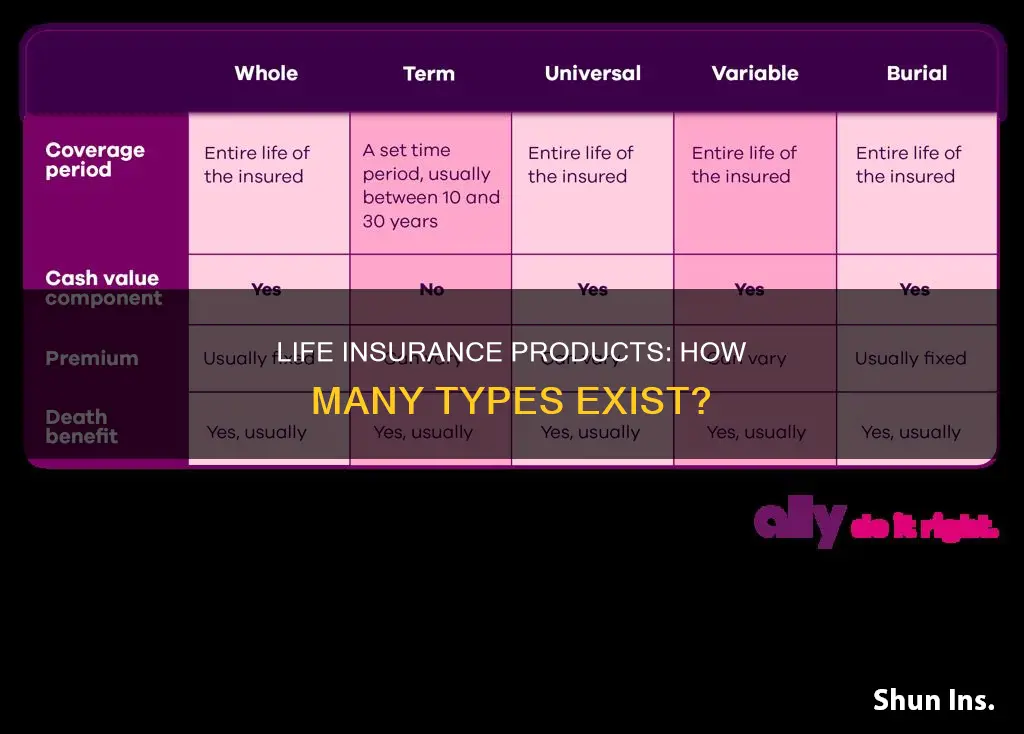

Life insurance is an essential part of financial planning and legacy planning. There are two main types of life insurance: term life and permanent life. Term life insurance is purchased for a specified period, such as 1, 5, 10, or 30 years, and provides coverage only during that time. Permanent life insurance, on the other hand, provides coverage for the insured person's lifetime as long as premium payments are maintained. Within these two broad categories, there are several subtypes of life insurance products.

| Characteristics | Values |

|---|---|

| Number of Types | 5 main types, 2 main categories |

| Examples | Term life insurance, Whole life insurance, Universal life insurance, Variable life insurance, Final expense life insurance |

| Coverage Length | Temporary (1, 5, 10, 20, 30 years) or lifelong |

| Complexity | Straightforward or flexible |

| Coverage Amount | $2,500 to $50,000+ |

| Cash Value | Yes or No |

| Medical Exam Required | Yes or No |

| Best for Ages | 18-85 |

What You'll Learn

Term life insurance

There are five main types of life insurance: term life insurance, whole life insurance, universal life insurance, variable life insurance, and final expense life insurance. Term life insurance is a popular choice for those looking to save money upfront. Here is some more information about term life insurance:

Types of Term Life Insurance

There are several types of term life insurance to choose from:

- Fixed Term: This is the most popular and basic version of term life insurance. It lasts 10, 20, or 30 years, and the premiums remain static.

- Increasing Term: This type of policy allows you to scale up the value of your death benefit over time, but your premiums will slightly increase. These policies tend to cost more but usually deliver a larger payout.

