Auto insurance policies typically last for six or twelve months, depending on the type of policy purchased. Temporary and short-term car insurance policies can last from a few hours to three months. The six-month policy is the most common, as it allows insurance companies to reassess the cost of the policy more frequently. The twelve-month policy provides more predictability in terms of payment amounts. The policy period is important as it dictates the payment due date and determines when the policy is up for renewal.

| Characteristics | Values |

|---|---|

| Typical policy length | 6 months or 12 months |

| Temporary/short-term policy length | 3 months or less |

| Policy renewal | Automatic unless cancelled |

| Premium payment frequency | Monthly or annually |

| Premium recalculation | Every 6 months or 12 months |

| Premium discount | Pay annually |

What You'll Learn

Six-month policies are more common than 12-month policies

Six-month auto insurance policies are more common than 12-month policies. This is because insurance companies can reassess their customers' risk twice as often with six-month policies and make adjustments to premiums based on their findings. For example, if a customer has had a string of accidents during the first few months of their policy, the insurance company will want to raise their rates without waiting out the full year.

Six-month policies also benefit the customer in some ways. For instance, if a customer's insurance company requires a lump-sum payment and doesn't allow monthly payments, the cash outlay will be less for a six-month policy. Additionally, if a customer's driving record or credit score improves, they can ask for a lower rate sooner with a six-month policy.

However, opting for a six-month term isn't always in the customer's best interest. One drawback is that premiums rise faster if the customer has an at-fault accident or moving violation. Another disadvantage is that insurance companies are more likely to require the customer to pay for the policy in full upfront rather than monthly. Finally, the customer is guaranteed coverage for a shorter period, and the insurance company can elect to decline to renew the policy once it ends.

Auto Insurance in the US: Understanding Coverage and Costs

You may want to see also

Car insurance rates may change every six months

Auto insurance policies typically last for six months or a year, though temporary and short-term policies can be as short as a few hours or as long as three months.

If you have an accident, a moving violation, or if your credit score declines, the insurance company only has to wait six months instead of 12 to increase your rate. However, if your personal factors improve, you will also be able to benefit from a reduced rate sooner.

There are several advantages to a six-month policy. Firstly, if your insurance company requires a lump-sum payment, the cash outlay is less than that of a 12-month policy. Secondly, if your driving record or credit score improves, a six-month policy lets you petition for a lower rate sooner. Finally, with a six-month policy, you are not locked in with one company for as long, and you can shop around for a better deal more often.

However, there are also some disadvantages to a six-month policy. Your premiums will rise faster if you have an at-fault accident or moving violation. Insurance companies are also more likely to require you to pay for the policy in full upfront rather than monthly. You are guaranteed coverage for a shorter period, and the insurance company can elect to decline you for a subsequent term once your policy ends.

Engine Repair: Auto Insurance Claims

You may want to see also

The pros and cons of six-month policies

Six-month auto insurance policies are the most common, but they have their pros and cons.

Pros of six-month policies

- Flexibility: You can switch insurance companies sooner if there's an issue with your current provider.

- Driving record evaluated more often: Insurance companies assess your risk more often. If you have traffic violations coming off your driving record, you won't have to wait as long to benefit from lower premiums.

- Easier to pay in full: Paying your premium in full can earn you discounts. A six-month policy costs less to pay in full.

Cons of six-month policies

- Tracking: Having to renew twice a year means there's a risk you could forget to pay and miss a payment.

- Rate increases: Your rates aren't locked in for as long as with a 12-month policy, meaning they could increase with each renewal assessment.

- Lost discounts: If you no longer qualify for a discount, you'll lose those savings sooner with a six-month policy.

Auto Insurance: Can It Be Cancelled?

You may want to see also

The pros and cons of 12-month policies

The pros and cons of 12-month auto insurance policies

Most auto insurance policies are either six or 12-month policies, and some companies offer both. However, 12-month policies are not very common. Six-month policies are more common because they allow insurance companies to change prices more often and stay competitive in the market.

Pros

- Rate stability: A 12-month policy locks in your insurance rate for a year, providing stability and protection against potential rate increases.

- Less frequent renewals: With a 12-month policy, you only need to renew your policy once a year, which is more convenient and saves time and energy.

- Fewer interruptions to coverage: A 12-month policy reduces the risk of lapses in coverage since you only need to renew once a year.

- Fewer rate increases: Even if you get into an accident, your rate will stay the same until the renewal date.

Cons

- Lack of flexibility: A 12-month policy may come with a fee or cancellation penalty if you switch insurance companies before the end of the policy term.

- High upfront costs: Paying for a 12-month policy upfront can be challenging depending on your financial situation.

- Not cheaper: A 12-month policy is typically not cheaper than a six-month policy and may even have a slightly higher premium.

- Rate doesn't go down: Your rate cannot decrease until the end of the contract, even if your driving record improves or a violation is removed from your record.

