The average cost of car insurance in the U.S. varies depending on factors such as location, age, driving record, credit score, and vehicle type. The national average cost of car insurance is $1,483 per year, or $124 per month, according to a 2022 study. However, the cost can be as low as $64 per month for minimum coverage or as high as $194 per month for full coverage.

What You'll Learn

Average car insurance rates by state

The cost of car insurance varies significantly depending on the state in which you live. The national average rate for full coverage car insurance is $1,895, but this can be as low as $1,175 in Maine, the cheapest state for car insurance, and as high as $2,883 in Louisiana, the most expensive state.

Factors Affecting Insurance Rates by State

Several factors influence the price of auto insurance premiums by state. These include:

- Population density: Sparsely populated states like Idaho and North Dakota tend to have lower insurance rates than more populous states like California and New York.

- Crime rates: States with higher crime rates, including vehicle theft, tend to have higher insurance rates.

- Weather conditions: States prone to severe weather, such as hurricanes or hail, may have higher insurance rates to cover weather-related claims.

- Road conditions and infrastructure: States with poorly rated highway infrastructure may have higher insurance rates due to an increased risk of accidents.

- Number of licensed drivers: States with a higher number of licensed drivers can experience more accidents and claims, leading to higher insurance rates.

- Traffic density and congestion: Heavily congested areas can lead to higher insurance rates due to an increased risk of accidents and higher repair and labor costs.

- Cost of living: States with a high cost of living may have higher insurance rates, as the cost of repairs and labor is typically higher in these areas.

- Percentage of uninsured drivers: A high percentage of uninsured drivers can lead to increased insurance rates due to the risk of lawsuits and uninsured motorist claims.

Most and Least Expensive States for Car Insurance

Most Expensive States

- Louisiana

- Florida

- California

- Colorado

- South Dakota

- Michigan

- Kentucky

- Montana

- Washington, D.C.

- Oklahoma

Least Expensive States

- Maine

- New Hampshire

- Vermont

- Ohio

- Idaho

Insurance Drop: When You're Not Covered

You may want to see also

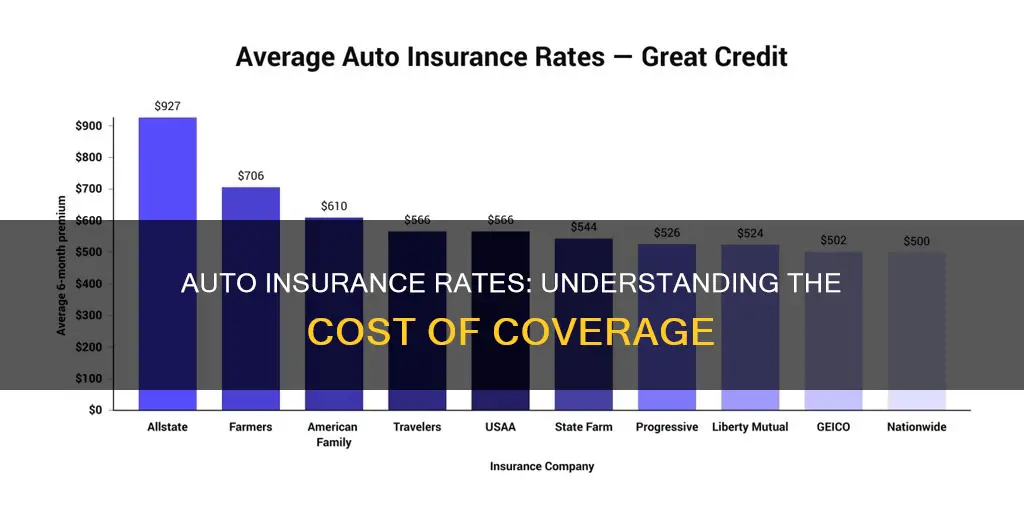

Average car insurance rates by company

The average cost of car insurance varies depending on the company, the driver's age, gender, location, credit score, driving history, and vehicle type.

USAA, Auto-Owners, and Geico are the cheapest car insurance companies for full coverage. However, USAA is only available to military members, veterans, and their families. For those who do not qualify for USAA, Auto-Owners and Erie offer competitive rates.

For state minimum liability insurance, Erie, Mercury, and Progressive are the cheapest options.

Average car insurance rates by age

Younger and older drivers tend to pay more for car insurance than those in their 30s and 40s. This is because insurance companies view less experienced drivers and senior citizens as riskier to insure.

Average car insurance rates by gender

In most states, women tend to pay lower premiums than men. This is because men generally engage in riskier driving behaviour and are more likely to be involved in accidents. However, the difference between male and female drivers' premiums tends to decrease after the age of 25.

Average car insurance rates by location

Car insurance rates vary by state. For example, Idaho, Vermont, and Ohio have some of the cheapest annual full coverage car insurance rates, while New York, Florida, and Louisiana have the most expensive rates.

Average car insurance rates by credit score

Drivers with poor credit pay higher premiums than those with good credit. This is because drivers with poor credit are seen as more likely to file insurance claims.

Average car insurance rates by driving history

Drivers with a clean driving record pay lower rates than those with a history of accidents, speeding tickets, or DUIs.

