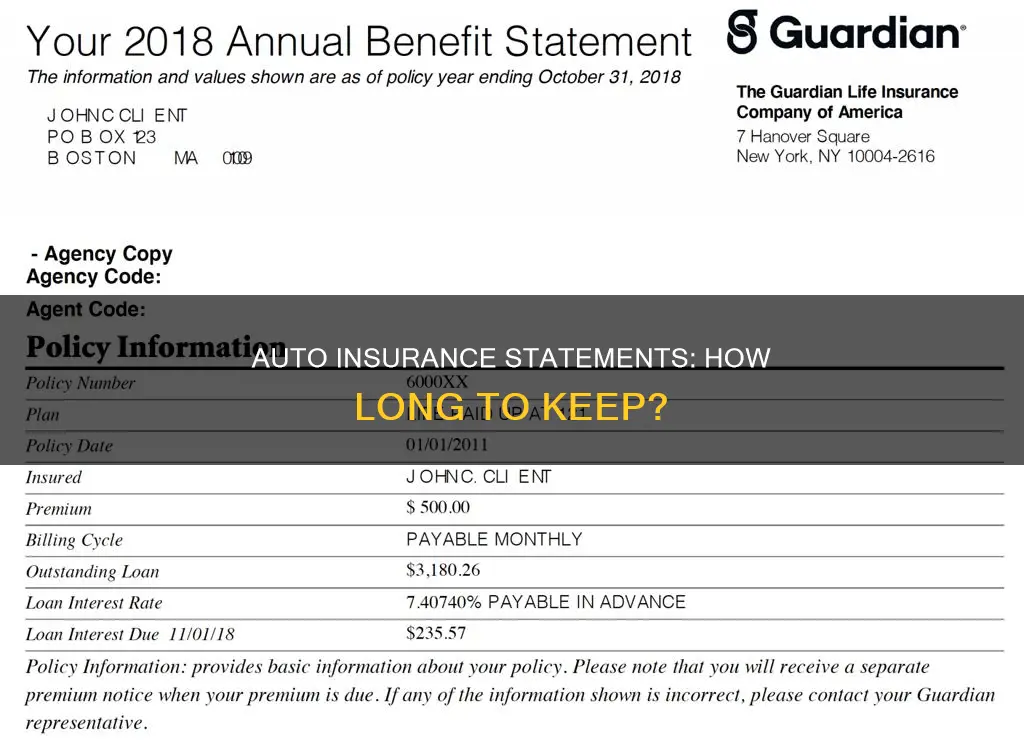

How long you should keep your auto insurance statements depends on several factors. If you have a business auto insurance policy, it is recommended to keep your statements for seven years in case of an IRS tax audit. If you deduct your car insurance premiums from your income to reduce your taxes, you should also keep your statements for seven years. However, if you don't have any open claims and your policy has expired, you don't need to keep old insurance policies or statements. In general, it is a good idea to keep insurance records until your policy has expired and any outstanding claims have been settled.

| Characteristics | Values |

|---|---|

| How long to keep auto insurance statements | Keep for as long as the policy is active. If it's a business policy, save statements for seven years for tax audit purposes. |

| When to keep insurance statements for tax purposes | If you deduct your auto insurance premiums from your income to reduce your taxes, keep statements for seven years. |

| When to keep old insurance policies | Keep when there's a pending claim. |

| When to keep insurance claims paperwork | Keep until the claim is settled and you've been paid. |

What You'll Learn

- Keep auto insurance statements for at least as long as the policy is active

- If you have a business auto insurance policy, keep statements for seven years for a potential tax audit

- Retain auto insurance statements until any open claims are resolved

- Keep insurance ID card in your wallet, glove compartment, or digitally on your phone

- Keep monthly billing statements until your payment has been processed or the policy period ends

Keep auto insurance statements for at least as long as the policy is active

Keeping your auto insurance statements for at least as long as your policy is active is a good idea for several reasons. Firstly, these records serve as proof of insurance, which you must provide when requested by a police officer or in the event of an accident in many states. Additionally, the insurance declarations page within these statements outlines essential details about your policy coverage, limits, and exclusions. Keeping this information easily accessible can be helpful for reference and confirmation purposes.

Furthermore, retaining auto insurance statements is crucial if you have any unresolved claims. This includes keeping relevant documents such as receipts from repairs and pictures from accidents, as they can significantly contribute to ensuring your insurance provider processes your claim accurately. It is advisable to keep these documents until your claim is processed and any related payments are received.

If your auto insurance policy is related to a business, there may be additional considerations for tax purposes. In such cases, it is recommended to consult with a tax advisor, as you may need to keep your insurance records for a few years.

While there is no one-size-fits-all answer to how long you should keep your auto insurance statements, maintaining them for at least the duration of your active policy is generally advisable. This ensures that you have the necessary proof of insurance, a clear understanding of your coverage, and the relevant documentation to support any open claims.

Allstate's Salvage Vehicle Insurance

You may want to see also

If you have a business auto insurance policy, keep statements for seven years for a potential tax audit

If you have a business auto insurance policy, it is recommended that you keep your statements for seven years in case of an IRS tax audit. This is because the IRS may review your accounts or financial information to determine whether you have correctly reported your taxes and whether the amounts you paid match the reported values. This is known as a tax audit, and the IRS can examine documents from as far back as three to six years. Therefore, keeping your auto insurance statements for seven years is advisable to be on the safe side.

