Purchasing auto insurance is a crucial step in the process of owning and operating a vehicle. In the state of Georgia, drivers are required by law to maintain a minimum level of auto insurance coverage, specifically liability insurance, to legally drive on public roads and highways. This insurance protects individuals financially in the event of vehicle-related accidents or incidents by helping to pay for damages to others' property or injuries they may have sustained. The minimum liability coverage requirements in Georgia include bodily injury liability and property damage liability, each with specific coverage limits per person and per incident.

When purchasing a new or used car, it is important to understand the timeline and process for obtaining auto insurance. In Georgia, individuals typically have a grace period of 7 to 30 days to inform their insurance provider about their new vehicle and ensure they have the necessary coverage. Dealerships will require proof of insurance before allowing individuals to drive their newly purchased car off the lot. Obtaining auto insurance can be a relatively quick process, often taking as little as 15 minutes to a few hours, and coverage can begin on the same day.

| Characteristics | Values |

|---|---|

| Time taken to get car insurance | 15 minutes to a few hours |

| Time taken to get a car insured | Same day |

| Minimum auto insurance requirements | Liability insurance: $25,000 for bodily injury per person, $50,000 for bodily injury per accident, $25,000 for property damage per accident |

| Uninsured motorist bodily injury | $25,000 per person and $50,000 per accident |

| Uninsured motorist property damage | $25,000 with a $250, $500, or $1000 deductible |

| Grace period for adding a new vehicle to an existing policy | 7 to 30 days |

| Penalty for non-insured drivers | Up to one year in jail, $25 fine (plus $160 if the fine isn't paid within 30 days), license suspension for 60 to 90 days, possible vehicle impoundment |

What You'll Learn

Georgia auto insurance requirements

Georgia has specific auto insurance requirements that all drivers must meet. Auto insurance is mandatory for all drivers in Georgia, and proof of insurance must be presented if requested by a law enforcement official. The minimum liability coverage required by the state is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident. This basic liability package is meant to protect you and other drivers on the road in the event of an accident.

It is important to note that liability insurance only covers injuries or property damage caused to others and not to yourself or your property. Therefore, additional coverage options are available for purchase to provide further protection. Collision coverage, for example, covers repairs to your vehicle in the event of a collision with another vehicle or object, while comprehensive coverage includes damages sustained from incidents like fire, severe weather, vandalism, or collisions with animals.

Uninsured motorist coverage is also available and particularly important, given that not all drivers on the road carry insurance as required by law. This coverage will protect you if you are in an accident with an uninsured driver and your vehicle is damaged or you sustain injuries.

While Georgia mandates a minimum level of auto insurance, it is recommended that drivers consider increasing their liability limits and purchasing additional coverage options to ensure they are adequately protected. The state's minimum requirements may not be sufficient in the event of a serious accident or extensive property damage.

Tennessee Vehicle Insurance Requirements

You may want to see also

Minimum liability coverage

In Georgia, drivers must have liability insurance that meets the minimum limits required by law to drive on the state's public roads and highways. This means that drivers must have at least the state minimum coverage to be legally allowed to drive. The minimum limits of liability insurance required under Georgia law are:

- Bodily Injury Liability – $25,000 per person and $50,000 per incident. This covers injuries to others if you are at fault in an accident.

- Property Damage Liability – $25,000 per incident. This covers damage to another person's property if you are at fault in an accident.

The minimum coverage liability limits in Georgia are often referred to as "25/50/25" coverage, with the numbers representing the dollar amounts of the above minimums. This basic level of protection is intended to provide a small level of protection for those who suffer personal injuries in a car accident.

Liability coverage is the type of auto insurance that pays any claim for damages asserted against the at-fault driver. In other words, if a person is injured due to your negligence, then they have the right to recover medical expenses, lost wages, vehicle repair costs, and compensation for pain and suffering from you. If there are multiple injured persons in a car accident, each of those persons has a right to recover these damages. If you have “minimum limits”, then the most your auto insurance will pay any one person is $25,000, and the most it will pay for all persons injured in the same car accident is $50,000. If the injured persons have damages greater than your insurance coverage, they have the right to collect the amount of their damages in excess of your insurance coverage from your personal assets.

