The average cost of car insurance in the US is $124 per month, or $1,488 per year, for a liability-only policy. However, this figure can vary widely depending on several factors, including age, location, driving history, credit score, vehicle type, and more. For example, young drivers tend to pay more for car insurance due to their lack of experience, while drivers with a history of traffic violations or DUIs will also face higher premiums. Additionally, insurance rates can differ between states and even between ZIP codes, with more densely populated or high-risk areas typically resulting in higher insurance costs.

| Characteristics | Values |

|---|---|

| Average cost of car insurance per year | $1,718 for full coverage |

| Average cost of car insurance per year | $488 for minimum coverage |

| Average cost of car insurance per month | $143 for full coverage |

| Average cost of car insurance per month | $41 for minimum coverage |

| Average cost of car insurance in New York per year | $3,587 for full coverage |

| Average cost of car insurance in New York per year | $1,502 for minimum coverage |

| Average cost of car insurance in New York per month | $299 for full coverage |

| Average cost of car insurance in New York per month | $125 for minimum coverage |

| Average cost of car insurance per month | $190 for full coverage |

| Average cost of car insurance per month | $52 for minimum coverage |

| Average cost of car insurance per year | $2,278 for full coverage |

| Average cost of car insurance per year | $621 for minimum coverage |

| Average cost of car insurance per month | $50 for liability-only coverage |

| Average cost of car insurance per year | $595 for liability-only coverage |

What You'll Learn

- Full coverage insurance costs an average of $1,718 per year, or about $143 per month

- Minimum coverage costs an average of $488 per year, or around $41 per month

- Young drivers, drivers with a recent DUI and drivers with poor credit pay some of the highest car insurance rates on average

- Wyoming, Vermont and New Hampshire have some of the cheapest full coverage car insurance rates in the country

- Florida, Louisiana and Texas are the most expensive states for car insurance

Full coverage insurance costs an average of $1,718 per year, or about $143 per month

The national average annual car insurance cost is $1,718 for full coverage and $488 for minimum coverage. The monthly average cost of car insurance for drivers in the US is $190 for full coverage and $52 for minimum coverage.

Young drivers, drivers with a recent DUI, and drivers with poor credit pay some of the highest car insurance rates on average.

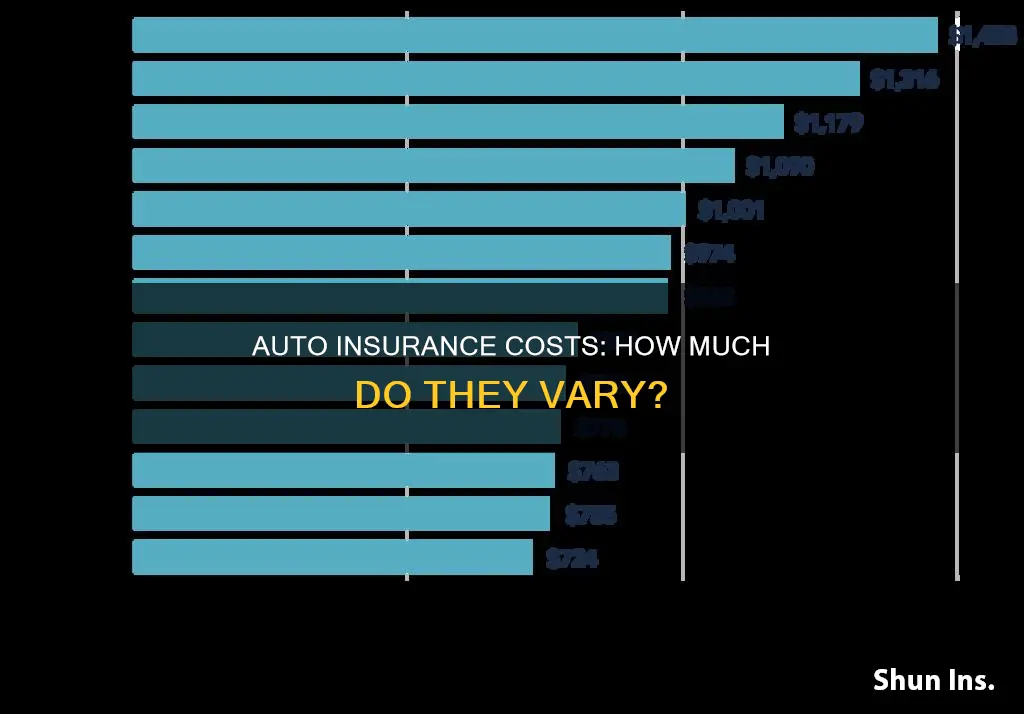

The cost of car insurance also varies by state. For example, Wyoming's average full coverage annual rate of $972 is much lower than Florida's $3,067.

In addition to these factors, car insurance rates can be influenced by your gender, occupation, previous insurance company, annual mileage, marital status, education level, and additional coverage options.

Stolen Vehicles: Insurance Claim Process

You may want to see also

Minimum coverage costs an average of $488 per year, or around $41 per month

The cost of auto insurance varies depending on the type of coverage you choose. The monthly average cost of car insurance for drivers in the U.S. is $190 for full coverage and $52 for minimum coverage.

Minimum coverage is a more affordable option, as it only includes the state-mandated minimum insurance requirements. This typically includes bodily injury and property damage liability, but specific coverage limits vary from state to state. Minimum coverage does not include coverage for damage to your own vehicle.

The average cost of minimum coverage car insurance is $488 per year, or approximately $41 per month. This option is suitable for those seeking basic financial protection while still meeting legal requirements. However, it is important to note that minimum coverage may not provide sufficient protection in the event of a major accident or claim.

