In the context of auto insurance, 100/300/100 refers to the different coverage levels of bodily injury liability costs and property damage liability costs in your insurance policy. This means that your insurance company will cover up to $100,000 for bodily injury liability per injured person in an accident, $300,000 for total bodily injury liability per accident, and $100,000 for property damage liability per accident.

| Characteristics | Values |

|---|---|

| First number | $100,000 per person for bodily injury liability coverage |

| Second number | $300,000 per accident for bodily injury liability coverage |

| Third number | $100,000 per accident for property damage liability coverage |

| Average annual premium | $1,822 |

What You'll Learn

What does 100/300/100 mean?

100/300/100 insurance coverage is a type of auto liability insurance that provides protection for bodily injury and property damage if you cause an accident. The numbers in the coverage refer to the maximum amount your insurer will pay out for each type of claim.

So, in a 100/300/100 policy, you would have $100,000 coverage per person, $300,000 in bodily injury coverage per accident, and $100,000 in property damage coverage per accident. Bodily injury liability coverage pays for the medical expenses of the other driver and passengers if you cause an accident. Property damage liability coverage pays for repairing or replacing the other driver's vehicle.

The first two numbers in your 100/300/100 policy are your bodily injury liability coverage limits. The first number represents your bodily injury liability limits per person, and the second number represents your bodily injury coverage per accident. In a 100/300/100 liability policy, you would have $100,000 in coverage per person and $300,000 per accident. This means that if you hit someone else’s car and injure four people, your insurance company will pay up to $300,000 toward their total medical bills, with a limit of up to $100,000 per person.

The third number in a 100/300/100 split limit policy represents your property damage liability coverage limit. Property damage pays for damage you cause to another person’s property, up to the limits of your policy. Property damage liability insurance covers a wide variety of property damage, which means you are covered for things like hitting another car on the highway, driving through someone’s fence, or knocking over your neighbour’s mailbox. With a 100/300/100 liability policy, you would have up to $100,000 in property damage coverage per accident.

While 100/300/100 coverage provides a high level of protection, it doesn't cover everything. For example, this type of policy doesn't cover your own medical expenses or damage to your own vehicle. If you want coverage for these things, you'll need to add additional policies, such as personal injury protection or collision coverage, to your policy.

Gap Insurance: Headquarters Location

You may want to see also

How much does 100/300 insurance cost?

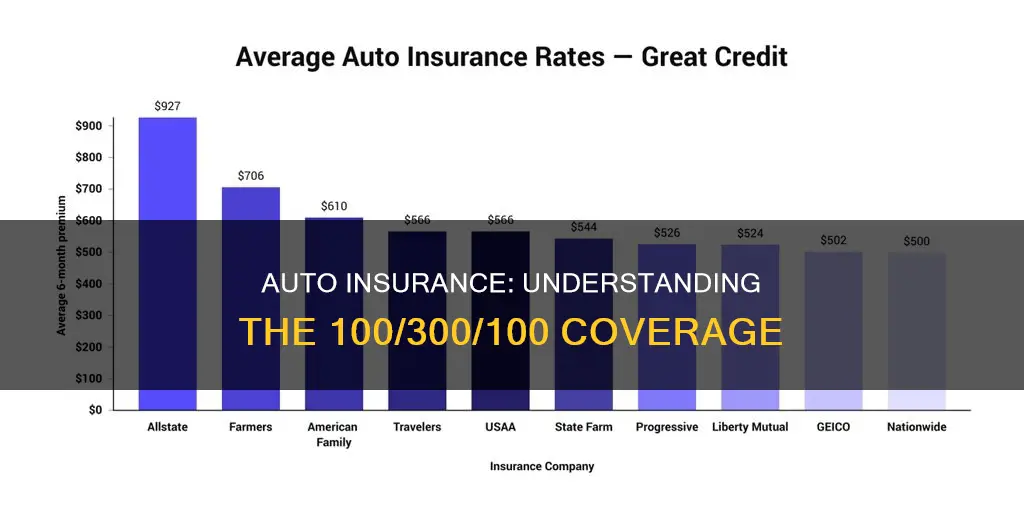

The cost of 100/300 insurance varies depending on the company and the driver's circumstances. However, drivers in the US pay an average of $1,822 for 100/300 coverage. In most cases, drivers can double their liability insurance coverage for less than $100 per year. For example, at Auto-Owners Insurance, the average rate for full coverage with 50/100 liability is $1,286, while full coverage with 100/300 liability is $1,422.

The term "100/300 insurance" refers to the minimum and maximum limits an insurance company will pay to cover bodily injury liability. A 100/300 auto insurance policy will typically cover up to $100,000 per person and $300,000 per accident for bodily injury liability, and $100,000 per accident for property damage liability. This is often written as 100/300/100 coverage.

While 100/300 insurance coverage is not mandated by law in any US state, it is a standard recommendation by national auto insurance carriers. Some states, such as Florida, require drivers with DUI convictions to purchase 100/300 coverage. Certain industries, such as food delivery, couriers, and rideshare companies, may also require their drivers to have 100/300/100 policies.

Having 100/300 insurance coverage can provide better financial protection in the event of an accident. While most states only require 25/50 coverage, this may not be sufficient to cover the costs of repairs and medical treatment. It is generally recommended to have at least 100/300/100 liability coverage to protect yourself from financial burden and potential litigation if you are at fault in an accident.

