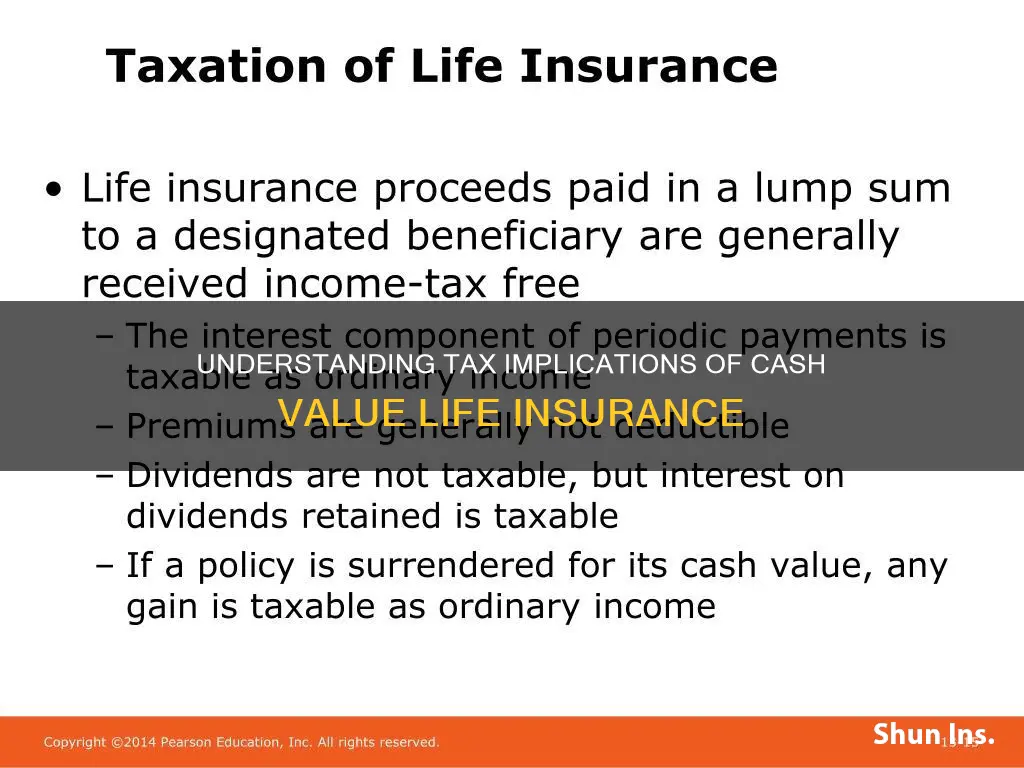

Life insurance is often seen as a reliable way to provide for loved ones after you're gone, and one of its biggest advantages is the tax relief it offers. Typically, the death benefit your beneficiaries receive isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs or securing their future. However, there are some situations where taxes could come into play, and it's important to know when that might happen.

| Characteristics | Values |

|---|---|

| Are cash value life insurance payouts taxable? | No, cash value life insurance payouts are generally not taxable as they grow within the policy. |

| Are there any taxes on withdrawals? | Withdrawals are tax-free up to the total premium paid unless it's a modified endowment contract. |

| Are there any taxes on loans? | Loans are not taxable unless the policy is a modified endowment contract. |

| Are there any taxes on surrendering or cashing out a policy? | Surrendering or cashing out a policy may incur taxes. |

| Are there any taxes on interest earned on beneficiary life insurance proceeds or periodic (annuity) payments? | Interest earned on beneficiary life insurance proceeds or periodic (annuity) payments is generally taxable. |

What You'll Learn

Withdrawals from cash value life insurance policies

It's important to note that withdrawals could cause your policy to lapse, resulting in a loss of coverage. Withdrawals that reduce your cash value could also lead to a reduction in your death benefit and potentially cause your premiums to increase to maintain the same death benefit.

If you are considering withdrawing money from a cash value life insurance policy, it is important to understand the specific rules and consult a tax advisor or financial professional for guidance.

Life Insurance: Injury Coverage and its Limits Explained

You may want to see also

Policy loans

Here's how it works: when you take out a policy loan, you are essentially borrowing from the insurance company, using your policy's cash value as collateral. The amount you can borrow depends on the value of the policy's cash-accumulation account and the contract's terms. You don't have to go through an approval process or adhere to a repayment schedule because you are borrowing against your own assets.

While the loan itself is not considered taxable income, any interest charged by the insurance company will increase the loan value, and if left unpaid, could cause the policy to lapse. This is because the interest is effectively reducing your cash value, which can lead to insufficient funds to cover the cost of insurance and maintain the policy.

If the policy lapses or is surrendered before the loan is repaid, you may face tax implications. In such cases, the taxable amount is based on the loan value exceeding your policy basis (total premium payments made). This is because the tax authorities will treat the amount above your basis as investment gains.