Auto Insurance Minimums: State Requirements

You may want to see also

How to determine the right policy for your needs

Auto insurance policies typically last for six or twelve months, but temporary and short-term policies can cover you for as little as a few hours or as long as three months. The right policy for your needs will depend on several factors, including your budget, driving record, and personal preferences. Here are some tips to help you determine the right auto insurance policy for your needs:

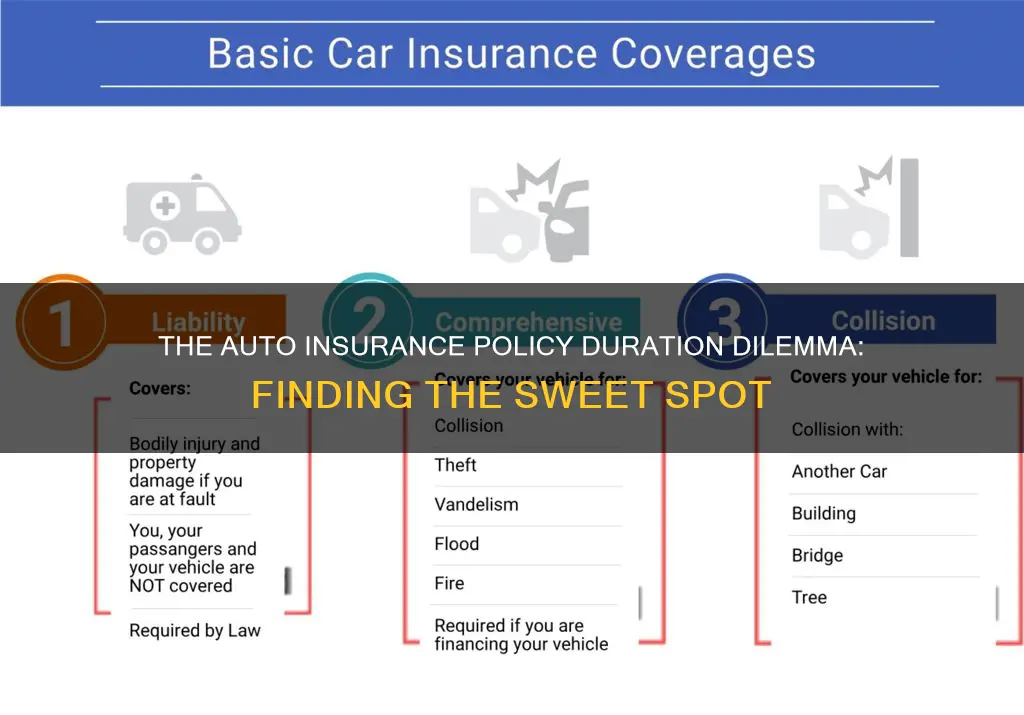

Determine the Level of Coverage You Need:

The cheapest policy may not provide collision coverage or comprehensive coverage, which pays to fix your car after an accident or covers non-accident damage, respectively. Consider your state's requirements, the age of your car, and your financial situation when deciding on the level of coverage. For example, if you're leasing a car, you may need gap insurance to cover the difference between the vehicle's value and the outstanding lease balance if it's totaled.

Review the Financial Health of Car Insurers:

Opt for a company with strong financial health, as you want to ensure they can pay their claims. Independent ratings from companies like A.M. Best, Fitch, Moody's, and Standard & Poor's can help you assess their financial stability.

Compare Quotes from Multiple Companies:

Prices for the same level of coverage can vary significantly across different insurers. Get multiple quotes and compare the coverage, deductibles, and discounts offered by each company. Consider using online tools or working with an independent insurance agent to obtain quotes from multiple insurers at once.

Ask About Discounts:

Many insurance companies offer a range of discounts, such as good student discounts, low mileage discounts, and driver education class discounts. Inquire about the availability of discounts and how you can qualify for them.

Consider the Length of the Policy:

Six-month policies offer more flexibility, allowing you to compare rates and take advantage of an improved driving record. On the other hand, twelve-month policies provide rate stability and predictable payments for a more extended period. If you prefer the option to shop around more frequently, a shorter policy may be better.

Understand Your Driving Profile:

Your driving record, credit score, and claim history are critical factors in determining your insurance rates. If you have a history of accidents or violations, a shorter policy may be preferable, as it gives you a chance to improve your record and secure lower rates sooner. Conversely, if you have a clean record and stable credit, a longer policy can lock in a favourable rate for a more extended period.

Evaluate Your Budget:

Consider your financial situation and whether you prefer predictable payments or the flexibility to adjust your budget more frequently. Twelve-month policies offer rate stability, while six-month policies allow you to reassess your budget twice a year.

Weigh the Pros and Cons of Each Option:

Both six-month and twelve-month policies have their advantages and disadvantages. Six-month policies offer more frequent rate adjustments, flexibility to switch insurers, and lower lump-sum payment amounts. In contrast, twelve-month policies provide longer rate locks, fewer renewals, and longer-lasting discounts.

Remember, the right policy for you will depend on your unique circumstances, preferences, and financial situation. Take the time to research, compare, and ask questions to make an informed decision that aligns with your needs.

Gap Insurance: Down Payment Refund?

You may want to see also

Frequently asked questions

Auto insurance policies typically last for six or 12 months, but some providers also offer short-term policies that can cover you for as little as a few hours or as long as three months.

A six-month auto insurance policy provides more flexibility, allowing you to switch insurance companies or take advantage of an improved driving record sooner. It may also be easier to pay for your policy in full, as the cost for six months of coverage will be less than the cost for 12 months.

A 12-month auto insurance policy locks in your insurance rate for the entire year, providing more predictable payment amounts. You also won't need to remember to renew your policy as often, reducing the risk of a lapse in coverage if you forget to pay.