However, keeping seven years of auto insurance records is not mandatory for everyone. This is only relevant if you deduct your auto insurance premiums from your gross income to reduce your taxable income. Typically, individuals who use their vehicles for business can deduct part or all of their auto insurance premiums from their income as business expenses for tax purposes. Additionally, qualified performing artists, reservists in the armed forces, or local or government officials paid on a fee basis are also eligible to deduct car insurance expenses.

If you do not fall into any of these categories and do not deduct your insurance premiums from your income, retaining your auto insurance statements for seven years is not necessary. In general, it is advisable to keep your auto insurance statements for as long as your policy is active or until you need to account for payments during tax time. This documentation can be essential for confirming whether your premiums are up to date or providing proof of payments to the IRS.

Furthermore, keeping your auto insurance statements can be beneficial in the event of a dispute with your insurance company. The statements serve as proof that you have been diligently paying your premiums. Therefore, it is recommended to retain your auto insurance statements until your policy is no longer active or until you have accounted for payments during tax time.

Nissan Finance: Gap Insurance Coverage

You may want to see also

Retain auto insurance statements until any open claims are resolved

It is important to retain auto insurance statements until any open claims are resolved. This is because you may need to refer to them when confirming whether your premiums are up to date or if the IRS asks you to show proof of payments. In addition, in the case of any dispute with the insurance company, you will have the documentation to prove that you have been paying your premiums.

If you have a business auto insurance policy, it is recommended to keep the statements for seven years in case of an IRS tax audit. However, if your policy is no longer active and you haven't filed any claims, you don't need to keep your statements.

It is also worth noting that insurance companies are required to maintain current electronic copies of your full insurance policy, so you can always contact your insurance provider to request a copy of your records if needed.

SPV Insurance: What's the Special Purpose?

You may want to see also

Keep insurance ID card in your wallet, glove compartment, or digitally on your phone

Keeping your insurance ID card in your wallet, glove compartment, or digitally on your phone is a good idea for several reasons. Firstly, it serves as proof of insurance and must be provided when requested by a police officer or in the event of an accident in many states. Secondly, it allows for easy access and reference, especially if you need to register your vehicle or during an insurance claim or dispute.

The insurance ID card is just one of several important insurance documents you should keep safely. The declarations page of your auto insurance policy, for instance, provides a snapshot of your policy coverage types, limits, and exclusions. It's a good idea to keep this in a safe and easily accessible place, such as a file cabinet or desk drawer, until the policy period ends and any open claims are resolved.

Additionally, you should retain documents pertaining to any insurance claims. These may include receipts from repairs and pictures from accidents, which can be crucial for ensuring your claim is processed accurately. It's generally recommended to keep these documents until your claim is processed and you've received your settlement.

When it comes to insurance statements, the duration you should keep them depends on the type of policy and document. For business auto insurance policies, it's advisable to retain statements for seven years in case of an IRS tax audit. If you're deducting your auto insurance premiums from your income to reduce your taxes, the same seven-year recommendation applies. However, if you don't have any open claims and aren't using the statements for tax purposes, you may discard them once your policy expires and there are no unresolved claims.

Remember to keep both digital and hard copies of your insurance records, with the latter being stored in a climate-controlled space to prevent damage and ensure longevity. When it's time to dispose of old insurance documents, be sure to use a cross-cut shredder to protect your personal information from potential identity theft.

Recording Insurance Proceeds: Vehicle Loss

You may want to see also

Keep monthly billing statements until your payment has been processed or the policy period ends

Keeping monthly billing statements until your payment has been processed or the policy period ends is a good practice for several reasons. Firstly, it helps you stay organised and maintain financial control. By reviewing your statements, you can track expenses, identify any discrepancies or unauthorised charges, and ensure that your payments are accurate and up to date. This is especially important for budgeting purposes, as it allows you to make informed decisions and adjust your budget as necessary.

Secondly, retaining monthly billing statements can aid in dispute resolution. If there are any issues or errors on your statement, having a clear understanding of the components will enable you to effectively communicate and resolve these matters with your service provider. Additionally, keeping statements can be useful for tax purposes, as they provide proof of payment in case of a dispute or audit. This is particularly relevant if you're self-employed or running a business, as you may need to keep records for several years for tax reasons.

Furthermore, maintaining records of your monthly billing statements can help you build credit. Reviewing these statements helps you monitor your credit utilisation, payment history, and overall creditworthiness, all of which can positively impact your credit score. Finally, keeping statements ensures that you have the necessary documentation if you need to refer to specific details, such as transaction dates, descriptions, and amounts. This can be helpful when reconciling expenses or following up on specific transactions.

In summary, keeping monthly billing statements until your payment has been processed or the policy period ends is a prudent practice that enables you to stay organised, resolve disputes, build credit, and maintain comprehensive financial records.

Insuring an Unregistered Vehicle

You may want to see also

Frequently asked questions

You should keep your auto insurance statements for as long as your policy is active or until any open claims are resolved. If your policy is no longer active and you haven't filed a claim, you don't need to keep your statements.

If your policy is for a business, you might need to keep insurance documents for tax purposes for up to seven years. Check with your tax advisor for advice.

If you file a car insurance claim, keep your statements until the claim is closed and all payouts have been sent to you.

You can throw away old car insurance documents when you switch providers or when your policy renews and you get new documents.