To avoid this scenario, you can choose to repay the loan during your lifetime. However, it's important to weigh the benefits against the potential reduction in the death benefit for your beneficiaries. Consulting a tax advisor or financial professional can help you navigate these complexities and make informed decisions.

U.S.A.A. Life Insurance: Spouse Coverage Options Explained

You may want to see also

Surrendering a policy

Surrendering your life insurance policy means cancelling it in exchange for a cash payout. This payout is known as the cash surrender value. Not all life insurance policies have a cash surrender value—only whole life, universal life, and variable universal life policies can be surrendered for a cash payment. Term policies, for example, do not accumulate cash value over time and therefore do not have a cash surrender value. However, some term policies can be converted into other types of policies that are eligible for cash surrender value.

The cash surrender value of a life insurance policy depends on the cash value it has accumulated over time, minus any fees associated with surrendering the policy. The longer you have had a policy, the higher its cash value and, consequently, its cash surrender value.

When you surrender your life insurance policy, you forfeit the right to the death benefit and no longer have to pay premiums. This is an alternative to borrowing against your policy, which would keep it in effect and require you to continue paying premiums and interest on what you borrowed.

The cash surrender value of a life insurance plan is the amount you will receive if you surrender your policy to your insurer. This amount is based on your cash value, the component of a permanent life insurance policy that can help you build cash value through regular premium payments. A policy's cash surrender value depends on the policy's duration, growth, and assets.

If you surrender your policy earlier in the term, you may face lower cash surrender values since the cash value will be smaller, and you may owe surrender charges. However, if you surrender the policy later, you could receive a larger payout since the cash value will be larger, and you'll pay fewer fees.

The cash surrender value you receive is generally tax-free. This is because it's a tax-free return of the principal of the premiums you paid. However, not all the money you receive will be counted as tax-free. For example, any dividends, interest, and capital gains you earn while the policy is in place will be taxed, and you'll have to pay taxes on those earnings.

SunTrust's Free Life Insurance Offer: What You Need to Know

You may want to see also

Interest earned on beneficiary life insurance proceeds

In the US, the interest earned on life insurance proceeds is reported as interest received on a tax return. The interest is taxable whether the beneficiary is an individual or a business.

In New York, interest on the proceeds of a life insurance policy accrues from the date of the death of the insured, rather than from the date that the claim is fully filed with the life insurer.

Understanding PA's Tax on Employer-Provided Group Term Life Insurance

You may want to see also

Modified endowment contracts

A modified endowment contract (MEC) is a cash value life insurance policy that has lost its tax benefits because it contains too much cash. The IRS reclassifies a life insurance policy as an MEC when the total collected premiums and cash value exceed federal tax-law limits. This permanent change can occur when you pay excess premiums in too short a period.

Criteria for an MEC

For a life insurance policy to be considered an MEC by the IRS, it must meet three criteria:

- The policy was entered into on or after 20 June 1988.

- It must meet the statutory definition of a life insurance policy.

- The policy must fail to meet the Technical and Miscellaneous Revenue Act of 1988 (TAMRA) "seven-pay test".

Tax Implications of an MEC

The cost basis within an MEC and withdrawals from one are not subject to taxation. However, taxes on gains are considered regular income for MEC withdrawals under the last-in-first-out (LIFO) accounting methodology. This means that interest is disbursed before the principal, which is worse for the policyholder as it provides for taxable interest to be distributed first.

In addition, the taxation of withdrawals under an MEC is similar to that of non-qualified annuity withdrawals. Withdrawals made before the age of 59 1/2 may incur a 10% premature withdrawal penalty.

Another serious drawback of an MEC is that it removes the tax benefits for policy loans. In a traditional life insurance policy, you can borrow your cash value, including your earnings above premiums paid, without owing income tax. However, in an MEC, taking out your gains through a loan is considered a taxable withdrawal, and the 10% premature penalty also applies before the age of 59 1/2.

Despite the tax implications, MECs are still a life insurance product, and the death benefit remains tax-free.

Unum Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Withdrawing money from a cash value life insurance policy is generally not taxable if the amount withdrawn is equal to or less than the total amount of premiums paid into the policy. However, if the withdrawal exceeds the total premiums paid, the amount above the premiums paid is typically considered taxable income.

Taking out a loan against a cash value life insurance policy is usually not taxable as long as the policy remains in force. However, if the policy is surrendered or lapses before the loan is repaid, the outstanding loan balance that exceeds the total premiums paid may be treated as taxable income.

Surrendering or cashing out a cash value life insurance policy may result in tax implications. The amount received, known as the cash surrender value, is typically the cash value minus any surrender charges. The portion of the cash surrender value that exceeds the total premiums paid is generally considered taxable income, reflecting the investment gains made on the policy.

Yes, there are a few strategies to consider. Firstly, withdrawing only up to the total amount of premiums paid can help avoid taxes, as this is typically not considered taxable income. Additionally, consulting with a tax advisor or financial professional can provide guidance on tax implications and strategies specific to your situation.