To sell life and health insurance in Kentucky, individuals must obtain a license by passing the Kentucky Life and Health Insurance exam. The exam consists of 50 questions and has a time limit of 1 hour. A score of 70% or higher is required to pass. While the specific questions on the exam may vary, individuals can prepare by studying topics such as types of health insurance policies, disability income insurance, medical expense insurance, health insurance providers, and common provisions and features. Additionally, individuals must meet certain requirements, such as being at least 18 years of age and completing a pre-licensing education program, before they can take the exam.

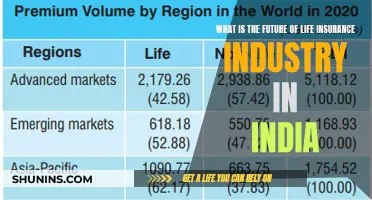

| Characteristics | Values |

|---|---|

| Number of Questions | 50 |

| Time Limit | 1 Hour |

| Passing Score | 70% |

The number of questions

The exam covers a range of topics related to life and health insurance, including health insurance policies, disability income insurance, medical expense insurance, health insurance providers, and various provisions and features of insurance policies. It is important to note that the exam content, format, and length can vary by state, so it is recommended to check the specific requirements for Kentucky.

Preparing for the exam involves completing a pre-licensing education program and studying the relevant material. Practice tests and study guides are available to help candidates prepare effectively. Additionally, there are specific requirements that must be met before taking the exam, such as submitting the appropriate forms, application, and fees, as well as completing a criminal background check.

Kansas Executor: Can They Be a Life Insurance Beneficiary?

You may want to see also

Time limit

The time limit for the Kentucky Life Insurance exam is 1 hour. This is also the time limit for the Kentucky Health Insurance exam, which has the same number of questions as the Life Insurance exam.

The number of questions and the time limit for the exam vary depending on the state. While some states' tests contain 150 questions, others have as few as 50. Similarly, some states' exams are timed at 2.5 hours, while others are set at 1.5 hours.

The Kentucky Life Insurance exam consists of 50 questions, and candidates must achieve a passing score of 70%. The exam covers various topics, including types of health insurance policies, disability income insurance, medical expense insurance, health insurance providers, and common provisions and features.

To prepare for the exam, it is recommended to complete a prelicensing course approved by the Department of Insurance and review the exam content outline available on the testing provider's website. Additionally, candidates can take advantage of practice tests and study guides offered by various sources to familiarize themselves with the exam format and improve their understanding of the material.

It is important to note that the time limit for the Kentucky Life Insurance exam is relatively shorter than some other states, so candidates should ensure they manage their time effectively during the exam.

Business Owners: Life Insurance Through Your Company?

You may want to see also

Topics covered

The topics covered in the Kentucky Life Insurance exam are diverse and comprehensive, providing candidates with a thorough understanding of the subject. Here is a detailed overview of the topics that candidates can expect to encounter:

Types of Health Insurance Policies:

The exam will delve into the different types of health insurance policies available, including HMOs (Health Maintenance Organizations). Candidates should be familiar with the features, benefits, and limitations of each type of policy.

Disability Income Insurance:

This section focuses on disability income insurance, which provides financial protection for individuals unable to work due to injury or illness. Candidates should understand the eligibility criteria, benefits provided, and any exclusions or limitations of this type of insurance.

Medical Expense Insurance:

Candidates will be tested on their knowledge of medical expense insurance, which covers medical costs associated with accidents, illnesses, or injuries. This includes understanding the scope of coverage, exclusions, and how the policy interacts with other forms of health insurance.

Health Insurance Providers:

The exam will cover the various types of health insurance providers, including traditional insurers, managed care organizations, and government programs. Candidates should know the roles, responsibilities, and unique characteristics of each provider type.

Common Provisions and Features:

This section explores the standard provisions and features found in life and health insurance policies. Candidates should be familiar with terms such as premiums, deductibles, coinsurance, and policy limits, as well as any optional add-ons or riders that can be included in a policy.

Required and Optional Uniform Policy Provisions:

Candidates will need to understand the mandatory provisions that must be included in all life insurance policies, as well as the optional provisions that may be offered. This includes knowledge of policy conditions, exclusions, and any additional benefits provided.

The Application and Underwriting Process:

The exam will cover the steps involved in applying for life insurance, including the underwriting process. Candidates should understand the factors considered during underwriting, such as medical history, lifestyle choices, and financial stability, and how these factors impact the policy's terms and premiums.

Group Health Insurance:

Group health insurance, commonly provided by employers, will be covered in the exam. Candidates should know the features, benefits, and eligibility requirements of group health plans, as well as how they differ from individual policies.

