Home insurance is calculated based on several factors, including the location of the property, the construction materials used, the age of the home, and the cost of rebuilding. The insurance company will also consider the likelihood of claims being made and the potential cost of those claims. This includes taking into account the number of claims made in the area, crime rates, and the distance to the nearest fire hydrant and fire station. Additionally, the square footage of the home, the contents and quality of construction, and the presence of security systems can influence the insurance premium. The premium is the amount paid for the insurance policy, and it can be paid monthly or annually.

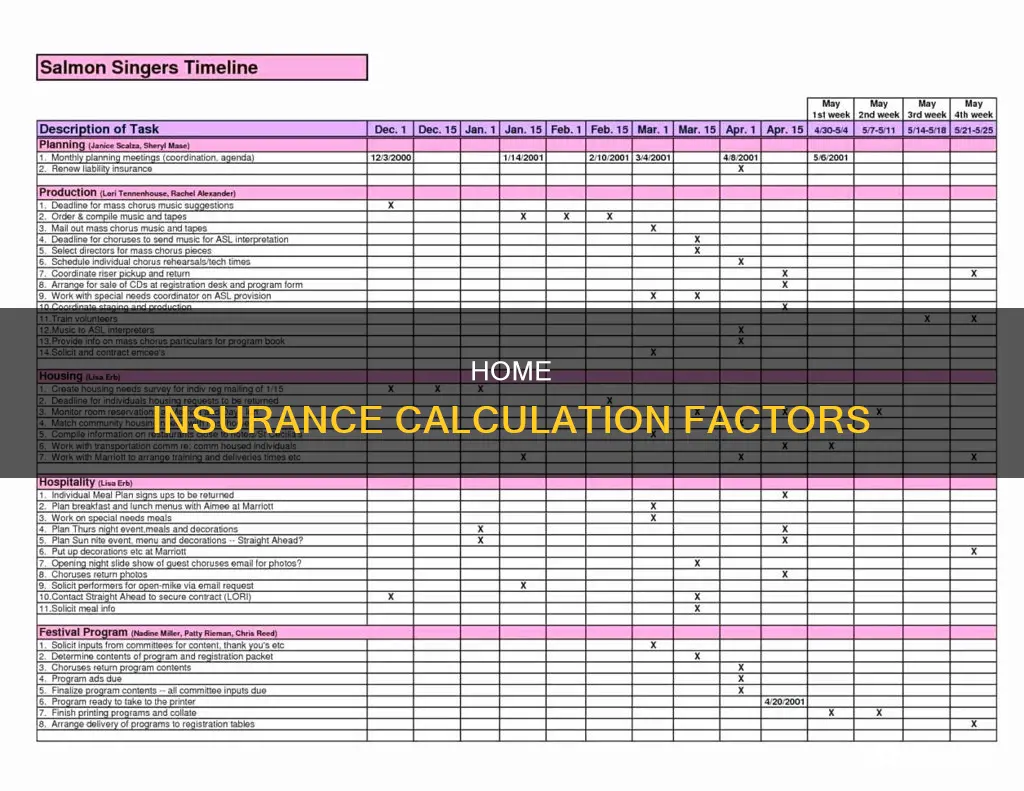

| Characteristics | Values |

|---|---|

| Home location | Areas with frequent natural disasters, proximity to the coast, fire stations, fire hydrants, crime statistics |

| Home characteristics | Age, square footage, building materials, roof type and age, custom features, building codes, size and number of other structures |

| Home value | Replacement cost, market value |

| Personal factors | Credit score, claims history |

| Insurance choices | Company, coverage options, deductible, bundling, discounts |

What You'll Learn

Home location and risk

The location of your home is a significant factor in determining your home insurance premium. Insurance companies use your address to track the number of claims, the type of claims, and the cost of claims in your area. This information is used to determine the likelihood of a potential claim arising.

If you live in an area with a high incidence of break-ins or vandalism, for example, your rate is likely to be higher than in an area where those things are rare. Similarly, if your house is located in an area with a history of losses, such as theft, vandalism, or weather-related events, you may see a higher rate.

The location of your home can also impact the replacement cost, as construction costs, including labour and materials, may vary depending on the region.

Insurers will also consider the distance of your home from a fire station and a fire hydrant. The closer you are to a fire hydrant and fire station, the more likely a fire can be quickly extinguished, reducing the risk of severe damage or the complete destruction of your home.

Other location-specific factors that can impact your home insurance premium include:

- Crime rates in your area.

- Susceptibility to natural hazards such as tornadoes, earthquakes, and floods.

- Whether your house sits in a flood plain.

Allstate vs. Farmers Insurance: A Comprehensive Comparison Guide

You may want to see also

Rebuild cost

The rebuild cost is the amount it would cost to completely rebuild a home if it were destroyed beyond repair. This cost typically includes the price of labour and materials and is usually lower than the home's sale price or market value.

The rebuild cost is important because it is what home insurance policies are rated on. The higher the cost to rebuild a home, the higher the insurance premium. The value never includes the cost of the land, as that does not factor into the replacement cost.

There are two ways to calculate the rebuild cost of a standard, brick-built home:

- Use an online rebuilding cost calculator, such as the Building Cost Information Service’s house rebuilding cost calculator.

- Hire a chartered surveyor to carry out a professional assessment.

If your home is made from non-standard materials, has special architectural features, or is a listed building, it is recommended to contact a chartered surveyor for advice.