Average car insurance rates by vehicle type

The type of vehicle being insured also affects insurance rates. Sports cars, luxury cars, and electric vehicles tend to be more expensive to insure due to higher repair costs and the increased likelihood of accidents.

Other factors affecting car insurance rates

Other factors that can impact car insurance rates include occupation, annual mileage, marital status, insurance history, and previous insurance coverage.

NatGen Auto Insurance: Understanding Rental Car Coverage

You may want to see also

Average car insurance rates by age and gender

Age and gender are two of the biggest factors influencing car insurance premiums. Insurance companies charge drivers in their teens and 20s more because of their lack of experience and higher statistical risk of accidents.

Average Car Insurance Rates by Age

Insurance rates are highest for teens and seniors because they are considered high-risk groups. The likelihood of accidents and expensive claims is higher for these age groups.

The average cost of car insurance decreases as drivers age. Drivers aged 55 to 60 have the lowest insurance rates. This is because of their decades of experience behind the wheel. However, rates start to increase again around age 65 as the risk of accidents and claims rises.

Average Car Insurance Rates by Gender

Male drivers tend to pay higher insurance rates than female drivers. This is because men are statistically more likely to be involved in accidents and make more claims. From 2016 to 2020, men were the drivers in 72% of fatal crashes in the US.

The gap between insurance premiums for men and women is most pronounced in the under-20 age group, with an average difference of 14%. This is because young men aged 16 to 19 are more than twice as likely to cause a fatal car accident than females of the same age. The gender gap between insurance prices narrows once drivers reach middle age, with a difference of just 1% in premiums.

When age and gender are combined, there is an even greater disparity in auto insurance rates. For example, the average insurance rate for a 20-year-old male driver is 14% higher than for a 20-year-old female driver. By age 30, this difference decreases to just 2%.

It is important to note that not all states in the US allow age and gender to be used as rating factors in calculating insurance premiums. Some states have banned the use of gender as a factor, while others do not allow age to be considered.

Half-Year Florida Auto Insurance: Possible?

You may want to see also

Average car insurance rates by driving record

The cost of car insurance varies depending on a range of factors, including age, gender, driving history, and location.

Clean Driving Record

Drivers with a clean driving record and good credit will pay, on average, $194 per month for full coverage and $53 for minimum coverage in the US. However, rates differ across states. For example, in Idaho, the average annual cost of full coverage is $1,162, while in Florida, it is $3,067.

Speeding Ticket

A speeding ticket can increase car insurance costs by 23% on average. In some states, such as New York, car insurance companies are not allowed to raise rates if the accident damage is below a certain threshold and there are no injuries.

At-Fault Accident

An at-fault accident can increase monthly full-coverage insurance by 45% on average, or from $194 to $281. The increase will depend on the severity of the damage and the state.

DUI Conviction

A DUI conviction can cause a significant increase in car insurance costs, with rates going up by 95% on average. The increase will vary by state, with a DUI conviction costing, on average, $2,213 per year in Idaho and $7,714 per year in Michigan.

Ameriprise's Business Auto Insurance: What You Need to Know

You may want to see also

Average car insurance rates by credit score

The average cost of car insurance is influenced by a number of factors, including age, gender, driving history, credit score, and location. In the US, the average annual cost of car insurance is $2,150 for full coverage and $467 for state minimum coverage. However, these rates can vary significantly depending on individual factors.

Credit score can have a significant impact on car insurance rates. Drivers with poor credit may be considered higher-risk and more likely to file claims, resulting in higher insurance premiums. On the other hand, those with good credit may enjoy lower rates as they are seen as less likely to file claims. The difference in rates between those with good and poor credit can be substantial. For example, drivers with poor credit may pay up to 88% more for full coverage car insurance than those with good credit. In dollar terms, this could mean an average monthly difference of $144.

The impact of credit score on car insurance rates varies across states. Some states, such as California, Hawaii, Massachusetts, and Michigan, prohibit or severely limit the use of credit scores in determining insurance rates. In these states, insurance companies base rates primarily on driving records, location, and other factors.

To improve credit scores, individuals can take several steps such as paying bills on time, minimizing hard credit inquiries, regularly monitoring their score, maintaining old lines of credit, and managing their credit utilization ratio.

It is worth noting that car insurance rates are influenced by various factors in addition to credit score, including age, gender, driving history, vehicle type, and location. By comparing quotes from multiple insurance providers and considering available discounts, individuals can find ways to optimize their rates and secure more affordable coverage.

Insurance and Vehicle Registration: What's the Link?

You may want to see also

Frequently asked questions

The average cost of car insurance is $50 per month for liability-only coverage and $108 per month for full coverage. However, rates can vary depending on factors such as age, location, driving history, and vehicle type.

Car insurance rates are influenced by various factors, including age, location, driving record, vehicle type, and credit score. Rates tend to be higher for younger drivers, those with a history of accidents or violations, and individuals with poor credit. Additionally, location plays a significant role, with urban areas typically having higher premiums due to increased risk factors.

To lower your car insurance rates, consider the following strategies:

- Compare quotes from multiple insurance companies.

- Bundle your policies, such as home and auto insurance.

- Improve your credit score.

- Maintain a clean driving record.

- Increase your deductible.

- Take advantage of discounts, such as good student discounts or safe driving programs.