Special Types of Health Policies:

This section focuses on less common types of health insurance policies, such as long-term care insurance and social health insurance. Candidates should understand the unique features and benefits of these policies and the specific situations they cater to.

Life Insurance Plans:

In addition to health insurance, the exam will cover life insurance plans. Candidates should be familiar with the different types of life insurance, such as term, whole life, and universal life insurance, and the benefits provided by each type.

Health Insurance Tax Issues:

The exam will touch on the tax implications of health insurance, including tax deductions for premiums, tax treatment of benefits received, and any tax penalties associated with specific types of policies.

Kentucky Insurance Laws and Administrative Rules:

Candidates are expected to have a solid understanding of the Kentucky insurance laws and regulations that govern the industry. This includes knowledge of the licensing requirements, consumer protections, and any rules specific to the state of Kentucky.

Life Insurance Options for People Living with MS

You may want to see also

Exam format

The exam format for the Kentucky Life Insurance exam will consist of 50 questions in total, with a time limit of 1 hour. To pass, you will need a score of 70% or above.

The exam will cover a range of topics, including:

- Types of Health Insurance Policies

- Disability Income Insurance

- Medical Expense Insurance

- Health Insurance Providers

- Common Provisions and Features

- Required Uniform Policy Provisions

- Optional Uniform Policy Provisions

- The Application and Underwriting

- Group Health Insurance

- Special Types of Health Policies

- Long-Term Care Insurance

- Social Health Insurance

- Health Insurance and Taxation

- Kentucky Law

The exam will likely be in a multiple-choice format, and you will need to select the best answer from the choices provided. It is important to note that the exam may also include questions that are not directly related to the topics mentioned above. Therefore, it is essential to have a strong understanding of the broader context and concepts related to life insurance.

Additionally, there are specific requirements and procedures that you must follow on the day of the exam. These include presenting a valid form of government-issued identification, such as a driver's license, passport, or military ID, and ensuring that your full name and photograph are included in the identification. You may also need to provide your test confirmation and complete any necessary pre-test requirements. It is prohibited to bring electronic devices, such as cell phones, tablets, or watches, into the testing room, and certain articles of clothing may also be prohibited.

To prepare for the exam, it is recommended to utilize study guides, practice tests, flashcards, and online prep courses specifically designed for the Kentucky Life Insurance exam. These resources can help you gain a comprehensive understanding of the material and identify areas that require further study.

Finding Life Insurance Clients: Strategies for Success

You may want to see also

Passing score

To pass the Kentucky Life Insurance exam, you need to score at least 70%. The exam consists of 50 questions, which must be completed within a time limit of 1 hour. The exam covers various topics, including different types of insurance policies, such as group life insurance, universal life insurance, and whole life insurance. It is important to prepare for the exam by studying the relevant material and practicing with sample questions.

The Kentucky Life Insurance exam is designed to test your knowledge of life insurance products and related concepts. While the specific questions on the exam may vary, you can expect to be assessed on your understanding of key life insurance principles and your ability to apply them to real-world scenarios.

To pass the exam, you need to achieve a score of 70% or higher. This means that you need to answer at least 35 out of the 50 questions correctly. It is important to note that the passing score is set by the state of Kentucky and may be subject to change, so it is always a good idea to check for the most up-to-date information before taking the exam.

The exam consists of 50 multiple-choice questions, and you will have one hour to complete them. This means that time management is crucial during the exam. It is essential to allocate your time effectively and not spend too long on any single question. Practicing with sample exams and timed conditions can help you improve your time management skills and increase your chances of passing.

The exam covers a range of topics related to life insurance. These topics include the different types of insurance policies, such as group life insurance, universal life insurance, and whole life insurance. The exam may also test your knowledge of relevant state laws and regulations, tax considerations, and other factors that impact life insurance planning.

To prepare for the Kentucky Life Insurance exam, it is essential to study the relevant material thoroughly. This includes understanding the different types of insurance policies, their features, and how they work. You should also familiarize yourself with the specific laws and regulations related to life insurance in Kentucky, as these topics are likely to be covered on the exam.

In addition to studying the material, it is highly beneficial to practice with sample questions and exams. This will help you become familiar with the exam format and the types of questions asked. By practicing under timed conditions, you can also improve your time management skills and identify areas where you need further review.

Life Insurance for Dogs: Is It Possible?

You may want to see also

Frequently asked questions

There are 50 questions on the KY life insurance exam.

The time limit for the exam is 1 hour.

You need to score 70% or higher to pass.

The exam covers a range of topics, including types of health insurance policies, disability income insurance, medical expense insurance, health insurance providers, and common provisions and features.