- Roof type: The type of roof you have can impact the rebuild cost as some roofs are built to withstand harsh weather conditions and are therefore more costly to replace.

- Local building codes: This is especially important for older homes as newer guidelines could make the repair cost higher.

- Foundation type: The type of foundation your house has can significantly contribute to the rebuild cost.

- Square footage of your home: The average rebuild cost per square foot is a primary factor in determining the replacement cost.

- Local construction costs: Construction costs differ depending on your location.

- Outdoor features: Patios and decks attached to your home can add value and should be considered in the replacement value.

- Home improvements or additions: Upgrades to your home can add significant value and should be disclosed to your insurer.

It is important to review the rebuild cost of your home each time you renew your insurance and after any renovations or extensions. This will ensure that you are fully covered in the event of a total loss.

Farmers Insurance Observes Martin Luther King Jr. Day: A Look at Hours and Services

You may want to see also

Home age and characteristics

The age of a home is a significant factor in determining insurance costs. Older homes generally have higher premiums due to increased risks associated with ageing infrastructure. For instance, an older roof is more susceptible to leaking after heavy rainfall, potentially leading to water damage claims. However, updates like a new roof can help decrease the impact of the building's age on insurance costs.

The construction materials used in a home influence its insurance costs. Homes built with brick, stone, concrete, slate, tiles, metal, or asphalt are generally preferred by insurers. Additionally, the quality of construction plays a role, with state-of-the-art construction methods often resulting in lower premiums. Older homes may have outdated electrical wiring or plumbing, increasing the likelihood of issues and, consequently, insurance claims.

The size of a home also matters, as larger homes typically cost more to repair and replace in the event of damage. The square footage of a house can impact the number of furnishings and belongings that need to be covered by insurance, leading to higher premiums.

Features such as crown mouldings, custom windows, and built-in cabinets can increase the cost of replacing a dwelling, which, in turn, increases insurance premiums.

The location of a home is another critical factor. Neighbourhoods with higher crime rates, theft, or vandalism may result in higher insurance costs. Additionally, the distance from a fire station and fire hydrant is considered, as proximity can reduce the damage caused by a fire.

The age and condition of a home's roof are also important. A new roof is more durable and less likely to cause water damage, leading to lower insurance premiums.

Overall, the age and characteristics of a home significantly impact the cost of insurance. Insurers consider the risks associated with ageing infrastructure, construction materials, size, location, and the condition of essential components like the roof when calculating insurance premiums.

Solar Panels: Insurance Impact

You may want to see also

Credit score and claims history

Credit scores and claims history are two of the most important factors that insurance companies consider when calculating home insurance premiums.

Credit Score

In most states, insurance companies use what’s known as a credit-based insurance score to help determine home insurance rates. Credit-based insurance scores are similar to traditional credit scores but weighted differently. They take into account factors such as how much debt you have and whether you’ve made payments on time. Insurance companies use these scores to predict how likely you are to file a claim, as studies have shown that those with lower credit-based insurance scores are responsible for a higher number of claim payouts.

While a credit check can affect your insurance offer and rates, it is usually not the sole reason for an insurance company’s decision. In fact, many states don't allow insurance companies to use scores this way, and some states strictly regulate or completely outlaw the use of credit reports and credit-based insurance scores in relation to homeowners insurance.

Claims History

Insurance companies also consider your claims history when calculating your home insurance premium. They will look at past claims to determine your future behaviour and whether you are likely to make a claim. The more claims you have, the higher the risk you are considered to be. This goes for the claims history of your neighbourhood as well.

Insurers don’t expect you to never make a claim, but your claims history can work against you if it’s deemed to be ‘adverse’. Adverse can mean you’ve made many claims in a short space of time or you’ve claimed for a few high-value events. For example, you may have claimed on your insurance ten times in one year or you’ve claimed for costly events like theft or break-ins.

If you have an adverse claims history, an insurer may see you as a high-risk customer and may reject your application or refuse to renew your policy.

Farmers Insurance Military Discounts: Unraveling the Benefits for Service Members

You may want to see also

Policy deductible

A home insurance deductible is the amount of money that you will have to pay out of pocket if you file a claim through your insurance policy and it is approved. It is different from your insurance premium, which is the amount you pay to maintain your insurance coverage. Typically, the higher your deductible, the lower your premium. The insurance deductible must be met before your home insurance company begins to pay out for the repairs required after an approved claim.

There are two main types of homeowners insurance deductibles: dollar-amount and percentage-based. A dollar-amount deductible will define a specific dollar amount that you must pay out of pocket in a claim situation. A percentage-based deductible will define a specific percentage of your home’s insured value to be the deductible.

When choosing a deductible, it is important to consider your financial situation and what you can afford to pay out of pocket for damage to your home. You should also weigh the cost difference when changing the deductible amount, as a lower deductible will result in a higher premium and vice versa.

It is also worth noting that deductibles for damage from hurricanes, wind, or hail are often a percentage of your home's insured value, rather than a flat dollar amount.

Vacant Homes: Insurance Validity

You may want to see also

Frequently asked questions

Home insurance is calculated using a variety of factors, including the age, location, and condition of your home, as well as the value of your personal property and the types of coverage you choose. The cost of rebuilding your home is a significant factor in determining your insurance premium.

In most states, your credit score is used as a rating factor by insurance companies. Homeowners with lower credit scores tend to file more claims and therefore pay higher premiums than those with good or excellent credit.

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, while a lower deductible means the insurance company assumes more risk and leads to a higher premium.