While Georgia's minimum coverage requirements include bodily injury and property damage liability, they do not include collision and comprehensive insurance. Collision coverage pays for physical damage to your car as a result of your auto colliding with an object such as a tree or another car. Comprehensive coverage pays for damage to your auto from almost all other causes, including fire, severe weather, vandalism, floods, and theft. This coverage will also cover broken glass and windshield damage. Both collision and comprehensive insurance are optional in Georgia and are not required by law. However, if you financed or leased your vehicle, the lender or leasing company usually requires it.

Auto Shop: Insurance Check Endorsement?

You may want to see also

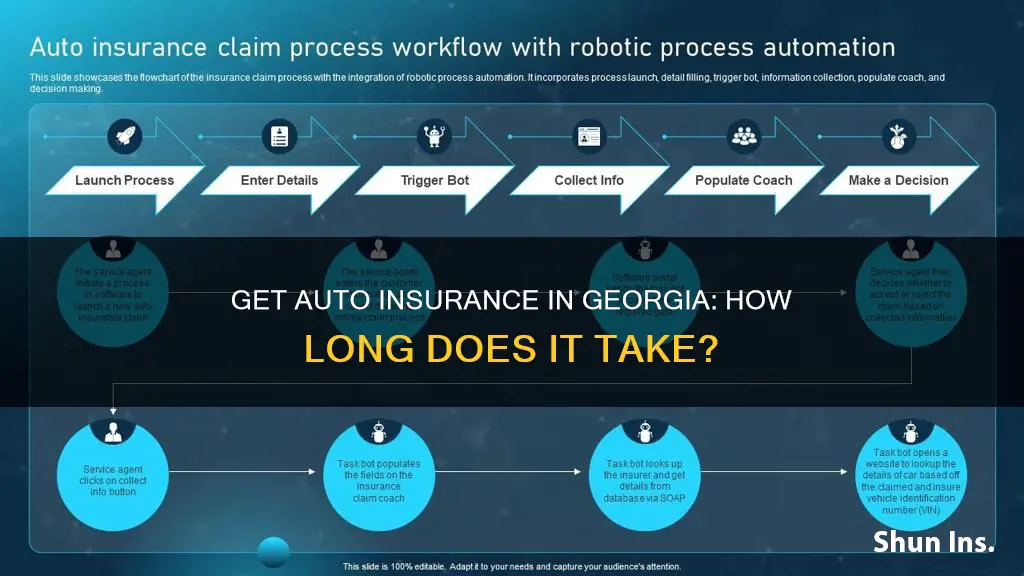

Getting auto insurance quickly

Understand the Requirements

It is important to understand the minimum insurance requirements in your state. In Georgia, drivers must have liability insurance that meets the minimum limits required by law to drive on public roads and highways. The minimum coverage includes Bodily Injury Liability of $25,000 per person and $50,000 per incident, and Property Damage Liability of $25,000 per incident. Uninsured Motorist coverage is also required in Georgia, which protects you if an uninsured driver causes an accident that damages your vehicle or injures you or your passengers.

Gather Necessary Information

Before starting the process, make sure you have all the necessary information ready. This includes personal information such as names, dates of birth, driver's license numbers, and Social Security numbers for all drivers. Additionally, you will need the Vehicle Identification Number (VIN) for all vehicles and your address.

Research Coverage Options

Take time to understand how much coverage you need beyond the state minimums. Consider factors such as where you live and how much you are prepared to pay out of pocket if you exceed your coverage limit. You may also want to look into optional coverages such as collision, comprehensive, or uninsured/underinsured motorist coverage.

Compare Quotes

Use online tools or contact insurance companies directly to get quotes. Provide the necessary information, including details about the vehicle(s) and driver(s), to receive accurate quotes. Compare the quotes to find the best combination of coverage and price for your needs.

