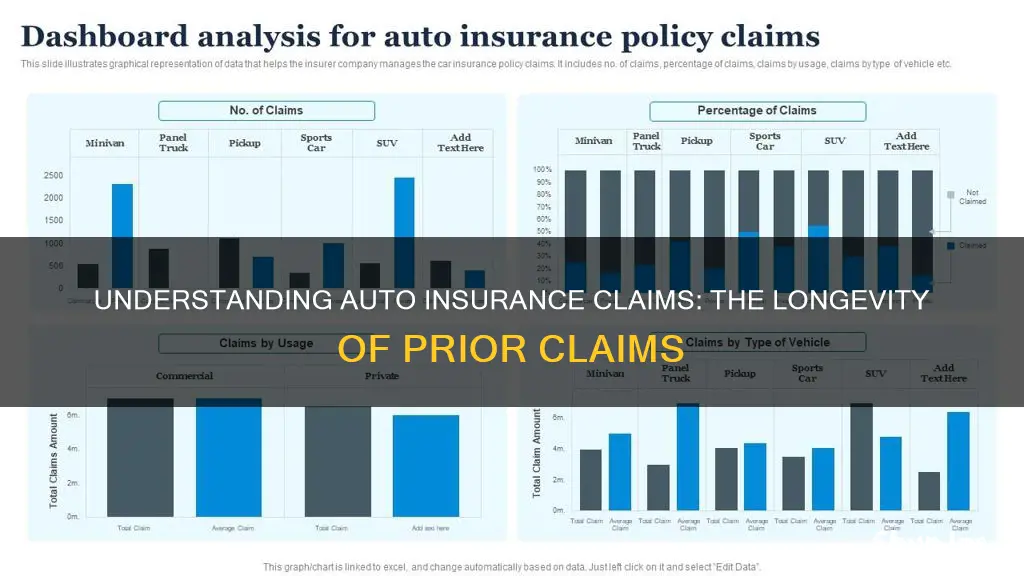

Car insurance claims can stay on your record for up to seven years, but this depends on the insurance company and the state. Most car insurance companies keep claims on record for three to five years. In the UK, all car insurance claims are added to the Claims and Underwriting Exchange (CUE), which is a record of all car insurance claims. In Ontario, insurance companies providing car insurance must file their rules and rates with the Financial Services Commission of Ontario (FSCO).

| Characteristics | Values |

|---|---|

| How long do prior claims stay on auto insurance? | 3 to 7 years, but can be longer depending on the state and insurance company |

| How long do insurance companies keep records of claims? | Around 3 to 5 years, but can vary by state and insurer |

| How long do claims stay on your record in Ontario, Canada? | 6 to 10 years |

| How long do home insurance claims stay on your record in Ontario, Canada? | Typically the last 5 years, but can be longer depending on the company |

| How long do claims stay on your record in the UK? | 3, 7, or 10 years, depending on the insurance company |

What You'll Learn

- Claims can stay on your record for up to seven years, but this varies by state and insurer

- A claim won't necessarily be removed from your record after a certain period, but it may not factor into your rates

- In Ontario, insurance companies must file their rules and rates with the Financial Services Commission

- The length of time a claim stays on your record can depend on the insurance company and how long you've been with them

- Fault determination can play a role in how long a claim affects your insurance premiums

Claims can stay on your record for up to seven years, but this varies by state and insurer

The length of time that prior auto insurance claims stay on your record depends on several factors, including the state you live in and your insurance provider. In general, claims can remain on your record for up to seven years, but this duration can vary.

In the UK, car insurance claims are added to the Claims and Underwriting Exchange (CUE), which serves as a central record of all car insurance claims. While these claims never disappear from your record, they may only impact your insurance rates for a certain period. Some insurance companies may only inquire about claims made in the last three years, while others may consider claims made in the last seven or even ten years. Generally, insurers focus on the previous five years when evaluating your rates.

Similarly, in Ontario, Canada, car insurance companies must file their rules and rates with the Financial Services Commission of Ontario (FSCO), providing transparency to consumers. However, the duration over which insurance companies consider your claims history can range from six to ten years, depending on the company.

In the United States, the length of time that claims affect your insurance rates can vary by state and insurer. Most car insurance companies keep claims on record for three to five years, but some may retain them for up to seven years. It's important to note that even if a claim is older than this timeframe, it may still appear on your record but may have a lesser impact on your insurance rates.

To summarize, the duration that prior auto insurance claims stay on your record is influenced by factors such as the regulations in your state and the policies of your specific insurance company. While claims can remain on your record for up to seven years, this period can be shorter or longer depending on the circumstances.

Strategies to Lower Auto Insurance Costs

You may want to see also

A claim won't necessarily be removed from your record after a certain period, but it may not factor into your rates

When it comes to car insurance claims, it's important to know that they never truly disappear from your record. All claims are added to a central record, which in the UK is known as the Claims and Underwriting Exchange (CUE). This means that insurance companies can access your entire claims history. However, this doesn't mean that your past claims will continue to affect your insurance rates forever.