When considering minimum coverage, it is essential to review the specific requirements and limitations of your state. Additionally, keep in mind that the cost of auto insurance can vary based on factors such as your age, driving record, location, vehicle type, and credit score.

Switching Auto Insurance: Early Termination

You may want to see also

Young drivers, drivers with a recent DUI and drivers with poor credit pay some of the highest car insurance rates on average

Young drivers, drivers with a recent DUI, and drivers with poor credit are often charged some of the highest auto insurance rates. There are various factors that influence the cost of car insurance, and these factors can differ from one person to another. For instance, young drivers, typically those under 30 years old, are considered less experienced and hence riskier to insure. As a result, they are often charged higher premiums. Similarly, drivers with a recent DUI are considered high-risk and may face significant increases in their insurance rates or even have their policies non-renewed. On the other hand, drivers with poor credit may be charged higher premiums as insurance companies often associate poor credit scores with a higher likelihood of filing claims.

The cost of car insurance for young drivers depends on various factors, including age, gender, driving record, credit score, and location. According to NerdWallet's analysis, the average annual car insurance cost for a 20-year-old driver with a clean driving record and good credit is $3,576 for full coverage and $1,023 for minimum coverage. However, young drivers with poor credit or a less-than-perfect driving history can expect to pay even higher premiums. Gender can also play a role in determining insurance rates, with men typically paying more than women, especially at a younger age.

For drivers with a recent DUI, the impact on insurance rates can be significant. On average, car insurance costs for full coverage increase by about 85%, which translates to an additional $1,468 per year. The increase in insurance rates after a DUI can vary by state, with some states having more stringent laws and higher average premiums. Additionally, some insurance carriers may refuse to provide coverage to drivers with a DUI conviction, making it challenging to find affordable insurance options.

Drivers with poor credit also face higher insurance rates. On average, car insurance costs for full coverage are about 60% higher for drivers with poor credit compared to those with good credit. This disparity is due to insurance companies associating poor credit scores with a higher likelihood of filing claims. However, it's important to note that some states, such as California, Hawaii, and Massachusetts, prohibit insurers from using credit scores to determine insurance rates.

While young drivers, drivers with a DUI, and those with poor credit may face higher insurance rates, there are ways to mitigate these costs. Maintaining a clean driving record, improving credit scores, shopping around for quotes, and comparing rates from different insurance companies can help individuals in these categories find more affordable coverage options. Additionally, taking advantage of discounts, such as those offered for bundling policies or maintaining good grades for young drivers, can also help lower insurance premiums.

Health Insurance Claims After Auto Settlements

You may want to see also

Wyoming, Vermont and New Hampshire have some of the cheapest full coverage car insurance rates in the country

The national average annual cost of car insurance in the US is $1,718 for full coverage and $488 for minimum coverage. However, these rates vary widely by state, with Wyoming, Vermont and New Hampshire having some of the cheapest full coverage car insurance rates in the country.

Wyoming has an average full coverage annual rate of $972, which is 44% cheaper than the national average. Vermont's average full coverage annual rate is $1,082, which is 37% cheaper than the national average. New Hampshire's average full coverage annual rate is $1,119, which is 34% cheaper than the national average.

These low rates in Wyoming, Vermont and New Hampshire can be attributed to a combination of factors, including low population density, a low number of licensed drivers, a low rate of uninsured drivers, and well-ranked infrastructure in these states. Additionally, these states experience relatively mild weather patterns, resulting in fewer weather-related claims.

It is worth noting that car insurance rates are highly personalized and can vary based on individual factors such as age, driving record, credit score, and vehicle type. However, the state in which one resides plays a significant role in determining the cost of car insurance.

Auto Insurance: Re-evaluating Claims

You may want to see also

Florida, Louisiana and Texas are the most expensive states for car insurance

The cost of car insurance varies significantly from state to state, and Florida, Louisiana and Texas are the three most expensive states for car insurance in the US.

Florida

Florida has the second most expensive car insurance rates in the US, with an average annual premium of $3,430 for full coverage, according to Bankrate. This is 53% above the national average. Florida's high insurance rates are due to a combination of factors, including its location in "hurricane alley", which makes it prone to high winds, flooding and property damage; a large student population, resulting in many young drivers on the roads; and a high number of uninsured drivers (over 20%).

Louisiana

Louisiana has the most expensive car insurance in the US, with an average annual premium of $3,606 for full coverage, according to Bankrate. This is 61% above the national average. Louisiana's high insurance rates are attributed to a high number of uninsured and underinsured drivers, inflation pushing up the cost of parts and labour, and an increased risk of accidents and claims due to dangerous driving conditions.

Texas

Texas has the fifth most expensive car insurance in the US, with an average annual premium of $2,567 for full coverage, according to NerdWallet. This is 31% above the national average. Texas's high insurance rates are partly due to its large population, with more drivers on the roads leading to a higher risk of accidents and claims.

Auto Insurance: Legal Risks and You

You may want to see also

Frequently asked questions

The average cost of car insurance is $50 per month or $595 per year for liability-only car insurance across the U.S. Your rate may differ based on several factors, including your driver profile and location.

On average, full coverage insurance costs more than three times as much as minimum coverage. However, unlike minimum coverage, full coverage insurance pays out if your car is stolen or you need repairs after an accident. Minimum coverage pays for damage to another vehicle only in an at-fault accident. It will not cover your repairs.

In general, young drivers, drivers with a recent DUI and drivers with poor credit pay some of the highest car insurance rates.

Your car insurance rate will vary depending on factors such as where you live, the vehicle you drive and your driving history.

If you're looking to save when buying car insurance, there are several simple strategies you can use to lower your costs:

- Compare multiple quotes

- Bundle your policies

- Reduce your mileage

- Raise your deductible

- Look for discounts