Finalize Your Policy

Once you have selected the insurance company and coverage that suits you best, submit any required documentation, choose a start date for your policy, and make the first payment. Your coverage can typically begin on the same day you purchase it, so you can be insured promptly.

By following these steps, you can obtain auto insurance quickly and ensure you are protected when driving on Georgia's roads.

Vehicle Insurance File: What's Inside?

You may want to see also

Grace periods for adding a new vehicle

In Georgia, drivers must have liability insurance that meets the minimum limits required by law to drive on public roads and highways. Liability insurance helps pay damages to others if they are injured or their property is damaged in an accident where the insured driver is ruled at fault.

If you already have an active auto insurance policy, you may be allowed a short period of time, typically anywhere from one week to 30 days, to add a new vehicle to your policy. This is known as the grace period. During this time, your insurance company will extend coverage to your new vehicle. Most car insurance companies will do this in good faith. However, it is important to note that not all insurance companies offer a grace period, and it is always best to contact your insurance provider before purchasing a new vehicle to understand their specific policies.

If you do not currently have an existing policy, you will need to procure a new policy before driving your new vehicle. Luckily, car insurance quotes are typically free and obtaining a new policy can be done fairly quickly, often on the same day. In Georgia, you can get a quote from GEICO right from your computer.

Once you have purchased insurance for your new vehicle, remember to remove your old vehicle from your policy as soon as possible to avoid any issues in the event of an accident or claim.

Vehicle Insurance: Active or Not?

You may want to see also

Penalties for driving without insurance

Driving without insurance in Georgia can result in serious penalties, including fines, jail time, and the loss of driving privileges. It is considered a misdemeanor, which can affect your record and future insurance costs.

First Offense

If you are caught driving without insurance in Georgia, you will be charged with a misdemeanor. For a first offense, your license and registration will be suspended for 60 days, and you will be required to obtain a six-month insurance policy that meets the state's minimum requirements. You may also need to provide an SR-22 certificate to prove you have the necessary insurance coverage. Additionally, you must pay a $25 lapse fee and a $60 reinstatement fee to regain your license and registration. You could also face up to 12 months in jail, depending on the specific circumstances.

Second Offense

For a second offense within five years of a previous violation, your license and registration will be suspended for 90 days. You will need to show proof of at least a six-month minimum insurance policy to get your driving privileges back. You will also have to pay the $25 lapse fee and the $60 reinstatement fee again. Jail time of up to one year is also a possibility, depending on the handling of the second offense.

Third and Subsequent Offenses

If a third offense occurs within five years of previous violations, your license and registration will be suspended for six months. You will need to pay the $25 lapse fee and a $160 reinstatement fee. Additionally, you must provide proof of insurance with at least the minimum required coverage for six months to regain your license and registration. You may also be required to serve up to 12 months in jail. Additional penalties may apply if you are convicted of driving a suspended vehicle.

Failure to Provide Proof of Insurance

Under Georgia law, drivers must carry proof of insurance in their vehicle at all times. If you have insurance but cannot provide proof when requested by a police officer, you can be charged with no proof of insurance. The maximum fine for this offense is $25. However, if you can provide proof of insurance at the time of the ticket to the court, most courts will dismiss the charge.

Driving Without Insurance Penalties

Driving without insurance in Georgia is a misdemeanor offense, and the penalties include fines ranging from $200 to $1,000, jail time of up to 12 months, and the suspension of your driver's license for at least 60 days up to 90 days. These penalties are in addition to any fines or penalties imposed by a court of law.

Understanding Secondary Auto Insurance: Rental Car Coverage

You may want to see also

Frequently asked questions

It can take as little as 15 minutes to apply for auto insurance in Georgia, and your policy can begin the same day you buy it.

Georgia requires a certain amount of car insurance coverage for every driver. The minimum auto insurance limits for the state are:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage per accident

Operating a motor vehicle without insurance in Georgia is a misdemeanor and can result in penalties such as:

- Up to one year in jail

- A $25 fine (plus $160 if not paid within 30 days)

- License suspension for 60 to 90 days

- Vehicle impoundment