Uncovering Auto Insurance Fraud: A Guide for Illinois Residents

You may want to see also

Is 100/300 insurance required?

While 100/300 insurance coverage is not mandated by any US state law, it is a standard recommendation by national auto insurance carriers. Certain industries, such as food delivery, couriers, and rideshare companies, require 100/300/100 policies. Additionally, vehicle leasing companies may require this level of coverage to ensure financial protection in the event of an accident.

State laws differ on the minimum insurance coverage required, and it's important to check the specific requirements for your state. However, the recommended 100/300/100 coverage includes:

- $100,000 per person and $300,000 per accident for bodily injury liability.

- $100,000 per accident for property damage liability.

While this level of coverage is not mandatory in most cases, it offers better financial protection than the minimum required in most states, which is often 25/50 coverage. The higher limits of 100/300/100 can provide valuable peace of mind, knowing that you are covered for more significant expenses in the event of an accident.

It's worth noting that even with insurance, you will still be held financially responsible in an at-fault accident. Therefore, it is generally advisable to purchase more coverage than the state-mandated minimum to adequately protect yourself.

Combining Auto and Home Insurance in Michigan

You may want to see also

Why carry 100/300 limits?

The purpose of bodily injury liability coverage is to pay for other parties' injuries resulting from an accident you caused. While 48 states require a minimum amount of coverage, the cost of damages could exceed those liability limits. If the cost exceeds your insurance limits, you'll have to pay the remaining amount out of pocket.

Healthcare costs have risen dramatically in recent decades. From 1979 to 2020, healthcare costs in the U.S. rose nearly 669%, which comes out to more than 16% of the inflation rate per year. A single surgery to treat a serious spinal injury can approach $100,000, and that doesn't even include other medical bills, physical therapy, and lost wages. As a result, a serious accident could easily result in $100,000 of healthcare costs for a single person.

Purchasing higher insurance limits ensures that in the case of a serious accident, your insurance will cover it. While you might worry that 100/300 is too much coverage, it's likely not enough. As mentioned, a serious accident could easily result in serious injuries with medical expenses and lost wages of $100,000. In fact, the total could exceed that.

Many auto insurance policies offer coverage up to 250/500, meaning $300,000 per person and $500,000 per accident of bodily injury liability coverage. No matter your financial situation, it makes sense to purchase as much coverage as you can afford. If you have considerable assets and a high net worth, someone could take you to court for damages above and beyond what your insurance covers. Even if you don't have the assets to pay for those excess damages, you could have your wages garnished if you owe money after an accident.

Most U.S. states only require drivers to carry 25/50 insurance coverage. However, the 25/50 coverage is barely enough to cover the costs of repair and medical treatment needed after accidents. While the lower the numbers, the lower the premiums, and lower premiums are hard to resist, it's important to make sure you have enough car insurance coverage.

Any damages stemming from an accident that was your fault, even if those damages exceed your insurance coverage, are your financial responsibility. Not being able to pay for these damages could lead to the loss of savings and/or other assets, or even financial ruin. If you can't pay for whatever financial need remains after insurance coverage limits are exceeded, courts will go after your assets if you are the party at fault.

The more assets you have, the more auto insurance coverage you should have. The best way to protect yourself financially is with the recommended car insurance coverage of $100,000 per person and $300,000 per accident in bodily injury liability.

Postmates and Auto Insurance: What You Need to Know

You may want to see also

Is 100/300 insurance enough?

100/300 insurance is enough for the majority of drivers, but it's important to assess your risks, assets, and net worth when selecting your coverage. While it's not a minimum requirement in any US state, 100/300 insurance is a standard recommendation by national auto insurance carriers.

The term "100/300 insurance" refers to the minimum and maximum limits an insurance company will pay to cover bodily injury liability. A 100/300 auto insurance policy will cover $100,000 of bodily injury treatment costs for each injured person in an accident and $300,000 of bodily injury liability costs per accident.

The more assets you have, the more auto insurance coverage you should have. If you have a high net worth, you may want to increase your bodily injury coverage to 250/500/100. Additionally, if you live in an area with a lot of expensive cars on the road, you may want to increase your property damage liability coverage.

It's also worth considering an umbrella policy, which adds an extra layer of liability protection beyond the limits of your auto insurance. Umbrella policies typically start at $1 million in coverage for premiums of about $150 to $300 per year.

Ultimately, it's important to have enough insurance coverage to protect yourself financially in the event of an accident. While 100/300 insurance is enough for most drivers, those with more assets or a higher net worth may want to consider higher coverage.

Slavage Vehicles: Insured in California?

You may want to see also

Frequently asked questions

100/300/100 auto insurance covers up to $100,000 per person and $300,000 per accident in bodily injury liability, and up to $100,000 per accident in property damage liability.

100/300/100 auto insurance offers more coverage than 25/50/25 or 50/100/50 policies. It is considered the best coverage level for most drivers and is recommended by experts.

No, 100/300/100 auto insurance is not required by law in any state. However, some states mandate this level of coverage in special circumstances, such as for drivers with a DUI conviction.

On average, drivers in the US pay around $1,822 for 100/300/100 auto insurance. The cost may vary depending on factors such as location and driving record.