- Decreasing Term: This type of insurance reduces the premium payments over time, which can result in a smaller death benefit. This type of insurance makes sense for those who predict they will have fewer financial obligations as they age.

- Annual Renewable: This type of insurance provides coverage on a yearly basis and must be renewed by the policy end date. The premiums usually increase each time the plan is renewed, making this option best for those in need of short-term coverage.

Benefits of Term Life Insurance

- The cost of this type of coverage is usually low.

- You can choose the term length that suits you best.

- A term policy may save you money upfront and provide your family with ample security.

- You can scale your death benefit up and down with increasing and decreasing term policies.

- Many term life insurance policies allow you to convert to a permanent life insurance policy with no additional medical exam.

Is National Family Life Insurance a Good Option?

You may want to see also

Whole life insurance

There are five main types of life insurance products: term life insurance, whole life insurance, universal life insurance, variable life insurance, and final expense life insurance. This answer will focus on whole life insurance.

One of the main advantages of whole life insurance is that it offers lifelong coverage, whereas term life insurance only covers a specified period. Whole life insurance also provides a guaranteed death benefit, which means that the beneficiary will receive a payout regardless of when the insured person passes away, as long as the premiums have been paid. Additionally, the premiums for whole life insurance are fixed and do not change over time.

FAFSA and Life Insurance: What You Need to Know

You may want to see also

Universal life insurance

One disadvantage of universal life insurance is that it requires management. You need to determine how much you want to pay for premiums, and you need to keep an eye on your value balance over time. If the cash value falls to zero and your premiums don't cover the cost of insurance, your policy can lapse. Additionally, returns are not guaranteed, and some withdrawals are taxed.

Group Life Insurance: A Viable Option for Associations?

You may want to see also

Variable life insurance

There are five main types of life insurance: term life insurance, whole life insurance, universal life insurance, variable life insurance, and final expense life insurance. Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account with money that is typically invested in mutual funds.

Whole Life Insurance: Tax Write-Off or Not?

You may want to see also

Final expense life insurance

There are five main types of life insurance products: term life insurance, whole life insurance, universal life insurance, variable life insurance, and final expense life insurance. Final expense life insurance, also known as burial insurance, is a type of whole life insurance that offers a smaller and more affordable death benefit designed to cover end-of-life expenses such as funeral costs, medical bills, and outstanding debt.

Final expense insurance is one of the most affordable types of life insurance, with policies starting at around $63 per month for coverage ranging from $5,000 to $40,000. The approval process is also quick and easy, and coverage can be issued in days or even on the same day as the application. Final expense insurance policies do not require a medical exam, making them more accessible to seniors with pre-existing health conditions. Instead, applicants need only answer a few health questions to qualify for coverage.

Final expense insurance offers competitive, fixed premiums that do not change over time. The cash benefit can be used to cover funeral and burial costs, medical needs, or anything else that will help loved ones. The policy remains in place as long as the premiums are paid, and it builds cash value over time, which can be used to borrow against or as a non-forfeiture benefit. This type of insurance can help ease the financial burden on loved ones and allow them to focus on healing during a difficult time.

The cost of a funeral can be a significant expense, with the average funeral costing around $8,300 to $10,000 or more. Final expense insurance can help cover these costs, as well as other end-of-life expenses, ensuring that loved ones are not left with a financial burden. It is an important consideration when planning for the future and ensuring financial security for those left behind.

Life Insurance and Mortgages: What's the Connection?

You may want to see also

Frequently asked questions

There are two main types of life insurance: term life insurance and permanent life insurance. Within permanent life insurance, there are several subtypes, including whole life insurance, universal life insurance, variable life insurance, and final expense life insurance.

Term life insurance provides coverage for a specified period, such as 1, 5, 10, or 30 years. If the insured person dies during this period, a payout is made to the beneficiaries. However, if the policy expires before the insured person's death, no payout is made. Term life insurance is generally more affordable than permanent life insurance.

Permanent life insurance, also known as whole life insurance, provides coverage for the insured person's lifetime as long as premium payments are maintained. It also includes a "cash value" component, which can be used to build retirement savings or for other financial goals. Whole life insurance policies typically have fixed premiums, death benefits, and cash value growth rates.