be a more suitable option.

VA Life Insurance: Payouts and Coverage Explained

You may want to see also

Critical illness insurance

Specialty Life Insurance (SLI) is a Canadian company that offers several no-medical life insurance plans. One of their products is critical illness insurance, which provides a tax-free, lump-sum payment to help cover expenses related to a serious illness or condition. This can include medical costs, daily living expenses, transportation, and more.

In summary, critical illness insurance can be a valuable form of financial protection for individuals and families, especially for those with limited savings or high-deductible health insurance plans. It can provide peace of mind and help ease the financial burden associated with serious illnesses. However, it's important to carefully consider the coverage, restrictions, and cost of these policies before purchasing one.

Life Insurance and the American Bar Association: What's Offered?

You may want to see also

Frequently asked questions

Specialty Life Insurance (SLI) is a Canadian insurance company that offers no-medical life insurance plans. This means that, unlike traditional policies, SLI does not require its customers to undergo a medical exam. Instead, customers may simply answer a few health questions.

Specialty Life Insurance is ideal for those with a fear of needles, an underlying medical condition, or those who do not have the time to undergo a physical exam. They also cater to those who are traditionally considered hard to insure.

Specialty Life Insurance offers a simple, streamlined, and rapid application process with instant approvals. They also offer affordable rates and a range of options to ensure there's a plan suited to each individual.

Specialty Life Insurance offers a range of life insurance products, including:

- Term insurance

- Permanent life insurance

- Over-50 life insurance

- Funeral expenses coverage

- Critical illness insurance

- No-medical insurance

- Seniors life insurance

Specialty Life Insurance has generally positive reviews. On Google, they have 4.1 stars out of 5 based on 879 reviews, which is considered extraordinary for an insurance company. They also have a 4.2-star rating on Trustpilot. However, it is worth noting that they have an average rating of just 1 out of 5 stars from 11 reviews on the Better Business Bureau.