The impact of a claim on your insurance rates depends on how far back your insurer looks when assessing your risk level and calculating your premiums. This duration can vary from company to company and may be influenced by factors such as how long you've been with the insurer, whether you were at fault in the claim, and the state in which you reside. Generally, insurers will ask about the last 3 to 5 years, but some may go as far back as 7 or even 10 years.

It's worth noting that as claims get older, they tend to have a smaller impact on your insurance premiums. For example, a claim from 2 years ago is likely to affect your rates more than a claim from 5 years ago. Additionally, not all claims or accidents will result in an increase in your premiums, especially if it's your first claim or if you were not at fault.

To summarise, while a claim may remain on your record indefinitely, it doesn't mean it will always be taken into account when determining your insurance rates. The effect of a claim on your rates diminishes over time, and after a certain period, it may no longer be a factor in the calculation of your premiums.

Lamborghini Gap Insurance: What You Need to Know

You may want to see also

In Ontario, insurance companies must file their rules and rates with the Financial Services Commission

The Financial Services Regulatory Authority of Ontario (FSRAO) replaced the FSCO as the regulatory body for insurance in the province in 2019. The FSRAO is an independent regulatory agency that oversees a number of financial services in the province of Ontario, including:

- Loan and trust companies

- Credit unions/caisses populaires

- Life and health insurance (including drug plans)

- Home, auto, and business insurance

- Healthcare providers providing services related to auto insurance

- Pension plan administrators

- Financial planners and advisors (proposed)

When to Drop Collision Insurance

You may want to see also

The length of time a claim stays on your record can depend on the insurance company and how long you've been with them

The length of time a car insurance claim stays on your record can vary depending on several factors, including the insurance company and how long you've been with them. While claims never disappear entirely from your record, they may only impact your insurance rates for a certain period. This can range from three to seven years, with five years being the most common timeframe requested by insurers.

Different insurance companies have different practices regarding how far back they look when assessing your rates. Some may only be interested in claims made in the last three years, while others may go back as far as seven or even ten years. As such, the length of time a claim stays on your record in terms of affecting your rates can depend on the specific insurance company and their policies.

Additionally, the length of time a claim stays on your record can also depend on how long you've been with a particular insurance company. If you're a long-standing customer, they may have access to your claims history from when you first joined them. On the other hand, if you're a new customer, they may only have access to claims made within a certain timeframe, as dictated by their policies or state regulations.

It's worth noting that even if a claim is older than the timeframe considered by your insurance company, it will still be part of your permanent record. This record includes all claims and accidents, whether or not a claim was made. This information can be accessed through databases like the Claims and Underwriting Exchange (CUE) in the UK or the Comprehensive Loss Underwriting Exchange (CLUE) in the US.

UTV Auto Insurance: Understanding the Requirements

You may want to see also

Fault determination can play a role in how long a claim affects your insurance premiums

Fault determination is a crucial aspect of motor vehicle accidents (MVAs). It plays a significant role in insurance claims, legal proceedings, and the allocation of responsibility. When it comes to insurance claims, fault determination is essential in determining coverage, compensation, and potential increases in premiums.

If you are found to be at fault for an accident, your insurance rates may increase, and this increase can last for up to six years. The extent of the increase depends on various factors, such as your driving record, accident history, and the severity of the accident. However, if you are not at fault, your insurance rates generally do not increase. This is because, in a no-fault accident, each party's insurance company typically covers their respective damages, regardless of fault.

In some cases, fault can be shared between the parties involved in the accident. In these situations, comparative negligence laws come into play, assigning a percentage of fault to each party. For example, if a driver is found to be 70% at fault, while the other driver is 30% at fault, the compensation awarded to the less culpable driver will be reduced by 30%. Comparative negligence laws ensure a fair distribution of liability based on the actions and degree of responsibility of each party.

It is important to note that insurance companies in different states have varying rules and policies regarding fault determination and its impact on insurance rates. Additionally, the length of time that a claim affects your insurance rates depends on your state's laws, the severity of the accident, and other factors. Therefore, it is always recommended to review your insurance policy and understand the specific regulations in your state.

Gap Insurance: Money-Back Guarantee?

You may want to see also

Frequently asked questions

Prior claims can stay on your record for up to 10 years, but they may only impact your insurance rates for three to seven years.

Most auto insurance companies keep records of claims for three to five years.

In the UK, auto insurance claims are added to the Claims and Underwriting Exchange (CUE), which is a record of all car insurance claims. While these claims technically never disappear from your record, they may only impact your insurance rates for up to seven years.

Yes, auto insurance premiums typically increase after claims, especially if the claim was for an at-fault accident. The amount of the increase varies depending on the company and the claim.

You can check your auto insurance claim history by requesting a letter of experience from your insurance provider or by ordering a Comprehensive Loss Underwriting Exchange (CLUE) report from LexisNexis.